Oil pumping unit in Eagle Ford in South Texas. (Source: Shutterstock.com)

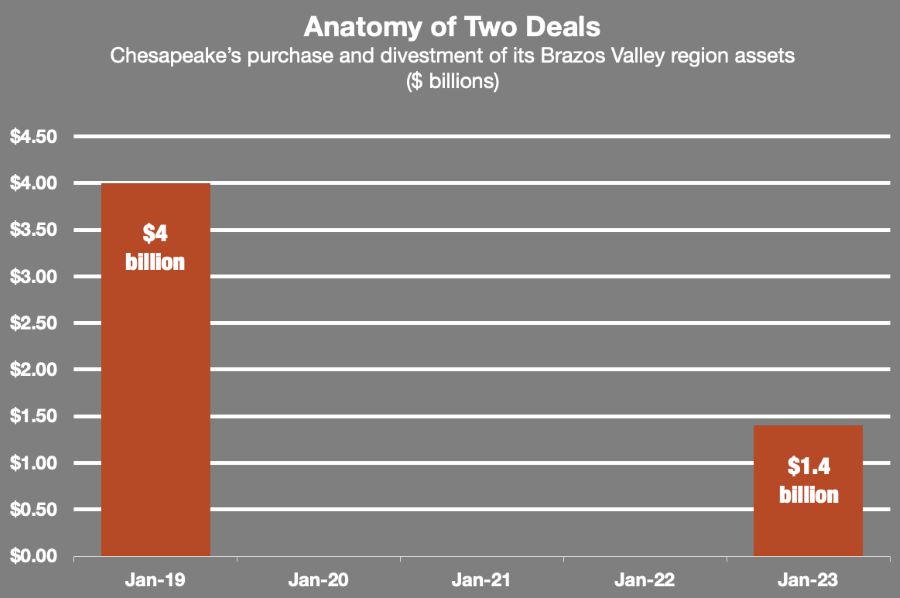

Chesapeake Energy Corp.’s recent divestment of its Brazos Valley assets to WildFire Energy I LLC for $1.43 billion was due to the assets not matching the company’s portfolio, CEO Nick Dell’Osso said on the sidelines of NAPE 2023.

“We completed that acquisition in the beginning of 2019, a very different time in the market, a very different time for our company… we've done well owning that asset. It's generated a lot of free cash flow for us,” Dell’Osso told Hart Energy. “That asset really doesn't fit in the portfolio of the company we are today. So, we are moving on, selling that [and] focused on our very best assets in our portfolio, which are Marcellus and Haynesville.”

Oklahoma City-based Chesapeake’s Jan. 18 divestment included approximately 377,000 net acres and approximately 1,350 wells in the Brazos Valley, along with related property, plant and equipment.

On Feb. 1, 2019, Chesapeake acquired about 420,000 net acres from WildHorse Resources Development Corp. The deal, valued at almost $4 billion in cash and stock, included the assumption of WildHorse’s $930 million net debt and was consummated with plans to create an Eagle Ford oil-producing powerhouse.

Recommended Reading

Dividends Declared in the Week of Sept. 9

2024-09-13 - Here is a compilation of dividends declared by select upstream and service and supply companies for third-quarter 2024.

Helix Secures Multi-year GoM Contract with Shell Offshore

2024-09-04 - Under the contract, to begin in 2025, Helix Energy Solutions will provide well intervention services for Shell Offshore in the U.S. Gulf of Mexico.

Cormetech Appoints Patricia Martinez to President, CEO

2024-08-20 - Cormetech’s former President & CEO Mike Mattes will now serve as chairman of the board.

Halliburton Working to Assess Cause, Impacts of Cyberattack

2024-08-22 - A Halliburton spokesperson said the company had activated a response plan and was working internally and with external experts to remediate the “issue.”

Dividends Declared in the Week of Aug. 19

2024-08-23 - As second-quarter earnings wrap up, here is a selection of dividends declared in the energy industry.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.