FireBird Energy II, founded in April 2023 with private equity backing from Quantum Energy Partners, is currently operating around 20,000 gross acres in the Midland Basin, CEO Travis Thompson said at Hart Energy's SUPER DUG. (Source: Shutterstock, GlobeNewswire)

After selling Permian E&P FireBird Energy for $1.6 billion, the FireBird Energy II team is building another position in the western Midland Basin.

FireBird Energy II, founded in April 2023 with private equity backing from Quantum Energy Partners, is currently operating around 20,000 gross acres in the Midland Basin, CEO Travis Thompson said.

“We have closed on 15 deals since [launching],” Thompson said during Hart Energy’s SUPER DUG Conference & Expo in Fort Worth, Texas. “We’ve had a busy year.”

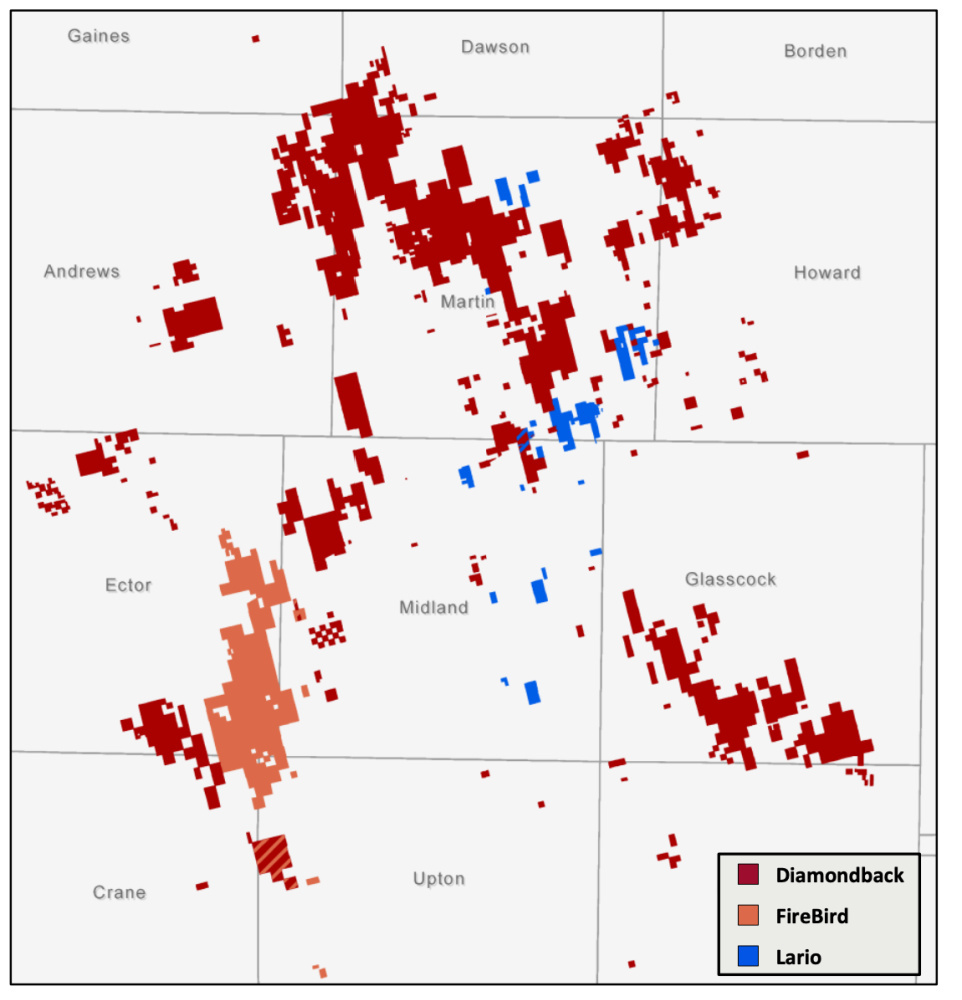

FireBird II currently holds the bulk of its leases and production in Upton and Midland counties, Texas, according to Texas Railroad Commission (RRC) data. The company also holds interests in Crane and Glasscock counties, Texas.

The company is developing another position on the western edges of the Midland Basin, Thompson said.

