Development of the wind energy areas will push the U.S. toward the Biden administration’s goal of deploying 30 gigawatts (GW) of offshore wind energy capacity by 2030.

The first U.S. wind auction for development rights in the Pacific Ocean attracted more than $757 million in winning bids Dec. 7 as developers looked to enter deepwater offshore California.

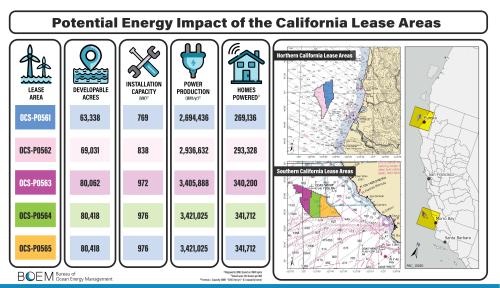

Provisional winners of the five wind leases areas, totaling nearly 373,270 acres offshore central and northern California, were RWE Offshore Wind Holdings, California North Floating, Equinor Wind US, Central California Offshore Wind and Invenergy California Offshore Wind.

The identities of the companies were unveiled after the end of the auction, which began Dec. 6 with multiple rounds of bidding and continued the next day after an evening recess.

RELATED

Bidding Continues in Historic U.S. Floating Wind Auction Offshore California

The companies are expected to set the course for commercial-scale floating wind projects in the deepwater off the California coastline. Previous U.S. offshore lease sales have been in shallow-water in the Atlantic.

“Today’s lease sale is further proof that industry momentum—including for floating offshore wind development—is undeniable,” said Department of Interior Secretary Deb Haaland. “A sustainable, clean energy future is within our grasp, and the Interior Department is doing everything we can to ensure that American communities nationwide benefit.”

Development of the wind energy areas will push the U.S. toward the Biden administration’s goal of deploying 30 gigawatts (GW) of offshore wind energy capacity by 2030 and 15 GW of floating offshore wind by 2035. The action will also move California closer to its ambitions of producing up to 5 GW of electricity from offshore wind by 2030 and 25 GW by 2045.

Winning high bids

Copenhagen Infrastructure Partners’ (CIP) California North Floating landed the 69,031-acre OCS-P 0562 lease area, which the company said has a potential capacity of more than 1 GW. Its $173.8 million bid was the sale’s highest.

“California is expected to develop into a key market for floating offshore wind and the auction represented a strong investment opportunity for us,” CIP Senior Partner Torsten Smed said.

Equinor Wind US secured the 2-GW OCS-P 0563 lease in the Morro Bay area with its $130 million bid. The lease will join Equinor’s U.S. wind portfolio that includes the Empire Wind and Beacon Wind projects on the Northeast coast.

“The U.S. West Coast is one of the most attractive growth regions for floating offshore wind in the world due to its favorable wind conditions and proximity to markets that need reliable, clean energy,” said Molly Morris, president of Equinor Wind US. She called the U.S. a key offshore wind market for Equinor.

Ocean Winds and Canada Pension Plan Investment Board’s newly-formed joint venture, Central California Offshore Wind, landed the 80,418-acre OCS-P 0564 lease in the Morro Bay area off central California with its $150.3 million bid.

“OW is a pioneer of floating offshore wind technology—with nearly 3.7 GW of floating wind projects in development or operations in Portugal, France, South Korea and the U.K. – and we are ready to bring our expertise to the U.S. as well,” said Michael Brown, the CEO of Ocean Winds North America.

With a $145.3 million bid, Invenergy California Offshore Wind secured the 80,418-acre OCS-P 0565 lease area, while RWE Offshore Wind Holdings’ landed the 63,338-acre OCS-P 0561 lease area with its $157.7 million bid.

Floating test

The American Clean Power Association (ACP) called the lease sale a “historic step forward.”

“California is set to become a pioneer in floating wind technology that will lower energy costs and increase grid reliability,” said JC Sandberg, ACP’s interim CEO and chief advocacy officer. “We applaud the companies that are advancing the deployment of floating offshore wind technology.”

