(Source: Shutterstock.com)

Bonanza Creek Energy Inc. agreed to acquire a restructured HighPoint Resources Corp. on Nov. 9 in a transaction valued at approximately $376 million.

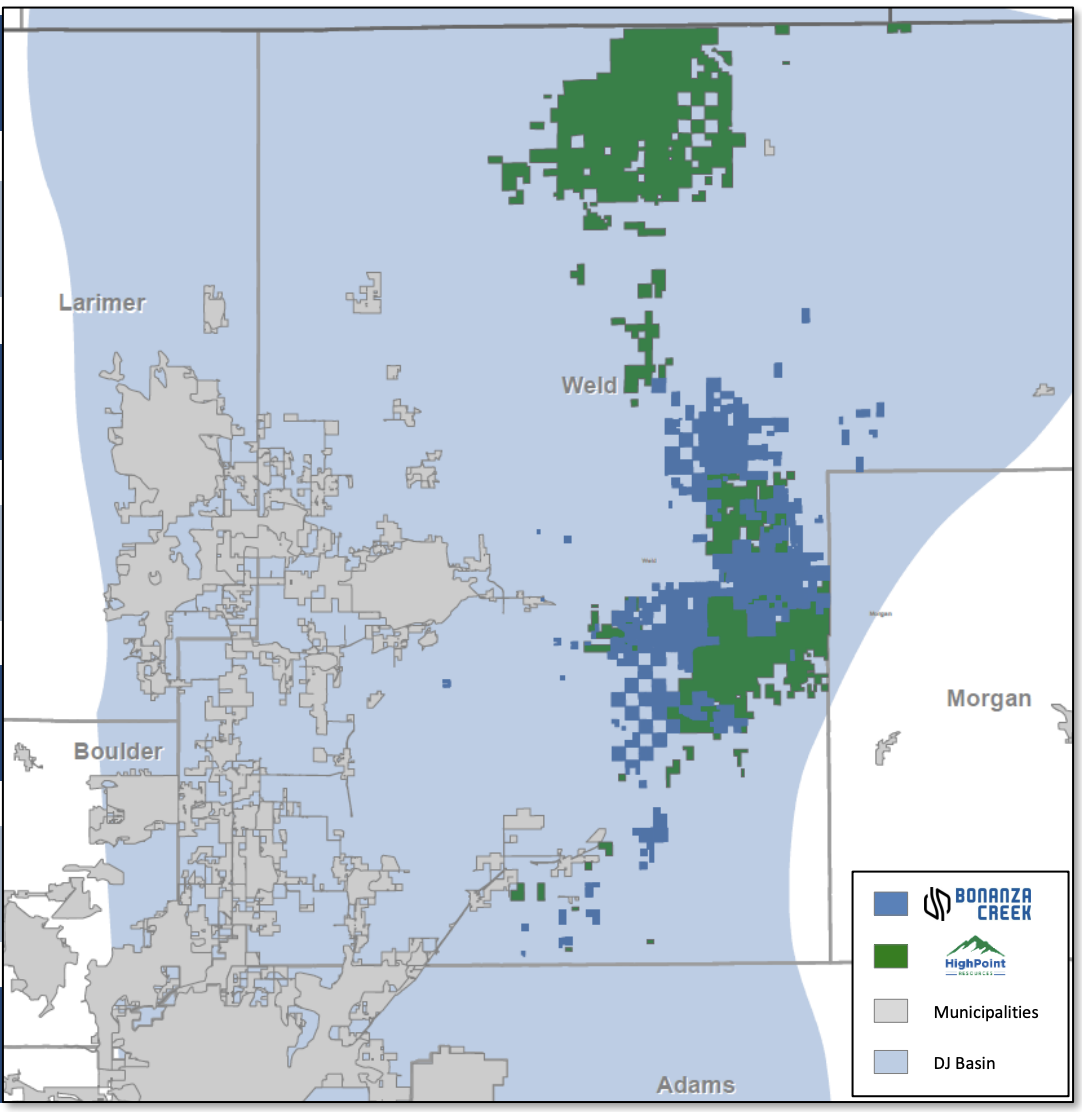

The combination is expected to create a leading unconventional oil producer in the Denver-Julesburg (D-J) Basin. Combined, the companies have production of 50,000 boe/d and a consolidated, contiguous leasehold position of approximately 206,000 net acres in rural Weld County, Colo.

Additionally, the companies expect the transaction to result in approximately $31 million in 2021 synergies on a pro forma basis, with $150 million of PV-10 synergies total, which represents nearly 45% of Bonanza Creek’s market cap at announcement, according to the company release.

