Flags of OPEC+ countries. (Source: Shutterstock)

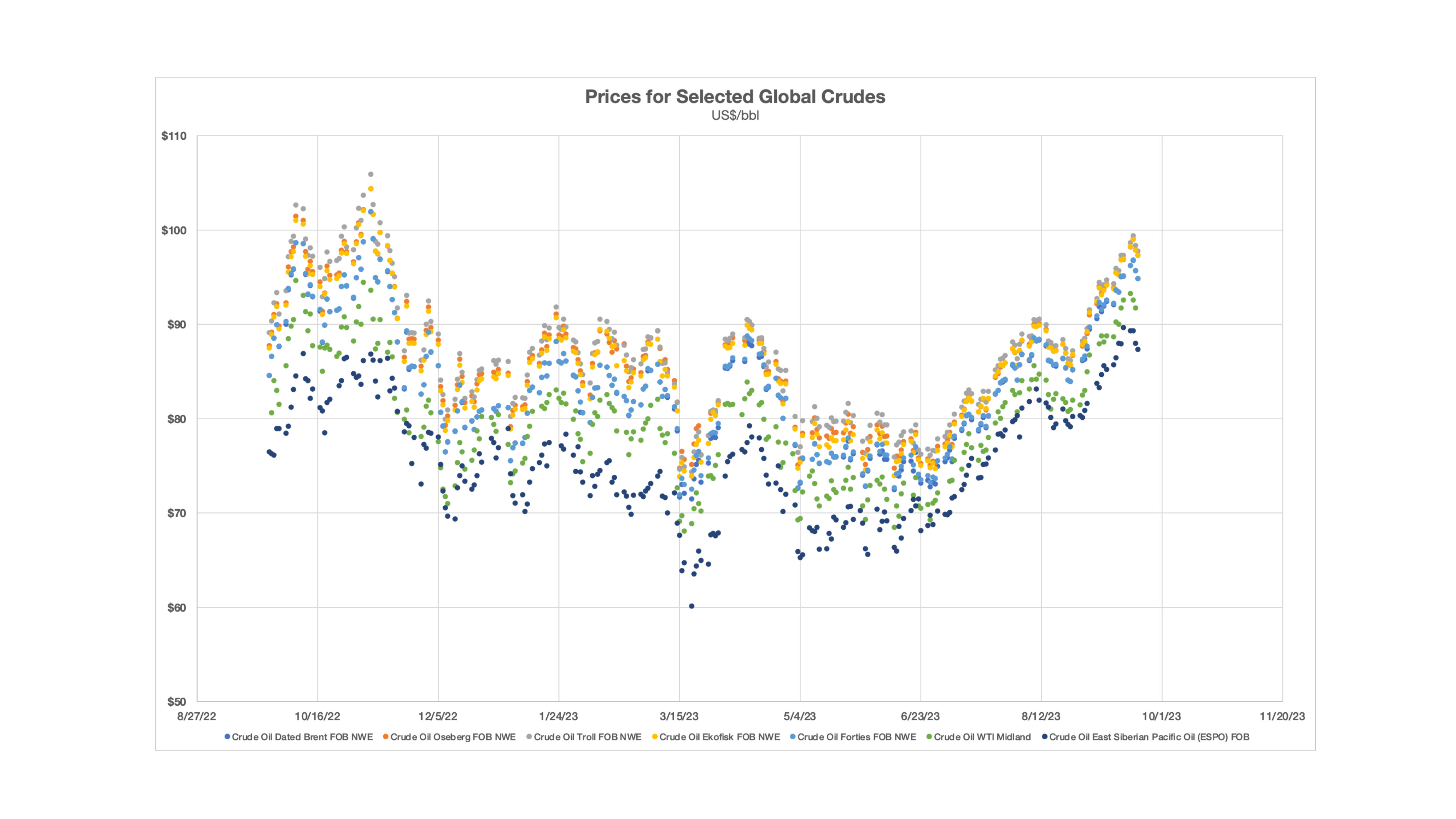

Oil prices for select global crudes are moving upward, with $100/bbl in close sight, according to data from General Index, a tech-native benchmark provider. Analysts say the upward trend is driven by OPEC+’s decision to extend production cuts.

“Oil prices have reached new highs since the extension of the voluntary production cuts (1 MMbbl/d) by Saudi Arabia until December 2023,” Rystad Energy senior oil market data analyst Sofia Guidi Di Sante wrote Sept. 22 in a social media post.

“Prices will remain sustained until year end, although it is unlikely they will stabilize at $100/bbl,” she said.

The rise in commodity prices has been driven by the extension of the supply cuts from OPEC+, as well as temporary export disruptions in Libya due to recent flooding, Stratas Advisors John E. Paise said Sept. 18 in column for Hart Energy. Prices have also been impacted by “some increased optimism about China’s economic growth and oil demand,” he said.

“For the upcoming week, however, we are expecting that oil prices will trend upwards with traders adding to their net long positions,” Paise said. “The price of Brent is already at the highest level of the year and the next resistance level is around $95/bbl.”

Worries about supply due to weather events also helped to support the oil market, OPEC said Sept. 12 in its Monthly Oil Market Report. “Hurricane Idalia and a temporary shutdown of the Novorossiysk port, one of the largest ports in the Black Sea, contributed to the bullish sentiment.”

Recommended Reading

Quantum Capital’s View on AI: Lots of Benefits, Pain Points

2024-05-16 - The energy industry is lagging in the race to implement AI, but Sebastian Gass, CTO of Quantum Capital Group, offered a few solutions during Hart Energy’s 2024 SUPER DUG Conference & Expo.

Aramco Credits Adaptability, Collaboration for Driving Innovation

2024-05-15 - Aramco’s implementation of different approaches has led to the creation and commercialization of newer products, said Max Deffenbaugh, principal scientist for Aramco, at the 2024 Offshore Technology Conference in Houston.

OTC: E&Ps Improving Operational Safety with Digitization

2024-05-13 - Artificial intelligence and the digitization of the oilfield have allowed for several improvements in keeping operators out of harm’s way, panelists said during the 2024 Offshore Technology Conference.

Exclusive: Cost-effective Benefits of Extracting from Mature Assets

2024-05-13 - Baker Hughes' well abandonment leader Bart Joppe details the importance of extracting resources from mature assets and the company's approach to managing a well, in this Hart Energy Exclusive interview.

TGS Starts Up Multiclient Wind, Metaocean North Sea Campaign

2024-05-07 - TGS is utilizing two laser imaging and ranging buoys to receive detailed wind measurements and metaocean data, with the goal of supporting decision-making in wind lease rounds in the German Bright.