ENPC was formed as a partnership among Paul Ryan, Alex Dunn and Solamere Capital, a private equity firm where Ryan also serves as a partner. (Source: Al Teich / Shutterstock.com)

Grey Rock Investment Partners agreed on May 16 to a $1.3 billion business combination with Executive Network Partnering Corp. (ENPC), a special purpose acquisition entity (SPAC) backed by former U.S. House Speaker Paul Ryan.

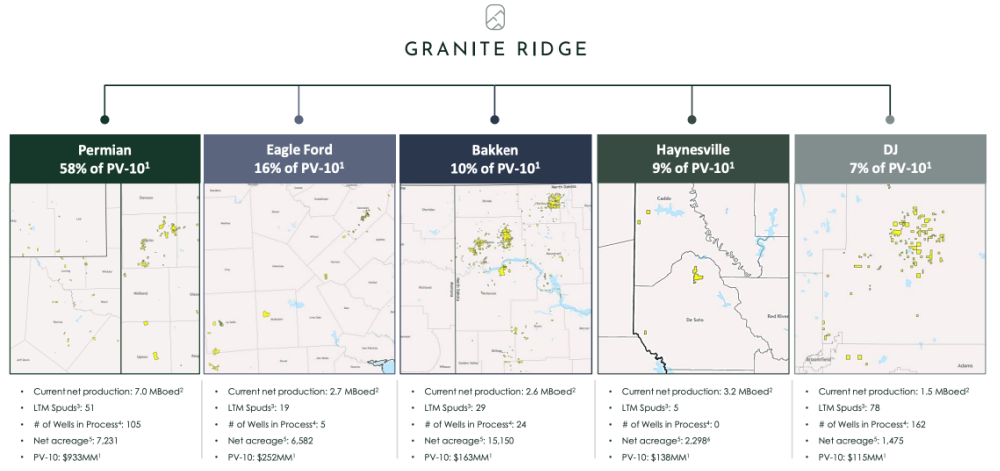

Based in Dallas, Grey Rock Investment Partners is a private equity firm with more than $525 million of committed capital under management and interests in more than 2,500 wells in core areas of the Permian’s Midland and Delaware basins as well as the Bakken, Eagle Ford, Denver-Julesburg and Haynesville plays.

“This transaction with Grey Rock reflects our philosophy and commitment to matching accomplished, proven executives and great assets, with the proper capital structure to maximize results and value creation,” commented Ryan, who serves as chairman of ENPC, in a joint release on May 16.

In connection with this transaction, Grey Rock will contribute oil and gas assets currently held in its Fund I, Fund II and Fund III portfolios to form Granite Ridge Resources Inc. in exchange for equity.

Subject to approval by the ENPC stockholders and customary regulatory requirements, Granite Ridge intends to be listed on the NYSE under the ticker symbol “GRNT” upon closing, which is expected to occur later this year. Grey Rock will not receive any cash proceeds as part of this transaction and will roll all of its equity into the pro forma company.

Granite Ridge will be led by CEO Luke Brandenberg, formerly with Vortus Investment Advisors LLC, Grey Rock Energy Partners and EnCap Investment LP, and CFO Tyler Farquharson, previously vice president, CFO and treasurer of EXCO Resources. The company is estimated to produce 20,500 boe/d with an EBITDA of $425 million and free cash flow of $240 million in 2022, according to an investor presentation.

“As hydrocarbons continue to play an important role in the global energy mix, we are confident that Granite Ridge, led by a world-class team with deep operational, technical, and financial expertise, is a compelling opportunity for investors looking to participate in the energy space,” Ryan added in the release.

Brandenberg previously served as a managing director of Vortus Investment Advisors LLC. Prior to join gin Vortus, he had worked at Grey Rock Energy Partners and before that spent 10 years with EnCap Investments LP, where he was the primary relationship manager and a key board member on multiple portfolio companies representing a significant portion of EnCap’s equity commitments.

