Permian oil and gas production is expected to hit new records, the EIA says. (Source: Shutterstock)

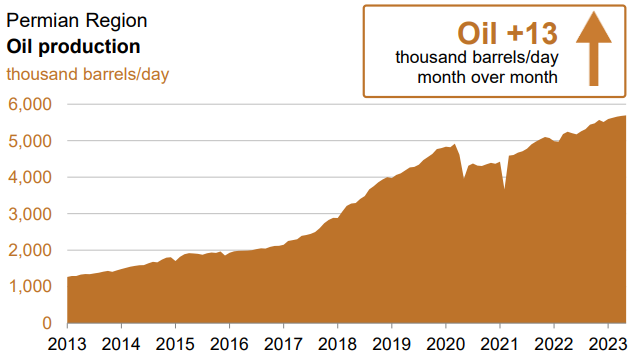

Oil and gas output from the Permian Basin is expected to reach record levels next month, according to new forecasts.

Crude oil production in the Permian will rise to a record 5.693 MMbbl/d in May, according to figures released by the U.S. Energy Information Administration (EIA) on April 17.

That’s about a 13,000 bbl/d increase from the basin’s April oil production forecast of 5.68 MMbbl/d, EIA reported.

RELATED

Occidental CEO: US Permian Production Has Yet to Hit Peak

Crude production is also expected to rise in other basins outside of the mighty Permian, the Lower 48’s premier oil play.

Oil production growth month-over-month will be led by the Bakken play in North Dakota and Montana. Crude output from the Bakken is forecasted to rise by about 17,000 bbl/d to an average of 1.175 MMbbl/d in May.

Crude production in the Bakken peaked at 1.544 MMbbl/d in November 2019, according to EIA data.

Month over month oil output gains are also anticipated next month in the Anadarko Basin (8,000 bbl/d), the Eagle Ford Shale (6,000 bbl/d) and the Niobrara Basin (4,000 bbl/d).

On April 11, the EIA raised its outlook for U.S. and global crude prices after OPEC’s surprise decision to cut oil production from May through the end of 2023.

WTI crude prices are expected to average $79.24/bbl this year, up from March’s forecast of $77.10/bbl.

Brent crude spot prices are expected to average about $85/bbl in 2023, up more than $2/bbl from the EIA’s forecast last month.

Haynesville, Permian lead gas growth

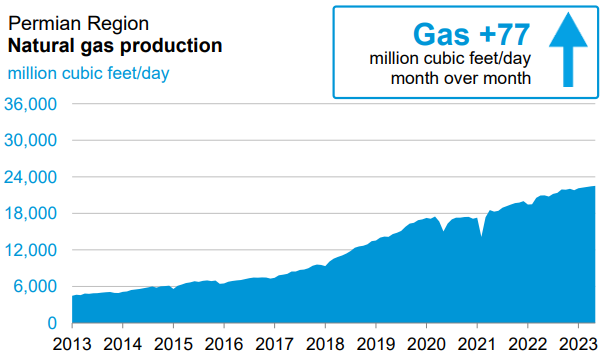

As the Permian ramps up to record production levels, associated gas volumes coming out of the basin are also expected to reach record levels.

Associated gas output in the Permian will top 22.51 Bcf/d in May, an increase of roughly 77 MMcf/d month over month, the EIA said.

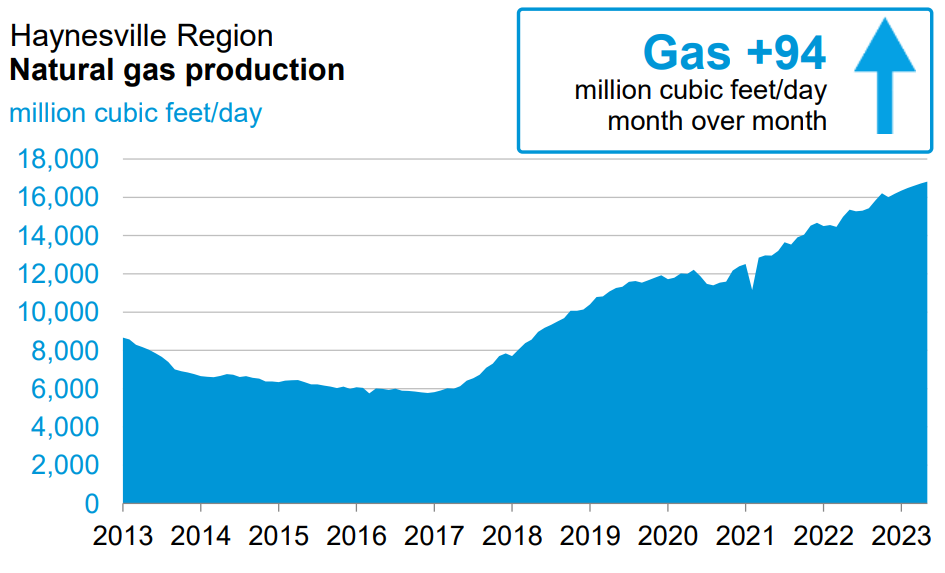

Natural gas production growth in the Lower 48 will be led by the Haynesville Shale in Louisiana and East Texas.

Haynesville gas production is forecasted to reach a record 16.82 Bcf/d in May, up 94 MMcf month over month.

Gas output from the Appalachia region is also at near-record levels: Appalachian gas production is expected to grow by 48 MMcf/d to 35.28 Bcf/d in May.

Natural gas production in Appalachia peaked at over 36 Bcf/d in December 2021, per EIA data.

An oversupply of gas and weaker-than-expected demand have pressured the sector and sent commodity prices plunging in recent months.

U.S. natural gas prices will average $2.94/MMBtu in 2023, down over 50% from the $6.42/MMBtu average last year, the EIA said.

Gas producers have faced a mild season for winter weather and higher-than-average inventories of gas storage this year.

RELATED

EIA Raises Crude Price Forecast, Slashes Natural Gas Price Outlook

Recommended Reading

E&P Earnings Season Proves Up Stronger Efficiencies, Profits

2024-04-04 - The 2024 outlook for E&Ps largely surprises to the upside with conservative budgets and steady volumes.

CEO: Coterra ‘Deeply Curious’ on M&A Amid E&P Consolidation Wave

2024-02-26 - Coterra Energy has yet to get in on the large-scale M&A wave sweeping across the Lower 48—but CEO Tom Jorden said Coterra is keeping an eye on acquisition opportunities.

Endeavor Integration Brings Capital Efficiency, Durability to Diamondback

2024-02-22 - The combined Diamondback-Endeavor deal is expected to realize $3 billion in synergies and have 12 years of sub-$40/bbl breakeven inventory.

Patterson-UTI Braces for Activity ‘Pause’ After E&P Consolidations

2024-02-19 - Patterson-UTI saw net income rebound from 2022 and CEO Andy Hendricks says the company is well positioned following a wave of E&P consolidations that may slow activity.

CEO: Magnolia Hunting Giddings Bolt-ons that ‘Pack a Punch’ in ‘24

2024-02-16 - Magnolia Oil & Gas plans to boost production volumes in the single digits this year, with the majority of the growth coming from the Giddings Field.