A newly formed coalition is gearing up to connect U.S. fuel producers to heavy-industry customers in Europe, aiming to make its first shipment of clean hydrogen in the form of ammonia by 2026, according to a news release.

The Transatlantic Clean Hydrogen Trade Coalition (H2TC) will focus on “supporting first movers in the U.S. Gulf Coast and Northwestern Europe, with the goal of facilitating trade of more than three million metric tons per year of hydrogen in the form of ammonia and methanol through this corridor by 2030.”

While mostly used today to produce fertilizer, ammonia is seen as a potential hydrogen carrier and a fuel for high-emitting, hard-to-abate industrial sectors. Ammonia is considered to be easily stored and transported in existing infrastructure, ports and terminals. Low-carbon or green ammonia could also be shipped overseas and used as in its original form or cracked and purified into hydrogen gas.

Formation of the coalition, which is building its membership, comes as the U.S. works to stand up hydrogen hubs across the country and as the EU moves to import some 10 million metric tons per year of renewable hydrogen by 2030, a move that would help the region reduce emissions from heavy industry.

“The capacity to import relatively cheap clean hydrogen from the U.S. to complement local production will have a direct and significant impact on the European industry’s efforts to deploy clean production processes at scale, including in the fertilizer, steel and shipping sectors,” Chad Holliday, co-chair of coalition member Mission Possible Partnership, said in a release. “More broadly, it underscores the potential of targeted coalitions to overcome the critical next stage challenges to operationalizing net-zero commitments.”

Coalition partners include the Center for Houston’s Future, the Port of Corpus Christi and the Port of Rotterdam, according to the news release. More than 20 companies are also part of the effort. These include Ambient Fuels, Apex Clean Energy, Buckeye Partners, BAES Infrastructure, Intersect Power, Linde, LyondellBasell, NextEra Energy, OCI, Shell, STX, Trafigura and Zhero.

Energy Storage

Standard Lithium Claims Highest North American Lithium Concentrations in Smackover

Vancouver, Canada-based Standard Lithium said on Oct. 10 it has confirmed what it believes is the highest lithium grade brine in North America in the East Texas Smackover region.

The company said its latest lithium sample analyses from a new well drilled in East Texas show lithium concentrations of 663 mg/liter with grades comparable to some resources in South America. Results are based on two samples from the Upper Smackover Zone.

The lithium concentrations are triple the average lithium concentration levels reported for the California Salton Sea Geothermal Brine area, the company said.

“We expect our East Texas landholdings to form a substantially larger and higher-grade lithium brine project for future production,” Standard Lithium COO Andy Robinson said in a news release. “Standard Lithium will continue to progress its portfolio of projects to help meet U.S. demand for lithium over the next decade.”

The push to lower emissions has led to higher demand for lithium, a critical metal and key ingredient for rechargeable batteries used to power electric vehicles (EVs) and personal electronic devices. As global lithium demand is expected to spike in the coming decades, the U.S. is on a mission to increase domestic supplies and reduce reliance on Asian imports.

In addition to the East Texas project, Standard Lithium has two other, more advanced projects underway in Arkansas. The Phase 1A project in El Dorado, Arkansas, is targeting production of 5,400 tonnes per annum (tpa) of battery quality lithium carbonate over a 25-year operating life, with an average lithium grade of 217 mg/liter. Standard Lithium’s South West Arkansas Project aims for at least 30,000 tpa of battery quality lithium hydroxide over a 20-year operating life, with an average reported lithium grade of 437 mg/liter, according to the release.

“Lithium grades in the company’s projects indicate an increasing trend moving westward from Phase 1A to the South West Arkansas Project and finally, into East Texas,” the release stated. ‘In Standard Lithium’s experience, higher lithium grades in brine are directly correlated with lower capital and operating expenses per tonne of lithium produced, thereby enhancing the economic viability of potential projects.”

New York PSC Approves $160MM Battery-based Storage Facility

The New York State Public Service Commission on Oct. 12 approved construction of $160 million-dollar battery-based energy storage facility in Brookhaven, a city in New York’s Suffolk County.

Holtsville Energy Storage, an independent developer of battery storage projects, will construct the facility. It is expected to be operational by 2025.

The project is supposed to generate local property tax revenues along with up to 200 local jobs during construction, plus some long-term jobs once it is operational, the developer said.

The commission also found that the project would help advance environmental justice goals by reducing reliance on older oil- and natural gas-fired plants in New York State.

