Exxon Mobil is acquiring Pioneer Natural Resources in a megadeal that will reshape the Permian Basin—and the U.S. oil landscape as we know it. (Source: Shutterstock)

Editor's note: This is a developing story. Check back for more details later.

Exxon Mobil Corp. agreed to acquire Pioneer Natural Resources in a megadeal that will reshape the American oil patch, the companies announced early Oct. 11.

The all-stock transaction, valued at approximately $59.5 billion, or $253 per share, brings together two of the largest crude oil producers in the Permian Basin, the nation’s top oil-producing region.

Pioneer shareholders will receive 2.3234 shares of Exxon stock for each Pioneer share at closing. The approximate total enterprise value of the transaction, including net debt, is approximately $64.5 billion.

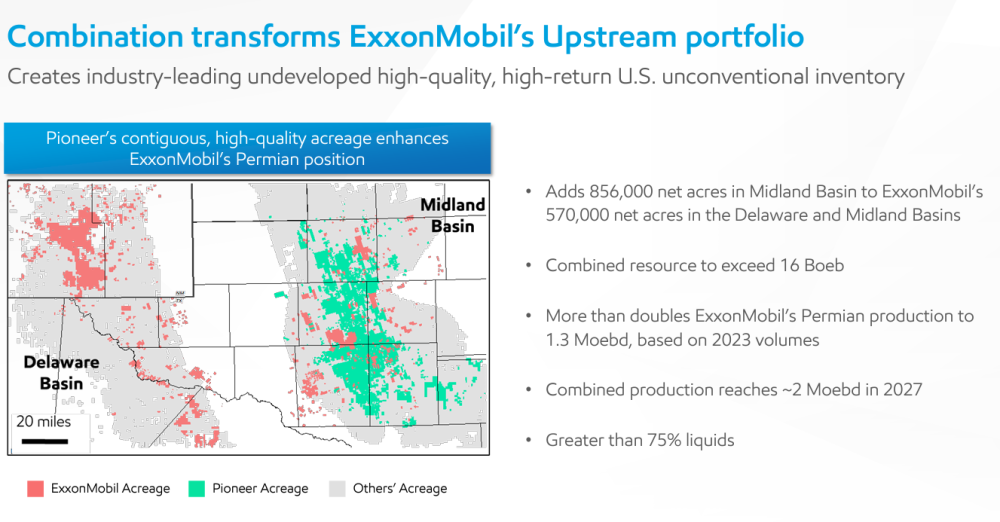

The merger adds Pioneer’s more than 850,000 net acres in the Midland Basin with Exxon's 570,000 net acres in the Delaware and Midland. Combined, the companies have an estimated 16 Bboe resource in the Permian. At close, Exxon’s Permian production volume will more than double to 1.3 Mboe/d, based on 2023 volumes, and is expected to increase to approximately 2 Mboe/d in 2027.

The historic shale deal reportedly represents Spring, Texas-based Exxon’s largest transaction since its mega-merger with Mobil in 1999.

The U.S. shale patch has seen a flurry of M&A this year—albeit on a much smaller scale—as E&Ps jockey for greater inventory depth. E&Ps including Permian Resources, Ovintiv, Civitas Resources, Callon Petroleum, Matador Resources, Vital Energy and Diamondback Energy have pumped billions of dollars into Permian Basin acquisitions in recent months.

