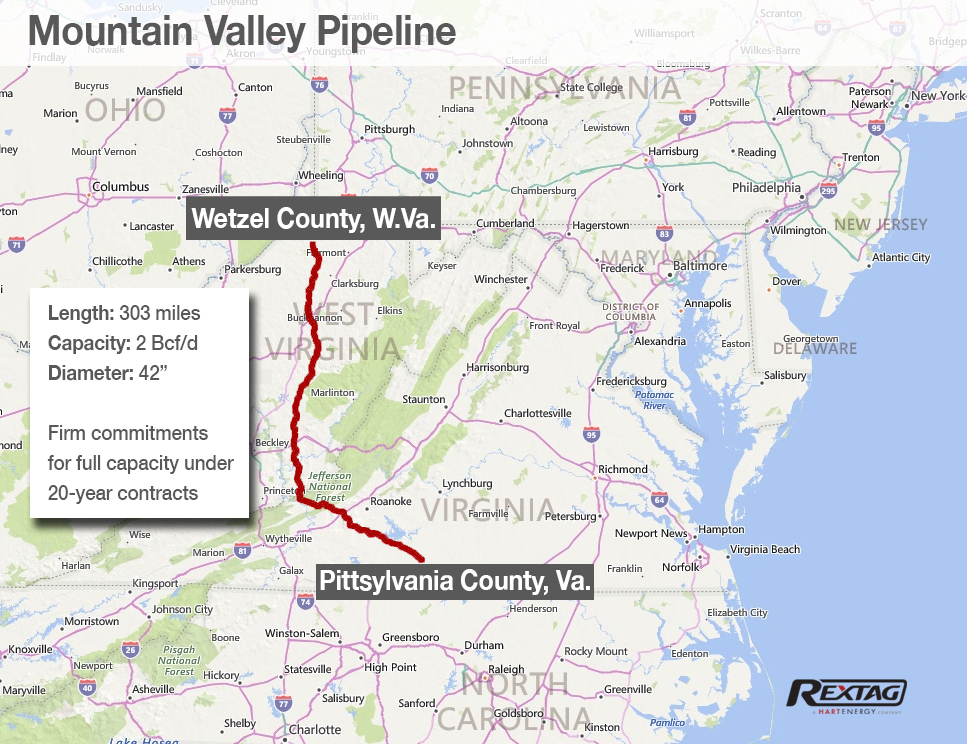

Shares in Equitrans Midstream rose 34% May 30 following news of a federal budget deal benefitting its Mountain Valley Pipeline project. (Source: Shutterstock.com)(Source: Shutterstock)

Equitrans Midstream’s stock shot up 34% on May 30 as investors responded enthusiastically to a federal budget deal favoring the company’s Mountain Valley Pipeline (MVP) project.

Whether the deal between President Joe Biden and House Speaker Kevin McCarthy (R-Calif.) passes Congress as it stands, however, and whether it will clear the way for the $6.6 billion natural gas pipeline’s completion is not entirely clear.

The pipeline still faces legal and political hurdles. Sen. Tim Kaine (D-Va.) promised to introduce an amendment to delete language supporting approval of MVP in the Senate’s bill. Rep. Jennifer McClellan (D-Va.) said she plans to do the same with the House version.

Still, industry groups were pleased with the budget compromise, which includes tools to speed up the federal permitting process. The legislation includes designating a lead agency to oversee reviews involving more than one government agency and requiring the approval process to be completed in one to two years.

“The Independent Petroleum Association of America (IPAA) is pleased Congress and the Biden Administration have developed a bipartisan agreement on the debt ceiling that includes important elements of reforming our nation’s onerous process for permitting energy projects,” said C. Jeffrey Eshelman II, president and CEO of the trade group, in a statement to Hart Energy. “Although the agreement does not address many of the key issues surrounding permitting reform for oil, natural gas and other energy projects, it is a good first step in that process.”

RELATED

SUPER DUG: IPAA's Pruett Talks Permit Reform [WATCH]

API also acknowledged in a statement the systemic issues at play as it applauded the compromise deal.

“Our current system for reviewing the infrastructure projects that fuel our economy and support our way of life did not become an endless gauntlet of bureaucratic hurdles overnight, and it will take more than one step to develop a workable process,” API President and CEO Mike Sommers said.

The House bill, known as the Fiscal Responsibility Act of 2023, states that Congress “finds and declares that the timely completion of construction and operation of the Mountain Valley Pipeline is required in the national interest.” The bill also requires expedited permitting to allow the pipeline to be completed and to start operation.

Policy shift ahead?

Equitrans’ stock price jump followed a research note from RBC Capital that raised the stock’s rating to sector outperform from perform, and its price target from $7 to $10. The May 30 price in mid-afternoon was $8.17, up $2.14 at the start of trading. Its 52-week high is $9.90.

EQM Midstream Partners, a wholly owned subsidiary of Equitrans, is the lead partner in the Mountain Valley Pipeline LLC joint venture (JV), with a 47.5% interest. Others in the JV are NextEra Capital Holdings, Con Edison Transmission, WGL Midstream and RGC Midstream.

Analysts expressed hope the deal signaled a shift in policy.

“Permitting reform could help finally get the Mountain Valley Pipeline across the finish line after being tied up in courts for years, which is a directional positive on industry-friendly policy,” TPH said in a research note. “The bill also includes permitting reform beyond expediting MVP that could encourage companies to bring previously shelved projects back to life.”

Federal, not state, reforms

Even if the bill passes both houses of Congress with provisions for permitting reform and MVP completion intact, any kind of acceleration in the process would only affect energy projects at the federal level. The legislation would not affect state and local regulations, Cale Jaffe, law professor at the University of Virginia, told Hart Energy while passage of Sen. Joe Manchin’s (D-W.Va.) permitting reform bill was in play late last year.

“I would anticipate, certainly, a change in perspective on the side of the federal regulator, but that does not mean that the permits for any particular project are a foregone conclusion or a project development is a fait accompli,” Jaffe said. “There still are other stakeholders that are not parties to that agreement, and I think you’ve seen that from a lot of the nonprofits who have already said they still intend to fight oil and gas infrastructure projects that they’ve been opposing.”

Cases already brought will continue to work their way through the courts. On May 26, the D.C. Court of Appeals sent several orders that extended MVP’s construction timeline back to the Federal Energy Regulatory Commission (FERC).

The suit by the Sierra Club and others argued that FERC did not conduct supplemental environmental analyses when issuing its orders. The court’s decision forces the commission to perform those analyses or explain why it did not conduct them.

And the Institute for Energy Economics and Financial Analysis was unsparing in its criticism of the plan to smooth the way for the MVP.

“The ill-advised plan to override the MVP public permit process and the right to judicial review undermines U.S. government principles,” wrote Suzanne Mattei, an energy policy analyst with the organization. “It’s a bad way to make decisions on a gas project.”

Recommended Reading

Going with the Flow: Universities, Operators Team on Flow Assurance Research

2024-03-05 - From Icy Waterfloods to Gas Lift Slugs, operators and researchers at Texas Tech University and the Colorado School of Mines are finding ways to optimize flow assurance, reduce costs and improve wells.

Defeating the ‘Four Horsemen’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production—and keep the cash flowing.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

TGS, SLB to Conduct Engagement Phase 5 in GoM

2024-02-05 - TGS and SLB’s seventh program within the joint venture involves the acquisition of 157 Outer Continental Shelf blocks.

StimStixx, Hunting Titan Partner on Well Perforation, Acidizing

2024-02-07 - The strategic partnership between StimStixx Technologies and Hunting Titan will increase well treatments and reduce costs, the companies said.