(Source: HartEnergy.com, Shutterstock.com)

How are oil and gas commodity markets reacting as the COVID-19 illness continues to sweep through the world and its U.S. death toll climbs into the double digits? Not well.

“Fears are growing,” EnVantage Inc. analysts wrote in a report “that global energy markets are on the cusp of a major demand shock to the downside.”

The WTI price ducked under $45 per barrel (bbl) on Feb. 28, the same day that Brent flirted with closing below $50/bbl. Henry Hub’s price of $1.684 per million cubic feet (MMcf) on Feb. 28 set a 12-month low.

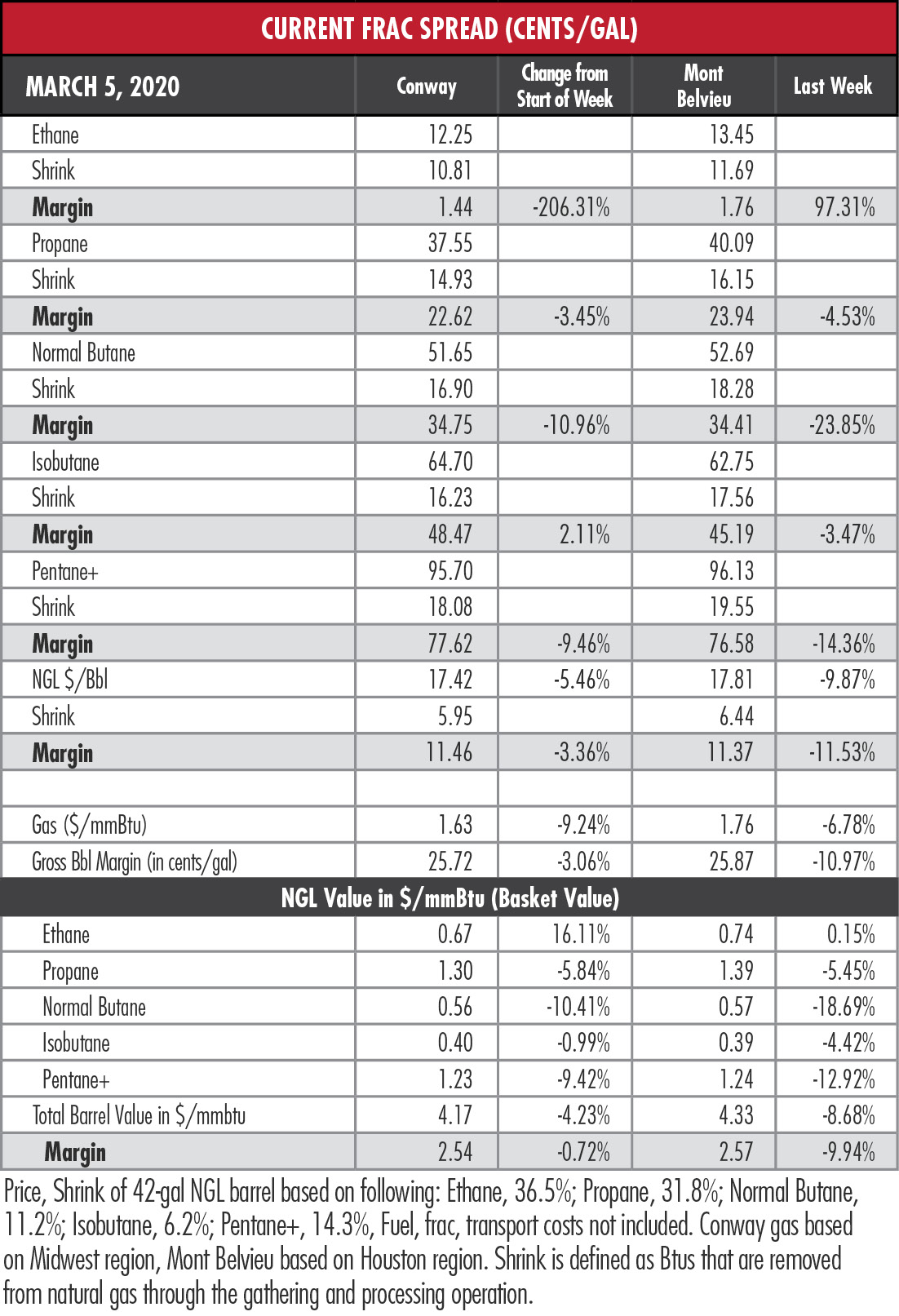

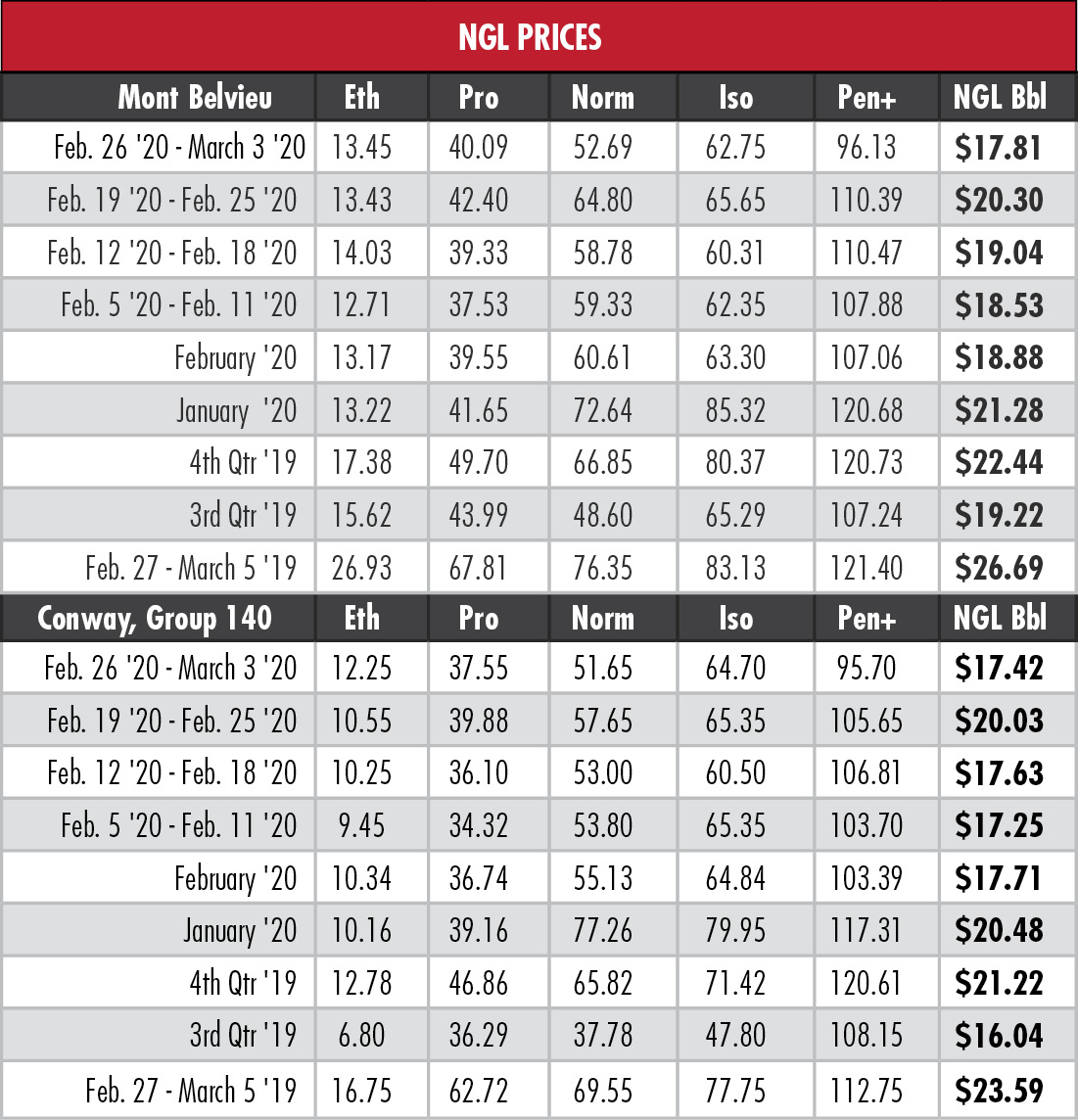

Butane sunk to a six-month low at Mont Belvieu, Texas, and that hub’s natural gasoline price dropped below 96 cents per gallon (gal) for the first time since June 2017, or 32 months. Overall, the Mont Belvieu hypothetical NGL barrel sunk below $18 for the first time since August.

With fundamentals in disarray, EnVantage turned to technicals to find a floor for volatile crude oil prices. Their analysis was that WTI is unlikely to fall lower than $42/bbl, which was the low point three times in the past four years: August 2016, June 2017 and December 2018. WTI closed at $47.18/bbl on March 3 and had slipped to $46.65 by late morning on March 4.

Natural gas prices have been low, but fairly stable through the market whirlwind. Some cooler weather would help, but EnVantage offered an outlook for a near-term gas floor as well.

