In another sign of greater capital discipline exercised by E&Ps, Fitch Ratings found resilience among the nine U.S. natural gas producers that the credit rating company submitted to a pricing stress test.

The test found the companies could withstand a multi-year period of lower natural gas and oil prices because they’ve toughened up with better cost structure, hedging intensity and fund availability under long-term credit facilities. Light hedging was also a threat to some companies.

However, some companies would face difficulties with debt repayment and others were dip into negative cash flow, the test found.

“There’s been a sizable amount of debt repayment across the space,” said Fitch Ratings Senior Director Michael Ainge. “There's been this meaningful change in the way that the industry and most of the individual companies within the industry manage themselves and think about capital allocation.”

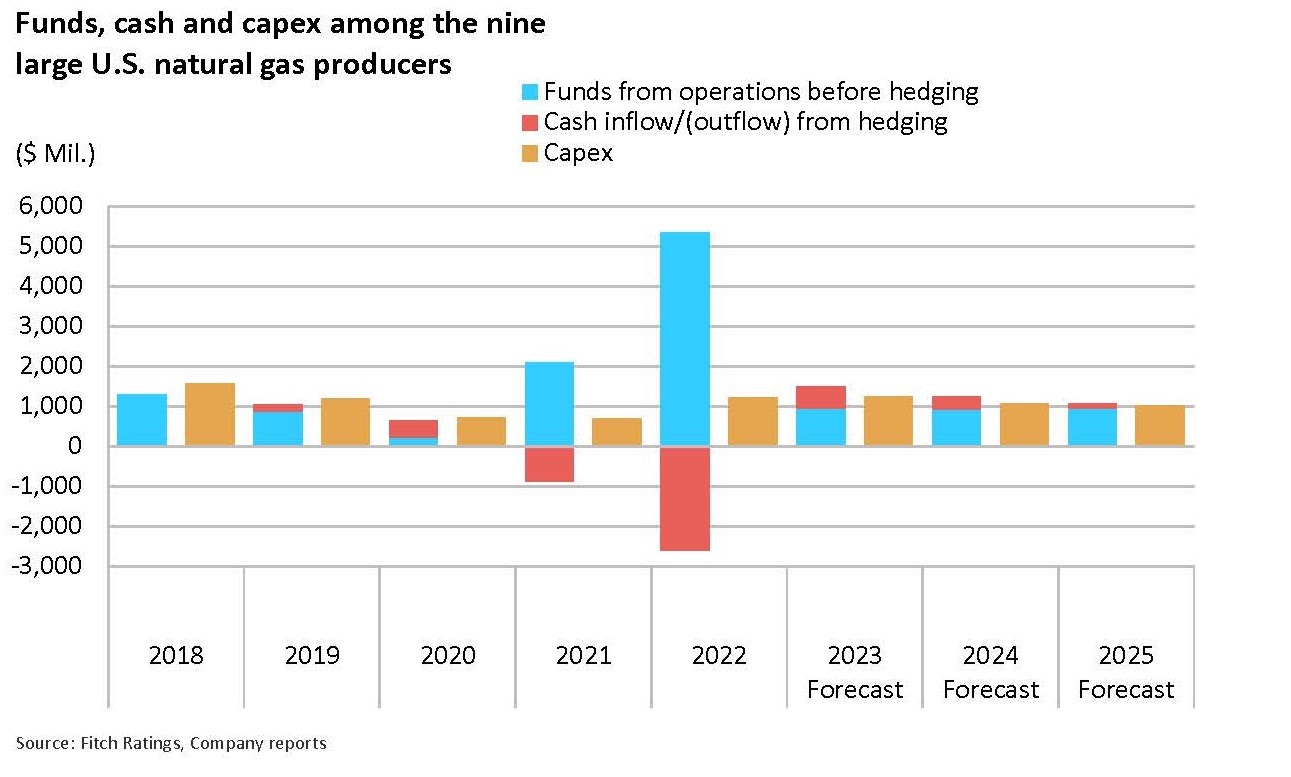

Slava Demchenko, Fitch Ratings’ director of natural resources and corporates, shared additional numbers with Hart Energy showing capex among these nine companies went from 127% of cash flow from operations in 2018 to just 48% in 2022.

“They are in much better shape than they were in 2019 when, unexpectedly, the pandemic hit,” he said. “This time around the companies are more prepared. They have lower debt. Most importantly, some of them have quite in-depth hedging programs.”

The companies selected to represent the entire U.S. natural gas industry were chosen due to more than 35% of their production volumes being natural gas. Companies tested were Antero Resources, Ascent Resources Utica Holdings, Chesapeake Energy, CNX Resources, Comstock Resources, Coterra Energy, EQT Corp., Gulfport Energy and Southwestern Energy Co.

Gas prices recently nudged up slightly, but long-time lows prompted Fitch to do a stress test of a further price drop.

The companies were tested at average Henry Hub spot prices of $2.25/thousand cubic feet in 2023-2025.

The testing found Antero, Chesapeake and Comstock would have negative free cash flow if gas prices dropped to $2.25/thousand cubic feet. They also have the lightest hedging programs among the nine companies, according to Fitch. Fitch’s commodity forecast for natural gas prices in 2023 is $2.50/Mcf.

Comstock has sufficient liquidity, but it could be pinched by a 3.5x leverage maintenance covenant to maintain access to the credit line they have with a syndicate of banks.

Coterra, Gulfport and Ascent came out on top as the most resilient in Fitch’s stress test.

Antero, Chesapeake, EQT and Southwestern Energy did not have excessively high leverage, but could exceed their downgrade sensitivities under the stress test, according to Fitch.

Despite the test, the New York- and London-based rating agency said it expects gas prices rise this year, according to its June 22 stress test report.

Fitch’s prediction is based on a number of factors, including a declining number of active drilling rigs, increased LNG gas feeds following the restart of the Freeport LNG plant and increased switching from coal to gas.

Demchenko said gas prices bumped up a bit recently because of high temperatures demanding more energy.

Recommended Reading

BP’s Kate Thomson Promoted to CFO, Joins Board

2024-02-05 - Before becoming BP’s interim CFO in September 2023, Kate Thomson served as senior vice president of finance for production and operations.

Magnolia Oil & Gas Hikes Quarterly Cash Dividend by 13%

2024-02-05 - Magnolia’s dividend will rise 13% to $0.13 per share, the company said.

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

HighPeak Energy Authorizes First Share Buyback Since Founding

2024-02-06 - Along with a $75 million share repurchase program, Midland Basin operator HighPeak Energy’s board also increased its quarterly dividend.