Unforeseen disruptions to global supply could move oil prices higher than estimated this year, the U.S. Energy Information Administration said in its latest Short-Term Energy Outlook. (Source: Shutterstock)

Geopolitical conflicts in the Middle East and risks to disrupting global oil supply have experts questioning where crude prices will move. So far, the answer has been up.

The spot price for Brent crude rose to an average of $80/bbl in January—up $2/bbl from December levels—after attacks to vessels in the Red Sea intensified and heightened uncertainty about global oil shipments, the U.S. Energy Information Administration (EIA) reported in its latest Short-Term Energy Outlook.

“The Red Sea is more critical to the flexibility of global oil trade than in years past following Russia’s full-scale invasion of Ukraine,” the EIA said in its outlook published Feb. 6. “These attacks have increased both transit times and shipping costs for oil, limiting the flexibility of the oil market to adjust to any future supply disruptions.”

There’s also the potential for oil production in certain parts of the Middle East to be shut in—a risk premium also being baked into price increases. However, no oil production has been lost as of Feb. 6, the EIA noted.

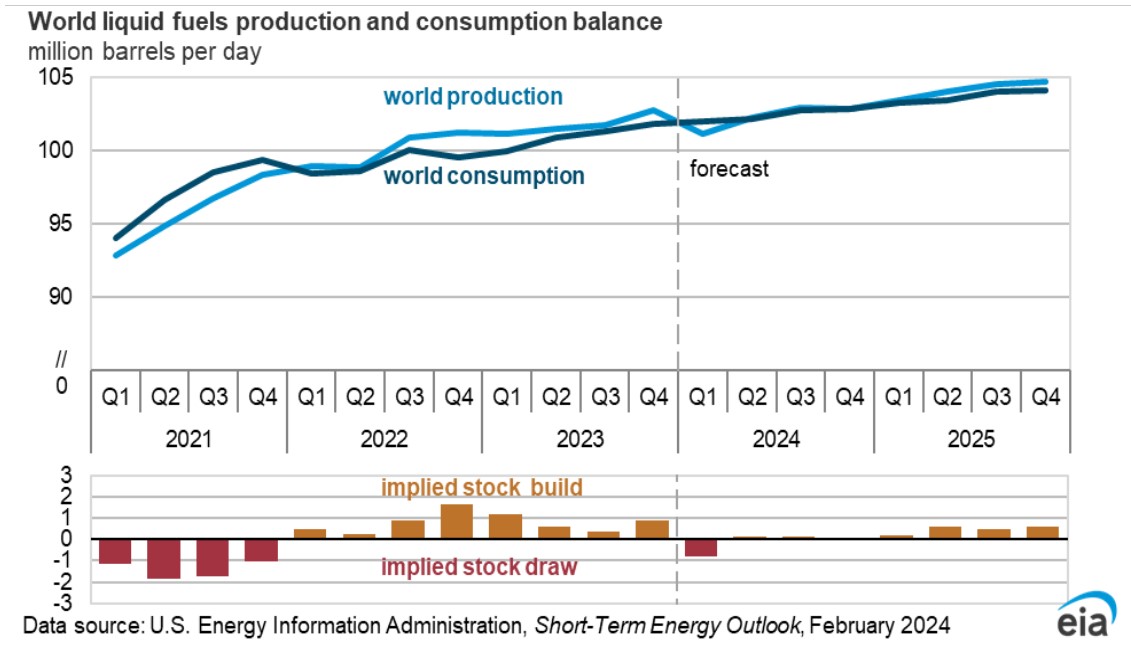

The impact of the Red Sea attacks has been relatively muted due to “prolonged global oil inventory accumulation” in 2022 and 2023 and a lack of disruptions to oil production.

But, ongoing risks of supply disruptions create the potential for crude oil prices to move higher, the EIA said.

Production cuts by the OPEC+ cartel will lead to inventory withdrawals during February and March and put upward pressure on oil prices in the short term. Prices are expected to rise into the mid-$80/bbl range in the first quarter.

But rising oil production in other areas—including record output from the U.S.—are keeping downward pressure on prices.

The EIA estimates that U.S. crude oil production reached an all-time high in December at more than 13.3 MMbbl/d.

However, output fell to 12.6 MMbbl/d in January due to shut-ins related to cold weather, per EIA estimates.

“We forecast production will return to almost 13.3 MMbbl/d in February but then decrease slightly through the middle of 2024 and will not exceed the December 2023 record until February 2025,” EIA said.

RELATED

Oil Prices Edge Lower on False Report of Israeli Ceasefire, Sustained OPEC Cuts

Gas glut keeps going

Freezing winter weather in January caused natural gas demand to spike—while simultaneously forcing some of the nation’s record gas output to be shut in.

The supply-demand imbalance forced prices up in the short term: Henry Hub spot prices rose sharply to $13.20/MMBtu on Jan. 12, in anticipation of the icy gales of Winter Storm Heather. But prices fell quickly, dropping to a monthly low of $2.15/MMBtu by Jan. 23.

Henry Hub spot prices averaged $3.18/MMBtu for the entire month of January.

“We forecast that mild weather for the remainder of [the first quarter] will keep the average Henry Hub spot price near $2.40/MMBtu during February and March,” EIA said. “But volatility could return if severely cold weather emerges, even for a short period.”

Increased demand, coupled with lower natural gas production, caused a massive withdrawal of gas inventories—storage capacity that has been glutted with too much gas for several months.

January’s withdrawal of nearly 920 Bcf from storage was the third-largest in U.S. history, according to EIA.

But because the U.S. began the month with 13% more gas in storage than average of the past five years, inventories are still brimming.

U.S. gas producers have faced an up-and-down roller coaster of flailing price-swings in recent years. Henry Hub spot gas prices averaged $6.42/MMBtu in 2022 amid the confluence of supply-demand imbalances emerging from the COVID-19 downturn, Russia’s invasion of Ukraine and a myriad of other issues.

But prices fell over 60% to average $2.54/MMBtu in 2023 due to a production oversupply and rapidly filling storage capacity.

Most U.S. gas producers, by and large, expect to see higher prices later this year and into 2025 as a wave of new LNG export capacity comes online along the Gulf Coast.

RELATED

US Drew New No. 3 Record 326 Bcf From Storage in Winter Storm Heather

Recommended Reading

Laredo Oil Subsidiary, Erehwon Enter Into Drilling Agreement with Texakoma

2024-03-14 - The agreement with Lustre Oil and Erehwon Oil & Gas would allow Texakoma to participate in the development of 7,375 net acres of mineral rights in Valley County, Montana.

JMR Services, A-Plus P&A to Merge Companies

2024-03-05 - The combined organization will operate under JMR Services and aims to become the largest pure-play plug and abandonment company in the nation.

New Fortress Energy Sells Two Power Plants to Puerto Rico

2024-03-18 - New Fortress Energy sold two power plants to the Puerto Rico Electric Power Authority to provide cleaner and lower cost energy to the island.

SilverBow Rejects Kimmeridge’s Latest Offer, ‘Sets the Record Straight’

2024-03-28 - In a letter to SilverBow shareholders, the E&P said Kimmeridge’s offer “substantially undervalues SilverBow” and that Kimmeridge’s own South Texas gas asset values are “overstated.”

Enerplus Increases Quarterly Cash Dividend

2024-02-23 - Enerplus Corp. increased its dividend 8% to US$0.065 (CA$0.088) per share.