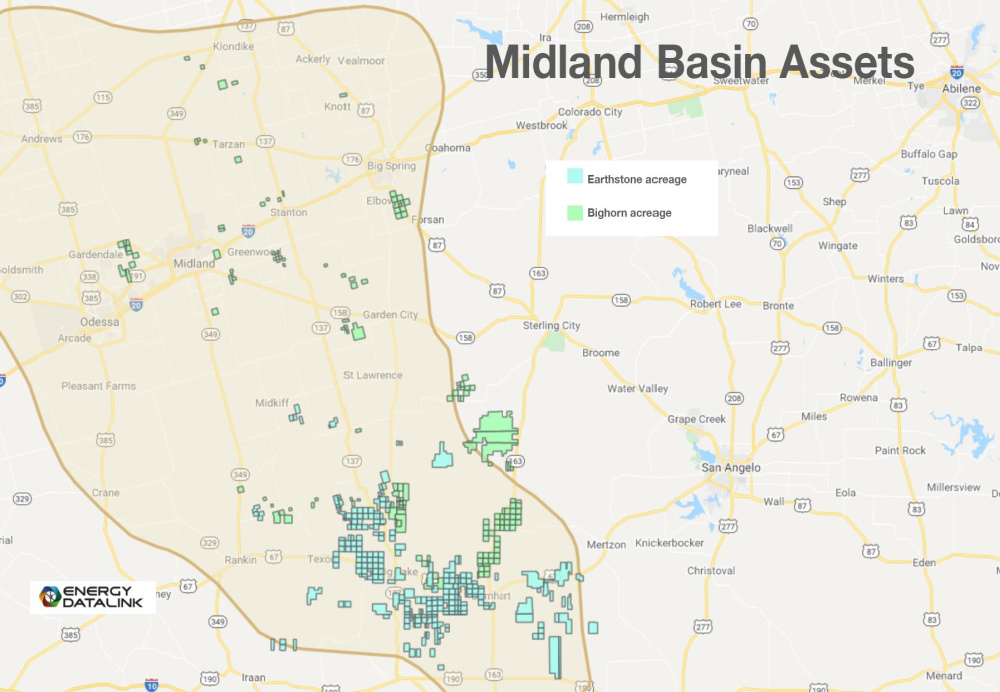

The proximity of the Bighorn assets to existing Earthstone operations, positions the company to create further value by applying Earthstone’s proven operating approach to these assets, primarily in the form of reducing operating costs, said Robert J. Anderson, president and CEO of Earthstone. (Source: Earthstone Energy Inc. / Oil and Gas Investor February 2021 issue)

Earthstone Energy Inc. continued its role as a consolidator in the Permian Basin with the agreement on Jan. 31 to acquire Bighorn Permian Resources LLC for roughly $860 million in cash and stock.

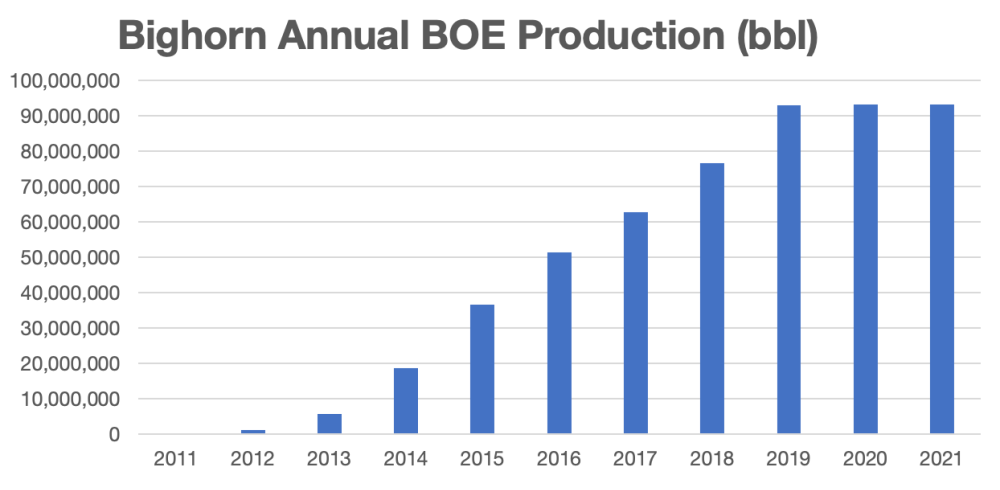

Bighorn is a privately held E&P company with approximately 110,600 net acres (98% operated, 93% working interest, 99% HBP) in the Midland Basin, primarily in Reagan and Irion counties, Texas. The acquisition of Bighorn, which averages daily production of roughly 42,400 boe/d (25% oil, 57% liquids), is expected to increase Earthstone’s free cash flow in 2022 by roughly 194%, according to a company release.

