(Source: HartEnergy.com, Shutterstock)

Ethane tumbled to its lowest price since mid-August at Mont Belvieu, Texas, and the natural gas supply-demand imbalance prompted the U.S. Energy Information Administration (EIA) to forecast a 9% price drop for 2020 compared to 2019.

On the propane front, EnVantage Inc. described the outlook as “going to get uglier.”

The “EIA expects the natural gas spot price for the U.S. benchmark Henry Hub will average $2.33 per million British thermal units (MMBtu) in 2020, about 24 cents lower than the 2019 average of $2.57/MMBtu,” the EIA said in its “Today in Energy” report. “Following a year of decline, EIA expects 2021 natural gas prices to rise by 9% because of upward pricing pressure from declining growth in natural gas production.”

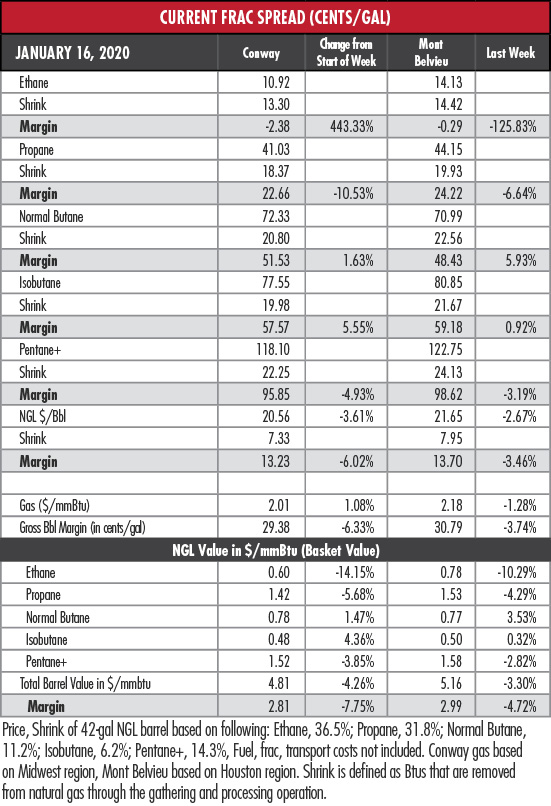

The average Henry Hub price over the five-day Frac Spread tracking period dipped just slightly, leaving the 10.3% falloff in the Mont Belvieu ethane price to drag the margin back into negative space. A year ago, the Mont Belvieu ethane margin was reeling from a one-week 28% hit, but was still more than 6 cents per gallon (gal).

“Ethane supplies are still overwhelming ethane cracking and export demand, as such ethane prices are trading fairly close to their equivalent Btu value to natural gas prices,” EnVantage said.

Gulf Coast NGL bulk storage capacity has increased, said EnVantage, citing the EIA. Not enough, though, and with another 1.5 million barrels per day of fractionation capacity coming online, storage will be tight.

Upshot: “For the first half of 2020, it is more likely that ethane prices could collapse to near single digits as was the case this past July when ethane inventories exceeded storage capacity limits,” EnVantage warned. “It may not be until the second half of 2020 before Mont Belvieu ethane prices show sustainable strength relative to natural gas prices to justify prices in the 25 cents to 30 cents/gal range.”

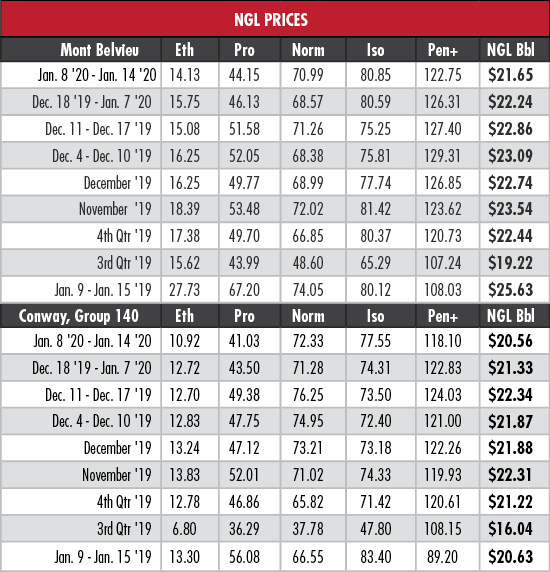

Mont Belvieu propane continued its slide from 55 cents/gal in early December, settling to its lowest point in 18 weeks and registering a paltry 31% to the price of West Texas Intermediate (WTI) on Jan. 14.

“Propane is simply oversupplied, particularly on the Gulf Coast,” EnVantage said. Tight inventories and warm winter weather are strangling the Mont Belvieu price. The margin narrowed by 6.6% to 24.22 cents/gal last week, compared to 37.62 cents/gal a year ago.

“Our projection of U.S. propane inventories for the remainder of the winter shows a severe overhang developing,” EnVantage said. “As spring approaches, U.S. propane inventories could easily be 55% above 2019 springtime levels.”

What does EnVantage think this means for prices as the surplus balloons?

- Mont Belvieu propane prices could dip to 25% of WTI; and

- Assuming WTI prices stay around $60, propane could fall to 36 cents/gal.

In the week ended Jan. 10, storage of natural gas in the Lower 48 experienced a decrease of 109 billion cubic feet (Bcf), the EIA reported. That compared with the Bloomberg consensus of a 94 Bcf withdrawal and the expectation by Stratas Advisors of an 87 Bcf withdrawal. The EIA figure resulted in a total of 3.039 trillion cubic feet (Tcf). That is 19.4% above the 2.545 Tcf figure at the same time in 2019 and 5.2% above the five-year average of 2.89 Tcf.

Recommended Reading

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

2024-04-25 - Henry Hub blues: CNX Resources and other Appalachia producers are slashing production and deferring well completions as natural gas spot prices hover near record lows.

Chevron’s Tengiz Oil Field Operations Start Up in Kazakhstan

2024-04-25 - The final phase of Chevron’s project will produce about 260,000 bbl/d.

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.