Another U.S. electric vehicle (EV) battery manufacturing facility is in the works for Georgia as Hyundai Motor Group and lithium-ion battery maker SK On announced plans for the facility this week.

There were also more moves toward growing the hydrogen market with Air Products and AES Corp. announcing plans for a $4 billion green hydrogen production facility in Texas.

Plus, Ørsted unveiled investment plans for a large facility in Denmark to produce hydrogen.

The week also marked milestones in the offshore wind sector as the U.S. wrapped up its first wind auction for development rights in the Pacific Ocean. In Norway, government officials are gearing up for the country’s first awards in an offshore wind power tender.

Here’s a look at some of this week’s renewable energy news.

Batteries

Hyundai, SK to Build New U.S. Battery Plant in Georgia

Hyundai Motor Group and lithium-ion battery maker SK On said Dec. 8 they will build an EV battery manufacturing facility in Georgia.

The new facility, which aims to start operations in 2025, will supply the Korean automaker’s U.S. assembly plants. The announcement comes after the two companies recently signed an agreement regarding a partnership for EV batteries in the U.S. At the time, details of the partnership were still in development, the companies said.

“Stakeholders estimate [the facility] will create more than 3,500 new jobs through approximately $4-5 billion of investment in Bartow County,” Hyundai said in a news release.

Separately, Hyundai broke ground in October on a $5.54 billion EV manufacturing facility in Georgia’s Bryan County.

The state is also home to SK Innovation’s $2.6 billion battery plant in Commerce.

Hydrogen

CrossWind Selects KBR for Engineering Services

Houston-based engineering firm KBR has been tapped to design offshore energy storage for CrossWind, the Shell and Eneco joint venture (JV) developing a project that will produce and store hydrogen from offshore wind.

KBR said Dec. 5 that it will perform front-end engineering design of the baseload power hub for the Hollandse Kust (north) wind farm located offshore Netherlands, having landed a contract from CrossWind.

The developers will design and develop facilities that integrate lithium-ion battery storage and green hydrogen electrolysis production, KBR said in a news release.

“The design will enable hydrogen production and electricity storage in periods of high-power production,” it said, “and will convert hydrogen to electricity, via a fuel cell, during periods of lower power production.”

The JV company plans to begin operations at the wind farm in 2023. With an installed capacity of 759 megawatts, the wind farm is expected to generate at least 3.3 TWh year.

Air Products, AES Plan Mega $4 Billion Green Hydrogen Facility

Pennsylvania-based Air Products is extending its first mover advantage as a hydrogen company by teaming with utility and power company AES Corp. to spend $4 billion in what could become the largest green hydrogen production facility in the U.S.

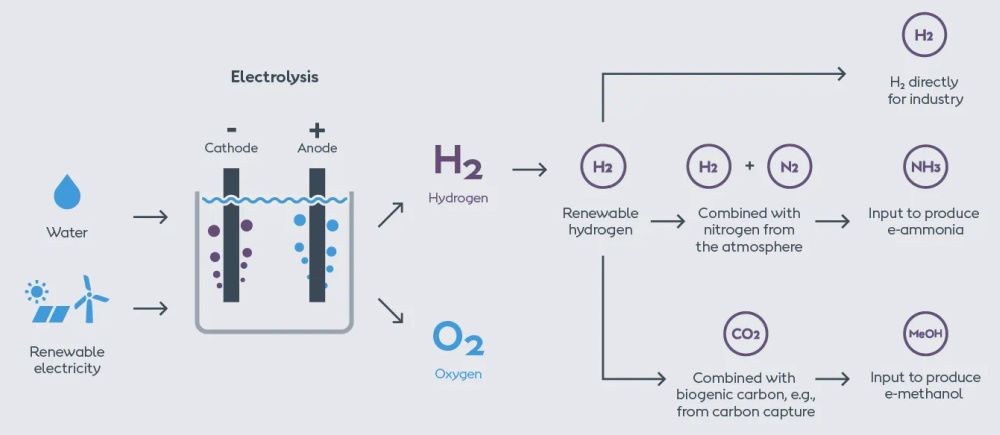

Demand for green hydrogen is expected to grow as the world seeks ways to lower its carbon footprint to slow global warming. The zero-emission alternative to fossil fuels is seen as a way to decarbonize hard-to-abate sectors such as shipping, aviation and other parts of the mobility market.

