(Source: Shutterstock, HartEnergy.com)

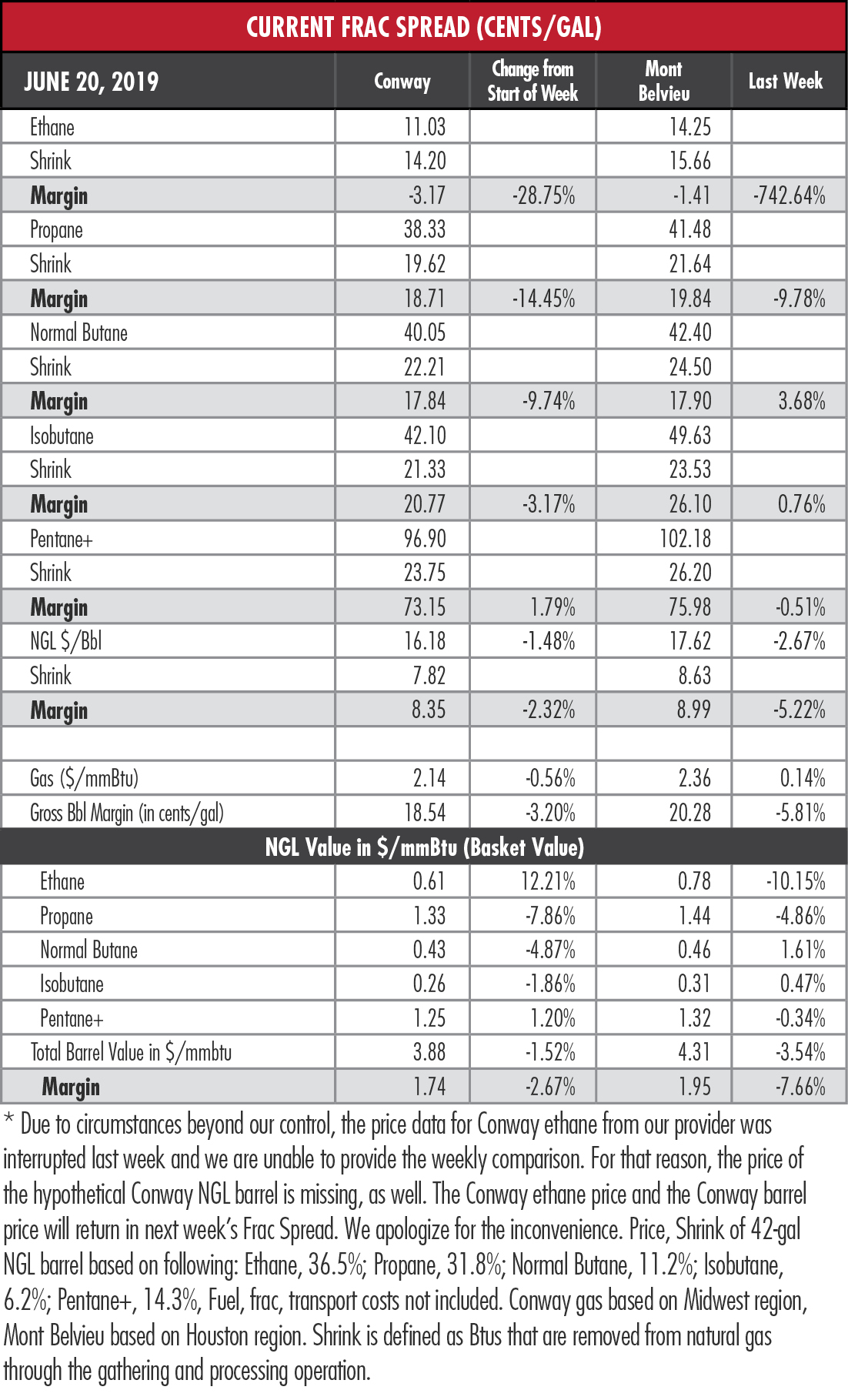

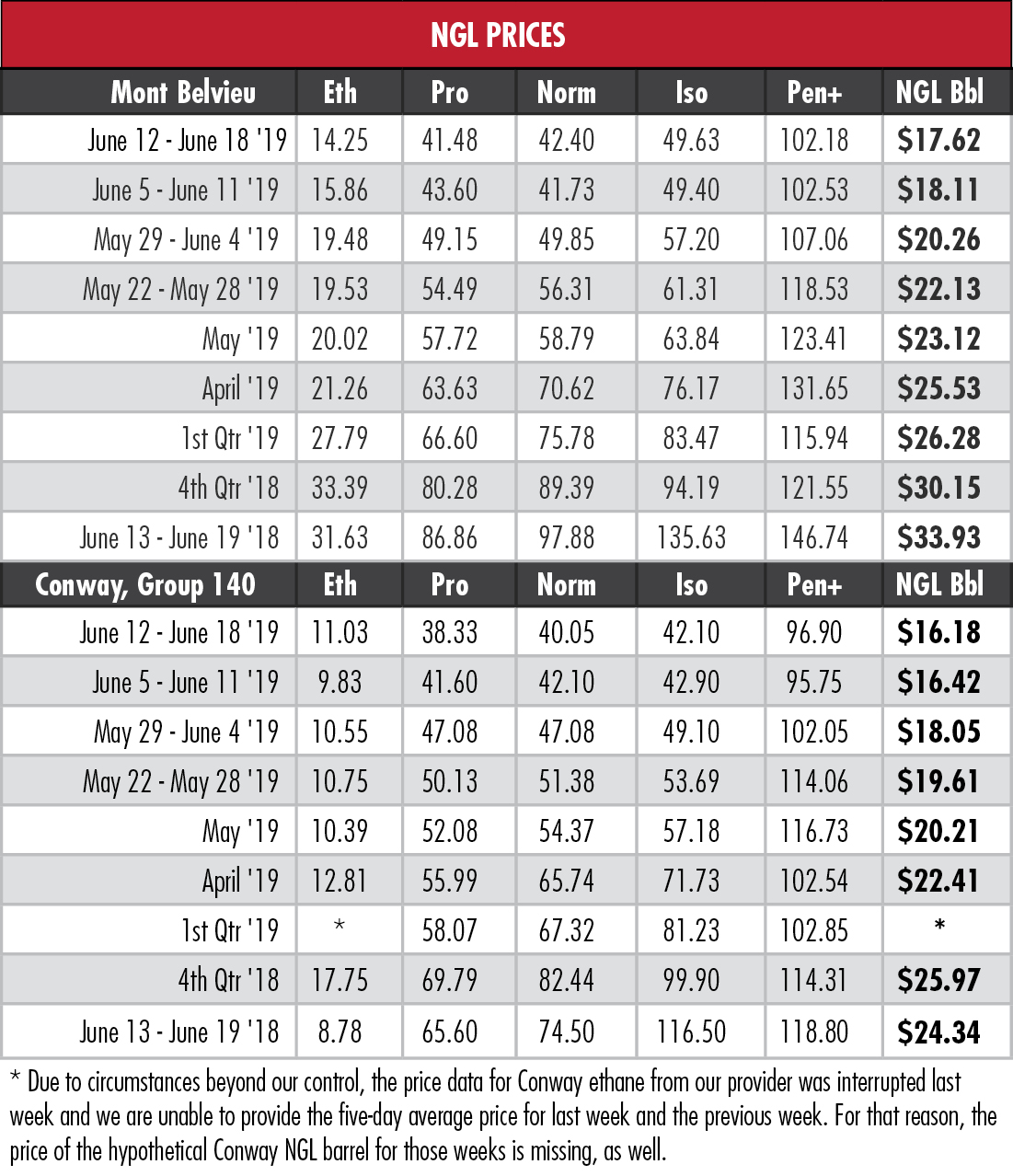

Ethane’s price slipped closer to single digits last week at Mont Belvieu, Texas, to its lowest point in almost 40 months as its margin dropped into negative territory. The price is off 55% compared to a year ago. The dubious 40-month marker applied to the prices of propane and the hub’s hypothetical NGL barrel, as well.

