(Source: Shutterstock.com)

Oil and gas explorers are expected to pick up the pace in 2021 after being knocked off course last year amid the global coronavirus pandemic and oil price volatility that led to deep spending cuts and activity slowdowns.

Analysts at Westwood Global Energy Group anticipate seeing between about 70 and 100 high-impact exploration wells in 2021, though companies are still solidifying drilling plans. Such wells typically target more than 100 MMboe or frontier plays.

“High impact exploration may have taken a few hits in 2020 from the ravages of a global pandemic, a crash in the oil price and the acceleration of the energy transition, but in no way is the game over,” Westwood said Jan. 11.

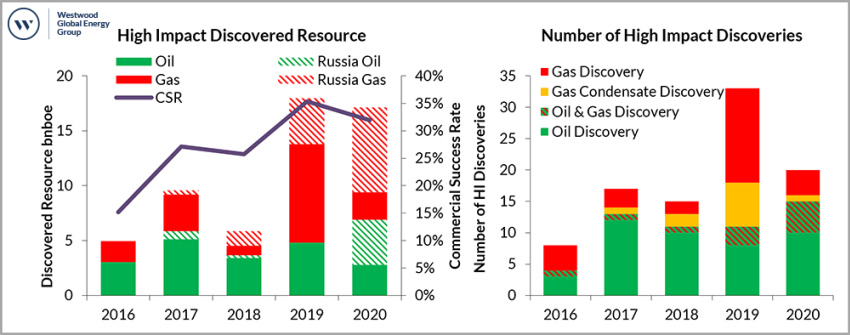

The low end is in line with the final tally of 2020 when companies completed 72 high-impact wells globally. Companies’ efforts resulted in the highest number of discovered oil barrels seen in the last five years—about 6.8 billion barrels of oil plus 10 Bboe of natural gas, the firm’s data show.

This year, exploration activity is expected to be the highest in some familiar areas. These, according to Westwood, include offshore Brazil, where eyes are on the Nemo prospect in the C-M-541 block; and offshore Mexico, where oil majors like Royal Dutch Shell Plc continue deepwater drives.

The Suriname-Guyana Basin also remains among the so-called exploration hotspots. Here, the Exxon Mobil Corp.-led consortium has made 18 discoveries totaling some 8 barrels of recoverable oil and gas on the massive Stabroek Block offshore Guyana, while Apache Corp. with partner Total SA have made three oil discoveries offshore Suriname.

Westwood believes Exxon, Shell and Total will top the list of active high-impact oil and gas explorers this year.

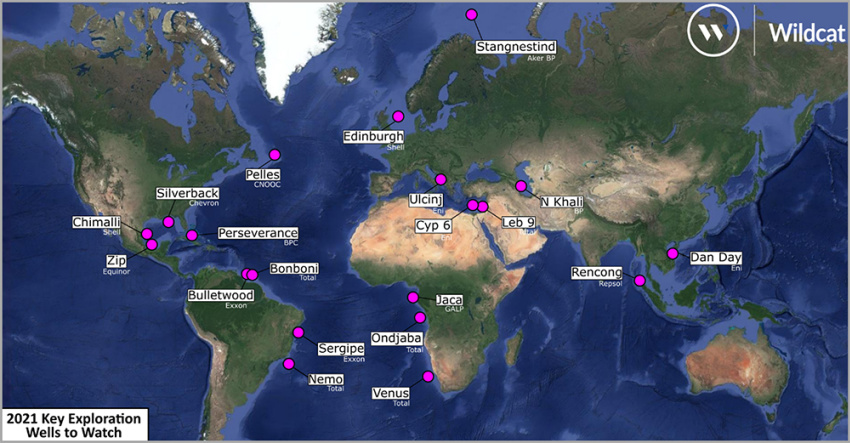

Oil and gas companies have made plans to test frontier basins, new plays in proven basins and extensions to proven commercial deepwater plays, according to Westwood analysts, which have singled out 20 wells to watch this year. These include the:

- Ultradeepwater Venus prospect in Namibia, where operator Total could be on the precipice of jumpstarting activity in a frontier basin. The prospect has multibillion-barrel potential, Westwood said;

- Bahamas Petroleum Co.-operated Perseverance prospect offshore the Bahamas where drilling started in December, targeting prospective oil resources of between 770 MMbbl and 1.4 Bbbl; and

- Chevron Corp.’s Silverback prospect in the U.S. Gulf of Mexico’s Mississippi Canyon Block 35 offshore Louisiana and Alabama.

Westwood’s list also includes Repsol SA’s Rencong well in the North Sumatra Basin offshore Indonesia, the offshore Edinburgh prospect in the central North Sea and Exxon Mobil’s Bulletwood-1 offshore Guyana in the Canje Block.

In all, “An estimated 26 Bboe is being tested by 76 wells that are considered ‘probable’ in 2021, weighted 75:25 oil to gas,” Westwood said. “This drops to ~8 Bboe split 65:35 oil to gas when the chance of success is considered, reflecting the higher risk nature of some of the oil prospects being targeted.

“As in previous years, additional discoveries may be announced in countries where drilling plans are less transparent, especially in Russia and the Middle East,” the firm added.

Westwood data show Russia was home to the biggest discoveries in 2020, making up about 70% of the discovered volumes, with finds by Rosneft in the Kara Sea and West Siberia.

The firm’s estimates show high-impact exploration led to the discovery worldwide of about 17 Bboe total in 2020.

Recommended Reading

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

For Sale, Again: Oily Northern Midland’s HighPeak Energy

2024-03-08 - The E&P is looking to hitch a ride on heated, renewed Permian Basin M&A.

Gibson, SOGDC to Develop Oil, Gas Facilities at Industrial Park in Malaysia

2024-02-14 - Sabah Oil & Gas Development Corp. says its collaboration with Gibson Shipbrokers will unlock energy availability for domestic and international markets.

E&P Highlights: Feb. 16, 2024

2024-02-19 - From the mobile offshore production unit arriving at the Nong Yao Field offshore Thailand to approval for the Castorone vessel to resume operations, below is a compilation of the latest headlines in the E&P space.