Federal Energy Regulatory Commission’s office in Washington, DC. (Source: Shutterstock)

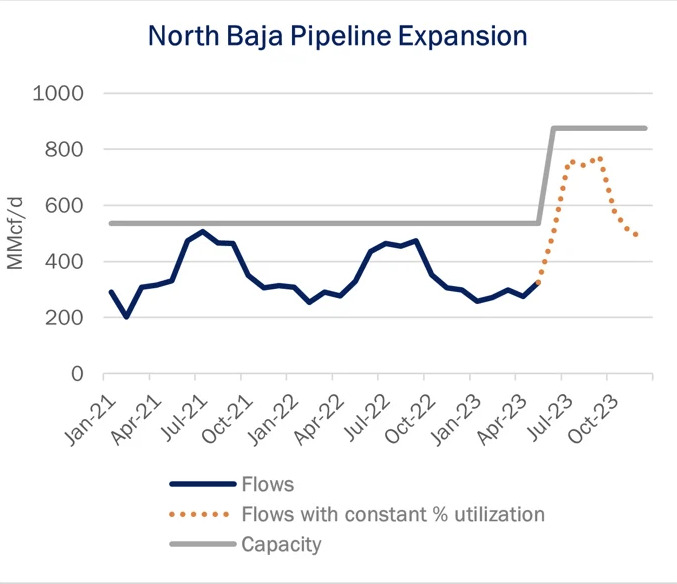

TC Energy will boost pipeline capacity to the U.S.-Mexico border by 495 MMcf/d after the Federal Energy Regulatory Commission (FERC) approved its request to place the North Baja XPress (NBX) project in service.

The approval will allow for the additional gas deliveries to the southwest and Mexico, Oren Pilant, East Daley Analytics energy analyst, said June 9 in a research report.

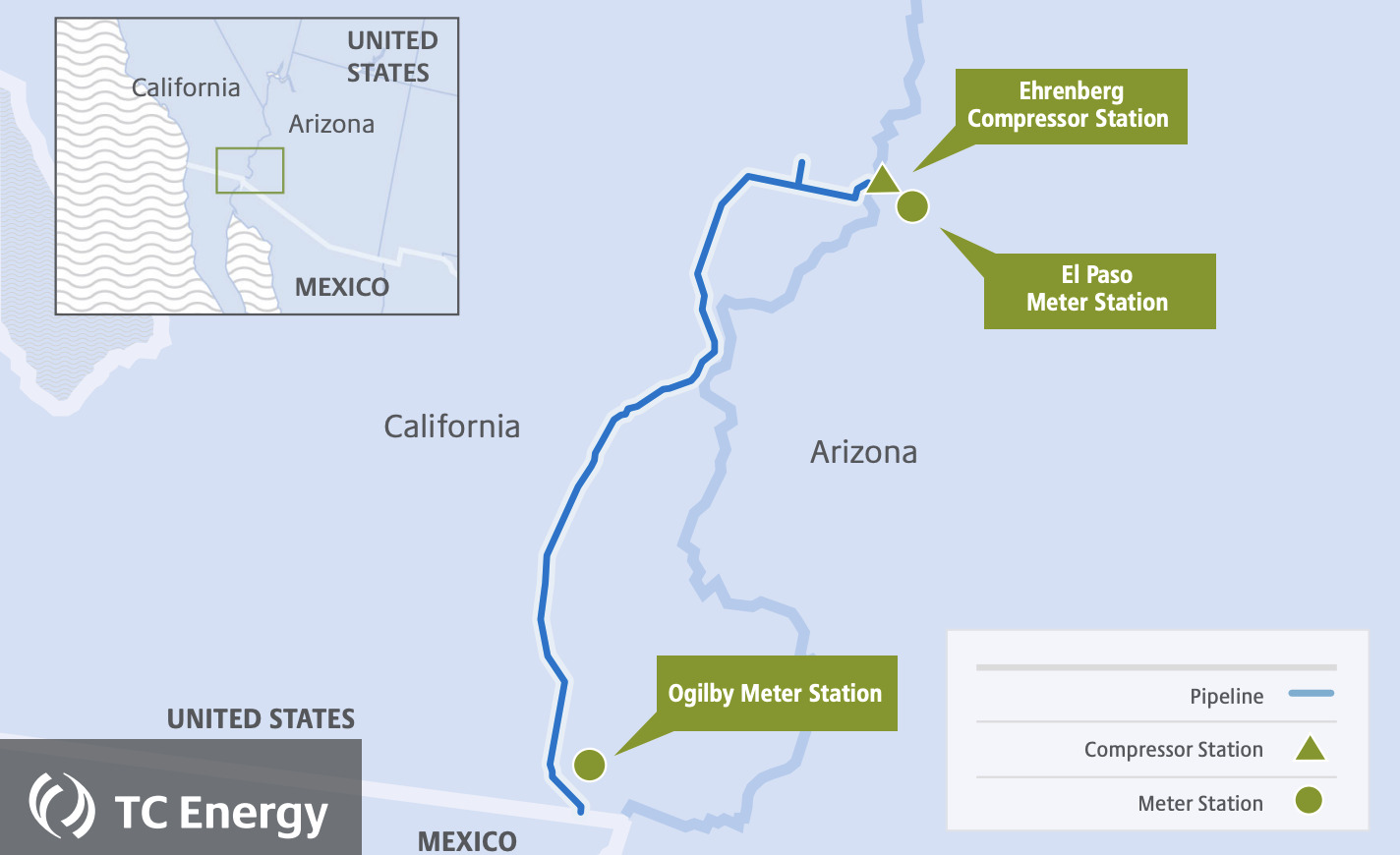

NBX was designed to expand capacity on the North Baja pipeline by upgrading one existing compressor station and two existing meter stations in Arizona and California, according to details on TC Energy’s website.

The North Baja pipeline is bi-directional and spans 80 miles from Arizona and California to the Mexico border. There, it connects to another line linked to Sempra Energy’s Energia Costa Azul LNG import terminal in Baja California, Pilant said.

The pipeline can ship up to 600 MMcf/d northbound and 500 MMcf/d south to Mexico. Currently, the pipeline transports 380 MMcf/d from the El Paso Natural Gas system, nearly all of which flows to Mexico. The El Paso system interconnects with the North Baja pipeline in Ehrenberg, Arizona, where it supplies an average 745 MMcf/d (50% utilization) to the Southern California Gas distribution system, peaking at more than 1 Bcf/d, according to Pilant.

Feeding Mexico LNG

Mexico has a number of liquefaction projects planned, including Costa Azul, with potential to add 6.1 Bcf/d beyond 2025, according to BTU Analytics.

NBX is important to the supply chain necessary for companies to eventually ship LNG from Mexico’s Pacific coast region, Pilant said.

Sempra Energy is adding liquefaction and export capability to the Costa Azul facility. Additional pipeline capacity will support LNG exports from Costa Azul, Pilant said, and supply up to 430 MMcf/d for liquefaction.

“However, [Sempra Energy] is still constructing the Costa Azul expansion and targeting start-up in the third-quarter 2025, raising the question of how much gas will flow through the North Baja pipeline in the meantime,” Pilant said.

RELATED

Permian Producers Fancy Larger Piped-gas Exports to Mexico

“It is unlikely that the North Baja pipeline would pull gas from Southern California given the premium paid [for gas] on the West Coast. But when the Costa Azul expansion comes online, likely supplied under firm contracts, either California or Mexico will pay a premium,” Pilant said.