Editor's Note: This article has been updated with additional maps and acquisition details from BCP Resources.

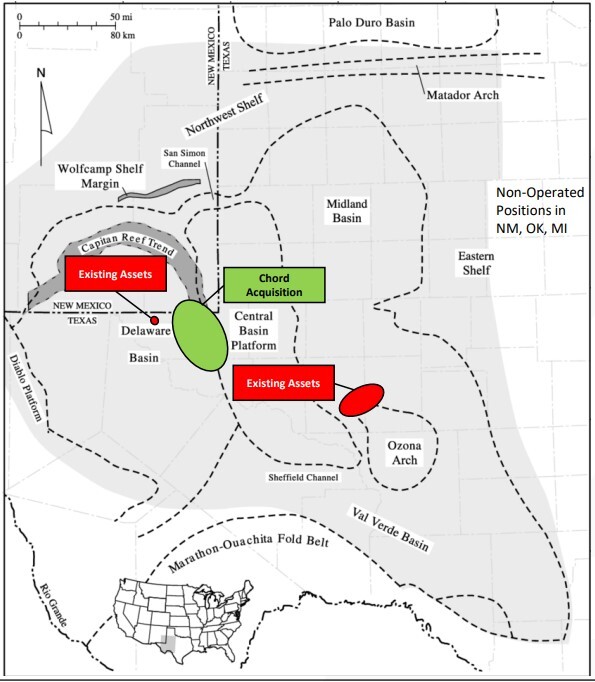

Chord Energy Corp. is shedding non-core assets in the Permian Basin as part of a broader divestiture plan to streamline its portfolio.

Chord, formed through the public-public merger of Whiting Petroleum and Oasis Petroleum last year, closed a deal to sell acreage and producing wells in the Permian to private operator BCP Resources LLC, the company’s CEO told Hart Energy on June 8.

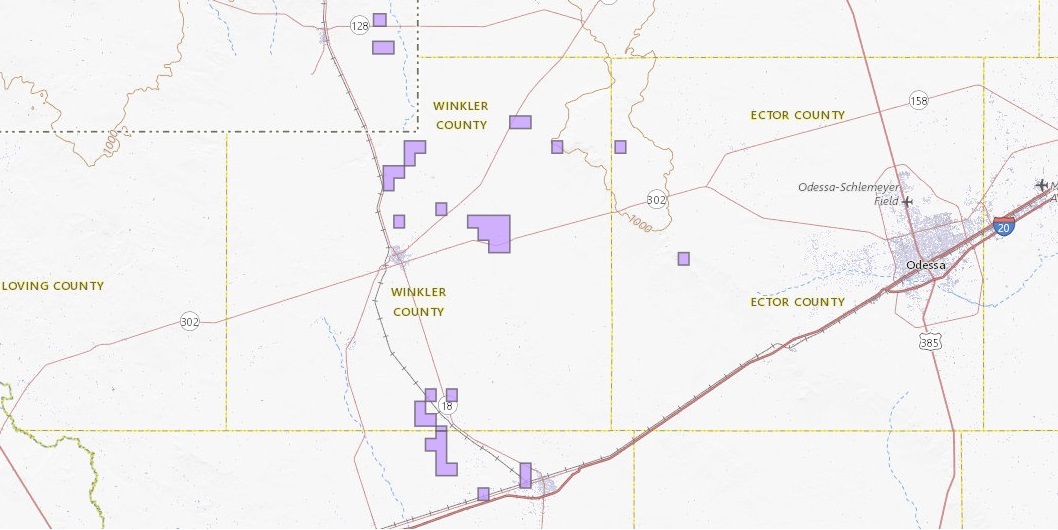

The transaction includes 153 producing wells across six counties in Texas, with the majority focused in the Permian’s Central Basin Platform’s Winkler County.

The deal also includes non-operated properties and mineral interests in Texas, New Mexico, Oklahoma and Michigan, BCP Resources said.

Private E&P BCP, based in Midland, Texas, said the acquisition adds 1.3 MMboe of net proved developed producing (PDP) reserves (84% liquids) to its portfolio. Financial terms of the transaction were not disclosed.

In an interview, Barry Portman, owner and CEO of BCP Resources, told Hart Energy the acquired assets made up most of the remaining position Whiting Petroleum held in the Permian Basin, with the exception of a few other properties.

Portman, who previously held operational roles at Pioneer Natural Resources, Kinder Morgan and Marathon Oil before launching BCP Resources last year, said the company sees opportunity in scooping up legacy properties— including conventional assets that might not compete for capital in the horizontal drilling plans of larger operators.

“Your typical 2, 3-mile shale laterals that most of the majors pursue—we want to do everything but that,” Portman said.

The deal with Chord scaled BCP Resources’ Permian position in a big way. The company grew from 640 Permian acres before the deal to 15,818 acres (100% HBP) after closing, according to data from BCP.