Battery energy storage facilities can also lead to long-term cost savings for electricity consumers by lowering the overall cost of providing electricity and by allowing customers to avoid paying premium pricing or peak-demand rates.

On Jan. 5, 2022, New York Gov. Kathy Hochul announced plans to double the state’s energy storage target to at least 6 gigawatts (GW) by 2030.

Toyota, Idemitsu to Mass-produce All-solid-state Batteries

Toyota Motor and Idemitsu Kosan have teamed up to develop and mass-produce all solid-state batteries for EVs, the companies said on Oct. 12.

The partnership follows an announcement in June by Toyota, the world’s biggest automaker by sales, that it would introduce the high-performance batteries to improve the driving range and reduce costs of future EVs in a strategic pivot.

Idemitsu and Toyota said in a statement they would aim to commercialize the next-generation batteries in 2027 and 2028, followed by full-scale mass production.

Solid-state batteries can hold more energy than current liquid electrolyte batteries. Automakers and analysts expect them to speed the transition to EVs by addressing their often-limited range, which remains a major consumer concern.

Geothermal

Wells2Watts Consortium Commissions Geothermal Closed-Loop Test Facility

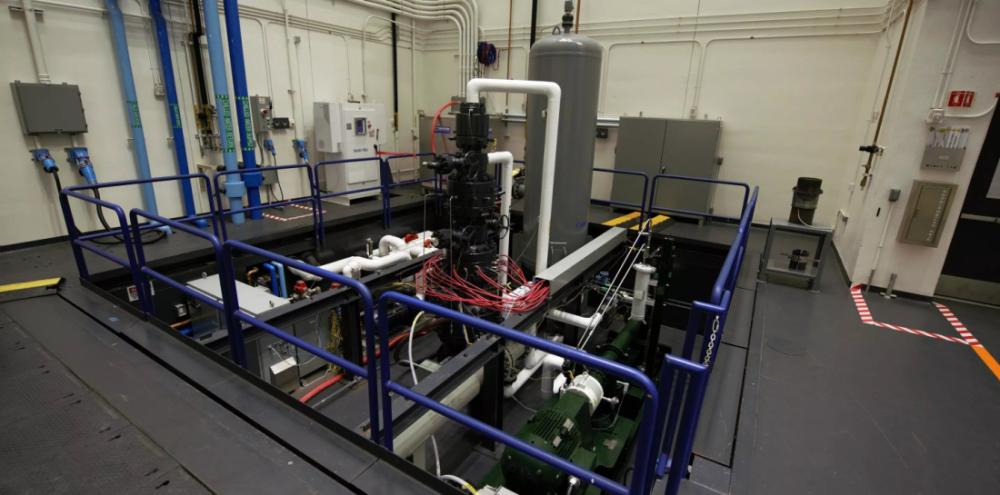

Energy technology company Baker Hughes announced on Oct. 11 the completion of the test well for its consortium Wells2Watts, a geothermal energy consortium retrofitting old well technology for geothermal energy and renewable electricity production.

The well is now ready to simulate geothermal flow testing to accelerate technology development and commercially scale geothermal as a baseload energy supply.

The geothermal test well, located at the Hamm Institute for American Energy in Oklahoma City, Oklahoma, will simulate geothermal subsurface environments to test the closed-loop system for various well configurations. The well will also validate engineering performance models and offer scale for field pilot efforts.

“Collaborating with other organizations, investing in research and development and partnering with startups are all critical to making geothermal energy more accessible and affordable,” said Maria Claudia Borras, executive vice president of oilfield services and equipment at Baker Hughes. “The completion of the Wells2Watts geothermal test well is a momentous step in our commitment to delivering new sources of energy to meet the world’s increasing demand.”

During the commissioning ceremony, the Wells2Watts consortium, which includes Continental Resources, INPEX Corp. and Chesapeake Energy Corp., welcomed California Resources Corp. as its newest member.

“[California Resources] is excited to join the Wells2Watts geothermal energy consortium, and we look forward to collaborating with its members,” Francisco Leon, president and CEO of California Resources, said in the release. “California has ambitious climate goals, and [the company] is committed to providing the state with real solutions to help meet its decarbonization targets and a sustainable, reliable and affordable energy supply.

Hydrogen

German Hydrogen Company Hy2gen Expands to US

Germany-headquartered Hy2gen, a developer of renewable hydrogen plants and producer of hydrogen-derived e-fuels, said Oct. 10 it is expanding to the U.S. as the company grows its global footprint.

