U.S. Department of Energy headquarters in Washington, D.C. (Source: Shutterstock)

Hydrogen players voiced concern about the lack of demand incentives to give the sector a boost, and the U.S. Department of Energy (DOE) responded with plans to invest up to $1 billion in subsidies to encourage the use of clean hydrogen.

The notice of intent (NOI) and request for information (RFI) announced July 5 by the DOE comes as part of the regional Clean Hydrogen Hubs (H2Hubs) initiative, which includes up to $7 billion—funded through the Bipartisan Infrastructure Law—to establish six to 10 regional hubs across the U.S. The latest effort aims to give producers and end users in the H2Hubs market certainty to unlock private investment.

“This new initiative will support the growth and sustainability of the H2Hubs program by providing the revenue certainty that hydrogen producers require to attract private sector investment,” the DOE said. “It will also help meet the needs of end users who often prefer the flexibility to purchase hydrogen on shorter-term contracts and require confidence in the long-term availability of clean hydrogen before making critical, long-term investments.”

The NOI is looking for the best way to engage the private sector in driving demand—seeking potential benefits and risks, operating models, governance structures and equipped implementing partners. The DOE said it will also take into consideration dialogue from the energy industry, investment firms, nonprofit groups, non-governmental organizations and public response from the demand-side RFI issued last year.

Demand-side support for clean energy commercialization could include “direct procurement through a request for proposal or reverse auction; advanced market commitments; and guaranteed price floors,” according to the Office of Clean Energy Demonstrations.

The demand-side support mechanism could also include pay-for-delivery contracts, offtake backstops, feasibility funding to support analysis by offtakers or other measures that strengthen demand for clean hydrogen and increase revenue certainty for H2Hubs.

RELATED

Hydrogen’s Chicken, Egg Quandary Has Financers Flying the Coop

Exxon Mobil: Market Will Determine Hydrogen’s Path

Hydrogen's Biggest Hurdles: Customers and Demand

Talk surrounding hydrogen demand surfaced July 6 during a low-carbon hydrogen webcast hosted by the Center for Strategic and International Studies’ Energy Security and Climate Change Program.