In a Nov. 9 statement commenting on the transaction, Eric Greager, president and CEO of Bonanza Creek, said: “The combination of Bonanza Creek and HighPoint creates significant scale in the rural D-J Basin, which will immediately increase free cash flow generation. The combination of our complementary asset bases will yield significant synergies and represents a transformative transaction for Bonanza Creek.”

Greager will serve as the CEO of the combined company and Brian Steck will serve as its board chairman. Steck, who joined the Bonanza Creek board in April 2017 following the company’s emergence from Chapter 11 bankruptcy, has served as its independent chairman since 2019.

Under the terms of the definitive merger agreement, Bonanza Creek and HighPoint have agreed to commence a registered exchange offer and consent solicitation and simultaneous solicitation of a prepackaged plan of reorganization under Chapter 11 of the United States Bankruptcy Code

Bonanza Creek will issue 9.8 million shares of common stock and up to $100 million in senior unsecured notes in the transaction. The transaction value of $371 million is based on the equity to be issued to HighPoint equity holders, the equity and debt to be issued to HighPoint debt holders in connection with the exchange offer and the remaining debt to be assumed.

Bonanza Creek shareholders are expected to own approximately 68% of the combined company and HighPoint’s stakeholders will own approximately 32%. Existing HighPoint shareholders will own approximately 1.6% of the combined company while participating HighPoint noteholders will receive in the aggregate shares representing approximately 30.4% of the combined company and up to $100 million of newly issued senior unsecured notes due 2026.

The transaction is expected to close in first-quarter 2021 under the exchange offer and consent solicitation or no later than the second quarter under the prepackaged plan.

Upon closing, Bonanza Creek’s balance sheet is expected to consist of approximately $50 million of cash, $100 million of senior unsecured notes, and approximately $150 million of reserve based lending debt. The combined asset base will likely support a borrowing base well in excess of Bonanza’s current $260 million borrowing base, near its existing level, according to the company release.

Bonanza Creek and Fifth Creek Energy Co. LLC, which owns approximately 46.5% of the outstanding shares of HighPoint, have entered into a support agreement whereby Fifth Creek will vote in favor of the merger, subject to certain customary termination rights. Additionally, HighPoint, Fifth Creek, and holders of 73% of 2022 and 2025 senior notes of HighPoint have entered into the transaction support agreement, which obligates Fifth Creek and the noteholder parties to support and vote in favor of the transaction, subject to specified termination rights.

Following the completion of the transaction, the board of directors of the combined company will consist of seven members comprising of five directors from Bonanza Creek and two selected by HighPoint’s supporting noteholders.

Bonanza Creek’s long-term strategy is to be a low-cost operator focused on generating free cash flow and returning cash to shareholders. The company’s assets and operations are concentrated in rural, unincorporated Weld County within the Wattenberg Field, focused on the Niobrara and Codell formations.

In 2021, Bonanza Creek expects to generate approximately $130 million of free cash flow assuming Nymex strip pricing. Full-year production is expected to average between 45,000 and 50,000 boe/d. The company expects its combined cash costs to be between $9/boe and $10/boe.

Bonanza Creek retained Evercore as its financial adviser and Vinson & Elkins LLP as its legal adviser for the transaction. J.P. Morgan Securities LLC also served as an adviser to HighPoint.

Tudor, Pickering, Holt & Co. and Perella Weinberg Partners are financial advisers to HighPoint. Kirkland & Ellis LLP is HighPoint’s legal adviser, and AlixPartners LLP is its restructuring adviser. Akin Gump LLP is serving as legal adviser to an informal group of HighPoint noteholders that have signed the transaction support agreement.

Recommended Reading

Deep Well Services, CNX Launch JV AutoSep Technologies

2024-04-25 - AutoSep Technologies, a joint venture between Deep Well Services and CNX Resources, will provide automated conventional flowback operations to the oil and gas industry.

EQT Sees Clear Path to $5B in Potential Divestments

2024-04-24 - EQT Corp. executives said that an April deal with Equinor has been a catalyst for talks with potential buyers as the company looks to shed debt for its Equitrans Midstream acquisition.

Matador Hoards Dry Powder for Potential M&A, Adds Delaware Acreage

2024-04-24 - Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities.

TotalEnergies, Vanguard Renewables Form RNG JV in US

2024-04-24 - Total Energies and Vanguard Renewable’s equally owned joint venture initially aims to advance 10 RNG projects into construction during the next 12 months.

Ithaca Energy to Buy Eni's UK Assets in $938MM North Sea Deal

2024-04-23 - Eni, one of Italy's biggest energy companies, will transfer its U.K. business in exchange for 38.5% of Ithaca's share capital, while the existing Ithaca Energy shareholders will own the remaining 61.5% of the combined group.