ConocoPhillips would raise its stake in Australia Pacific LNG (APLNG) to 49.9% and become the upstream operator of the company, the U.S. oil and gas producer said March 27.

The announcement follows the $10.2 billion takeover of Origin Energy by a consortium led by Canada’s Brookfield Asset Management.

ConocoPhillips currently holds a 47.5% stake in APLNG, one of the largest suppliers of natural gas to Australia’s East Coast. Origin and China’s Sinopec hold the remaining shares in APLNG.

For the additional 2.49% of shareholding interest, ConocoPhillips would pay $500 million to MidOcean Energy which would gain Origin’s stake in APLNG following the takeover.

The transaction is expected to close in early 2024.

Recommended Reading

Darbonne: The ESG Sword: BlackRock's Life, Death by ESG

2024-04-17 - BlackRock, the $10 trillion investment manager, is getting heat for too much ESG investing, while shareholders are complaining it’s doing too little.

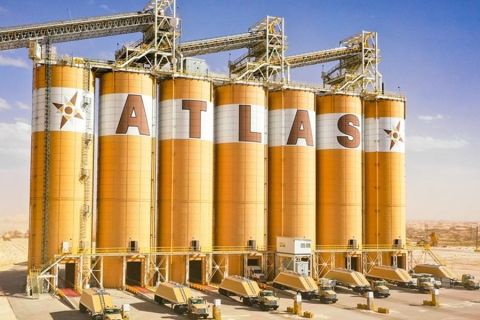

Fire Closes Atlas Energy’s Kermit, Texas Mining Facility

2024-04-15 - Atlas Energy Solutions said no injuries were reported and the closing of the mine would not affect services to the company’s Permian Basin customers.

Coalition Launches Decarbonization Program in Major US Cities, Counties

2024-04-11 - A national coalition will start decarbonization efforts in nine U.S. cities and counties following a federal award of $20 billion “green bank” grants.

Exclusive: Scepter CEO: Methane Emissions Detection Saves on Cost

2024-04-08 - Methane emissions detection saves on cost and "can pay for itself," Scepter CEO Phillip Father says in this Hart Energy exclusive interview.