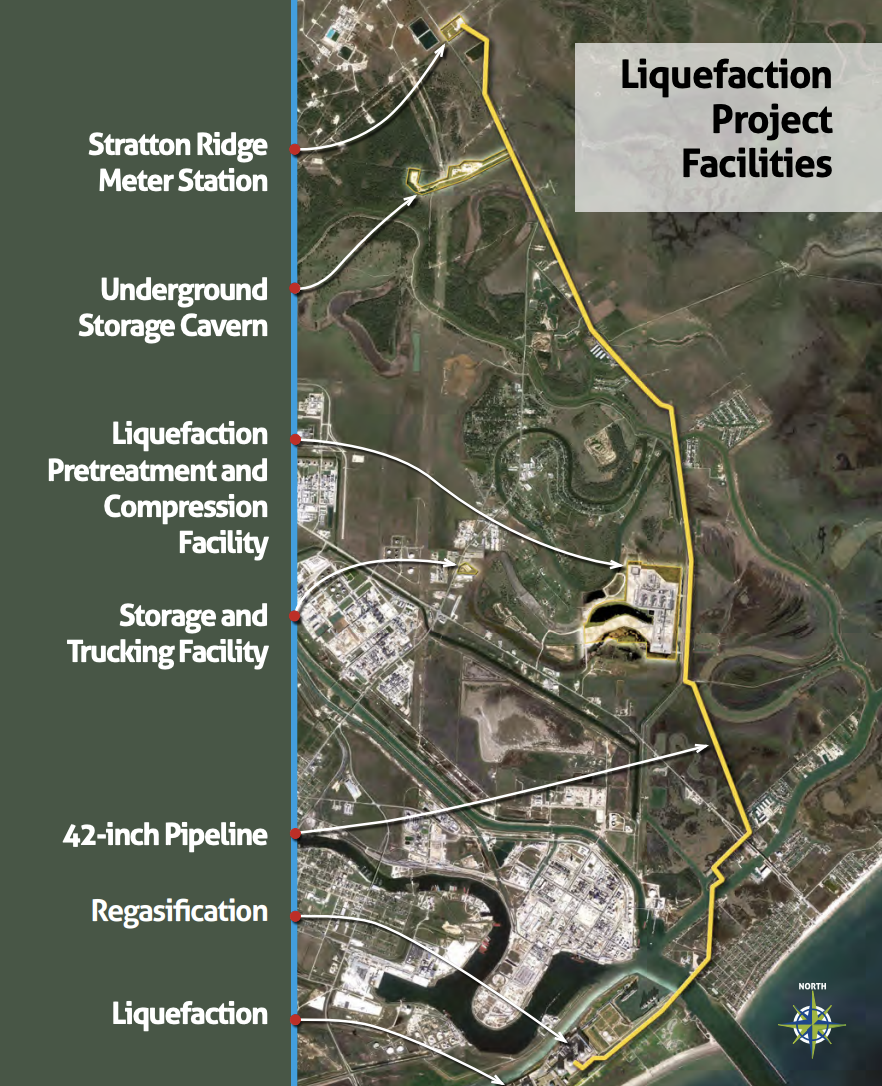

Most days, tiny Quintana Island on Texas’ Gulf Coast lures in visitors with a bird sanctuary, RV park and beaches. But, for worldwide attention, there’s no contest about the center of attention of the island located south of Houston: three liquefaction trains operated by Freeport LNG.

Economically, the trains make up a critical part of the U.S. LNG export infrastructure. Freeport’s 15 million tonnes per annum (mtpa) facility is the seventh largest in the world and second largest in the U.S. Its capacity is equivalent to 2.2 Bcf/d — enough to power and light a metropolitan area the size of San Antonio for a full day.

So, when something goes wrong in Quintana, the world tends to pay attention.

At 11:28 a.m. on June 8, 2022, something did. Freeport suffered a catastrophic failure in one of the facility’s lines that led to a vapor cloud explosion, with a fireball filling the sky.

An estimated 239,610 cf of methane gas was released into the atmosphere, with about 50% consumed in the fireball, according to a redacted report released in October by the U.S. Pipeline and Hazardous Materials Safety Administration (PHMSA).

A full year later, the Freeport accident highlights a time in which a single supplier could tip the scales of global markets—and continues to raise questions about the viability of the company’s planned, multibillion-dollar expansion on the island.

The incident reduced the export capacity of Freeport LNG, and the U.S. overall, at a time when European gas supplies were threatened by the Russia-Ukraine war. Prior to Freeport’s shutdown, U.S. LNG exports peaked in March 2022 at 11.7 Bcf/d, according to the U.S. Energy Information Administration (EIA).

