The megamerger between Chesapeake and Southwestern—a deal that would establish a new E&P with a commanding sway over the Haynesville Shale and the Appalachian Basin production—follows an energy industry trend seen picking up speed in 2023. Large, cash-flush companies are acquiring other major players to establish even more advantageous shale play positions.

Some federal legislators, however, are pushing back, calling the deals anticompetitive and demanding regulators step up scrutiny of the transactions.

“On the back of the last couple of years, it comes as no surprise that there is a war chest of capital available for most oil and gas companies to go out and invest and avoid playing the debt management and dividend game,” said Joanne Salih, a Houston partner in the Oliver Wyman Energy Practice. “So it’s the best time possible to go after some of these acquisitions.”

The next step, however, is getting the deal past a federal government in which some political leaders have been critical of the large recent deals and in which natural gas mergers bring intense scrutiny.

Chesapeake and Southwestern announced an agreement to combine on Jan. 11. The $7.4 billion deal would create the largest natural gas producer in the U.S.

“The oil market is a global market and gets a little bit less scrutiny than the gas market,” said Ajay Bakshani, director of analytics for East Daley Analytics. “Even with the FTC [Federal Trade Commission] investigation, I think most people expect the Exxon Mobil deal to go through pretty smoothly. But there have been rumors of more pushback from regulators.”

Exxon Mobil’s acquisition of Pioneer Natural Resources in October has brought calls of alarm from Congress. Senate Majority Leader Charles Schumer demanded a Federal Trade Commission (FTC) investigation of the deal, saying the merger would result in higher prices for the customers. The FTC, which enforces antitrust laws, is currently reviewing the deal. Schumer has also called for a review of Chevron’s acquisition of Hess.

RELATED

Feds Dig Deeper into Chevron-Hess Merger Amid Oil, Gas M&A

U.S. natural gas, for the time being, remains in a far more domestically centered market, Bakshani said, even though LNG exports has more than doubled since 2018 and is expected to double again by the end of the decade.

“So regulators are taking a closer eye on energy deals than they might have in the past,” Bakshani said. “On top of that, when we look at the latest merger, which is EQT buying Tug Hill in a much smaller deal, that took about 11 months to close.”

In September 2022, EQT announced the acquisition of gas producer Tug Hill Appalachia and midstream company THQ-XcL Holdings in a $5.2 billion deal. The FTC did not give final approval for the deal until August of 2023.

The FTC had antitrust concerns about the deal, and eventually approved the acquisition after the EQT and Tug Hill backer Quantum Energy Partners signed a consent order “that prevents entanglements between the two companies and the exchange of confidential, competitively sensitive information.”

The commission was concerned enough that for the first time in 40 years it enforced Section 8 of the Clayton Act, an antitrust law that seeks to stop “interlocking directorates” when an officer or director of a firm also serves as an officer or director of a competing firm.

The FTC’s consent order prohibits Quantum from occupying a seat on the EQT board of directors and requires the private equity firm to divest its EQT shares.

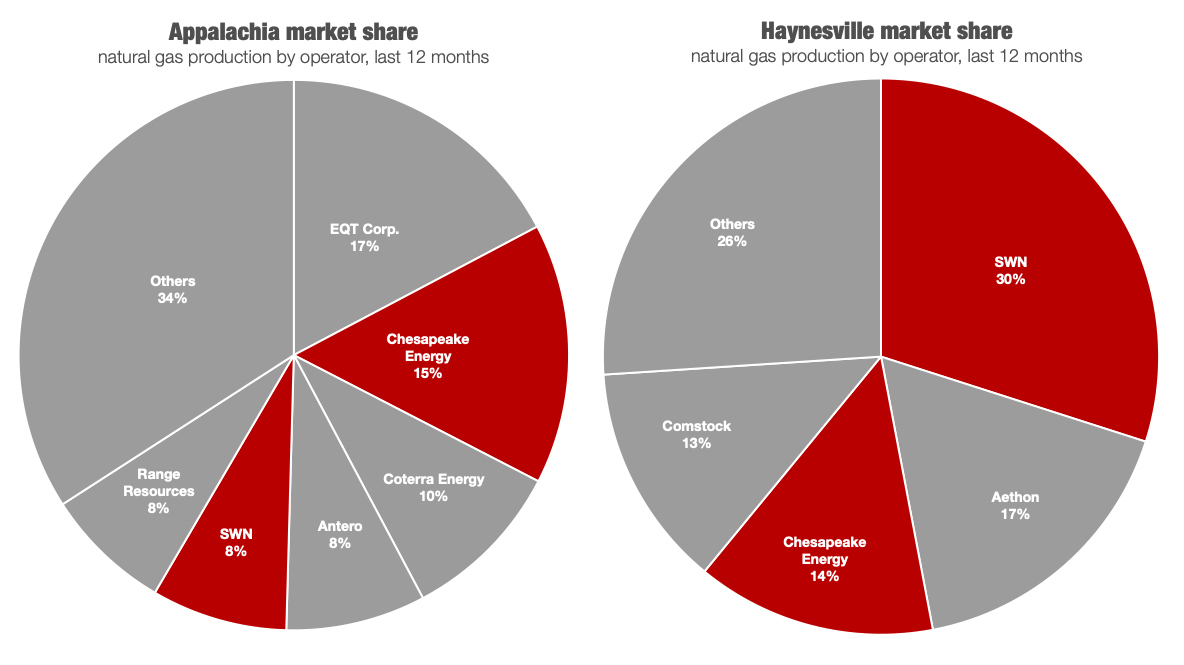

Before the Chesapeake and Southwestern announcement, JP Morgan reported that there would be scrutiny, as a combined Southwestern-Chesapeake “would control about 21% of Appalachia’s gross production … and about 25% of Haynesville’s gross production.”

Bakshani said the deal was likely to “take some time” to pass through regulatory hoops.

However, Silah said she believes the merger will ultimately pass muster with regulators.

“Governments come and go,” she said. “In general, if you look over the last century to the periods of times when there is consolidation in oil and gas, especially of a particular size, there’s obviously always issues around competitiveness and overgearing towards a few major players.”

People and governments fear over-consolidation that shifts all decision to a small group or one person.

“Nobody wants that,” Silah said. “But I don’t think (the Chesapeake-Southwestern merger) is of the size to really, in and of itself, result in a significant pushback.”