“We still look for spring prices to remain under pressure,” the analysts said. “Northern hemisphere storage levels remain elevated with the exception being Canada.

“With … discussion that all of March may prove mild, there does not appear to be any catalyst to spur any real price appreciation,” EnVantage said.

“We believe that under current circumstances a test of long-term support of $1.61/MMBtu is likely to be tested by the April contract and feel that a move closer to $1.50/MMBtu is quite feasible,” they added.

The stability at Henry Hub has lent itself to stability with Mont Belvieu ethane. The average five-day price last week was nearly identical to the previous week and the margin almost doubled to 1.76 cents/gal thanks to a weekly average drop of 13 cents/MMBtu in the price of gas.

On the bright side, COVID-19 now appears to be spreading everywhere quickly except for China, which is good news for the unloading of ethane in Taixing, Jiangsu Province.

Mont Belvieu propane slipped 5.4% last week but remained above 40 cents/gal, which is higher than the average for all of February. The outlook, however, is bleak.

“There are just too many headwinds facing propane such as weakening crude prices, warmer weather, 460,000 bbl/d of new fractionation capacity on the Gulf Coast and narrowing export spreads to Asia,” EnVantage said. “Although shipping costs are dropping, lower naphtha prices in Asia and in Europe will pressure propane prices at Mont Belvieu.”