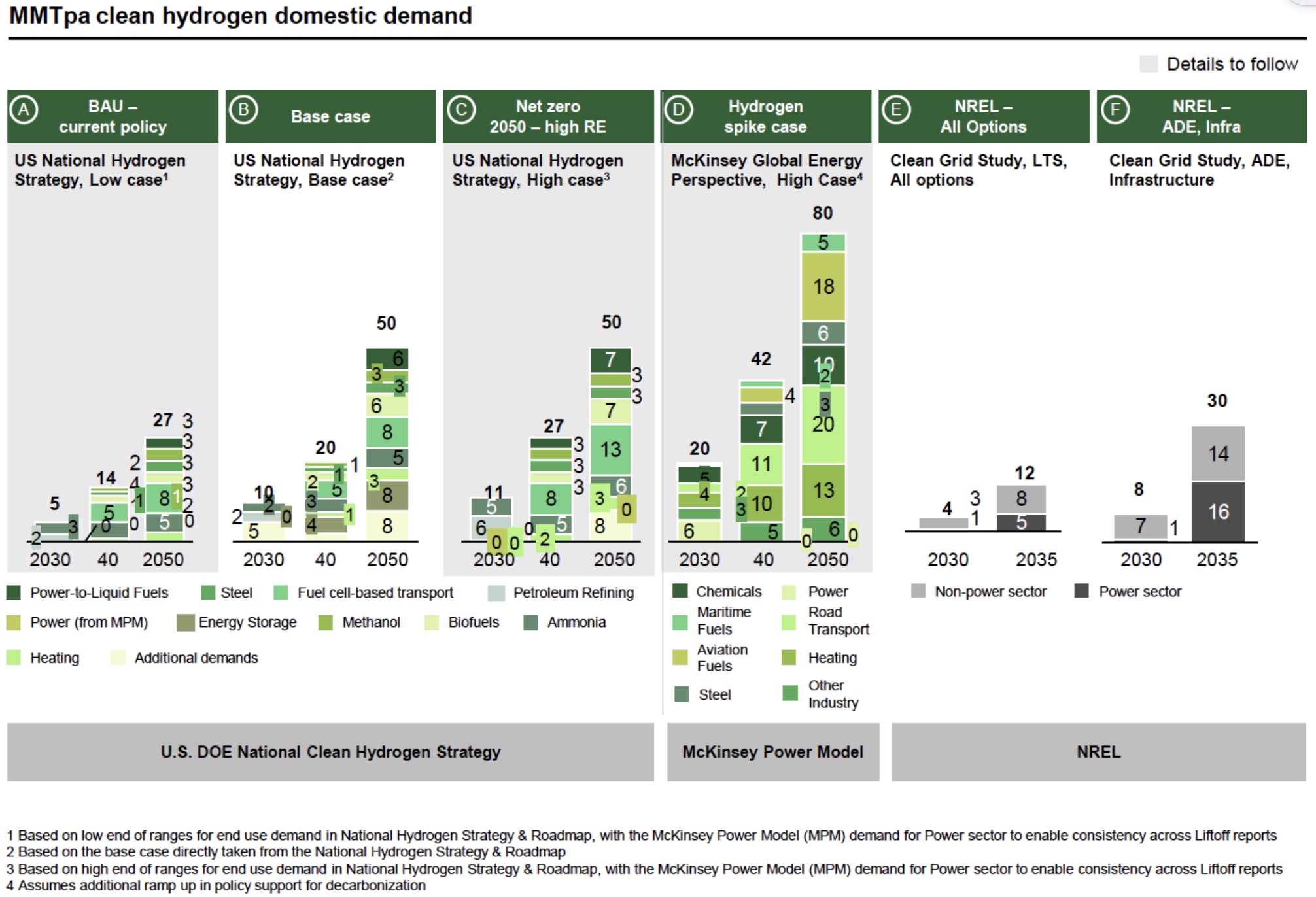

While there are opportunities for hydrogen use in heavy-duty vehicles and long-term storage on the electric grid, Resources for the Future fellow Aaron Bergman called these industries “nascent.” Future demand could come from existing hydrogen users in chemicals and refining.

However, “even for the existing users, I think a key question is, even with all these subsidies, ‘How does the subsidized price of clean hydrogen compare with just basic steam methane reforming where you put all the carbon dioxide into the air?’” Bergman asked. “There is a green premium potentially. How much are people willing to pay for the cleaner hydrogen in the absence of further incentives?”

Alex Dewar, managing director and partner at the Boston Consulting Group, sees opportunity for blue hydrogen to tap into areas where gray hydrogen is used today, such as marine shipping, sustainable aviation fuel, industrial decarbonization and global exports.

“While the U.S. is focusing on the supply side carrots in many ways, we have policies on the international scale here that are focusing on the sticks or the demand side carrots, if you will, within Europe, Japan, other countries as well,” Dewar said.

Matt Reeves, new products and strategy integration manager for Exxon Mobil Corp., shared similar comments. Besides fuel switching, he highlighted exporting hydrogen as ammonia.

“The U.S. is set up very well to be a major player in this because of the abundance of low-cost natural gas, good pore space availability, good low carbon electricity opportunities,” Reeves said.

Exxon Mobil has plans to build what could become the world’s largest low-carbon hydrogen plant. Located at Exxon’s Baytown, Texas, complex, the project aims to produce about 1 Bcf/d of hydrogen, while capturing more than 98% of the associated CO2 and storing it underground. A final investment decision for the project is expected by 2024. If cleared by investors, regulators and other stakeholders, the plant would start up by 2028.

Recommended Reading

ProPetro Reports Material Weakness in Financial Reporting Controls

2024-03-14 - ProPetro identified a material weakness in internal controls over financial reporting, the oilfield services firm said in a filing.

ProPetro Ups Share Repurchases by $100MM

2024-04-25 - ProPetro Holding Corp. is increasing its share repurchase program to a total of $200 million of common shares.

ProPetro to Provide eFrac Services to Exxon’s Permian Operations

2024-04-29 - ProPetro has entered a three-year agreement to provide electric hydraulic fracturing services for Exxon Mobil’s operations in the Permian Basin.

Daniel Berenbaum Joins Bloom Energy as CFO

2024-04-17 - Berenbaum succeeds CFO Greg Cameron, who is staying with Bloom until mid-May to facilitate the transition.

Chord Energy Updates Executive Leadership Team

2024-03-07 - Chord Energy announced Michael Lou, Shannon Kinney and Richard Robuck have all been promoted to executive vice president, among other positions.