Oil pumping unit in Eagle Ford in South Texas. (Source: Shutterstock.com)

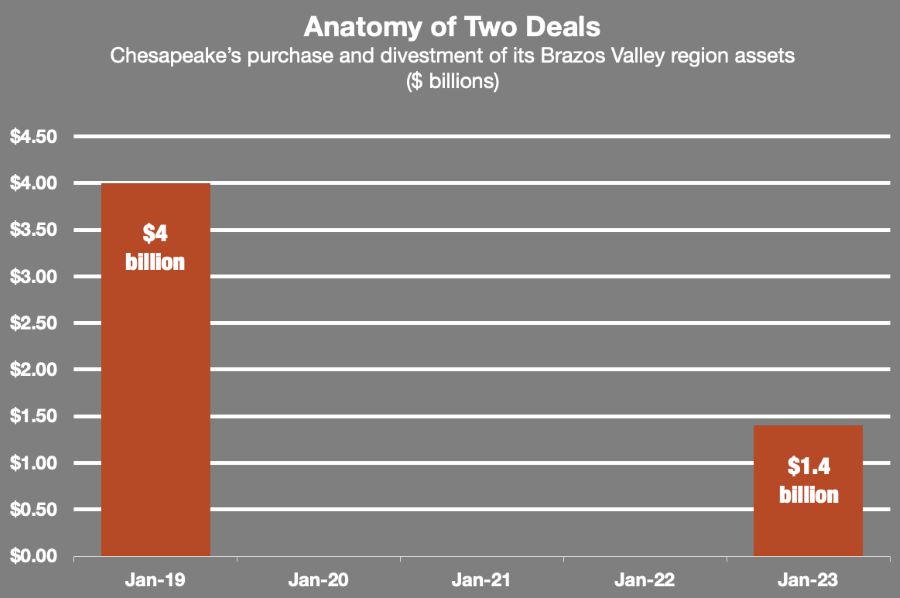

Chesapeake Energy Corp.’s recent divestment of its Brazos Valley assets to WildFire Energy I LLC for $1.43 billion was due to the assets not matching the company’s portfolio, CEO Nick Dell’Osso said on the sidelines of NAPE 2023.

“We completed that acquisition in the beginning of 2019, a very different time in the market, a very different time for our company… we've done well owning that asset. It's generated a lot of free cash flow for us,” Dell’Osso told Hart Energy. “That asset really doesn't fit in the portfolio of the company we are today. So, we are moving on, selling that [and] focused on our very best assets in our portfolio, which are Marcellus and Haynesville.”

Oklahoma City-based Chesapeake’s Jan. 18 divestment included approximately 377,000 net acres and approximately 1,350 wells in the Brazos Valley, along with related property, plant and equipment.

On Feb. 1, 2019, Chesapeake acquired about 420,000 net acres from WildHorse Resources Development Corp. The deal, valued at almost $4 billion in cash and stock, included the assumption of WildHorse’s $930 million net debt and was consummated with plans to create an Eagle Ford oil-producing powerhouse.

Recommended Reading

How Diversified Already Surpassed its 2030 Emissions Goals

2024-04-12 - Through Diversified Energy’s “aggressive” voluntary leak detection and repair program, the company has already hit its 2030 emission goal and is en route to 2040 targets, the company says.

BKV CEO Chris Kalnin says ‘Forgotten’ Barnett Ripe for Refracs

2024-04-02 - The Barnett Shale is “ripe for fracs” and offers opportunities to boost natural gas production to historic levels, BKV Corp. CEO and Founder Chris Kalnin said at the DUG GAS+ Conference and Expo.