(Source: Vintage Tone/Shutterstock.com)

[This story first appeared in Oil and Gas Investor's Capital Options supplement in October 2020. Subscribe to the magazine here.]

The energy industry is particularly capital intensive, meaning that access to the equity and debt markets is critical to the survival and growth of companies in this sector. While the current economic climate has only exacerbated the need for access to liquidity—as reduced revenue resulting from historically low energy prices have required energy companies to seek additional capital—energy companies are looking beyond traditional offerings of straight debt or common equity.

Considering their present stock prices, energy companies are reticent to issue common equity securities because low trading prices mean equity issuances would be significantly dilutive. Further, energy companies have found it difficult to obtain debt financing on commercial terms when their balance sheets are already stressed due to market conditions.

Therefore, energy companies have looked to preferred stock as an alternative financing source for their existing operations and future capex. Preferred stock can provide maximum flexibility for both the company and the investor.

To assist energy companies in their capital raising strategies, in this article, Gibson Dunn & Crutcher summarizes the key terms of preferred securities, highlights potential benefits and pitfalls for companies and investors to consider when negotiating these terms, and provides market data regarding key terms of preferred stock. This article also shares the firm’s expectations, based on experience and discussions with investment bankers in the space, for future developments with respect to the preferred private placement market in the energy industry.

What is preferred equity?

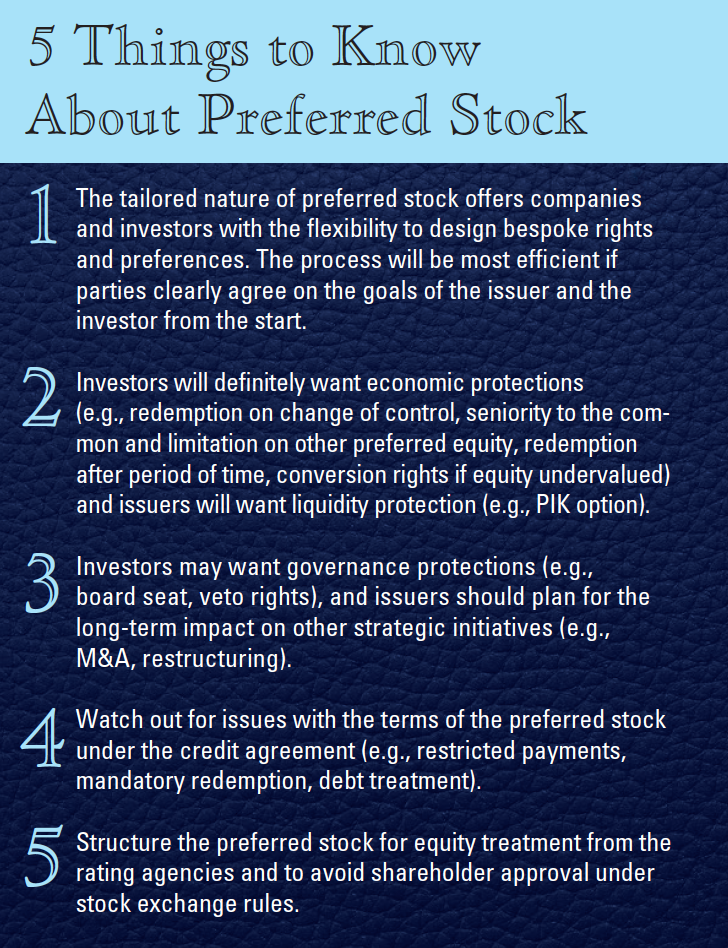

Preferred equity is a separate class of equity securities that entitles holders thereof to certain rights and preferences over common equity. The terms of the preferred stock can be tailored to the needs of the company and the investment goals of the purchasers. Common features include dividends, liquidation preferences, redemption rights, conversion rights, voting powers and, occasionally, preemptive rights. These preferences are heavily negotiated between companies and investors and result in bespoke terms from issuance to issuance.

What are the benefits of preferred equity?

The tailored nature of preferred stock offers companies with the flexibility to determine the scope of the rights and preferences to be offered to the investors. Depending on the circumstances and funding needs of the company, the rights of preferred stockholders may be narrow or broad. These preferences vary on a case-by-case basis as parties make accommodations to meet their ultimate investment goals.

In the current climate, many companies believe their common stock is temporarily undervalued and the issuance of additional common stock would be significantly dilutive. These companies can raise capital by issuing preferred stock and avoiding immediate dilution. The extent to which the company minimizes the risk of dilution depends on whether, when and under what circumstances the company or the holder can convert the preferred stock to common stock.