Ironically, this was also a great week for ethane, as the State of Texas approved permits to begin construction on the $10 billion Gulf Coast Growth Ventures petrochemical plant that will feature the world’s largest ethane cracker. The joint venture between Exxon Mobil Corp. and SABIC, the Riyadh, Saudi Arabia-based chemical maker that is majority-owned by Saudi Aramco, will be able to produce 1.8 million metric tonnes per year (mtpa) of ethylene.

Construction is scheduled to begin in the third quarter and the plant, near Corpus Christi, Texas, will start up sometime in 2022.

“Demand growth for NGL in the U.S. has been primarily ethane as ethane crackers have come online,” said Scott Potter, managing director of business development for Houston-based RBN Energy LLC, at Hart Energy’s recent Midstream Texas conference in Midland, Texas.

“Demand growth for NGL in the U.S. has been primarily ethane as ethane crackers have come online,” said Scott Potter, managing director of business development for Houston-based RBN Energy LLC, at Hart Energy’s recent Midstream Texas conference in Midland, Texas.

“A lot of folks haven’t paid a lot of attention to exports—we’re building a pipeline, we’re committed to a pipeline—but the reality is that exports are going to be crucial to the success of our industry going forward,” he said.

It’s not just Texas that is laden with untapped potential. Appalachia could be a player, as well, as noted by Greg Haas, director of integrated energy research for Stratas Advisors, during his presentation at Hart Energy’s DUG East conference June 19 in Pittsburgh.

It’s not just Texas that is laden with untapped potential. Appalachia could be a player, as well, as noted by Greg Haas, director of integrated energy research for Stratas Advisors, during his presentation at Hart Energy’s DUG East conference June 19 in Pittsburgh.

“We think up to four world-scale crackers could be supported in Appalachia with NGL growth and fuller ethane recovery,” Haas said.

