BW Offshore sold the BW Opportunity FPSO to Turkish Petroleum Corp. for $125 million in 2023. (Source: BW Offshore)

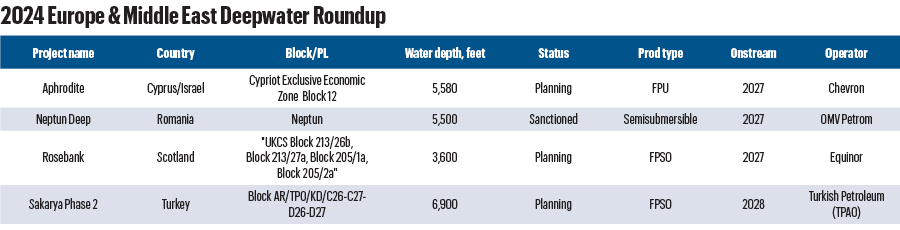

Part three of Hart Energy E&P’s summary of deepwater projects highlights some of the latest deepwater developments in Europe and the Middle East, based on publicly available information and analysis.

After conflict in the area and dispute over territorial waters, Chevron was able to submit its plan for development of the Aphrodite field in Cyprus and is currently awaiting approval.

Neptun Deep, the largest natural gas project in the Black Sea, is poised to begin producing in 2027, with more than 80% of its execution agreements having been awarded.

Part four of this summary will cover deepwater projects in the Americas.

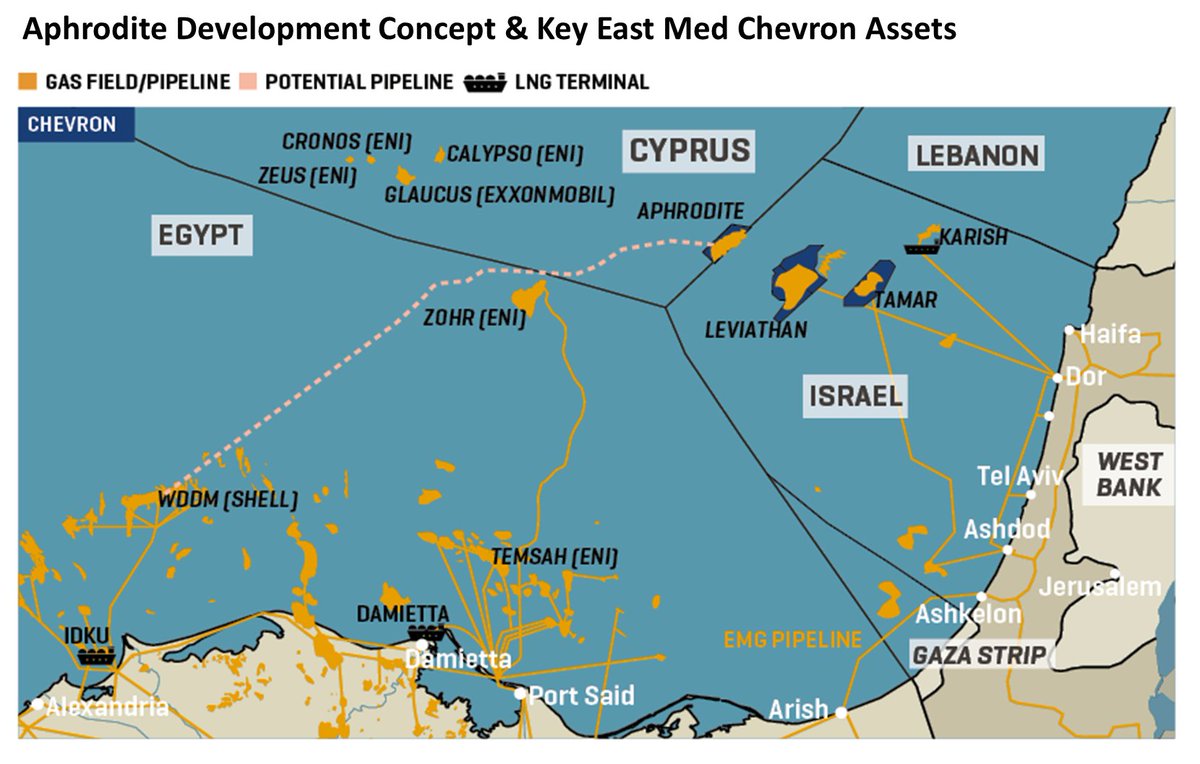

Aphrodite

In late March, Chevron submitted a floating production unit (FPU)-based proposal for the development of the Aphrodite Field offshore Cyprus, which is set to be evaluated by the Cypriot Energy Ministry.

