(Source: Shutterstock)

Global energy consumption and associated emissions are likely to increase through 2050 due to both increasing demand and current policies, according to the 2023 International Energy Outlook (IEO) released by the U.S. Energy Information Administration (EIA).

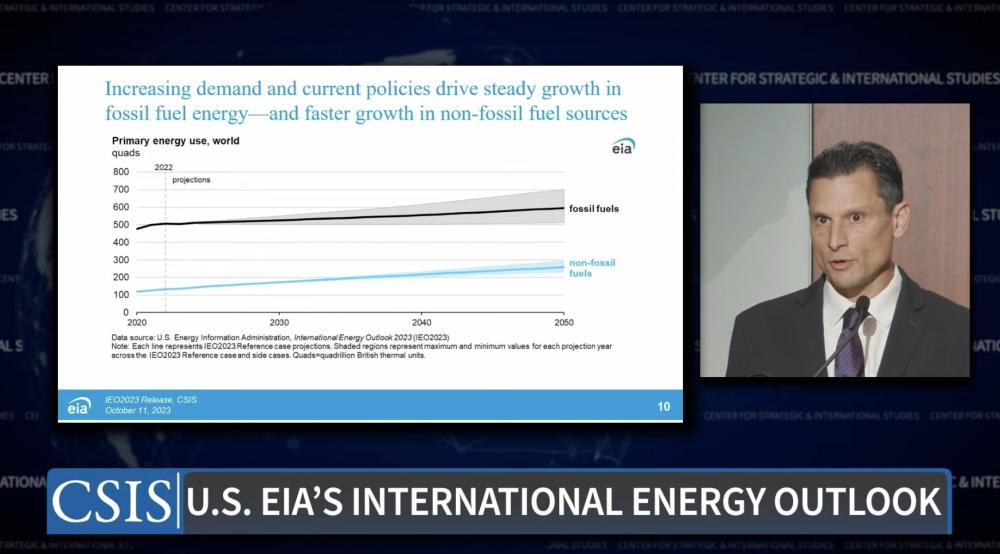

According to the report, steady growth in fossil fuel energy and faster growth in non-fossil fuel sources is expected.

The outlook included three main findings. First, it found global population growth, increased regional manufacturing and higher living standards push growth in energy consumption beyond advances in energy efficiency. Second, regional resources, technology costs and policy drive the shift to renewables to meet growing electricity demand. Third, energy security concerns hasten a transition from fossil fuels in some countries and drive increased fossil fuel consumption in others.

“Across most of the cases, we find that energy-related CO2 emissions continue to rise through 2050 under current laws,” DeCarolis said. Population increases and GDP growth are tied to increased energy consumption.

“There's more people, and as they gain wealth, they tend to demand more energy intensive goods and services,” DeCarolis said. At the same time, the expectation is that energy intensity will decline.

“For every unit of energy we consume, we're emitting less carbon emissions,” he said. As a result, the IEO expects upward pressures of population and GDP growth to outweigh the downward pressures delivered from reduced energy and carbon intensity, he said. The composition of the total energy mix will shift over time.

“What we find is that increasing demand and current policies drive steady growth in fossil energy, but even faster growth in non-fossil sources,” DeCarolis said.

"Over time, the fuel mix will change," he said. “Generally, what we find is that fossil fuels hold onto their share through time, but that renewables really pick up, and most of that renewable development is taking place in the electricity sector.”

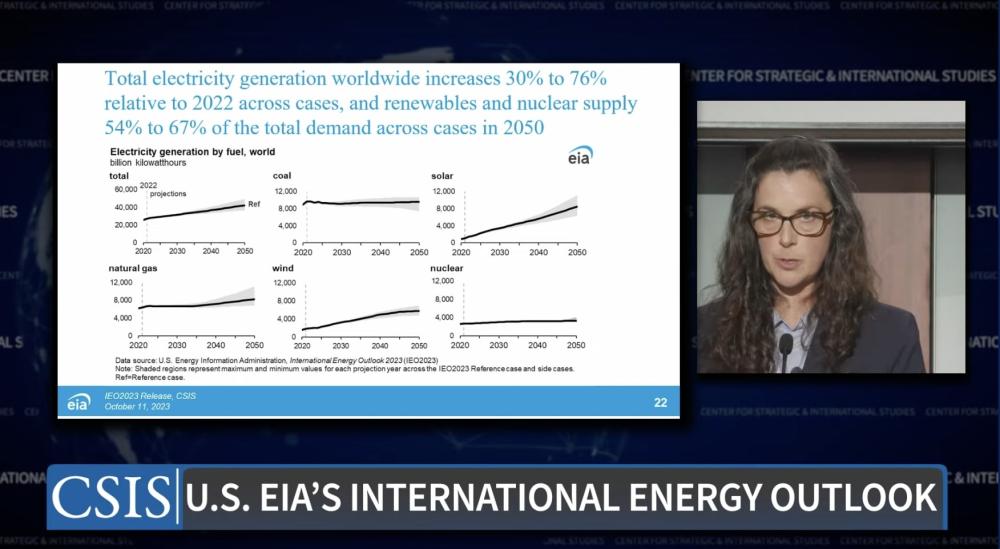

In 2050, the combination of renewable and nuclear will represent 54% to 67% of the global electricity supply, although DeCarolis said that would vary by region based on prevailing policy, trade patterns and the cost of local resources.

