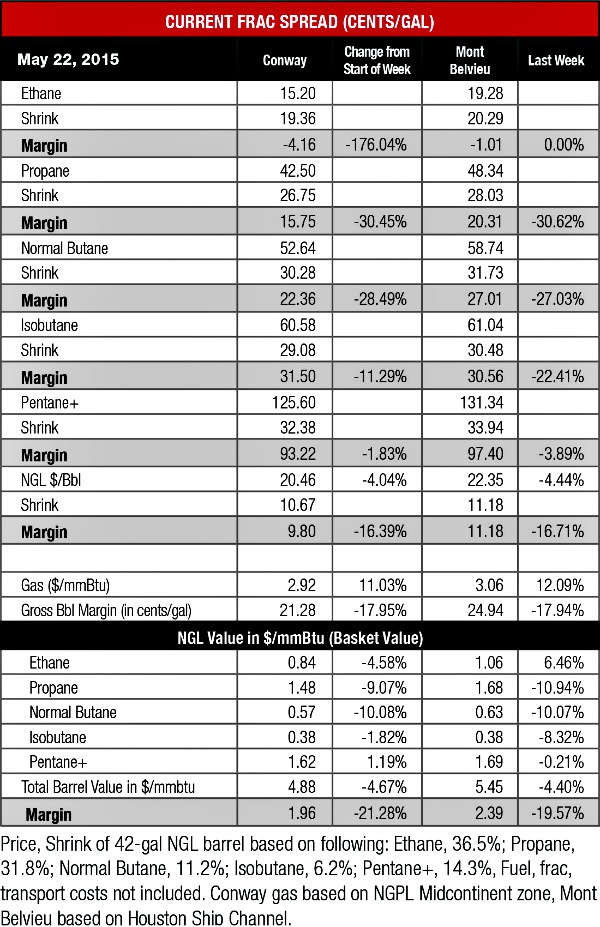

Natural gas prices improved to its highest level since the beginning of 2015 as coal-to-gas switching by power generators gained steam. This switching resulted in gas prices rising by 11% at Conway to $2.92 per million Btu (/MMBtu) and 12% to $3.06/MMBtu at Mont Belvieu.

There are signs that this rally is dissolving as gas prices began to fall late on May 19 with coal-to-gas switching limited. Gas prices need to trade at a reduced rate for a sustained period of time to encourage more power generation switching. This is especially difficult in the midst of a price rally.

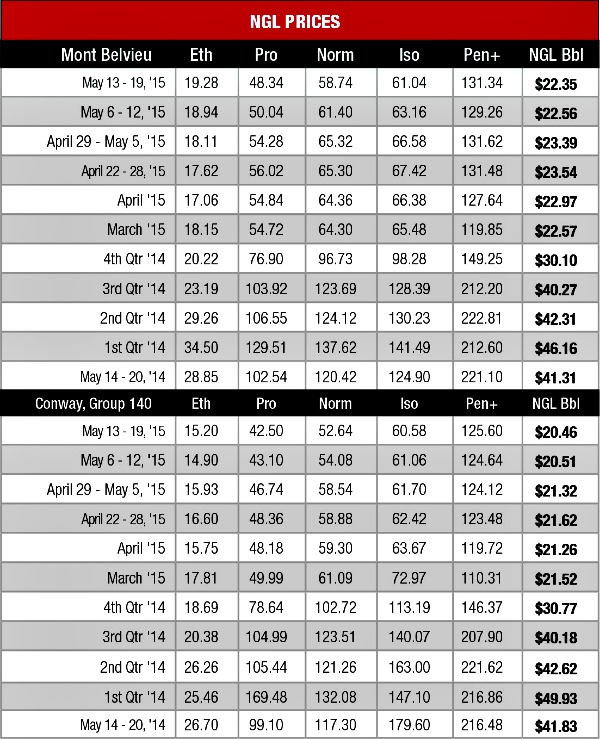

Improved gas prices did support slight increases in ethane prices, which rose 2% at both hubs. However, the real gain was less than 1 cent per gallon (/gal) at Conway and Mont Belvieu. It is unlikely that ethane prices will make real advances unless gas prices vastly improve. Unless this occurs, the market will be waiting until 2018 when more cracking capacity is brought online.

Pentanes-plus (C5+) continues to have the largest correlation to West Texas Intermediate crude oil with both products experiencing improved prices the last few weeks. Mont Belvieu C5+ gained 2% to $1.31/gal while Conway C5+ rose 1% to $1.26/gal.

The same cannot be said of butane and isobutane, which have been losing value as refiners switch to summer-grade gasoline blending. Mont Belvieu butane lost 4% to fall to 59 cents/gal, its lowest price since the week of Dec. 3, 2008. The Conway price fell 3% to 53 cents/gal, which was also its lowest price since the week of Dec. 3, 2008 when it was 50 cents/gal. LPG exports have fallen the last few weeks with the bulk of these exports being made up of propane rather than butane.

The decreased export demand is another hit to an already weak propane market as storage levels are extremely high. The Mont Belvieu price fell 3% to 48 cents/gal and the Conway price fell 1% to 43 cents/gal. It isn’t clear whether the market has hit the bottom as of yet, but margins are approaching their thinnest levels in years. Though margins remain positive, they are at their lowest levels in five years.

Overall the theoretical NGL bbl price fell 4% at both hubs with the Conway price down to $20.46/bbl with a 16% drop in margin to $9.80/bbl. The Mont Belvieu price wasn’t much better at $22.35/bbl with a 17% drop in margin to $11.18/bbl.

The most profitable NGL to make at both hubs was C5+ at 93 cents/gal at Conway and 97 cents/gal at Mont Belvieu. This was followed, in order, by isobutane at 32 cents/gal at Conway and 31 cents/gal at Mont Belvieu; butane at 22 cents/gal at Conway and 27 cents/gal at Mont Belvieu; propane at 16 cents/gal at Conway and 20 cents/gal at Mont Belvieu; and ethane at negative 4 cents/gal at Conway and negative 1 cent/gal at Mont Belvieu.

Recommended Reading

E&P Highlights: April 29, 2024

2024-04-29 - Here’s a roundup of the latest E&P headlines, including a new contract award and drilling technology.

Kosmos Energy’s RBL Increased, Maturity Date Extended

2024-04-29 - Kosmos Energy’s reserve-based lending facility’s size has been increased by about 8% to $1.35 billion from $1.25 billion, with current commitments of approximately $1.2 billion.

Barnett & Beyond: Marathon, Oxy, Peers Testing Deeper Permian Zones

2024-04-29 - Marathon Oil, Occidental, Continental Resources and others are reaching under the Permian’s popular benches for new drilling locations. Analysts think there are areas of the basin where the Permian’s deeper zones can compete for capital.

NOV Announces $1B Repurchase Program, Ups Dividend

2024-04-26 - NOV expects to increase its quarterly cash dividend on its common stock by 50% to $0.075 per share from $0.05 per share.

Repsol to Drop Marcellus Rig in June

2024-04-26 - Spain’s Repsol plans to drop its Marcellus Shale rig in June and reduce capex in the play due to the current U.S. gas price environment, CEO Josu Jon Imaz told analysts during a quarterly webcast.