Also in the current climate, companies are concerned about leverage or the impact of issuing debt on their credit ratings. These companies can carefully tailor the terms of the preferred stock to attract fixed income investors but still receive partial or full equity treatment under their credit agreement or from the rating agencies.

From the investor’s perspective, preferred stock can be an attractive investment as it can provide both debt-like returns and equity upside. The convertible nature of many preferred stock allows the investor to share in the upside returns alongside common stockholders, including in a change of control. If cash dividends are required to be paid on the preferred stock, then the investor will receive a debt-like instrument with interest payments. Further, while preferred stock is generally subordinate to debt claims, preferred stock may provide superior downside protection for equity investors due to being senior in priority in the capital structure in the event of bankruptcy or liquidation.

Another benefit to bespoke preferred stock is the private nature of the transaction. First, the negotiation process between the company and the investors as to the terms of the preferred security is more efficient. Rather than negotiating with a representative of potential investors, the company can negotiate directly with the investor to tailor the terms of the preferred security to provide the suite of economic and governance rights desired by the investor while being satisfactory to the company. Second, the deal timeline can be more condensed than in a public offering. The growth and maturity of the private placement market has resulted in increased standardization of documentation and terms, which has expedited the length of negotiations between companies and investors. Further, placing preferred stock with a previous or current sponsor eliminates any time delay resulting from the investor needing to complete certain due diligence prior to making the investment.

What are the key provisions of preferred stock?

As previously mentioned, one of the primary benefits of preferred stock, particularly when issued in a private placement, is the ability of the parties to customize the terms of the security. The most common customized terms relate to dividends, liquidation preferences, conversion rights, redemption rights, voting powers and board representation rights.

Dividends: Although dividend payments on preferred stock are conceptually similar to interest payments on debt securities, preferred stock generally provides for a higher return to compensate the investors for their junior position in the capital structure as compared to the debtholders. Further, dividends generally must be paid to holders of preferred stock prior to payment of a dividend to holders of common stock, eliminating some of the risk of payment. Other points of negotiation relating to dividends include (a) whether the dividend rate is fixed or floating, (b) the frequency and form of payment, (c) whether the dividends are cumulative or noncumulative and (d) any restrictions on payment.

The dividend rate on preferred stock may be fixed or floating. A fixed rate dividend is generally a percentage of the initial purchase price, but it can also be based on the liquidation preference or another predetermined metric. This rate may increase or be adjusted after a certain period of time. A floating rate is adjustable and is typically tied to a predetermined formula that fluctuates with interest rates.

Dividends on preferred stock are commonly paid on a quarterly basis, although the parties may instead negotiate for semiannual or annual payments. Dividends may be paid in cash, payment-in-kind (PIK) of company securities or a combination. A PIK option is attractive to a company that is prohibited from issuing cash dividends by debt covenants in its outstanding debt or that has limited liquidity.

Dividends may be cumulative or noncumulative. A cumulative dividend will accrue over time until paid, rather than being lost. Companies are restricted from paying dividends on junior stock so long as accumulated dividends remain unpaid. Noncumulative dividends are lost if not paid by the company and will not be made up at a later time.

The majority of the recent preferred private placements in the energy industry were fixed rate securities that paid quarterly dividends with a combined cash/PIK payment option. However, the precise terms of payment varied widely. For example, one company’s preferred stock provided that no dividends would be payable in the first year, but dividends would be payable thereafter at a fixed rate of 10% of the purchase price. Another company’s preferred stock provided for an initial fixed dividend rate, but a

representative of a majority of holders of the preferred security could elect to convert the fixed rate into a variable rate after the five-year anniversary.

Liquidation: One of the hallmarks of preferred stock is that upon the occurrence of a liquidation event, the holders of preferred stock are entitled to receive a certain amount (called the liquidation preference) prior to any liquidation distribution to holders of junior securities (e.g., common stock).

A key issue for the parties is determining what qualifies as a liquidation event. Typically, liquidation events include an IPO, mergers or consolidations, or a sale of all or substantially all of the company’s assets. There are variations on this depending on the forecast for the company. If a merger is likely in the near term, then the preferred stock might provide that a “merger, consolidation or other business combination transaction” in which the company retains less than 50% ownership would trigger a redemption event, rather than a liquidation, requiring the company to redeem all of the preferred security for cash at a premium.

Alternatively, if the preferred stock is perpetual in a company without a near-term fundamental change, then the preferred stock might provide that anything less than a winding up of the entirety of the company’s affairs, including a merger or consolidation, would not constitute a liquidation event.

The liquidation preference generally equals the greater of (a) an amount equal to the invested capital, plus all accrued accumulated dividends (if applicable) and (b) the amount the holder would have received had its shares of preferred security been converted into common stock immediately prior to the liquidation.