Hy2gen USA Inc. plans to develop a 300-megawattt (MW) electrolysis-to-e-methanol plant for a global maritime customer, the company said. It also intends to pursue two more projects, producing renewable fuels for the marine and aviation sectors at other locations.

Cyril Dufau-Sansot, CEO of Hy2gen, said the U.S. has great potential for renewable fuels given favorable framework.

“The U.S. excels in the hydrogen economy with tax incentives and expedited, technology-open permitting processes,” said Dufau-Sansot. “This provides companies, like us, with reliable framework conditions that give them a crucial starting advantage in upcoming investment decisions.”

Portugal to Launch Pioneering Auction for Piped Green Hydrogen

Portugal will launch a pioneering auction for rights to sell green hydrogen for injection into the national gas grid in the coming weeks, with crucial state aid being discussed with Brussels, energy secretary Ana Fontoura said Oct. 12.

Some analysts say the sale—the first of its kind in Europe—could kick-start Europe’s fledgling market for green hydrogen, as countries turn to it to tackle carbon emissions and improve energy security.

“The auction for green hydrogen and biomethane [injection into the natural gas grid] will be launched in the coming weeks. We are dealing with state aid issues with the European Commission,” Fontoura, energy secretary at the environment ministry, said during a conference.

She did not say how much aid the government was intending to provide.

Under the terms of the auction, energy group Galp will contract to buy green hydrogen mixed with natural gas from producers and resell it to meet demand, a system designed to boost investment in production by giving suppliers a guaranteed buyer.

That would remove the need for dozens of bilateral contracts between suppliers and consumers.

Portugal wants to become a major producer and exporter of green hydrogen produced through a process of electrolysis using renewable energy.

Portugal’s largest gas distributor Floene tested for many months whether its polyethylene pipelines for gas can also carry hydrogen with gas blended with up to 5% of hydrogen and proved it can do so without any leaks.

Portugal eventually plans to lift that share to 20%.

Solar

Silicon Ranch, SSVEC Announce McNeal Solar Farm Completion

Renewable energy company Silicon Ranch and not-for-profit distribution cooperative Sulphur Springs Valley Electric Cooperative (SSVEC) completed their joint 20 MW alternating current McNeal Solar Farm, according to an Oct. 9 press release.

The solar farm includes an 80 megawatt-hour and battery energy storage, allowing SSVEC to meet increasing load demand throughout the day and into evening hours. The site connects to Arizona’s grid for energy distribution to more than 3,000 households across the state.

“The McNeal solar and battery storage project allows SSVEC to increase the amount of affordable, renewable energy for our members while supporting system reliability and promoting energy independence,” Jason Bowling, SSVEC CEO, said in a release.

Silicon Ranch developed and funded the project, investing over $70 million into the solar farm’s installation.

Perch Energy Lands $30MM Investment from Nuveen

Community solar service company Perch Energy has secured a $30 million investment from global asset manager Nuveen, according to an Oct. 11 news release.

The Boston-based company, which connects solar developers with consumers, said it plans to use the investment to further develop its clean energy tech platform, expand into new sales channels, products, and community solar markets, scale operations and customer care services, grow management talent, and fund strategic partnerships.

“Nuveen’s investment and affordable housing portfolio makes us even stronger to deliver on our client’s capacity targets and to meet the LMI [low or moderate income] mandates in both state and federal IRA [Inflation Reduction Act] regulations,” Perch Energy CEO Bruce Stewart said in the release. “Most importantly, it broadens our horizons for delivering discounts on electric bills to those facing barriers to entering the clean energy economy.”

Wind

Copenhagen Infrastructure Partners, SK Reach FID for Wind Farm Off South Korea

Copenhagen Infrastructure Partners (CIP) and partner SK E&S aim to startup what is expected to be South Korea’s first commercial-scale offshore wind farm by the end of 2024, the companies said Oct. 11, having reached a final investment decision on the project.

Located off Shinan County in South Korea’s Jeonnam Province, the 99-MW Jeonnam 1 wind farm secured a 20-year, fixed-price offtake agreement with Korea Hydro & Nuclear Power through Korea’s first wind offtake auction.

“Jeonnam 1 is expected to provide green electricity equivalent to approximately 60,000 households in Korea,” Daniel Yun, CEO of the Jeonnam 1, the joint venture company comprised of CIP and SK, said in a news release.

South Korea is among the countries that have established offshore wind capacity goals in an effort to reduce greenhouse-gas emissions and slow global warming. The country is targeting 14 GW of offshore wind by 2030.