Whether the project would be developed via FPU or pipeline to shore delayed the project, but in December, Chevron reportedly agreed to an FPU-based design.

Discovered in 2011, the field is located in Block 12 of the Cypriot Exclusive Economic Zone in 5,580 ft of water.

Development of the field, which holds up to 4.2 Tcf of recoverable gas reserves, was further complicated due to a dispute between Cyprus and Israel. While most of the discovery lies within Cyprus’ territorial waters, a small portion of the field lies in Israeli waters, creating an ownership dispute between the two countries that delayed the project for a decade. While the dispute remains unsettled, operators have created a plan to develop the field.

Appraisal well drilling for the Aphrodite gas field offshore Cyprus began in May 2023. The appraisal well will be used as a production well. Operator Chevron—and partners Shell and NewMed Energy—contracted the Stena Forth drillship to drill the appraisal well, which contains the largest share of overall volumes. First gas is targeted for 2027.

Chevron, which inherited the field from Noble Energy, holds a 35% interest in the field. Shell also holds a 35% interest in the field, while Israel’s NewMed Energy has a 30% interest.

Neptun Deep

In October 2023, OMV received approval from Romania for the development of the Neptun Deep gas project. First gas is expected in 2027.

The $4 billion Neptun Deep project lies in the Neptun Block of the Black Sea in 5,500 ft of water. The field is estimated to hold around 3.53 Tcf of natural gas reserves. OMV believes the project may reach a production plateau of 140,000 boe/d. Production is expected to peak between 350 Bcf/year and 420 Bcf/year.

The plan for development includes 10 wells, six of which will be in waters of about 3,280 ft and four in shallower waters. There will also be three subsea production systems and associated flowlines. An offshore platform, in 328 ft of water, will connect to the main gas pipeline to Tuzla and a gas measurement station. The platform will generate its own energy, with infrastructure operated remotely.

As of December 2023, more than 80% of execution agreements for the project had been awarded.

OMV Petrom signed an agreement for the use of the Transocean Barents semisubmersible drilling rig for a minimum of one and a half years. Halliburton Romania won a contract for integrated drilling services.

In October, Saipem was awarded the engineering, procurement, construction and installation (EPCI) contract for the gas processing platform, three subsea developments, a 99-mile long gas pipeline and associated fiber optic cable from the shallow water platform to the Romanian coast. The gas processing platform will be fabricated at Saipem’s yards in Italy and Indonesia. The Saipem 7000 and JSD 6000 vessels will handle offshore operations.

OMV Petrom, along with SNGN Romgaz, signed a contract with national gas pipeline operator Transgaz for the supply of natural gas from the Neptun Deep field to Romania’s National Transport System (NTS).

Transgaz is planning to build a 190-mile long, $530 million pipeline to bring natural gas from the Neptun Deep Block in the Black Sea to the national grid via the Tuzla entry/exit NTS point.

OMV Petrom is the operator of the field with a 50% interest stake. Romgaz holds the remaining 50% after acquiring it from Exxon Mobil.

