EQT also expanded its upstream and midstream footprint in the Marcellus Shale with a nearly $3 billion acquisition of Alta Resources LLC. (Source: Shutterstock/ EQT)

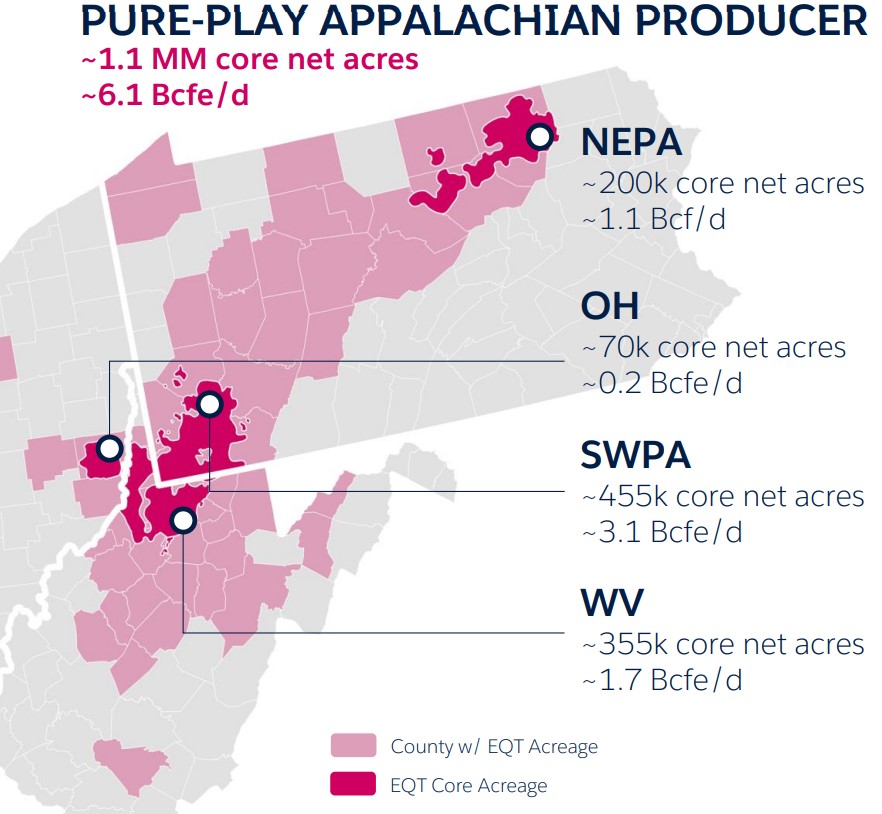

EQT Corp. upped its interest in Appalachia gas gathering systems to close out 2023 with incremental M&A—and the E&P is eyeing more acquisition opportunities this year.

Pittsburgh-based EQT entered into an agreement with a minority equity partner to acquire its 34% ownership stake in EQT-operated gathering systems for $205 million, the company reported in fourth-quarter earnings.

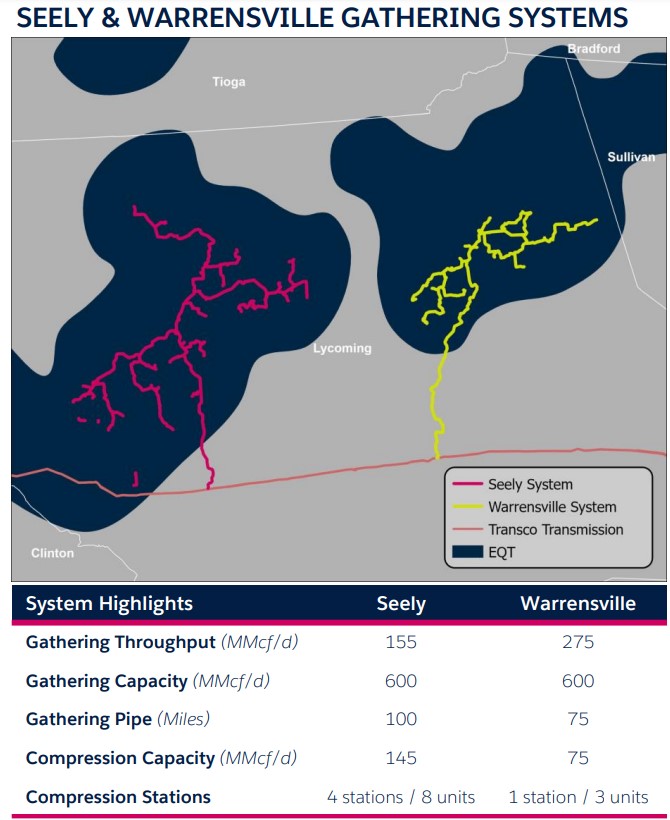

The deal includes interests in the Seely and Warrensville gathering assets in northeast Pennsylvania, where EQT is one of the largest natural gas producers.