By the time Freeport fully shut down, monthly U.S. exports declined by about 14.5% to an average 10 Bcf/d from June to December.

With Freeport back online, U.S. LNG exports are expected to exceed 12 Bfc/d, and the U.S. will remain the world’s largest LNG exporter, according to a March EIA report.

Freeport LNG pointed Hart Energy to its ‘Freeport LNG Sustainability and Community Investment Report 2022’ for details around the fire when questioned about the lessons learned from the incident.

On March 8, Freeport LNG received regulatory approval from PHMSA and the Federal Energy Regulatory Commission (FERC) to restart the final of its three trains.

Operations at Freeport LNG’s trains, as well as operations at two LNG storage tanks and a single dock, have allowed the company to again service its customers, the company said in its report.

“With the return to service of … the third LNG storage tank anticipated this summer, the full restoration of the facility is nearly complete,” Freeport LNG chairman, CEO and founder Michael Smith said in the report.

Freeport LNG’s restart is important for global LNG trade in general, and for offtakers such as TotalEnergies, BP, Osaka Gas, JERA and SK E&S, which look to benefit financially from the resumption of gas flows.

Specifically, France’s TotalEnergies said during its first quarter of 2023 webcast that it expects operational benefits to positively impact its LNG sales in coming quarters. Japan’s Osaka surmised in a May press release that it will no longer have to rely on replacement LNG volumes.

RELATED

Europe Remains a Hotspot for US LNG Exports

Asian Companies Keen on US Gas Supply and LNG

Q&A: Excelerate Energy’s Steven Kobos Talks LNG, Fuel-Switching and China

Japan's Osaka Gas Posts 9-month $10 Million Loss on Freeport LNG Project

Fourth train time crunch

Freeport LNG was originally designed to import LNG. A subsequent rise in U.S. gas production allowed the country to reduce its dependency on gas imports. The facility was eventually refitted to operate as an LNG export facility.

Commercial operations related to Train 1 commenced in December 2019, with Train 2 and Train 3 commencing operations in January and May 2020, respectively, according to the IFO Group. Since commencing operations in 2019, Freeport LNG says the facility has shipped cargos to 28 different countries.

The three-train facility leads Quintana Island in job creation and economic growth, according to Freeport LNG. The company says over $13 billion in direct investment went into building the first three trains while economic benefits of exporting at full capacity are between $5.5 billion and $8 billion annually.

In May 2019, Freeport LNG received authorization to build a fourth train. But a variety of factors, including the pandemic and last year’s explosion, may test Freeport’s ability to meet federal deadlines to build it.

A fourth train would add an additional 5.1 mtpa, or 0.67 Bcf/d, and boost the export facility’s capacity to 20.1 mtpa when complete, according to Freeport LNG.

Freeport LNG initially expected to make a final investment decision (FID) on Train 4 in 2022, with operations commencing in 2026, the company reported in a corporate brochure on its website. To date, the FID has still not been taken.

In May 2022, Freeport asked FERC for an extension through 2028 to construct the train. FERC granted an extension through May 2026 instead. At the time, construction of the Train 4 project had not commenced due to delays caused by the COVID-19 pandemic.

A second extension has since been granted by the FERC for an additional 26 months, meaning a new deadline of August 1, 2028, Enverus told Hart Energy. The consultancy said it expects the project to cost one-third of the $14 billion related to the first three trains.

"Pending FID, which may get pushed into 2024, it is anticipated that a minimum 48-56 month construction period would be required,” Enverus said. “This results in a potential in-service date that is pushing close to FERC’s latest deadline. Given two previous extensions, combined with project opposition, time is of the essence as requesting a third extension seems risky.”

Like the first three trains, the fourth train would utilize electric motors with variable frequency drive for the cooling and liquefaction compression power, and result in negligible incremental emissions, according to Freeport LNG.

“We continue to progress our efforts on Train 4, which has already received all regulatory approvals,” Freeport LNG corporate communications director Heather Browne said in an emailed response to questions. Browne did not provide requested cost details or a potential start date for the train.

Approvals have been given by FERC, the main agency responsible for permitting LNG facilities, and by the U.S. Department of Energy (DOE), responsible for authorizing exports of LNG. Freeport LNG has also received approval from the Texas Commission on Environmental Quality, as well as with several other federal, state and local agencies.

All this came prior to the April 2023 roll out by the DOE of a new policy that implies it will be stricter on permit extensions to export LNG to non-FTA countries.

“While an initial off-take agreement with Sumitomo was announced back in 2018, the current state of T4’s contracts is not known as the original in-service date will not be met and additional off-takers have not been announced,” Enverus said but added that “the company said it is engaged in active negotiations with potential off-takers, particularly in European markets. Further announcements have not been made.”

