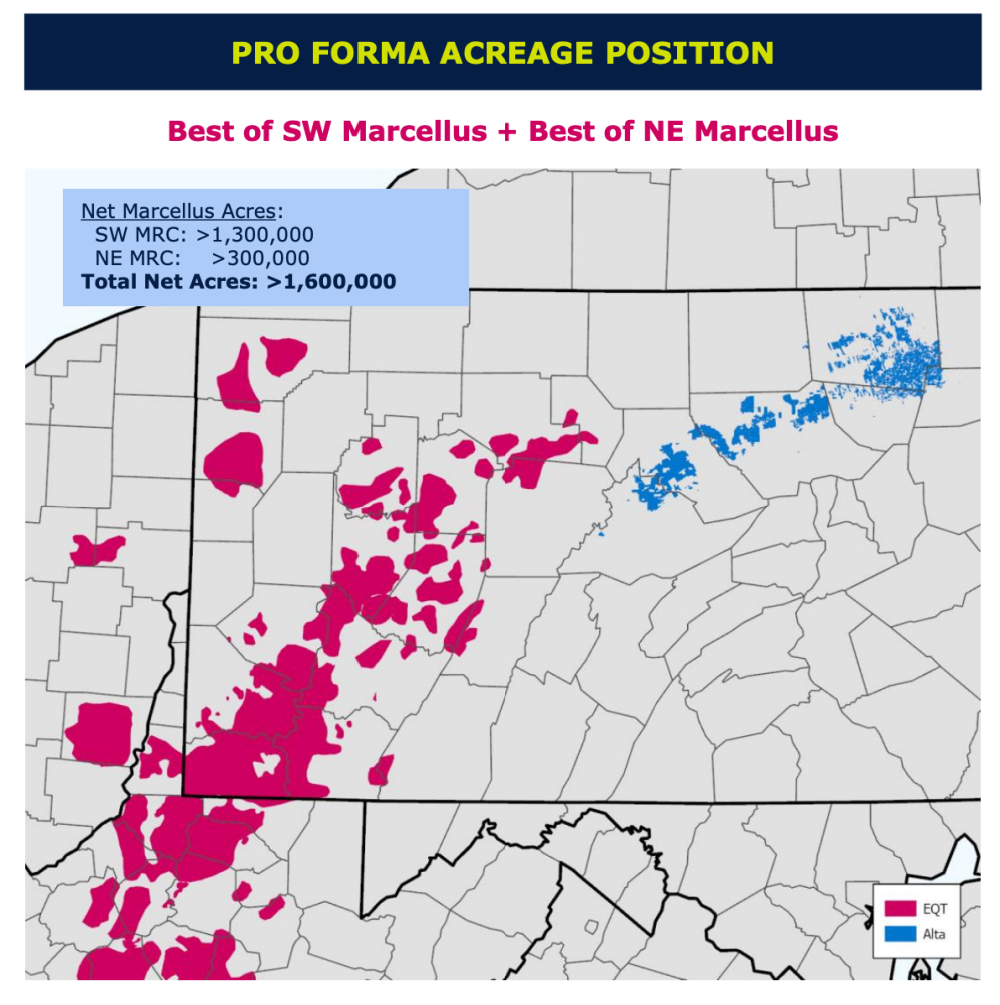

EQT said the purchase from Alta Resources will grow its acreage position in the Appalachian Basin to more than 1.6 million acres with the addition of Alta’s roughly 300,000 acreage position in the Northeast of the Marcellus Shale play. (Source: EQT Corp.; EQT Corp. logo by rafapress / Shutterstock.com)

EQT Corp. is expanding in the Marcellus Shale, adding a new operating position in Pennsylvania through an acquisition worth nearly $3 billion.

The Pittsburgh-based company announced the acquisition, comprising the Marcellus assets of Alta Resources LLC, in a company release on May 6. In the release, EQT said it will acquire all of the membership interests in Alta’s upstream and midstream subsidiaries in the core of the northeast Marcellus Shale for approximately $2.9 billion in cash and stock.