“The addition of the high cash flow producing assets from Bighorn to the strong drilling inventory of Earthstone, including the Chisholm acquisition, furthers Earthstone’s transformation into a larger scaled, low-cost producer with lower reinvestment in order to maintain combined production levels,” Robert J. Anderson, president and CEO of Earthstone, commented in the company release.

Within the past year, Earthstone has significantly transformed itself utilizing M&A of small operators, including Independence Resource Management LLC and Tracker Resource Development III LLC, both of which closed in 2021 and added to Earthstone’s Midland Basin position. The company in 2021 also closed an acquisition in the Eagle Ford Shale and a bolt-on deal in the Midland Basin before announcing its expansion into the Delaware sub-basin late last year through the pending acquisition of Chisholm Energy Holdings LLC.

“Combining the Bighorn acquisition with the four acquisitions completed in 2021 and the pending Chisholm acquisition,” Anderson added, “we will have more than quadrupled our daily production rate, greatly expanded our Permian Basin acreage footprint and increased our free cash flow generating capacity by many multiples since year-end 2020.”

The consideration for the Bighorn acquisition consists of approximately $770 million in cash and 6.8 million shares of Earthstone’s Class A common stock to be issued to Bighorn, subject to customary closing adjustments.

Bighorn, previously known as Sable Permian Resources, emerged from bankruptcy in February 2021. The company was reported by Reuters in October to be exploring a sale of its assets, which, according to the report, had been estimated to be worth around $1.3 billion at current commodity prices.

Earthstone intends to fund the cash portion of the consideration and fees and expenses with cash on hand, new borrowings under its credit facility and from proceeds of a concurrent private placement of Earthstone equity (PIPE) with EnCap Investments LP, a current beneficial owner of approximately 47% of Earthstone’s total Class A and Class B common stock, and Post Oak Energy Capital LP, an unaffiliated party.

Existing lenders under Earthstone’s credit facility have also agreed to an incremental $500 million increase to the borrowing base and available commitments from the total $825 million borrowing base and elected commitments under the credit facility in conjunction with the pending closing of the Chisholm acquisition, bringing the total borrowing base and available commitments to $1.325 billion.

The effective date of the Bighorn acquisition will be Jan. 1, with closing anticipated early in the second quarter. The previously announced Chisholm acquisition is expected to close in mid-February.

Earthstone anticipates holding production flat to moderate growth on a go forward annual basis based on continuously running the total of four rigs currently being operated by Earthstone and Chisholm in the Midland Basin and the Delaware Basin, respectively.

The proximity of the Bighorn assets to existing Earthstone operations, Anderson said in the release, positions the company to create further value by applying Earthstone’s proven operating approach to these assets, primarily in the form of reducing operating costs.

“Consistent with our track record, we are adding substantial size and scale while preserving our balance sheet strength,” he said. “The mix of debt and equity utilized for the Bighorn acquisition was designed to be leverage neutral and maintain our targeted 1.0x debt to EBITDAX or better.”

As a result of these transactions, Post Oak will have the right to appoint one individual to the Earthstone board of directors.

Johnson Rice & Co. LLC served as financial adviser to the audit committee of Earthstone with respect to the PIPE. RBC Capital Markets was exclusive financial adviser to Bighorn. Legal advisers included Haynes and Boone LLP and Jones & Keller, P.C. for Earthstone, and Simpson Thacher & Bartlett LLP for Bighorn.

Recommended Reading

CERAWeek: Large Language Models Fuel Industry-wide Productivity

2024-03-21 - AI experts promote the generative advantage of using AI to handle busywork while people focus on innovations.

Cyber-informed Engineering Can Fortify OT Security

2024-03-12 - Ransomware is still a top threat in cybersecurity even as hacktivist attacks trend up, and the oil and gas sector must address both to maintain operational security.

Exclusive: Halliburton’s Frac Automation Roadmap

2024-03-06 - In this Hart Energy Exclusive, Halliburton’s William Ruhle describes the challenges and future of automating frac jobs.

Oil States’ ACTIVEHub for Digitized Assets

2024-03-14 - Oil States Energy Services’ new ACTIVEHub system and ACTIVELatch help operators remotely monitor and automate frac locations for a more efficient and safer wellsite.