Farquharson joins Grey Rock from EXCO Resources where he served as vice president, CFO and treasurer since February 2017. He had previously served as acting CFO and treasurer. Farquharson had joined EXCO in August 2005 as a financial analyst.

“I look forward to leading Granite Ridge as we enter the public market and seize the opportunities presented by today’s energy environment,” Brandenberg commented.

Upon closing, Granite Ridge will maintain a seven-person board, which will include three independent directors as well as a committee dedicated to strong ESG practices, according to the company release.

Members of the Grey Rock team will also continue to help manage the assets post-transaction through a long-term services agreement, providing technical, legal, commercial, acquisition and divestment, and back-office support.

“As demonstrated by consistent success across multiple hydrocarbon price cycles and a fortress balance sheet, Grey Rock is unique among its peer group,” Brandenberg said. “Our team at Granite Ridge will maintain Grey Rock’s strategic, adaptable approach as we focus on non-operated working interest and joint ventures, partner with experienced operators in the most prolific basins, leverage real-time data and analytics, and build a diversified asset base that generates attractive returns and substantial value for our partners.”

Granite Ridge and Grey Rock have agreed that during the term of the services agreement, Granite Ridge and any additional oil and gas-focused funds managed by Grey Rock shall have the opportunity to jointly participate in investment opportunities for upstream oil and gas assets, with 75% of any future transactions allocated to Granite Ridge and 25% of any future transactions allocated to oil and gas funds managed by Grey Rock.

Grey Rock was founded and is led by three managing directors: Matt Miller, Griffin Perry and Kirk Lazarine.

“We see a tremendous market opportunity driven by the ever-increasing global demand for traditional energy commodities,” said Griffin Perry, co-founder of Grey Rock and son of former U.S. energy secretary Rick Perry.

“In creating Granite Ridge,” he continued, “we have the unique opportunity to build a new company anchored by a premiere, scaled, nonoperated oil and gas platform diversified across five of the most prolific basins in the United States.”

Matt Miller, co-founder of Grey Rock added, “We are excited to partner with ENPC to enter the public markets and deliver on our commitment to create healthy, risk-adjusted returns in underserved areas of the oil and gas market, while creating long-term value for Granite Ridge’s stockholders.”

Assuming no redemptions paid from ENPC cash in trust, gross proceeds of approximately $414 million held in the trust account will be transferred to Granite Ridge in connection with the transaction for growth capital purposes, including future acquisitions.

Evercore is exclusive financial and capital markets adviser to Grey Rock and Stephens Inc. is acting as financial adviser to ENPC. Holland & Knight LLP is providing legal counsel to Grey Rock and Kirkland & Ellis LLP is acting as legal counsel to ENPC.

Recommended Reading

Utility, Clean Energy Company Allete to Go Private in $6.2B Deal

2024-05-06 - The Minnesota-based utility said on May 6 it agreed to be acquired by a partnership led by Canada Pension Plan Investment Board and Global Infrastructure Partners.

Valaris’ 1Q Sets Positive Tone for Offshore

2024-05-06 - Coming out of first-quarter 2024, drilling contractor Valaris expects a sustained upcycle for the offshore drilling industry supported by demand growth, OPEC+ production cuts and supportive commodity prices.

U.S. Shale-catters to IPO Australian Shale Explorer on NYSE

2024-05-04 - Tamboran Resources Corp. is majority owned by Permian wildcatter Bryan Sheffield and chaired by Haynesville and Eagle Ford discovery co-leader Dick Stoneburner.

1Q24 Dividends Declared in the Week of April 29

2024-05-03 - With earnings season in full swing, upstream and midstream companies are declaring quarterly dividends. Here is a selection of dividends announced in the past week.

Analyst Questions Kimmeridge’s Character, Ben Dell Responds

2024-05-02 - The analyst said that “they don’t seem to be particularly good actors.” Ben Dell, Kimmeridge Energy Partners managing partner, told Hart Energy that “our reputation is unparalleled.”