In the week ended Feb. 28, storage of natural gas in the Lower 48 experienced a decrease of 109 billion cubic feet (Bcf), the EIA reported, compared to the Investing.com expectation of a 108 Bcf reduction. The EIA figure resulted in a total of 2.091 Tcf. That is 48.2% above the 1.411 Tcf figure at the same time in 2019 and 9.2% above the five-year average of 1.915 Tcf.

Recommended Reading

Deepwater Roundup 2024: Offshore Australasia, Surrounding Areas

2024-04-09 - Projects in Australia and Asia are progressing in part two of Hart Energy's 2024 Deepwater Roundup. Deepwater projects in Vietnam and Australia look to yield high reserves, while a project offshore Malaysia looks to will be developed by an solar panel powered FPSO.

BP: Gimi FLNG Vessel Arrival Marks GTA Project Milestone

2024-02-15 - The BP-operated Greater Tortue Ahmeyim project on the Mauritania and Senegal maritime border is expected to produce 2.3 million tonnes per annum during it’s initial phase.

Deepwater Roundup 2024: Offshore Africa

2024-04-02 - Offshore Africa, new projects are progressing, with a number of high-reserve offshore developments being planned in countries not typically known for deepwater activity, such as Phase 2 of the Baleine project on the Ivory Coast.

Technip Energies Wins Marsa LNG Contract

2024-04-22 - Technip Energies contract, which will will cover the EPC of a natural gas liquefaction train for TotalEnergies, is valued between $532 million and $1.1 billion.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.