Once in operation, assuming an average LNG value of $7/MMBtu, exports from Train 4 will provide positive economic benefits of approximately $1.7 billion per year, according to Freeport LNG.

‘Hard lessons’ of Freeport mishap

Many of the visitors to Quintana Island may have been oblivious to the potential danger lurking nearby.

Less than 100 yards from a main plant entrance, bird watchers stroll a section of the beach with binoculars and cameras in hand. At the nearby RV park, visitors take in the Texas summer heat with cigarettes and beers in their hands.

Along the coastline that serves as the marine entrance of LNG barges, fishermen cast nets in waist-deep water. Kids kick around soccer balls while others brave the waves of the brown-tinted waters common along the Texas coasts. Other than worries about strong rip currents, parents pay no attention to passing LNG barges and small teams of tugboats ferrying them to and from Freeport LNG’s docks.

While no fatalities were associated with the June 8 fire at Freeport LNG, another major incident could win their attention.

According to an October 2022 report, conducted by the IFO Group, the direct cause of the explosion and fire related to “contact between flammable vapor (methane) and an ignition source (open and damaged electrical conduits and circuitry) in the pipe rack following the Loss of Primary Containment (LOPC), which resulted in a vapor cloud explosion and a small secondary pool fire on the northeast end of the pipe rack in the elevated LNG drainage trench.”

The IFO Group also cited root and contributing causes including pressure safety valve (PSV) testing procedure and car-seal program deficiencies, facility operator fatigue due to significant overtime needs and the personnel’s inability to recognize an abnormal operating condition and related hazard, including “those related to pipe movement and the recognition of pipe movements/stresses,” among others.

Freeport had no formal PSV testing procedure to ensure they were properly returned to service after testing with isolation valves car-sealed in their correct open positions.

“At the time of the incident, operators at FLNG [Freeport] were trained to assist with PSV testing by observing another, more experienced operator, and then expected to be able to perform oversight of contractor-led PSV testing with no further training and without the aid of a written procedure or process,” according to IFO Group’s report.

Freeport LNG’s recent safety performance data showed a slight uptick in recordable incidents in 2022 compared to 2021. In terms of the direct employees, the company recorded 899,709 exposure hours with just the June 8 incident in 2022 compared to 831,545 exposure hours and no incidents in 2021. Non-project contractor exposure hours were 584,270 with four incidents in 2022 compared to 325,016 exposure hours with no incidents in 2021.

In terms of greenhouse-gas emissions and environmental data, the company also showed improvements in 2022 compared to 2021. Direct GHG were 341,361.2 metric tons (mt) of CO2 in 2022 compared to 749,599.6 mt in 2021, while indirect GHG were 855,109 mt compared to 2,889,683 mt, respectively.

However, methane emissions creeped up to 548.9 mt in 2022 compared to 202.24 mt in 2021, according to the data in the report.

The one-year anniversary of the incident saw Quintana Island residents express anger during a June 8 town hall, according to New York-based Climate Nexus, which helped to organize a live broadcast of the discussions with the non-profit Texas Campaign for the Environment (TCE).

During the town hall, residents reiterated calls that Freeport LNG be held accountable for the incident while requesting transparent and up-to-date safety standards at the facility.

“2022 made clear that no matter how good your record, the need to be vigilant and continuously improving never ceases; we must always strive to be better,” Freeport LNG’s Smith said in the company’s report.

“The hard lessons learned in 2022 will stick with and guide our company as we move ahead. We are committed to re-establishing our reputation as a reliable source of U.S. LNG for decades to come, and making Freeport LNG stronger and safer than ever,” said Smith, who founded Freeport LNG in 2002.

Recommended Reading

Defeating the ‘Four Horsemen’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production—and keep the cash flowing.

Tech Trends: AI Increasing Data Center Demand for Energy

2024-04-16 - In this month’s Tech Trends, new technologies equipped with artificial intelligence take the forefront, as they assist with safety and seismic fault detection. Also, independent contractor Stena Drilling begins upgrades for their Evolution drillship.

AVEVA: Immersive Tech, Augmented Reality and What’s New in the Cloud

2024-04-15 - Rob McGreevy, AVEVA’s chief product officer, talks about technology advancements that give employees on the job training without any of the risks.

Lift-off: How AI is Boosting Field and Employee Productivity

2024-04-12 - From data extraction to well optimization, the oil and gas industry embraces AI.

AI Poised to Break Out of its Oilfield Niche

2024-04-11 - At the AI in Oil & Gas Conference in Houston, experts talked up the benefits artificial intelligence can provide to the downstream, midstream and upstream sectors, while assuring the audience humans will still run the show.