Floating support structures are used in water depths greater than 60 m, according to the National Renewable Energy Laboratory.

The wind sale offshore California has put U.S. at the floating wind forefront, according to the National Ocean Industries Association (NOIA).

“Floating wind technology in its early stages, but it is an advanced technology that will lead to strong growth in the deployment of offshore wind,” NOIA President Erik Milito said. “The timely scaling and deployment of floating wind technology will be vital in meeting U.S. and global renewable energy goals.”

Unlike conventional fixed-bottom wind turbines that are attached to the seabed in shallower water, floating turbines are moored to floating structures to harness power in deeper waters.

Sitting atop a platform, the turbines are attached with mooring lines connected with anchors to the seafloor. They work the same as other wind turbines: wind pushes the turbine’s blades, causing them to spin and turn the rotor that is connected to a generator.

So far, only 0.1 GW of floating offshore wind has been deployed globally. By contrast, more than 50 GW of fixed-bottom offshore wind has been deployed.

In water depths between 95 m and 120 m, the world’s first commercial floating wind farm—the Equinor-operated, 30-MW Hywind Scotland—came online in 2017. Equinor and partner Masdar invested NOK 2 billion (US$200 million) on the 5-turbine wind farm.

Equinor is currently developing a floating wind farm that will provide electricity for the Snorre and Gullfaks oil and gas fields in the Norwegian North Sea. Once complete, the 11-turbine Hywind Tampen could be the world’s largest floating offshore wind farm with a capacity of 88 megawatts (MW), according to Equinor.

‘Substantial investment’

A total of 43 developers qualified to participate in the milestone lease sale. Only seven bidders were active when the auction started Dec. 6. However, by Round 6, that number had dropped to six.

The results far exceeded the first lease sales held in the Atlantic, according to the Interior Department.

“The innovative bidding credits in the California auction will result in tangible investments for the floating offshore wind workforce and supply chain in the United States, and benefits to tribes, communities and ocean users potentially affected by future offshore wind activities,” added said Bureau of Ocean Energy Management director Amanda Lefton. “This auction commits substantial investment to support economic growth from floating offshore wind energy development – including the jobs that come with it.”

So far this year the U.S. has held two offshore wind auctions, including the six-lease New York Bight offshore auction in February that attracted a record-setting $4.4 billion in winning bids from six companies.

Individual bids ranged from $285 million to $1.1 billion.

In May, the Carolina Long Bay Offshore Wind lease sale for two leases brought in $315 million in winning bids.

Recommended Reading

TotalEnergies Acquires Eagle Ford Interest, Ups Texas NatGas Production

2024-04-08 - TotalEnergies’ 20% interest in the Eagle Ford’s Dorado Field will increase its natural gas production in Texas by 50 MMcf/d in 2024.

TPH: Lower 48 to Shed Rigs Through 3Q Before Gas Plays Rebound

2024-03-13 - TPH&Co. analysis shows the Permian Basin will lose rigs near term, but as activity in gassy plays ticks up later this year, the Permian may be headed towards muted activity into 2025.

Texas Earthquake Could Further Restrict Oil Companies' Saltwater Disposal Options

2024-04-12 - The quake was the largest yet in the Stanton Seismic Response Area in the Permian Basin, where regulators were already monitoring seismic activity linked to disposal of saltwater, a natural byproduct of oil and gas production.

Chevron Hunts Upside for Oil Recovery, D&C Savings with Permian Pilots

2024-02-06 - New techniques and technologies being piloted by Chevron in the Permian Basin are improving drilling and completed cycle times. Executives at the California-based major hope to eventually improve overall resource recovery from its shale portfolio.

Proven Volumes at Aramco’s Jafurah Field Jump on New Booking Approach

2024-02-27 - Aramco’s addition of 15 Tcf of gas and 2 Bbbl of condensate brings Jafurah’s proven reserves up to 229 Tcf of gas and 75 Bbbl of condensate.