It’s a part of the Midland Basin the FireBird Energy team knows well. When FireBird I sold to Diamondback Energy for $1.6 billion in December 2022, the private producer had aggregated 75,000 gross (68,000 net) contiguous acres in Ector, Crane, Midland and Upton counties, Texas.

FireBird II has put together a 19,000-gross acre position immediately south of the original FireBird I leasehold, primarily in Upton County, Thompson said.

The position is offset by notable Permian operators, including SM Energy, ConocoPhillips and Chevron.

The company also holds around 1,000 gross acres in Midland County—in the city of Midland, Texas—where FireBird II is bringing online six horizontal wells. Nearby neighbors include Diamondback Energy, Endeavor Energy Resources, Exxon Mobil and Fasken Oil & Ranch.

Production from FireBird II’s total position has recently averaged around 30,000 boe/d, Thompson said.

FireBird II wants to continue acquiring in the Midland Basin. The team is currently evaluating deal opportunities across the basin.

“We’re at 20,000 acres but we’re in no place where we feel like we’re close to finishing,” Thompson said.

RELATED

Mighty Midland Still Beckons Dealmakers

Go west!

FireBird II, which launched with $500 million in equity commitments, has watched oil drilling activity by Permian operators move to the western side of the Midland over time.

Thompson isn’t surprised by the westward shift by offset Midland operators. It’s a part of the Midland Basin with bountiful oil production, high oil cuts and multiple stacked zones to attack.

FireBird II is an oil company. When the company evaluates potential deals, FireBird II aims to keep output as close to a 60% oil weighting as possible, Thompson said.

When it sold to Diamondback, FireBird I was producing around 22,000 boe/d at a 77% oil cut.

“As you look across the Midland Basin, you find areas that get a bit more gassy,” Thompson said. “We always try to lean toward areas that are more oil-prone, and we have found that to be predominately western.”

FireBird II’s primary development plans—its bread and butter—will focus on the Midland’s more popular intervals, including the Lower Spraberry, Wolfcamp A, Wolcamp B and Jo Mill formations.

The company also isn’t ruling out acquisitions in the Permian’s Delaware Basin, which stretches from West Texas into southeastern New Mexico.

FireBird II has brought in resources to help the company evaluate potential Delaware acquisitions, Thompson said.

“I think it’s a matter of time,” he said, “but the right deal has to come along.”

FireBird II has drilled 25 wells to date; the company expects to double the number to 50 by the end of this year.

The area surrounding FireBird II’s core position is awash in record-setting corporate consolidation. Two of its largest neighbors, Exxon Mobil and Diamondback Energy, are growing even larger through M&A.

Exxon’s $60 billion acquisition of Pioneer Natural Resources, a leading Midland producer, closed May 3.

Diamondback’s $26 billion acquisition of private Midland E&P Endeavor—the largest buyout of a private U.S. oil company in the sector’s history—is currently delayed by additional requests from the U.S. Federal Trade Commission.

Occidental Petroleum is also getting bigger in the Midland Basin through a smaller, though still massive, $12 billion acquisition of CrownRock LP.

RELATED

Decoding the Delaware: How E&Ps Are Unlocking the Future

Go deep!

FireBird II’s primary goal is delineating the western Midland Basin. But the company is also excited about opportunities to explore deeper and less-developed intervals around the Permian.

The deeper Wolfcamp D, Barnett Shale and Woodford zones are top-of-mind for FireBird II as the company evaluates potential Permian deals.

There is still a lot that operators don’t know about the less-developed Permian intervals, Thompson said. The geologic characteristics and the mix of gas-to-oil production can vary widely moving across the basin.

But FireBird is joining a growing list of operators such as Marathon Oil, Occidental and Continental Resources that are testing or planning tests in emerging Permian zones.

“We’ve acquired rights specifically for these zones, which is not something we did in FireBird I,” Thompson said. “That says something to our level of excitement about that.”

Most recently, FireBird has been operating two rigs across its Midland acreage position.

The company forecasts a total gross capex of $415 million this year. FireBird II expects to exit the year with average production of around 45,000 boe/d.

RELATED

Barnett & Beyond: Marathon, Oxy, Peers Testing Deeper Permian Zones

Recommended Reading

Canadian Railway Companies Brace for Strike

2024-04-25 - A service disruption caused by a strike in May could delay freight deliveries of petrochemicals.