ConocoPhillips leadership blamed a slide in second-quarter profits on volatile commodity prices and looked ahead to the company’s long-term efforts to export LNG during an Aug. 3 earnings call. (Source: Shutterstock.com)

ConocoPhillips leadership blamed a slide in second-quarter profits on volatile commodity prices and looked ahead to the company’s long-term efforts to export LNG during an Aug. 3 earnings call.

ConocoPhillips stock closed down 0.52% on Aug. 3 after the company reported adjusted earnings per share of $1.84 in the second quarter. Analysts had expected $1.94 per share.

The company delivered stronger than expected production but weakness in pricing, particularly gas and NGL realizations, drove “slightly disappointed/mixed 2Q results,” Ryan M. Todd, an analyst at Piper Sandler, wrote in an Aug. 4 report. The company delivered “record” production in the quarter, including 1.8 MMboe/d in the Lower 48.

ConocoPhillips management pointed to an overall strong quarter but faced questions by analysts over the company’s dividend yield.

“While commodity prices were volatile, ConocoPhillips continued to deliver strong underlying performance,” CEO Ryan Lance said on the earnings call. “We raised our full year production guidance for the second straight quarter. This was achieved through capital efficiency improvements.”

Phil Gresh, vice president of investor relations, said the missed profit expectations need to be put in the context of the broader commodity price environment.

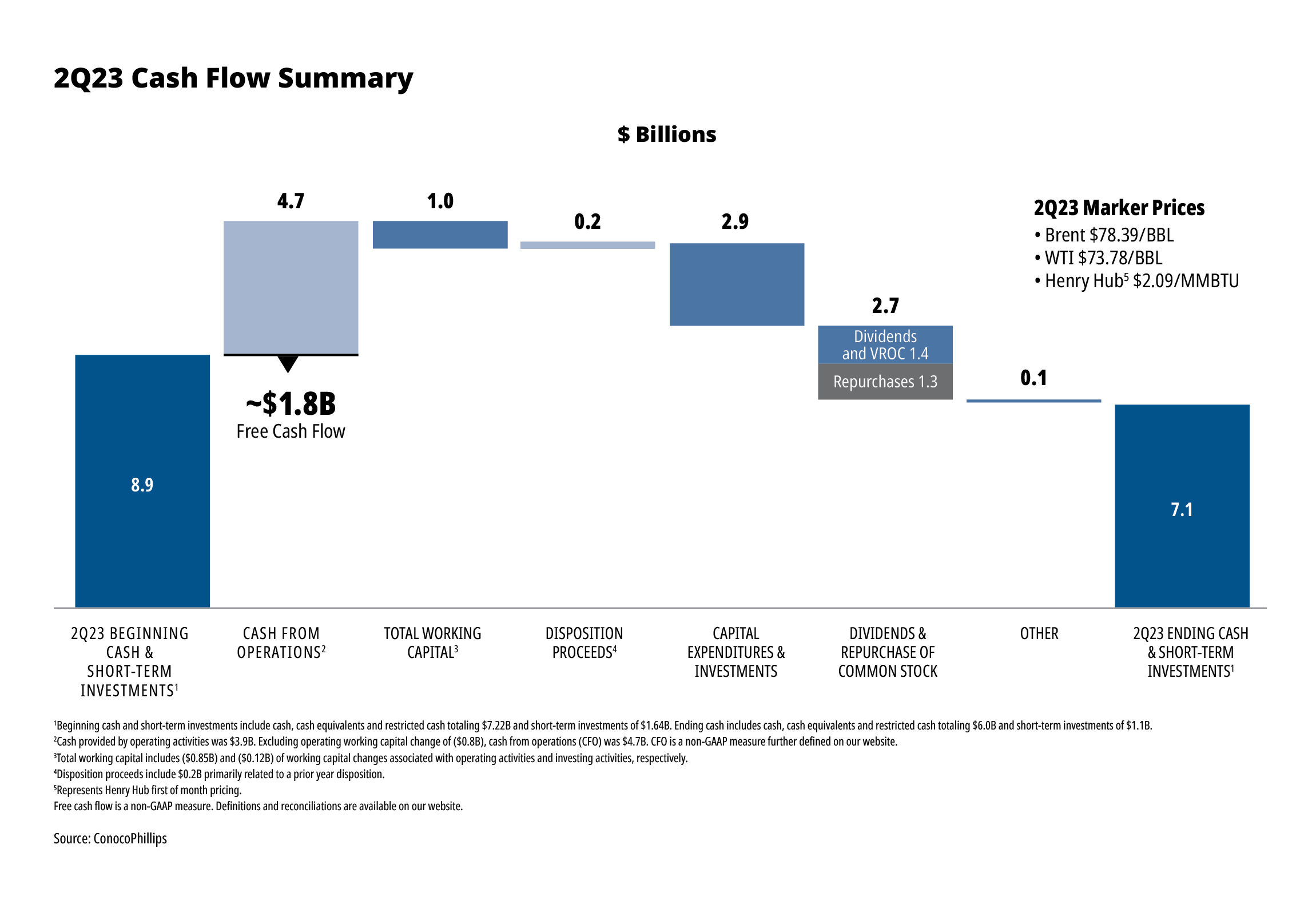

“We recognize that this result was below consensus which we primarily attribute to transitory price capture headwinds in Lower 48 natural gas and Alaska crude,” Gresh said. “Based on strip pricing for the second half, we expect price capture to normalize and be consistent with our previous full year guidance of $22 billion in [cash from operations] at $80 WTI and our published full-year sensitivities.”

Analysts said ConocoPhillips’ explanations made sense.

“From an earnings per share standpoint, I think that it was more of the tax burden that impacted them,” said John Edelman, an equity research analyst at Jefferies. “It was offset by those Alaska crude and Lower 48 gas [prices] … that held the company back.”

Truist Securities analyst Neal Dingmann told Hart Energy the missed profits were just a small setback, but there is room for improvement.

“It was a good quarter. It wasn't a great” one, said Dingmann. “The two biggest things that we [analysts] were hoping for was a boost in guidance. We didn't get that. Secondly, we were hoping [for more to be said] about shareholder return.”

He said ConocoPhillips’ dividend yield pales in comparison to other supermajors. ConocoPhillips’ yield is 0.5%, while Chevron is 3.8% and Exxon Mobil is 3.4%. One analyst on the call asked company leadership why ConocoPhillips still has “one of the lowest ordinary dividend yields” even though it has such hefty free cash flow.

Lance defended the company’s returns, saying shareholders receive robust cash while the company also funds short- and long-term organic growth.

“You shouldn't question ConocoPhillips’s commitment to giving a significant amount of our cash flow back to our shareholders,” Lance said. At the beginning of the call, he said ConocoPhillips had returned nearly $5.8 billion through dividends in the first half of the year and will return a total of $11 billion by year’s end.

LNG offtake agreement

Company leaders showcased their long-term LNG projects, including the signing of a 20-year, 2.2 million tonnes per annum (mtpa) offtake agreement for a future export facility on the west coast of Mexico. The Saguaro LNG export, upon final investment decision, will have a 15 mtpa capacity, according to the company’s website.

Edelman said some investors are concerned ConocoPhillips might be spending too much on long-term projects and not taking enough advantage of a deflationary cycle that allows for renegotiating deals to more favorable terms.

He cited the Willow Project, a major oil development project in Alaska, as an area where the company could save money.

“It's a $7 billion project. You could shave like 10% off of that,” he said. “A lot of the costs there are more construction related which has definitely come down a lot recently, between steel and a lot of consumable items, not just drilling equipment.”