Equally owned by Air Products and AES via a joint venture, the mega facility will be located in Wilbarger County, Texas, where more than 200 metric tons per day (mt/d) will be produced. Plans also include about 1.4 gigawatts of new solar and wind facilities to generate electricity for electrolyzers for the project that has been in the making out of public view for more than two years. It aims to begin commercial operations in 2027.

Ørsted Plans Large-Scale Green Hydrogen Project in Denmark

Renewable energy firm Ørsted on Dec. 6 said it intends to invest in a large-scale facility in Denmark to produce green hydrogen, considered a cornerstone of the shift to cleaner energy.

The first stage of the investment in the so-called Power-to-X facility is estimated at somewhere between $141 million and $705 million, a spokesperson told Reuters.

Power-to-X is a technology which converts surplus electricity, usually from renewable sources like wind and solar by using it to produce storable substances or fuels such as hydrogen or methane.

Ørsted, which is developing the project with Skovgaard Energy, plans for the first phase to have an electrolysis capacity of 150 MW.

The capacity might increase to more than 3 GW “if the necessary offshore wind capacity and hydrogen infrastructure in and out of Denmark are established,” it said in a statement.

BP Looks to Explore Egypt’s Green Hydrogen Potential

BP and Egypt have signed an agreement to look into possibly establishing a new green hydrogen facility in the country.

The energy company said Dec. 8 it will “carry out several studies to evaluate the technical and commercial feasibility of developing a multi-phase, large scale green hydrogen (gH2) export hub in Egypt,” as part of the agreement.

Hydrogen has been identified as one of BP’s five energy transition growth engines.

Earlier this year, the company formed a strategic partnership with Oman’s Energy Ministry to support the potential development of green hydrogen. It has also made hydrogen investments in other regions, including Australia.

Barcelona-Marseille Hydrogen Pipeline to Cost About $2 Billion

An underwater pipeline to carry green hydrogen between Barcelona and Marseille will cost around $2.1 billion, according to preliminary estimates of the project agreed between Spain, Portugal and France, two sources told Reuters.

It comes as an energy crisis caused by the war in Ukraine has accelerated European plans to bolster renewable energy as an alternative to Russian gas. Spain and Portugal aim to become clean hydrogen hubs and net energy exporters, causing tensions with France, which plans to produce its own hydrogen using nuclear energy.

On Dec. 9, the leaders of the three countries will meet in the Spanish city of Alicante together with European Commission President Ursula von der Leyen to discuss a construction timeline and financing for a new hydrogen pipeline.

The price estimate does not include the cost of linking the pipeline, dubbed H2MED, with connections on land, the two sources with knowledge of the matter said, with the second—an industry source—adding it could rise to around $3.2 billion depending on the underwater route the pipe takes.

Solar

Erthos, Industrial Sign to Develop Solar Project in Texas

Arizona-based solar startup Erthos Inc. said Dec. 8 it has signed an agreement with renewable energy and storage developer Industrial Sun LLC for a new utility-scale solar project in Texas.

The agreement marks the startup’s largest contract to date.

“The project has an expected interconnect capacity of 100 MWac [MW alternating current], all of which Industrial Sun is seeking to utilize,” Erthos said in a news release. “Facing an area with minimal lands suitable for development, they could not meet this target with conventional solar technologies, which typically require between five and six acres of land per MWac.”

The company said its Earth Mount Solar PV typically requires fewer than 2.5 acres per MWac.

“Erthos technology allows us to maximize our project capacity, particularly in those areas where our projects are land-constrained,” Wade Gungoll, managing director of Industrial Sun, said in the release. “Erthos is a very welcome solution for our business, and for any developer needing to up-size the capacity of their projects.”