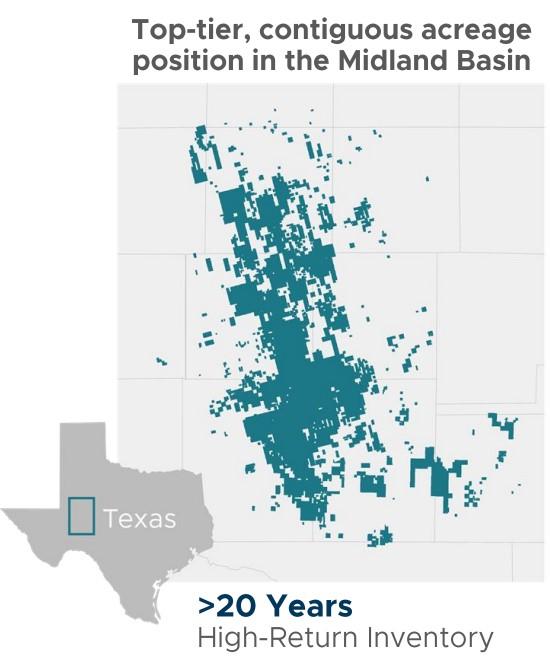

Irving, Texas-based Pioneer Natural Resources has long been seen as an attractive large-scale M&A target for Exxon, given the massive scale, quality, proportion of operatorship and undeveloped inventory depth of Pioneer’s Permian portfolio.

Pioneer is the largest producer in the Permian’s Midland Basin. The company’s second-quarter oil production averaged 369,000 bbl/d, while total production averaged 711,000 boe/d during the second quarter.

Exxon also holds a huge footprint in the Permian, where the U.S. supermajor is positioning itself for decades of future oil and gas production.

The company’s Permian production grew to a record 620,000 boe/d during the second quarter, up from 615,000 boe/d of output during the first quarter.

Exxon has aggressive growth plans for its Permian production: the company aims to boost output from the basin up to 1 million boe/d by 2027.

Scooping up Pioneer is extremely accretive to Exxon and its game plan for the Permian, said Andrew Dittmar, director at Enverus Intelligence Research.

Pioneer holds some 6,300 net locations of high-quality Midland Basin drilling inventory—or wells that generate a 10% return with WTI prices of below $50/bbl. By Enverus’ estimates, that represents 16 years of drilling activity at Pioneer’s current dig cadence.

“The key implication for the rest of the sector, in our view, would be setting a precedent for a reasonable premium in large-scale M&A,” Dittmar said in a statement. “We suspect other large-caps that are hungry for inventory would view the deal positively for any efforts to pursue similar deals.”

U.S. shale’s new era?

Throughout the COVID-19 pandemic—and even before the pandemic started—oil and gas companies weathered through a period of commodity price volatility, high levels of debt and a wave of bankruptcies and corporate restructurings.

Since that time, survivors of the great shale reckoning have worked to attract capital back into the energy sector. And they’ve tried to spend within their means to get there this time.

Matthew Bernstein, senior shale analyst at Rystad Energy, colloquially refers to this period of capital discipline by the shale industry as “Shale 3.0”—a period in contrast to the early innovations of the fracking industry and the drill-at-any-cost boom the sector saw in the years that followed.

Could a deal the size of the Exxon-Pioneer acquisition herald the start of a new era of U.S. shale, “Shale 4.0?”

“While capital discipline would still reign supreme, the “Shale 4.0” era would be unmistakably marked by consolidation,” Bernstein said in a statement.

“It would see high-spending supermajors, already in possession of large portions of the tight oil inventory, consolidate swathes of shale resources under their hold,” he said.

Recommended Reading

Well Logging Could Get a Makeover

2024-02-27 - Aramco’s KASHF robot, expected to deploy in 2025, will be able to operate in both vertical and horizontal segments of wellbores.

Tyra Redevelopment Heading for Production in March

2024-02-28 - TotalEnergies said the Danish North Sea project will take about four months to ramp up and is expected to produce 2.8 Bcm/year.

E&P Highlights: April 29, 2024

2024-04-29 - Here’s a roundup of the latest E&P headlines, including a new contract award and drilling technology.

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.

EOG: Utica Oil Can ‘Compete with the Best Plays in America’

2024-05-09 - Oil per lateral foot in the Utica is as good as top Permian wells, EOG Resources told analysts May 3 as the company is taking the play to three-mile laterals and longer.