INEOS Energy Chairman Brian Gilvary told Hart Energy the $1.4 billion Chesapeake acquisition adds “good, economic barrels to add to [the company’s] portfolio.” (Source: Shutterstock.com)

Despite criticism by analysts for an underwhelming sale of its Brazos Valley assets, Chesapeake Energy Corp. appears to have found a more favorable deal for its black oil Eagle Ford assets from a British chemical giant.

And as much as Chesapeake wants out of the oil business to focus on natural gas, buyer INEOS Energy wanted in.

For the past two years, INEOS Energy, an oil and gas subsidiary of INEOS Group, has worked to rebalance its portfolio from around 85% gas, 15% oil to a more oil-heavy mix, Chairman Brian Gilvary told Hart Energy. The deal marks the entry of INEOS Energy as operator into the U.S. onshore oil and gas market.

"For the next decade, two decades, oil is going to be really important to the world," said Gilvary, whose 34-year career at BP included CFO and chief executive of the supermajor’s commodity tradition division. "The idea that we're pivoting toward green energy? Absolutely. But oil is absolutely a fundamental part of the mix going forward."

Chesapeake offloading a portion of its Eagle Ford assets to INEOS Energy for $1.4 billion is probably the best realistic scenario the company could have hoped for, Enverus Intelligence Research Director Andrew Dittmar told Hart Energy.

"We see these as being good, economic barrels to add to the portfolio, and a nice-sized acreage and well position that we'll be able to develop." — Brian Gilvary, INEOS Energy

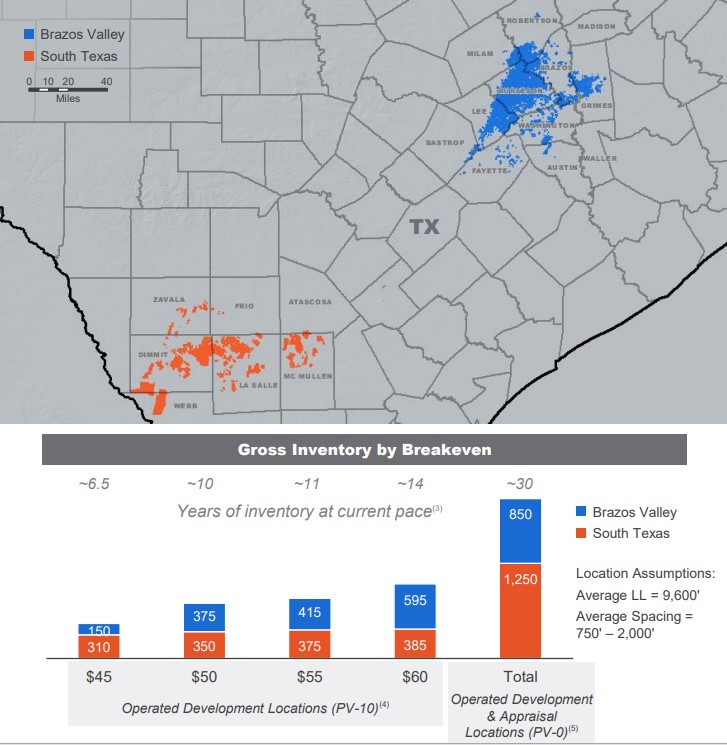

The Oklahoma City company agreed to sell approximately 172,000 net acres and 2,300 wells in the black oil portion of its Eagle Ford asset, Chesapeake announced alongside fourth-quarter earnings on Feb. 21.

The latest sale represents "a much better deal" for Chesapeake than what the company got for its sale to WildFire Energy I LLC earlier this year, Dittmar said. Chesapeake entered into an agreement to sell its Brazos Valley footprint to WildFire for $1.425 billion in January.

"If you look at what they're getting paid for production, the Brazos Valley sale was something like a PV-20 discount on production value," Dittmar said. "We have this one at more like PV-14 to PV-15, so a fairly substantial improvement of what they're getting credited for."

As Chesapeake moves toward natural gas, INEOS Energy is moving its focus more toward oil.

The company has taken steps in recent years to build up its oil footprint, Gilvary said. In 2021, INEOS Energy acquired Hess Corp. subsidiary Hess Denmark ApS and Hess' 61.5% stake in the Syd Arne oil field for $150 million.

Later that year, INEOS Energy sold its Norwegian business, which was predominately gas, to PGNiG Upstream Norway AS for $615 million.

Purchasing Chesapeake's Eagle Ford position should move INEOS Energy's portfolio to around 60%-oil, 40%-gas, Gilvary said.

"If you look at Texas, it's one of the great places of the world and a stable fiscal regime," Gilvary said. "We see these as being good, economic barrels to add to the portfolio, and a nice-sized acreage and well position that we'll be able to develop going forward."

INEOS Energy is entering the U.S. oil and gas production space for the first time with the Chesapeake deal. It's a significant step for the company to operate an oil and gas asset of this scale, Dittmar said.

Chesapeake said it has a long transition services agreement in place with INEOS related to the Eagle Ford deal, which is expected to close in the second quarter.

"They do not have a material upstream business in the U.S. and we will be aiding them as they create that organization," said Chesapeake CFO Mohit Singh.

Chesapeake’s Austin Chalk next on the block?

Chesapeake said it expects the first two of its Eagle Ford deals to net a total of $1.7 billion in after-tax proceeds at closing, with another $450 million in installments paid over the next four years, President and CEO Nick Dell'Osso said in a Jan. 22 earnings call.

Chesapeake remains actively engaged with several parties to sell the remainder of its Eagle Ford footprint, which includes acreage in the Austin Chalk play.

After completing the Brazos Valley and black oil asset deals, the company will have approximately 21,000 bbl/d of oil and NGL and 80 MMcf/d of natural gas production remaining in its Eagle Ford position.

Chesapeake acquired around 420,000 net acres from WildHorse Resources for nearly $4 billion in cash and stock in 2019.

Exiting the Eagle Ford and focusing the company's portfolio around gas-rich areas in the Haynesville and Marcellus basins moves Chesapeake closer to being a pure-play natural gas company, Gabriele Sorbara, managing director of equity research at Siebert Williams Shank & Co., said in a Feb. 22 report. The firm values Chesapeake’s remaining Eagle Ford assets at $900 million.

Recommended Reading

Barrio Energy Acquires 12-MW Data Center in Texas

2024-08-22 - Barrio Energy’s new 12-megawatt data center in Tyler, Texas, brings the company’s number of data center properties in the state to five.

Transocean Contracted for Ultra-deepwater Drillship Offshore India

2024-09-04 - Transocean’s $123 million deepwater drillship will begin operations in the second quarter of 2026.

HNR Increases Permian Efficiencies with Automation Rollout

2024-09-13 - Upon completion of a pilot test of the new application, the technology will be rolled out to the rest of HNR Acquisition Corp.’s field operators.

As Permian Gas Pipelines Quickly Fill, More Buildout Likely—EDA

2024-10-28 - Natural gas volatility remains—typically with prices down, and then down further—but demand is developing rapidly for an expanded energy market, East Daley Analytics says.

Exclusive: Embracing AI for Precise Supply-Demand Predictions

2024-10-17 - Dak Liyanearachchi, the CTO with NRG, gives insight on AI’s capabilities in optimizing energy consumption and how NRG is making strides to manage AI’s growth, in this Hart Energy exclusive interview.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.