After the liquidation preference is paid, depending on whether the preferred security is participating or nonparticipating, the holders of the preferred security may be entitled to additional distributions of the company’s assets in connection with a liquidation. Nonparticipating preferred stock is not entitled to any of the remaining assets distributed to holders of junior preferred stock and common stock following the payment of the liquidation preference. Participating preferred stock may receive additional distributions of the company’s remaining assets by participating alongside the holders of common stock on an as-converted basis. This preference may also be referred to as a double dip.

Most preferred stock issued in the energy industry recently provided that the holders of the preferred stock would not participate in any additional distribution of assets alongside the holders of common stock. These securities generally applied the formula presented above in determining the liquidation preference amount. A minority of preferred stock issued recently allowed the holders thereof to participate in additional distributions on an as-converted basis pari passu with the common stock.

Conversion: Another important feature of preferred stock is whether it is convertible into the company’s common stock (or other securities). Conversion can be an attractive feature to investors because it allows them to share in any appreciation in the price of the company’s common stock, particularly if trading prices are at low levels.

Conversion may be based on a fixed rate or floating rate, and it will often include anti-dilution adjustments to the rate upon certain corporate events occur (e.g., dilutive stock issuances and stock splits). Another important term related to conversion is whether the holders have the option to convert the preferred stock (i.e., mandatory conversion) and whether the company has the option to convert the preferred stock (i.e., optional conversion). With respect to mandatory conversion, holders are typically only permitted to convert the security after a specific date. With respect to optional conversion, the company is typically permitted to convert the security only after a specific date or upon the occurrence of certain circumstances, like a merger.

Considering the ubiquitous nature of the conversion feature, it was unsurprising that, among the recent issuances in the energy industry, only one series of preferred stock did not include conversion rights. All of the preferred stock with a conversion feature provided for mandatory conversion upon certain circumstances. Most of the preferred stock’s mandatory conversion feature was time-based, in which the holder could convert its securities following a period ranging from six months to two years. Most of the preferred stock with optional conversion features allowed the company to convert the preferred stock after a certain date (ranging from one to three years after the closing of the placement) or once a certain number of preferred shares remained outstanding. In addition, the most common conversion formula was the quotient of the (i) liquidation preference and (ii) the then-applicable conversion price (subject to anti-dilution adjustments and other equitable adjustments).

Redemption: Preferred stock may include redemption rights in which the company is required to redeem the preferred security for cash at various times or during a specific period.

When the holder of the preferred security has the right to cause the company to redeem the security, this is known as a mandatory redemption feature. This may be sought by investors if they require liquidity after a certain period or seek immediate liquidity upon a certain triggering event, such as a change of control of the company. Mandatory redemption is typically set at a fixed or floating price per share or unit and is typically cumulative.

When the company has the right to redeem the preferred security, this is known as an optional redemption feature. An optional redemption is typically expressed as a percentage of the liquidation value of the preferred security, which may decrease over time. For example, the certificate of designation (or other agreement setting forth the terms of the security) may not allow optional redemption for a certain number of years, but the company may redeem the security for an agreed upon percentage (which percentage decreases over time).

Finally, some preferred stock does not provide for redemption rights, and these securities are known as perpetual preferred stock.

Approximately half of the recent issuances provided for optional redemption. A majority of these securities featuring optional redemption rights granted the company with the option to redeem all or a portion of the preferred security at any time, while two of the securities permitted the company to redeem only following a certain period of time. With respect to mandatory redemption, five of the securities mandated redemption upon a change of control, three of which also provided preferred stockholders with an optional redemption right after a certain period of time.

Voting powers: Investors will often seek certain voting rights to protect their investment, particularly when they do not have board representation. These voting rights are typically structured whereby the holders of the preferred security are entitled to vote as a single class with the holders of common securities on matters that the holders of common securities are entitled to vote. But the holders of the preferred security also have the right to vote as a separate class on issues that specially impact the preferred security. These special rights, often referred to as consent rights, require an affirmative vote of a certain portion of holders of the preferred security (often a majority or two-thirds of the class) before the company may take any of the covered actions.

The consent rights can either be limited to certain fundamental transactions, such as the sale of the company, or relate to operational matters. The most common actions requiring a vote by a majority of preferred stockholders include:

- any amendment, alteration or repeal of any provision of the organizational documents in a manner that adversely affects the rights, preferences or powers of the applicable preferred security (and this consent right may be even further limited solely to amendments that directly or indirectly affect dividend, liquidation or redemption preferences of the applicable preferred security);

- authorization, creation or increase of senior equity or parity equity, or the reclassification of any existing class of securities if such reclassification would render the other security senior to the applicable preferred security;

- repurchase or redemption of shares of junior securities while the applicable preferred security remain outstanding; and

- change of control transactions or material acquisitions resulting in a change to the preferences and seniority of the preferred stock.