EQT, which claims to be the largest producer of natural gas in the U.S., operates in the core of the Appalachian Basin’s Marcellus and Utica shale plays. With an already formidable footprint in southwest Marcellus that stretches across Ohio, Pennsylvania and West Virginia, the company said its purchase from Alta will grow EQT’s acreage position to more than 1.6 million acres with the addition of Alta’s roughly 300,000 acreage position in the Northeast of the play.

“The acquisition of Alta’s assets represents an attractive entry into the Northeast Marcellus while accelerating our deleveraging path, providing attractive free cash flow per share accretion for our shareholders and adding highly economic inventory to EQT’s already robust portfolio,” President and CEO Toby Rice said in a statement.

EQT projects the Alta acquisition will increase its free cash flow by 55%, or $2 billion, through 2026.

Alta Resources is a private company headquartered in downtown Houston. The private E&P’s backers include the credit arm of Blackstone Group Inc., according to a note by Simmons Energy, a division of Piper Sandler.

Founded in 1999, Alta has been a leader in the exploration for and development of shale oil and gas assets including in the Fayetteville Shale of Arkansas and the liquids-rich Duvernay Shale play of Canada. The company’s current position comprises 300,000 net acres in the core of the northeast Marcellus, 98% HBP, according to the EQT release.

The Alta acreage consists of a 220,000 net-acre operated position with the remaining 78,000 net acres nonoperated. Net production is currently at 1 Bcfe/d, 100% dry gas.

“In addition to increasing our long-term optionality, we believe this transaction accelerates both our path back to investment grade metrics and our shareholder return initiatives,” Rice added. “We look forward to applying our differentiated modern operating model to maximize the prolific value embedded in these premier assets.”

Attaining an investment grade rating would bring EQT one step closer to returning capital to shareholders, noted the Simmons analysts in the firm’s note on May 6.

“Well performance from the acquired position looks attractive based on 2020 data and the asset benefits from a low royalty position,” wrote Kashy Harrison, senior research analyst at Simmons. “However, the asset does not fit hand-in-glove (i.e. CVX deal), effectively amounts to a new operating area for EQT, and possesses meaningful nonop exposure.”

The total $2.925 billion purchase price for the transaction includes $1 billion in cash and approximately $1.925 billion in EQT common stock issued directly to Alta’s shareholders.

EQT said it plans to fund the cash portion of the acquisition with cash on hand, drawings under its revolving credit facility and/or through one or more debt capital markets transactions, subject to market conditions and other factors.

Bank of America NA and JPMorgan Chase Bank NA have jointly provided $1 billion of committed financing in connection with the transaction. The company said it also has access to over $1.4 billion of liquidity under our unsecured credit facility.

The transaction is expected to close third-quarter 2021, with an effective date of Jan. 1, 2021, according to the company release.

BofA Securities is financial adviser to EQT on the transaction. Latham & Watkins LLP is serving as EQT’s counsel. Alta retained Citi Global Markets Inc. served as its exclusive financial adviser. The company is also receiving legal counsel from Kirkland & Ellis LLP.

Recommended Reading

Aethon, Murphy Refinance Debt as Fed Slashes Interest Rates

2024-09-20 - The E&Ps expect to issue new notes toward redeeming a combined $1.6 billion of existing debt, while the debt-pricing guide—the Fed funds rate—was cut on Sept. 18 from 5.5% to 5%.

Battalion Accepts Smaller Buyout Offer From Fury Resources

2024-09-19 - Permian Basin producer Battalion Oil agreed to an updated proposal to be acquired by Fury Resources for $7 per share in cash after an initial offer last year of $9.80 per share.

Vistra Buys Remaining Stake in Subsidiary Vistra Vision for $3.2B

2024-09-19 - Vistra Corp. will become the sole owner of its subsidiary Vistra Vision LLC, which owns various nuclear generation facilities, renewables and an energy storage business.

Energy Transition’s Big Ticket Item? $1.5T in Natgas Infrastructure

2024-09-19 - Energy executives from companies such as Cheniere and Woodside are planning for the energy transition—and natural gas as part of it.

Macquarie Sees Potential for Large Crude Draw Next Week

2024-09-19 - Macquarie analysts estimate an 8.2 MMbbl draw down in U.S. crude stocks and exports rebound.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.