Jeonnam 1 is the first of three offshore wind farms being jointly developed by CIP and S&K. Currently in the development phase, the Jeonnam 2 and Jeonnam 3 projects have a combined capacity of 800 MW, according to the release.

“Korea has a vast potential for offshore wind and CIP has, since entering the Korean market in 2018, invested significantly in developing the country’s wind power projects in multi-gigawatts scale and its supply networks and foster a strong industry ecosystem,” Torsten Lodberg Smed, senior partner at CIP, said in the release. “We are proud to have reached financial close and entering the construction phase on Jeonnam 1 and we look forward to completing this landmark project together with our partners.”

SSE Renewables, Equinor Deliver First Power from Dogger Bank Wind Farm

The first turbine at the Dogger Bank wind farm in the U.K. North Sea has produced power, Equinor said on Oct. 10, bringing electricity to British homes.

The wind farm, being jointly developed in three phases by Equinor, SSE Renewables and Vårgrønn, will be largest in the world at 3.6 GW with 277 wind turbines, Equinor said in a news release. Once complete, the wind farm will be capable of producing enough electricity to power the equivalent of 6 million British homes annually.

Full commercial operations are expected to begin in 2026.

“A renewable mega-project like Dogger Bank constitutes an industrial wind hub in the heart of the North Sea, playing a major role in the U.K.’s ambitions for offshore wind and supporting its net zero ambitions,” Equinor CEO Anders Opedal said in the release. “First power from Dogger Bank is a testament to the collaboration between the authorities, the project partners, suppliers and our host communities to realize this project.”

Power is being transmitted from the wind farm to the U.K.’s national grid via the Dogger Bank’s high-voltage direct current (HVDC) transmission system. It’s the first time HVDC technology has been used on a U.K. wind farm, according to Equinor.

The milestone also marked the first time that one of GE Vernova’s Haliade-X 13 MW turbines has been used offshore.

“Each rotation of the 107-m long blades can produce enough energy to power an average British home for two days,” Equinor said in the release.

SSE Renewables is lead operator for the project’s development and construction phase, while Equinor will serve as lead operator of the wind farm throughout its expected 35-year operational life, the release stated.

NY Rejects Ørsted, Equinor, BP Requests to Charge More for Offshore Wind

New York regulators on Oct. 12 denied requests by European energy firms Ørsted, Equinor, BP and other renewable developers to charge customers billions of dollars more under future power sale contracts.

The state denial could force some developers whose contracts may not cover project costs to scrap plans to sell power to customers in New York, cancel or delay projects, as happened with a couple of offshore wind projects in Massachusetts. Developers were looking to renegotiate contracts on four offshore wind and 86 land-based renewable projects.

Developers sought to renegotiate the contracts to include inflation adjustments, among other cost increases, because some agreements no longer cover the rising cost of building and financing projects in the current high inflation and high interest rate environment.

In response to the decision, New York Gov. Kathy Hochul released an “action plan” to support the renewable energy sector and reinforce the state’s commitment to reaching its clean energy goals. The state said it will launch an accelerated procurement process for offshore and onshore projects "to backfill any contracted projects which are terminated."

The New York Public Service Commission said amending contracts would have resulted in increases of as much as 6.7% for residential customers' monthly bills. New Yorkers already pay some of the highest rates for electricity in the country, according to federal energy data.

But if some renewable developers cancel projects, New York could have a tough time reaching its goals of having at least 70% of electric load served by renewables by 2030, development of 9,000 MW of offshore wind by 2035 and meeting statewide demand with zero emissions by 2040.

Hart Energy Staff and Reuters contributed to this report.

Recommended Reading

Pitts: Heavyweight Battle Brewing Between US Supermajors in South America

2024-04-09 - Exxon Mobil took the first swing in defense of its right of first refusal for Hess' interest in Guyana's Stabroek Block, but Chevron isn't backing down.

Exxon Mobil Green-lights $12.7B Whiptail Project Offshore Guyana

2024-04-12 - Exxon Mobil’s sixth development in the Stabroek Block will add 250,000 bbl/d capacity when it starts production in 2027.

Exxon Ups Mammoth Offshore Guyana Production by Another 100,000 bbl/d

2024-04-15 - Exxon Mobil, which took a final investment decision on its Whiptail development on April 12, now estimates its six offshore Guyana projects will average gross production of 1.3 MMbbl/d by 2027.

Petrobras to Step Up Exploration with $7.5B in Capex, CEO Says

2024-03-26 - Petrobras CEO Jean Paul Prates said the company is considering exploration opportunities from the Equatorial margin of South America to West Africa.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.