Total Eren, Chariot Partner on Solar Project for Mine in Zimbabwe

Renewable energy power producer Total Eren is working with Africa-focused Chariot to finance, construct and operate a solar photovoltaic project to power Karo Mining Holding’s platinum mine in Zimbabwe, the companies said in a news release Dec. 7.

The solar project will have the potential to expand to up to 300 megawatts peak (MWp) but is expected to have an initial installed capacity of 30 MWp, the news release stated.

Construction of the mine has begun, and Total Eren has already signed a long-term power purchase agreement with Karo, which aims to lower its carbon footprint.

“As part of our sustainable development plan, green power was always placed at the forefront of our energy strategy,” said Bernard Pryor, managing director of Karo. “Land designated to develop this type of power strategy has been allocated, close to the Karo Mine but also being mindful of a broader power strategy that we will develop with our partners and the government of Zimbabwe, to ensure stable and lasting green energy benefitting all our stakeholders and beyond."

Benoit Garrivier, CEO of Chariot Transitional Power, added that the project will also move the company toward its goal to deliver a 1 GW renewable energy pipeline in Africa.

Wind

Norway to Make First Offshore Wind Tender Awards by Autumn 2023

The Norwegian government plans to make its first awards in an offshore wind power tender by the summer or autumn of 2023, it said on Dec. 6 as it published long-awaited criteria for companies to take part in the bidding.

The Nordic country, a major producer of oil and gas as well as hydropower, plans to commission up to 30 GW of offshore wind capacity by 2040.

A wide range of utilities, oil and gas producers and engineering companies have lined up to develop offshore power projects in Norway, including Equinor, Shell, BP, Ørsted, Statkraft and Eni.

In a first step, Norway will develop Soerlige Nordsjoe II phase 1, covering 235 square miles of a wider, pre-chosen area bordering the Danish sector of the North Sea that is suitable for bottom-fixed wind-power turbines.

As part of a compromise over rising domestic power prices and a looming power deficit, the first phase comprising 1.5 gigawatt of capacity will connect to the Norwegian market only.

The auction for Soerlige Nordsjoe II will open at the end of the first quarter of 2023, with awards given toward summer/autumn, the government said.

U.S. Pacific Wind Energy Auction Racks up $757 Million in Winning Bids

The first U.S. wind auction for development rights in the Pacific Ocean attracted more than $757 million in winning bids Dec. 7 as developers looked to enter deepwater offshore California.

Provisional winners of the five wind leases areas, totaling nearly 373,270 acres offshore central and northern California, were RWE Offshore Wind Holdings, California North Floating, Equinor Wind US, Central California Offshore Wind and Invenergy California Offshore Wind.

The identities of the companies were unveiled after the end of the auction, which began Dec. 6 with multiple rounds of bidding and continued the next day after an evening recess.

Reuters contributed to this article.

Recommended Reading

NextDecade Appoints Former Exxon Mobil Executive Tarik Skeik as COO

2024-07-25 - Tarik Skeik will take up NextDecade's COO reins roughly two months after the company disclosed it had doubts about remaining a “going concern.”

CEO: Baker Hughes Lands $3.5B in New Contracts in ‘Age of Gas’

2024-07-26 - Baker Hughes revised down its global upstream spending outlook for the year due to “North American softness” with oil activity recovery in second half unlikely to materialize, President and CEO Lorenzo Simonelli said.

Freeport LNG Parent Receives Junk-level Credit Score From Fitch

2024-07-25 - Credit-rating firm Fitch Ratings cited the 2 Bcf/d Texas plant’s frequent downtimes among the factors leading to lowering Freeport LNG Investments LLLP’s credit grade on July 25.

Golden Pass LNG Likely Delayed After Engineering Firm Lays Off 4,400

2024-06-06 - An analyst estimated Golden Pass LNG’s in-service date could be set back six months and that the export terminal’s owners, Exxon Mobil and Qatar Energy, might try to retain workers formerly employed by Zachry Engineering.

Cheniere Increases Share Repurchase Budget by $4B Through 2027

2024-06-18 - Cheniere will also increase its quarterly dividend by approximately 15% to $2 per share annualized.