The company also boosted its gross production from 740 boe/d (63% liquids) to 2,280 boe/d (78% liquids) with the Chord transaction.

Over the next year, BCP Resources aims to grow production by optimizing the conventional assets acquired from Chord, he said. The company plans to extend the field by drilling additional vertical wells in the future, as well as using secondary recovery methods including waterflooding and CO2 flooding.

“We feel like we can boost our production 50% to 100% in the next year,” Portman said.

Outside of the Central Basin Platform, BCP Resources also operates wellbore interests in the Permian’s Midland Basin.

BCP Resources is the dedicated oilfield operator for Lodestone Energy Partners II LP, which acquired assets in Reagan and Upton counties, Texas, from Hibernia Resources III LLC in July 2022.

The deal with Hibernia included 85 conventional and 21 legacy horizontal wellbores and more than 2 MMboe of net PDP reserves (63% liquids).

With financial backing from a group of investors and access to senior bank debt, BCP Resources aims to move on accretive acquisitions in the Permian at least every 12 months, Portman said.

“We know we want to target the legacy properties and we know what we’re good at,” Portman said. “But we need to find [a deal] that fits our operational background and our expertise, and also fits our bank and our investors.”

The company typically evaluates potential transactions of less than $100 million, he said.

Community Bank of Midland provided a senior oil and gas debt facility to BCP Resources in connection with the transaction. The company was represented by Stubbeman, McRae, Sealy, Laughlin & Browder Inc. as legal counsel.

RELATED: Chord Energy Aims to Bulk Up in Bakken, Divest Non-core

Chord focused on Williston growth

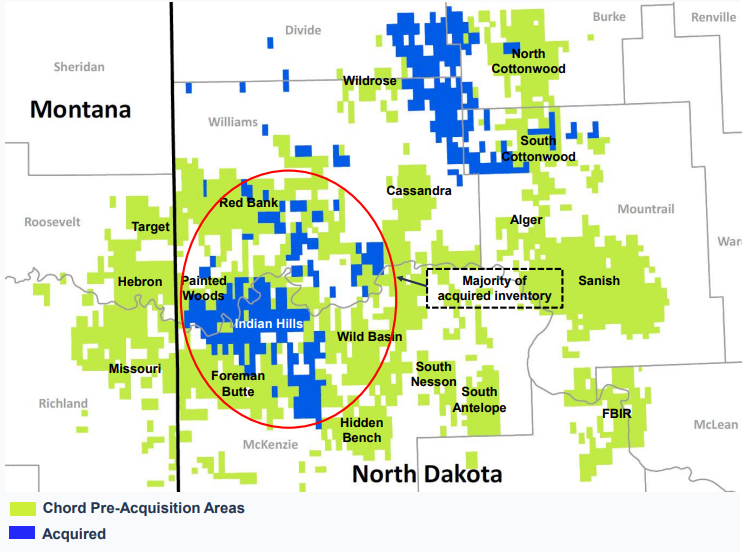

Chord Energy has been deliberately offloading non-core assets located outside of the Williston Basin in North Dakota and Montana.

The company lined up sales for about $35 million of non-core assets outside of the Williston during the first quarter, Chord reported in its May earnings.

During the company’s first-quarter earnings call, President and CEO Danny Brown said Chord still had a small amount of non-core assets in the portfolio that could be sold and monetized.

As Chord exits other geographies, the company is searching for opportunities to expand its footprint inside of the Williston.

In late May, Chord announced an agreement to acquire Williston assets from Exxon Mobil Corp. subsidiary XTO Energy Inc. and affiliates for $375 million in cash.

The deal included around 62,000 net acres, 77% of which are undeveloped, and more than 100 future drilling locations. Production acquired from XTO averaged more than 6,000 boe/d (62% oil).

Chord has around $590 million of cash on hand held in reserve for Williston Basin M&A opportunities, Chord Senior Vice President of Production Charles Ohlson said during Hart Energy’s SUPER DUG conference in May.

Chord ended the first quarter with approximately 936,000 net acres in the Williston and averaged 165,000 boe/d (95,000 bbl/d oil) of production.

Recommended Reading

TGS, SLB to Conduct Engagement Phase 5 in GoM

2024-02-05 - TGS and SLB’s seventh program within the joint venture involves the acquisition of 157 Outer Continental Shelf blocks.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

StimStixx, Hunting Titan Partner on Well Perforation, Acidizing

2024-02-07 - The strategic partnership between StimStixx Technologies and Hunting Titan will increase well treatments and reduce costs, the companies said.

Tech Trends: QYSEA’s Artificially Intelligent Underwater Additions

2024-02-13 - Using their AI underwater image filtering algorithm, the QYSEA AI Diver Tracking allows the FIFISH ROV to identify a diver's movements and conducts real-time automatic analysis.

Subsea Tieback Round-Up, 2026 and Beyond

2024-02-13 - The second in a two-part series, this report on subsea tiebacks looks at some of the projects around the world scheduled to come online in 2026 or later.