Venezuela’s U.S.-based refining arm Citgo Petroleum is a step closer to reaching a theatrical climax as a court ordered sale date quickly approaches.

And according to U.S. District Court documents, that process could start in late October.

Houston-based Citgo has been entangled in the legal spat for almost six years. At least 21 creditors including Canada’s Crystallex and U.S.’ ConocoPhillips are seeking compensation for asset expropriations in Venezuela.

According to Reuters, the claims are worth over $23 billion, nearly twice the $12 billion Citgo value Venezuelan officials have quoted in recent months. Citgo is on track to generate an annualized EBITDA of around $5 billion. Using a 5x times EBITDA multiple would translate into a value of $25 billion, according to Hart Energy calculations.

RELATED

Has US Policy Toward Venezuela Already Failed?

Citgo owns three refineries with processing capacity of 807,000 bbl/d. They include refineries in Corpus Christi, Texas, with 167,000 bbl/d capacity; Lemont, Illinois, with 177,000 bbl/d; and Lake Charles, Louisiana, 463,000 bbl/d.

Also, the company, wholly and/or jointly owns 38 active terminals, six pipelines and three lubricants blending and packaging plants. Citgo branded marketers sell gasoline and other motor fuels through more than 4,200 independently owned, branded retail outlets, all located east of the Rocky Mountains.

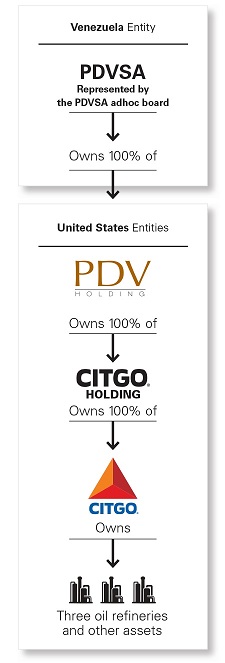

According to the court documents, the Citgo sale or auction process will involve as many shares of PDV Holding, an indirect sole stockholder of Citgo, as necessary to satisfy the financial judgments.

And it’s not just companies. Bondholders also want a piece of Citgo after state-owned Petroleos de Venezuela (PDVSA) defaulted on its 2020 bonds which were backed by a majority stake in Citgo.

To date, two things have worked in Citgo’s favor: the location of its assets and protection from creditors afforded by Washington.

But Venezuela’s opposition parties aren’t likely to win presidential elections in 2024, and both political and energy pundits ponder the merits of Washington’s continued shielding of Citgo until a so-called U.S.-friendly government is in place in Venezuela.

The lingering question now is whether Venezuela’s opposition—still divided on their approach to running against the ruling party in elections in 2024—will be able to delay the Citgo auction to change the company’s fate.

Only time will tell but it’s quickly running out.

RELATED: GLOBAL ENERGY WATCH VIDEO (GEWv) SERIES

Mexico: E-mobility, Alternative Transport and the Intersection of Change [WATCH]

Recommended Reading

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

JMR Services, A-Plus P&A to Merge Companies

2024-03-05 - The combined organization will operate under JMR Services and aims to become the largest pure-play plug and abandonment company in the nation.

Chord Energy Updates Executive Leadership Team

2024-03-07 - Chord Energy announced Michael Lou, Shannon Kinney and Richard Robuck have all been promoted to executive vice president, among other positions.

First Solar’s 14 GW of Operational Capacity to Support 30,000 Jobs by 2026

2024-02-26 - First Solar commissioned a study to analyze the economic impact of its vertically integrated solar manufacturing value chain.

SunPower Begins Search for New CEO

2024-02-27 - Former CEO Peter Faricy departed SunPower Corp. on Feb. 26, according to the company.