Eagle Ford and Austin Chalk E&P Magnolia Oil & Gas is eyeing growth from the storied Giddings Field. (Source: Shutterstock/ Magnolia Oil & Gas)

After spending nearly $400 million on acquisitions in 2023, Magnolia Oil & Gas looks to ink smaller deals to fill out its Giddings Field portfolio this year.

Houston-based Magnolia, which operates in the Austin Chalk and Eagle Ford Shale, still has a strong appetite for dealmaking following an active year of bolt-ons and carve-outs to add scale in the Giddings Field.

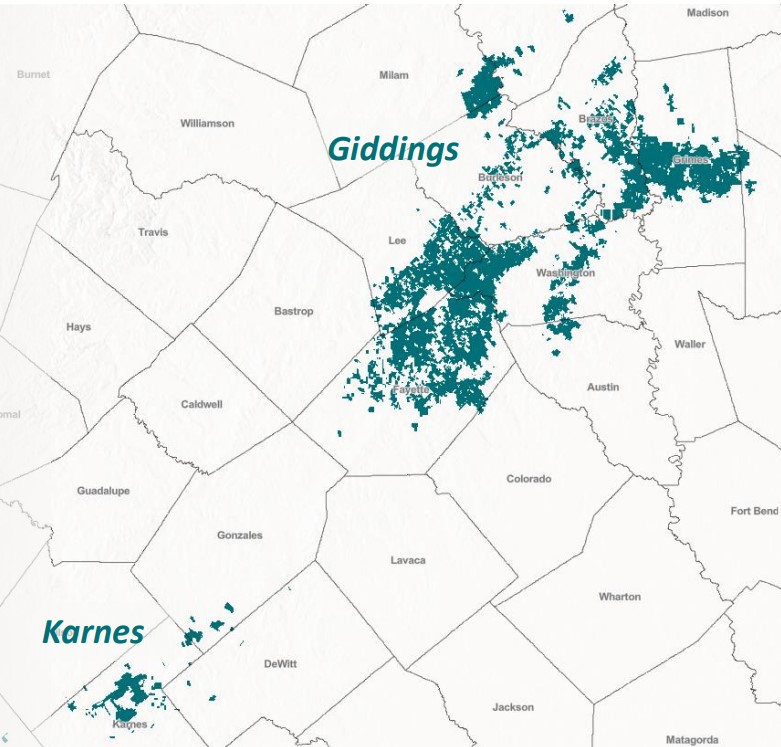

Magnolia has more than 500,000 net acres in Giddings, from which the company produces around 75% of its total oil and gas volumes.

The company also has a smaller footprint in the Karnes County, Texas, area of the Eagle Ford Shale to the southwest of Giddings.

Magnolia doesn’t want to own every bit of acreage in Giddings, President and CEO Chris Stavros said during the company’s fourth-quarter earnings call on Feb. 15. But the company does want to “fill in some of the blanks” with smaller deals for a blockier, more contiguous acreage position in the Austin Chalk.

“There are some areas that look interesting that will help us and will help the business—where I can see this enhancing the runway, if you will, and providing more sustainability for the business over time,” Stavros said.

“If there are some things, they’ll tend to be a bit smaller,” Stavros said, “but may hopefully pack a punch.”

Magnolia still needs time to digest more than $394 million in total acquisition costs incurred during 2023, according to the E&P’s latest earnings report. That compares to around $92 million in total M&A in 2022 and $23 million in 2021.

The company spent about $300 million for a Giddings acquisition from an undisclosed seller last fall, adding 48,000 net acres and 5,000 boe/d (more than 70% oil). The deal closed in mid-November.

Magnolia also disclosed a $40 million bolt-on Giddings acquisition in its second-quarter earnings report—a relatively small deal that left securities analysts with pointed questions about the E&P’s drilling plans in the Austin Chalk.

The Giddings Field holds gassier fairways and oilier areas, but Magnolia’s development plan aims to boost the oil weighting of its overall output over time.

Fourth-quarter production averaged 85,414 boe/d and oil volumes averaged 35,466 bbl/d. Magnolia is expecting an oil cut ranging between 41% and 42% from its 2024 production, but the company is “confident” that oil volumes will grow as a percentage of total output over time.

“That’s what the program is designed to deliver,” Stavros said.

Magnolia’s full-year oil production averaged 34,541 bbl/d, up 3% from 33,394 bbl/d in 2022.

RELATED

The $40MM Pencil Fight: Ringside at Magnolia Oil & Gas’ Earnings Call

Giddings growth

Magnolia plans to deploy 80% of its 2024 capex into the Giddings portfolio, with the remaining 20% allocated for the Karnes area.

The company’s 2024 budget will range between $450 million and $480 million; first-quarter spending is expected to be around $130 million, the highest quarterly rate of spending this year.

Magnolia’s first-quarter production guidance ranges between 84,000 boe/d and 85,000 boe/d and includes several days of facilities downtime due to severe winter weather conditions in January.

Freezing weather in January caused demand for natural gas to spike, and gas-producing facilities around the U.S. were forced to shut in output due to the winter blast.

Despite the impacts of inclement weather, Magnolia is still on track for single-digit production growth this year; most of the incremental growth will come from developing the Giddings asset.

The company’s 2024 operating plan includes running two rigs and one completion crew.

Magnolia was formed in 2018 through a combination between EnerVest and a blank-check company led by former Occidental CEO Stephen Chazen.

Stavros succeeded Chazen as Magnolia’s chief executive in September 2022, shortly before Chazen’s death.

RELATED

Recommended Reading

NOV Announces $1B Repurchase Program, Ups Dividend

2024-04-26 - NOV expects to increase its quarterly cash dividend on its common stock by 50% to $0.075 per share from $0.05 per share.

Repsol to Drop Marcellus Rig in June

2024-04-26 - Spain’s Repsol plans to drop its Marcellus Shale rig in June and reduce capex in the play due to the current U.S. gas price environment, CEO Josu Jon Imaz told analysts during a quarterly webcast.

US Drillers Cut Most Oil Rigs in a Week Since November

2024-04-26 - The number of oil rigs fell by five to 506 this week, while gas rigs fell by one to 105, their lowest since December 2021.

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

2024-04-25 - Henry Hub blues: CNX Resources and other Appalachia producers are slashing production and deferring well completions as natural gas spot prices hover near record lows.

Chevron’s Tengiz Oil Field Operations Start Up in Kazakhstan

2024-04-25 - The final phase of Chevron’s project will produce about 260,000 bbl/d.