The transaction increases EQT’s pro forma ownership of the systems to around 84% and is expected to lower EQT’s corporate free cash flow breakeven price by $0.01/Mcfe.

EQT also expanded its upstream and midstream footprint in the Marcellus Shale with a nearly $3 billion acquisition of Alta Resources LLC.

“This gathering system was part of the Alta acquisition we completed in 2021, which has been a significant source of value creation for EQT,” said EQT CFO Jeremy Knop during the company’s Feb. 14 earnings call.

Knop said the acquisition implies a “near-zero execution risk” given EQT operates the midstream systems and the company’s upstream development underpins the assets.

RELATED

EQT Integrates $5.2B Tug Hill Deal Faster Than Expected

Ground game

EQT has set aside between $200 million and $300 million for opportunistic growth projects in 2024, including for leasehold acquisitions and projects in water, midstream and gathering infrastructure.

The company is allocating $100 million for infill leasehold growth and mineral acquisitions this year, Knop said.

“We are seeing notable opportunities to add to our acreage position at extremely attractive prices this year given the low commodity price environment,” Knop said.

Incremental leasehold deals helped fuel EQT’s ground game strategy in Appalachia. The company replenished 65% of the acreage it developed over the past year through opportunistic leasehold additions.

“We believe this ability to organically backfill developed inventory is a unique feature among U.S. shale plays that largely exists only within southwest Appalachia due to the land configuration and historic development activity,” he said.

EQT found a lot of value in infill leasing activity; the company highlighted the Polecat North development in Greene County, Pennsylvania—a project in which EQT boosted its ownership stake by 18% in 2022.

The incremental interest EQT added in the project is projected to generate more than a 90% free cash flow yield in its first year of production, and a nearly 55% annual free cash flow yield over its first five years.

RELATED

$17B Chesapeake, Southwestern Merger Leaves Midstream Hanging

Biden banter

EQT CEO Toby Rice continued to lament the Biden administration’s move to pause certification of new LNG export terminals during the company’s earnings call.

The U.S. Department of Energy formally paused approvals for new LNG export projects on Jan. 26, citing the need for enhanced oversight over the environmental impacts to develop them.

“It is abundantly clear that nations around the world currently powered by coal desperately want, and need, greater access to natural gas,” Rice said in prepared remarks.

“Ultimately, political posturing will reconcile with this reality if we as a society are truly intent on achieving climate goals,” he said.

Rice is a vocal proponent for expanding U.S. LNG export capacity—or “unleashing” U.S. LNG, as he often puts it. He similarly blasted the Biden administration’s move at a House subcommittee hearing in early February.

Oil and gas industry advocates argue that the pause is hampering domestic LNG investment and leading European and Asian allies to question the security of long-term LNG supply from U.S. exporters. Environmental groups have largely supported the administration’s move.

Despite the politicization of LNG exports, EQT doesn’t expect to see a significant change in the build-out of several projects already under construction along the Gulf Coast.

“We expect in Q3, Q4, those facilities start to come online,” Knop said.

RELATED

ConocoPhillips CEO Ryan Lance Calls LNG Pause ‘Shortsighted’

Recommended Reading

Subsea Tieback Round-Up, 2026 and Beyond

2024-02-13 - The second in a two-part series, this report on subsea tiebacks looks at some of the projects around the world scheduled to come online in 2026 or later.

TGS, SLB to Conduct Engagement Phase 5 in GoM

2024-02-05 - TGS and SLB’s seventh program within the joint venture involves the acquisition of 157 Outer Continental Shelf blocks.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

StimStixx, Hunting Titan Partner on Well Perforation, Acidizing

2024-02-07 - The strategic partnership between StimStixx Technologies and Hunting Titan will increase well treatments and reduce costs, the companies said.

Tech Trends: QYSEA’s Artificially Intelligent Underwater Additions

2024-02-13 - Using their AI underwater image filtering algorithm, the QYSEA AI Diver Tracking allows the FIFISH ROV to identify a diver's movements and conducts real-time automatic analysis.