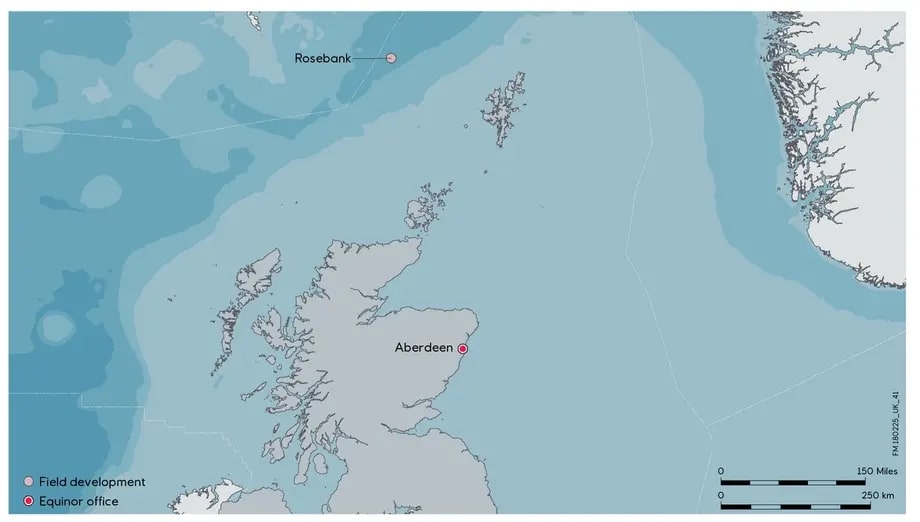

Rosebank

The Rosebank Field, located West of Shetland in the U.K. and operated by Equinor, received development consent from the North Sea Transitional Authority (NSTA) in September 2023. This comes after a group of 40 EU lawmakers attempted to block the development due to CO2 emissions concerns.

The field, in 3,600 ft of water, is believed to hold between 300 MMbbl and 500 MMbbl of oil. Production of 70,000 MMbbl/d and 21 MMcf/d of gas would make Rosebank one of the largest fields in the U.K.

Rosebank is planned to be developed in two phases, with the first coming onstream in 2027. Phase 1 will have Odfjell Drilling's Deepsea Atlantic semisubmersible rig drill four production wells and three water injectors between April 2025 and August 2026. The production wells will be tied back to Altera Infrastructure's Petrojarl Knarr floating production, storage and offloading (FPSO) unit. Phase 2 would involve drilling up to three production wells and two water injectors. FID for Phase 2 could be taken in 2028.

Oil will be offloaded via shuttle tankers, with some gas being used as fuel on the FPSO and the excess exported via a 53-mile pipeline to the existing West of Shetland Pipeline systems. From there it will be transported to the SAGE gas terminal in St. Fergus, Scotland.

Equinor awarded TechnipFMC an integrated engineering, procurement, construction and installation (iEPCI) contract by Equinor for the Rosebank project in September. Under the contract, TechnipFMC will manufacture and install subsea production systems, flexible and rigid pipe and umbilicals.

Aker Solutions was contracted to upgrade the FPSO under a joint venture with Drydocks World. The iEPCI contract scope, which began in 2023 and will finish by year-end 2025, covers newbuild, demolition and life extension services to the hull, marine systems and topsides to allow the FPSO to remain on the field for 25 years without the need for drydocking.

Equinor operates the field with an 80% interest. Ithaca SP E&P Ltd. holds the remaining 20%.

Sakarya Phase 2

Offshore Turkey, Phase 1 of the Turkish Petroleum Corp. (TPAO) owned and operated Sakarya gas project began production in April 2023.

The state-owned ultra-deep field is located in blocks C26, C27, D26 and D27 in 6,900 ft of water in the Black Sea. Phase 1 development involved the drilling of 10 wells and installing a subsea gas production system, the construction of an onshore gas processing terminal in Filyos, Turkey, and laying a 105-mile subsea pipeline to export gas from the field to the gas terminal.

Phase 2 involves further development of the field to up to an additional 30 wells. Work began in 2023 and involves an FPSO to process the produced gas offshore and deliver it to the grid using a gas transport pipeline. Phase 2 is expected to come onstream in 2028.

The field is believed to hold about 25 Tcf of recoverable reserves. Gas from Sakarya will be delivered to land via the subsea pipeline and then through various compression plants. Gas from the field will be able to supply between 25% and 30% of the country's domestic demand.

In May 2023, a consortium of SLB, Subsea 7 and Saipem won an EPCI for Phase 2 of the project. The scope consists of subsea production systems and subsea umbilicals, risers and flowlines.

TPAO purchased the BW Opportunity FPSO to develop Phase 2 of the project. The FPSO is undergoing upgrades.

Tenaris has been contracted to supply Phase 2 with 46,000 tons of 16-inch seamless pipes. The Subsea Integration Alliance will provide the subsea production systems, flowlines and umbilicals. OneSubsea will provide the manufacturing and supplying production systems and Subsea7 will be responsible for the EPCI for infield flowlines, control umbilicals and associated equipment.

TPAO is the 100% owner of the field.