With the exception of nonvoting convertible preferred stock issued to avoid the stock exchange’s 20% shareholder approval rule, all of the preferred stock issued recently in the energy industry granted consent rights in one form or another, though the specific language of each varied. Preferred stockholders generally held the right to vote as a separate class from the common stock on fundamental issues (e.g., merger or bankruptcy) and some extended to operational matters (e.g., large expenditures).

Board representation: Board representation presents a unique issue with respect to preferred investments. Investors that make a substantial investment may pursue board representation in some capacity to protect their interests beyond mere consent rights (although investors will often seek both board representation and certain consent rights). In the absence of board representation, an investor may seek board observation rights.

However, obtaining board representation or observer rights has drawbacks. For example, a director appointed by a designated group of stockholders risks violating fiduciary duties owed by the director to all stockholders. Further, access to material nonpublic information by the director may limit the investor’s ability to exit its investment without violating insider trading laws. Therefore, many investors elect not to seek such board representation or observer rights.

These concerns were reflected in the recent issuances. Only a minority of preferred stock recently issued in the energy industry granted board representation to the investors, and it required the investor to maintain a certain ownership threshold right to keep the board seat. Further, a small minority granted board observation rights to the preferred stockholder.

Other terms: There are other negotiated provisions of preferred equity issuances:

- Whether the preferred stock has preemptive rights;

- Whether the use of proceeds will be limited to certain corporate purposes;

- Whether the investors will be subject to a standstill;

- Whether the investors will be locked up from transferring the preferred equity for a period of time following the date of issuance;

- Whether the investors will receive registration rights;

- Whether the investment will include an equity kicker (e.g., warrants); and

- Whether the investor’s expenses will be reimbursed.

- What is the future of preferred stock?

Market conditions are conducive to private placements of preferred stock. Therefore, Gibson Dunn & Crutcher expects private placements of preferred stock to continue to serve as a tool for energy companies to manage their liquidity during the length of the existing crisis. In fact, the firm expects the size of these private placements to increase as companies use them to finance M&A and other consolidation efforts in the energy industry.

In particular, keep your eye out for more consistency among terms of new preferred stock:

- Use of proceeds is to enhance liquidity;

- Percentage of market cap at 10% to 20%;

- One to three private-equity or hedge fund investors;

- Not broadly marketed;

- More liquidity protection for the issuer (e.g., option to pay interest in-kind or cash);

- Investor receives board seats, subject to ownership requirements;

- Increased use of downside protection features;

- Mandatory redemption trigger upon change of control;

- Long-term investments (e.g., perpetual or matures 3 to 5 years; noncallable for at least 3 to 5 years); and

- More flexible mandatory conversion feature (i.e., provide investor with upside when equity markets strengthen).

Given preferred stock can provide maximum flexibility for both the company and the investor, and the equity and debt capital markets continue to present challenges, Gibson Dunn & Crutcher expects energy companies to continue to use preferred stock as an alternative financing source to fund their existing operations and future capex.

Hillary H. Holmes is partner with Gibson Dunn & Crutcher’s Oil & Gas practice and co-chair of the firm’s Capital Markets practice; she is based in Houston. Louis Matthews is an associate with the firm’s Oil & Gas and Capital Markets practices based in Dallas.

Recommended Reading

Paisie: OPEC+ Will Be Able to Manage Prices

2024-07-11 - Disappointing economic news has contributed to a drop in oil prices.

What's Affecting Oil Prices This Week? (June 10, 2024)

2024-06-10 - Stratas Advisors says the latest EIA report illustrates that U.S. production growth has stagnated with U.S. oil production remaining at 13.1 MMbbl/d, which is unchanged from the previous 12 weeks.

Paisie: Oil Demand to Rise 1.2 MMbbl/d in Second Half

2024-07-28 - WTI’s price is expected to stay in the low $80s/bbl.

Oil Settles Slightly Up on Forecasts for Strong Global Demand

2024-06-11 - Oil prices edged up to settle slightly higher on June 11 as the U.S. Energy Information Administration raised its global oil demand growth forecast for the year, while OPEC stuck to its forecast for relatively strong growth in 2024.

Oil Prices Up Slightly as US Crude Oil Inventories Fall

2024-07-03 - The U.S. Energy Information Administration reported a 12.2 million draw in the country's crude oil barrels in storage last week.