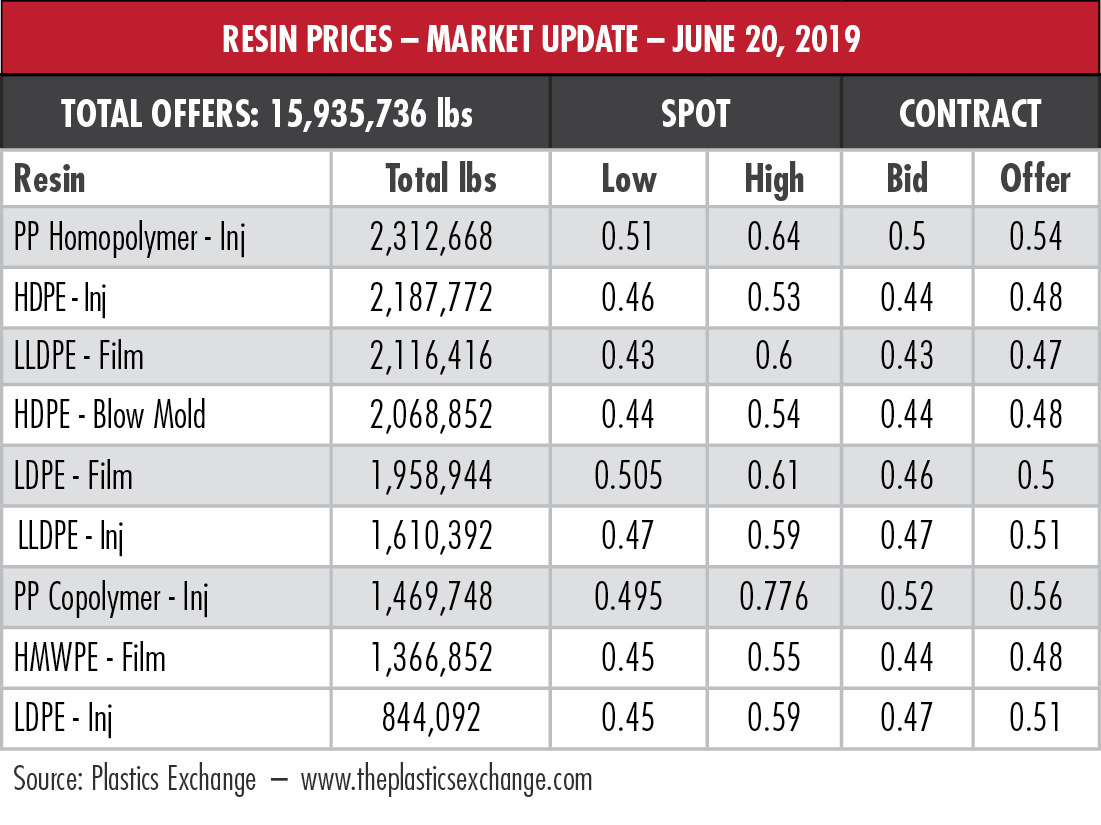

But until those crackers come online, price weakness will continue. And crackers, which tend to be massive in price and scale, often experience delays until they are ready to go. While the U.S. is the global leader in ethane exports, the sector is beginning to face headwinds in the form of resistance to the production of plastics.

In the week ended June 14, storage of natural gas in the Lower 48 experienced an increase of 115 billion cubic feet (Bcf), the EIA reported compared to the Bloomberg consensus of 106 Bcf. The figure resulted in a total of 2.203 trillion cubic feet (Tcf). That is 10.5% above the 1.994 Tcf figure at the same time in 2018 and 8.3% below the five-year average of 2.402 Tcf.

In the week ended June 14, storage of natural gas in the Lower 48 experienced an increase of 115 billion cubic feet (Bcf), the EIA reported compared to the Bloomberg consensus of 106 Bcf. The figure resulted in a total of 2.203 trillion cubic feet (Tcf). That is 10.5% above the 1.994 Tcf figure at the same time in 2018 and 8.3% below the five-year average of 2.402 Tcf.

Technical issues with Hart Energy’s data provider do not allow us to provide the price of ethane from Conway, Kan., for the last week of March because of a loss of pricing data for that time period. For the same reason, we cannot compare the price of the hypothetical Conway NGL barrel to the previous week. Conway ethane prices are not available for March 2019 and first-quarter 2019. We apologize for the inconvenience.

Recommended Reading

Chord Buying Enerplus to Create a Bakken Behemoth

2024-02-22 - Chord Energy said Feb. 21 it will acquire Enerplus Corp. for nearly $4 billion in a stock-and-cash deal to potentially create the largest producer in the Williston Basin.

Williston Warriors: Enerplus’ Long Bakken Run Ends in $4B Chord Deal

2024-02-22 - Chord Energy and Enerplus are combining to create an $11 billion Williston Basin operator. The deal ends a long run in the Bakken for Enerplus, which bet on the emerging horizontal shale play in Montana nearly two decades ago.

Marketed: EnCore Permian Holdings 17 Asset Packages

2024-03-05 - EnCore Permian Holdings LP has retained EnergyNet for the sale of 17 asset packages available on EnergyNet's platform.

Marketed: Foundation Energy 162 Well Package in Permian Basin

2024-04-12 - Foundation Energy Fund V-A has retained EnergyNet for the sale of a 162 Permian Basin opportunity well package in Eddy and Lea counties, New Mexico and Howard County, Texas.

Chord, Enerplus’ $4B Deal Clears Antitrust Hurdle Amid FTC Scrutiny

2024-04-08 - Chord Energy and Enerplus Corp.’s $4 billion deal is moving forward as deals by Chesapeake, Exxon Mobil and Chevron experience delays from the Federal Trade Commission’s requests for more information.