Upstream company FireBird Energy II secured more than $500 million in equity to pursue acquisitions in the Permian Basin. (Source: Shutterstock)

Upstream company FireBird Energy II secured more than $500 million in equity to pursue acquisitions in the Permian Basin.

FireBird Energy II, the successor to Permian-focused FireBird Energy LLC, is backed by Houston-based private equity firm Quantum Energy Partners, which anchored the new company’s fundraising effort.

Like FireBird I, Fort Worth-based FireBird II will focus on acquiring and growing oil and gas assets in the Permian Basin. The upstream company is primarily targeting investments in the Midland Basin, according to an April 21 statement.

“We are excited to partner with Quantum and build on the momentum from the successful sale of FireBird I,” said Travis Thompson, co-founder and CEO of FireBird II. “This partnership positions our team to take advantage of a number of exciting acquisition and development opportunities throughout the Permian Basin.”

RELATED: Analysts: Shale M&A Opportunities Shrink After Ovintiv’s $4.2 Billion Permian Deal

Thompson also led the original FireBird, which was founded in 2019 and developed a position in the Midland Basin. FireBird I was backed by RedBird Capital Partners and Ontario Teachers’ Pension Plan.

Late last year, FireBird was acquired by Midland-based E&P Diamondback Energy Inc. in a cash-and-stock transaction valued at $1.75 billion.

The deal included approximately 75,000 gross (68,000 net) highly contiguous acres in the Midland Basin and over 450 vertical and horizontal wells.

FireBird II was formed following the sale of FireBird I to Diamondback, the company said.

“The Permian is a strategically important region to Quantum, and we believe that FireBird II is uniquely positioned to build a platform of scale in the basin,” said Quantum Partner Blake Webster.

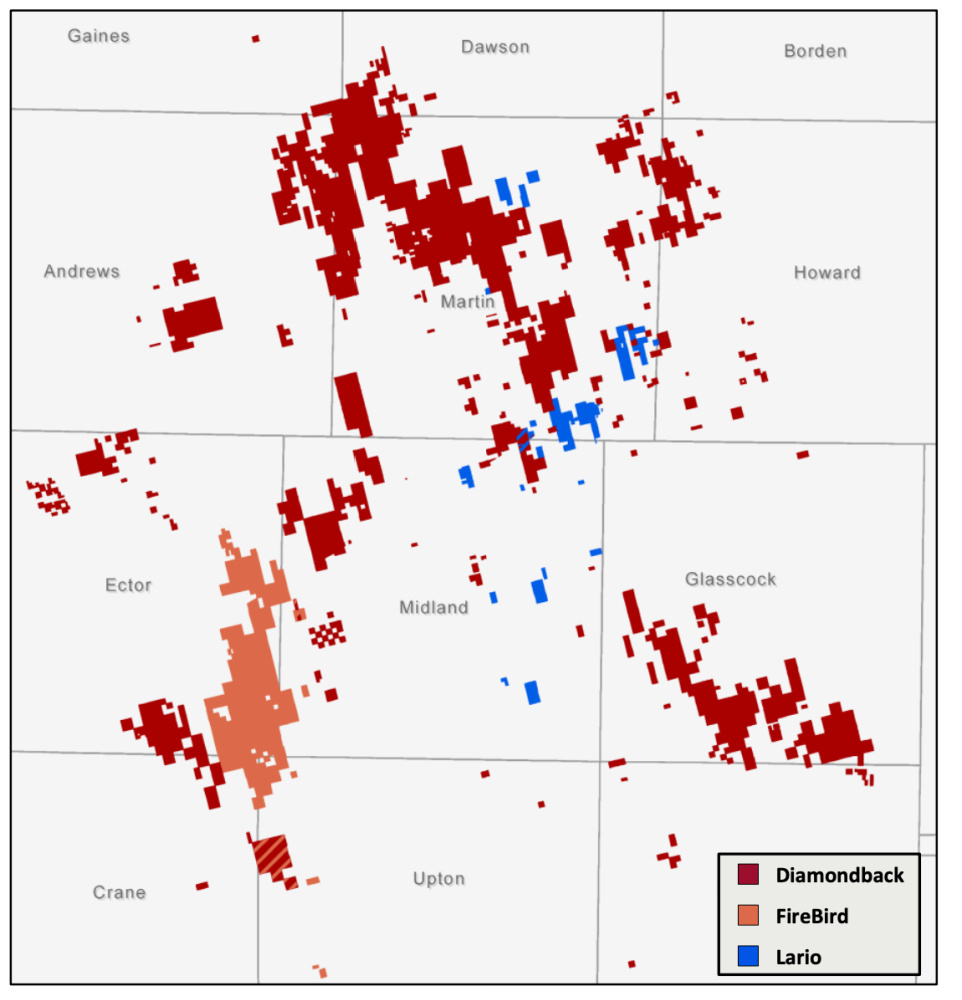

Diamondback Energy boosted its position in the Midland Basin by acquiring FireBird Energy LLC and Lario Permian LLC. (Source: Diamondback Energy investor presentation)

RELATED: Diamondback Energy Completes FireBird Acquisition for $1.75 Billion

Earlier this year, Quantum committed more than $500 million in equity capital to Bison Oil & Gas IV LLC. Bison is focused on acquiring and developing a position in the Denver-Julesburg Basin in Colorado and Wyoming.

Since forming, Bison IV has closed on multiple acquisitions purchasing over 75,000 net acres with current production of more than 25,000 boe/d.

Recommended Reading

SEC Climate Rule: The Devil's in the Lack of Details

2024-05-24 - The Securities and Exchange Commission’s climate disclosure rules requires companies to report a lot of information — from greenhouse-gas emissions to potential weather impacts that could have a material business impact. But the devil’s in the lack of details.

US Supreme Court Blocks EPA's 'Good Neighbor' Air Pollution Plan

2024-06-27 - The U.S. Supreme Court on June 27 blocked an Environmental Protection Agency regulation aimed at reducing ozone emissions that may worsen air pollution in neighboring states, handing a victory to three Republican-led states and the steel and fossil-fuel industries that had challenged the rule.