Chesapeake Energy Corp. has executed an agreement to sell its remaining assets in the Eagle Ford to SilverBow Resources Inc. for $700 million, according to an Aug. 14 press release. (Source: Shutterstock.com)

Chesapeake Energy Corp. will sell its remaining assets in the Eagle Ford, including acreage in the Austin Chalk, to SilverBow Resources Inc. for $700 million, the companies said Aug. 14.

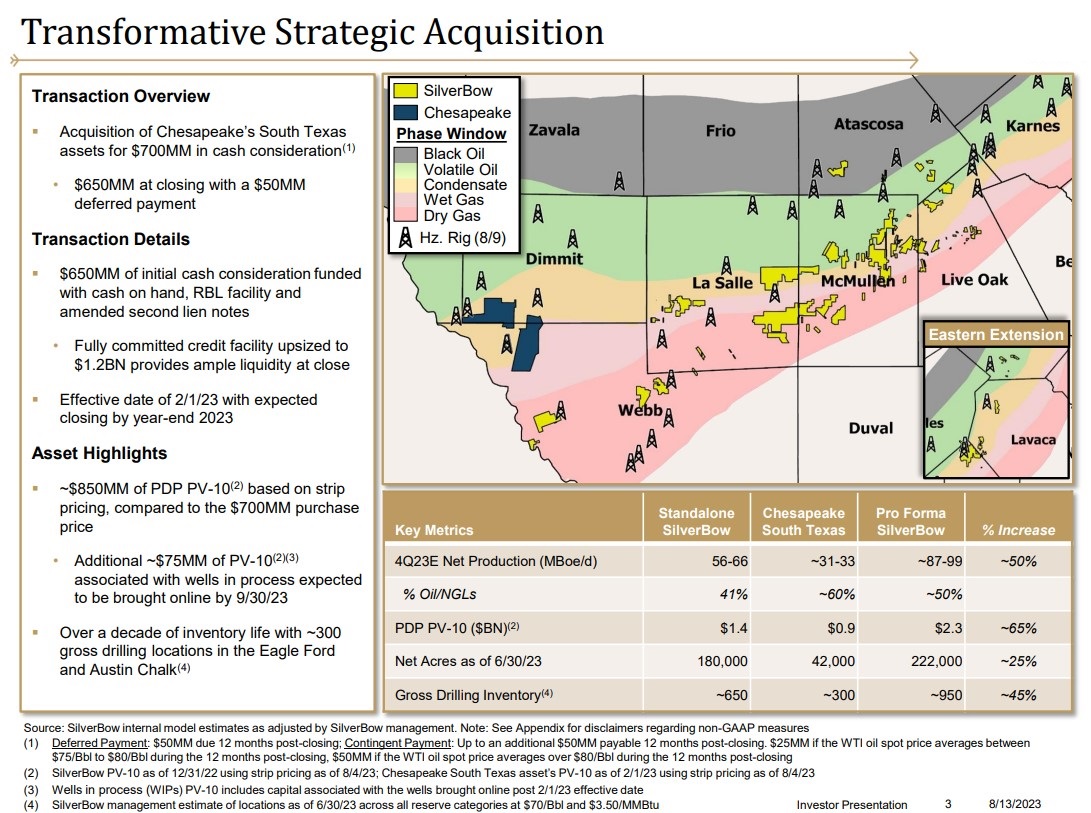

SilverBow said the “transformational” acquisition would add 87,000 boe/d to 99,000 boe/d, with 50% production oil and NGL. SilverBow will pay $650 million in upfront cash at closing, an additional $50 million in a deferred payment 12 months after close and a possible $50 million contingency payment based on future commodity prices.

SilverBow said the deal is “leverage neutral” at year-end 2023, when the deal is expected to close. The E&P expects a 1.0x leverage ratio by year-end 2024.

For Chesapeake, the deal ends its marketing of a trio of packages that represents an exit from the Eagle Ford with gross proceeds of more than $3.5 billion.

RELATED: Chesapeake Finds ‘Much Better Deal’ in Eagle Ford Sale to INEOS

Chesapeake’s transaction includes approximately 42,000 net acres and 540 wells in the condensate rich portion of the Eagle Ford asset in Dimmit and Webb counties, Texas, along with related property, plant and equipment.

In second quarter 2023, the average daily production from these properties was approximately 29,000 boe (60% liquid), which generated approximately $50 million of EBITDAX, according to the release.

Gabriele Sorbara, managing director of equity research at Siebert Williams Shank & Co. LLC, said the potential $750 million headline price tag comes in “above our expectations of $500.0-$600.0 million.”

He noted that the deal is dilutive to Chesapeake’s financial metrics, although that was expected as the company transitions into a pure-play gas producer.

“With the asset sale valuation coming in above expectations and following the recent underperformance (total return of 4.7% over past month vs. peers of 12.6% on average), we expect a positive response in today’s trading, as it should further support its buybacks over the next several quarters,” Sorbara said in an Aug. 14 report.

Based on the headline price tag and total production, the transaction is valued at $24,138 per flowing boe/d, Sorbara said. In SilverBow’s press release, the E&P estimates the PDP at $850 million based on Aug. 4 strip prices.

“However, based on our modeling assumptions, we think it is closer to $600.0 million at current strip prices,” he said. “Based on the annualized 2Q23 EBITDA of ~$50.0 million, we estimate the assets sold at ~3.5x EV/EBITDA.

“SBOW estimates the valuation at 2.3x NTM EBITDA with a >20% FCF yield. The asset sale results in about $100.0 million of capex savings in 2024, putting our adjusted estimate at $1.69 billion, 7.1% below Consensus of $1.81 billion.”

The transaction has an effective transaction date of Feb. 1, 2023. SilverBow will pay an additional contingent payment of $25 million if oil prices average between $75/bbl and $80/bbl WTI Nymex. If oil prices average above $80, however, the additional continent payment will increase to $50 million.

"We are pleased to have successfully completed the exit of our Eagle Ford asset, allowing us to focus our capital and team on the premium rock, returns and runway of our Marcellus and Haynesville positions," said Chesapeake President and CEO Nick Dell'Osso. "I want to thank our employees who built a culture of safety and excellence, which made this a powerful and attractive asset."

RBC Capital Markets, Citi and Evercore are serving as financial advisers to Chesapeake. Haynes and Boone LLP is the company’s legal adviser, and DrivePath Advisors is serving as the company’s communications adviser.