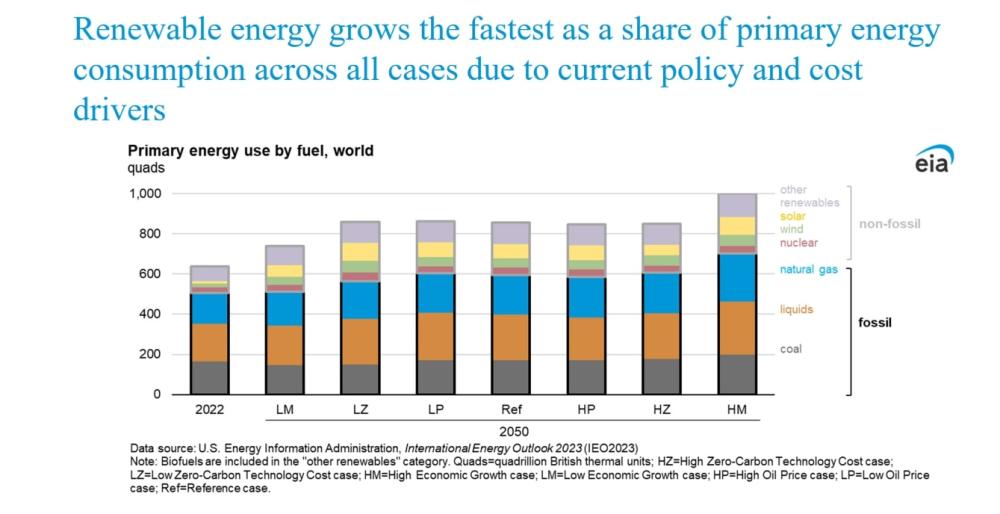

In nearly all the outlook’s cases, growth in energy production from non-fossil fuel sources outpaces growth in fossil fuels, but the dynamic varies from region to region. In Western Europe and China, policy, rapid demand growth and energy security considerations favor locally available resources such as wind, solar and battery storage, while regions like Asia-Pacific with access to relatively affordable coal are expected to consume more coal.

Angelina LaRose, assistant administrator for energy analysis at the EIA, said that installed power capacity will be one and a half to two times its 2022 levels in 2050 to meet increased global electricity demand.

“Solar and wind show the highest levels of generation growth,” she said, noting coal and natural gas power plants will continue to operate. “Coal, natural gas and liquid fuels combined constituted more than half of the world's electricity generation capacity (in 2022). By 2050, the share from these fuels for power generation decreases to 27% to 38% of the world's generating capacity across cases.”

And while coal’s share is flat or declining, the amount of natural gas in the energy mix is flat or rising, she said. “The percentage growth is nothing compared to what we're seeing in solar and wind, but both gas and coal remain a stable part of the generation mix,” LaRose said.

DeCarolis said liquids demand will likely grow from a base of 99 MMbbl/d in 2022 by 10% to 40% depending on the case model. The U.S. is likely to remain a net petroleum exporter across all of the cases, he added.

“There's a pretty wide variation, so it's anywhere from half a million barrels per day all the way up to nine,” DeCarolis said.

Grain of salt: outlook’s assumptions

The IEO assumes that the global energy system remains on its current trajectory. Existing policies are legally enforceable, no new policies will be put in place and any existing policies with sunset provisions will be allowed to expire, said Joseph DeCarolis, EIA administrator, during an Oct. 11 webcast discussing the outlook.

He called the cases modeled in the outlook plausible and sober.

“We don't model aspirations or targets unless there's a legally enforceable policy that backs it up. Second, we look at evolutionary rates of technological change that are based on recent history. And then third, we don't consider sweeping changes and consumer preferences or major geopolitical events that could produce durable change and shift the trajectory of the system,” he said.

The reference case for the outlook assumes a global average annual GDP change of 2.6% through 2050, Brent oil prices of $102/bbl in 2022 dollars through 2050 and up to a 20% reduction in costs for zero carbon technologies from 2022 to 2050. The economic growth case sets a low growth of 1.8% average annual GDP change between 2022 and 2050, while the high growth scenario sets a change of 3.4%. The oil price case sets a low of $48/bbl and a high of $187/bbl, both in 2022 dollars, in 2050. A zero-carbon technology cost case sets a low of 40% reduction in capital costs below the reference case, while the high scenario has no reduction in costs.

The outlook is not a forecast, DeCarolis said, and the energy landscape over the next 30 years is uncertain. Unforeseen factors like stringent new policies, technological breakthroughs or geopolitical events could occur, changing the trajectory of the global energy system, he noted. The IEO is intended as a reference for decision makers and to be used to judge future actions and developments, he said.

“One of the key takeaways is as governments explore a low carbon future, just know that there's this backdrop of continued development, and that's putting pressure on energy demand, and that informs our projection,” he said. “We're seeing steady or increased use of fossil fuels, but also rapid growth of renewable energy. I think the clean energy story is taking place in the electricity sector. It's largely being driven by solar and wind.”

Recommended Reading

SM Energy Targets Prolific Dean in New Northern Midland Play

2024-05-08 - KeyBanc Capital Markets reports SM Energy’s wells “measure up well to anything being drilled in the Midland Basin by anybody today.”

Vår Selling Norne Assets to DNO

2024-05-08 - In exchange for Vår’s producing assets in the Norwegian Sea, DNO is paying $51 million and transferring to Vår its 22.6% interest in the Ringhorne East unit in the North Sea.

Crescent Energy: Bigger Uinta Frac Now Making 60% More Boe

2024-05-08 - Crescent Energy also reported companywide growth in D&C speeds, while well costs have declined 10%.

SLB OneSubsea JV to Kickstart North Sea Development

2024-05-07 - SLB OneSubsea, a joint venture including SLB and Subsea7, have been awarded a contract by OKEA that will develop the Bestla Project offshore Norway.

Chevron, Total’s Anchor Up and (Almost) Running

2024-05-07 - During the Offshore Technology Conference 2024, project managers for Chevron’s Anchor Deepwater Project discussed the progress the project has made on its journey to reach first oil by mid-2024.