Diamondback announced its agreement in October to acquire FireBird Energy, a private Midland Basin operator backed by RedBird Capital Partners and Ontario Teachers’ Pension Plan, in a cash-and-stock transaction valued at roughly $1.6 billion. (Source: Hart Energy photo library)

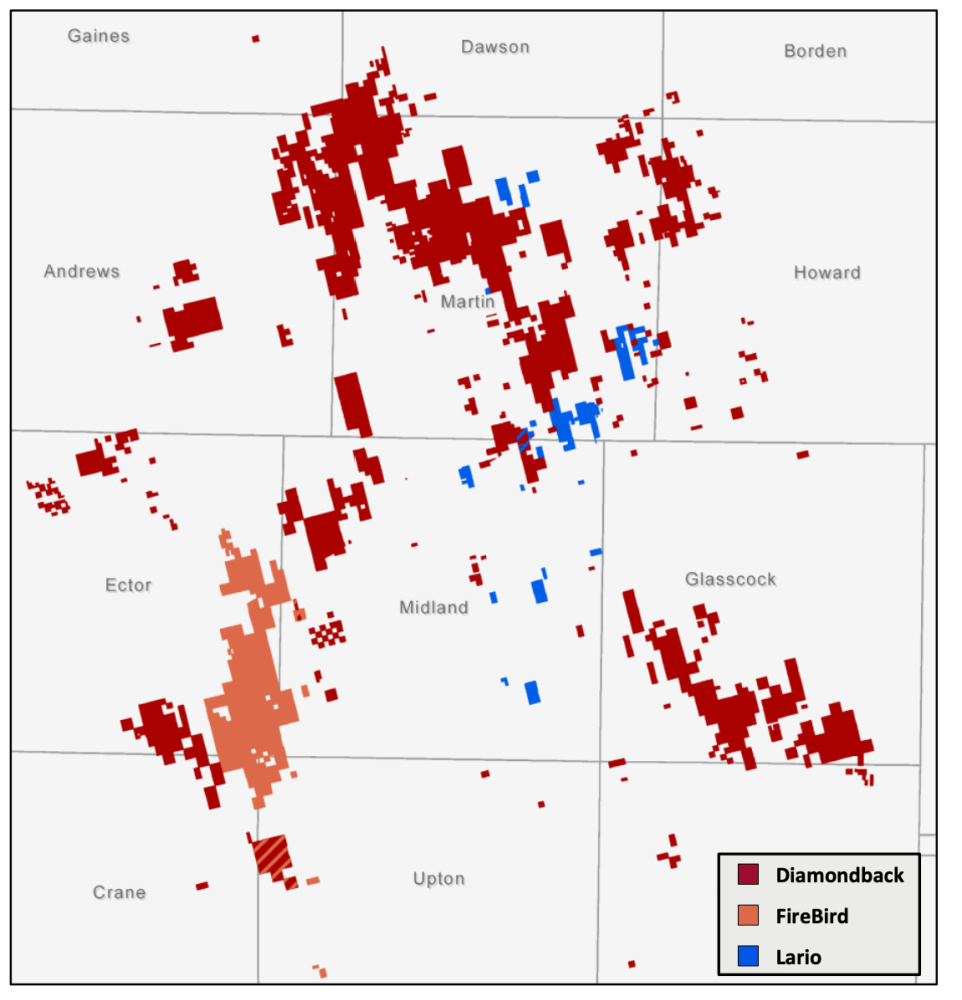

Diamondback Energy Inc. completed its nearly $2 billion-dollar acquisition of FireBird Energy LLC on Nov. 30, adding “significant, high-quality inventory” right in Diamondback’s backyard of the Midland Basin, according to the company’s chairman and CEO, Travis Stice.

Based in Fort Worth, Texas, FireBird operates over 450 vertical and horizontal wells in the Midland Basin. Diamondback announced its agreement to acquire the private operator on Oct. 11 in a cash-and-stock transaction valued at roughly $1.6 billion.

The value of the FireBird transaction has since increased to $1.75 billion, according to a recent investor presentation.

Diamondback’s FireBird transaction is part of a duo of acquisitions in the Midland Basin the company announced in the fourth quarter.

In addition to FireBird, Diamondback also agreed to acquire Lario Permian LLC on Nov. 16 in a cash-and-stock transaction valued at $1.55 billion. In total, Diamondback is spending roughly $3.3 billion to expand its position in the Midland Basin.

RELATED:

Diamondback Flexes Equity Muscles in $3.3 Billion Lario, FireBird Deals

FireBird Energy LLC is backed by RedBird Capital Partners and Ontario Teachers’ Pension Plan. A bulk of the company’s portfolio was acquired from Chevron Corp. around the time of FireBird’s founding, according to its website.

The company is led by CEO Travis F. Thompson, who founded FireBird in 2019. Thompson has more than 20 years of experience in the oil and gas industry and previously co-founded Torch Operating LLC.

In its October release, Diamondback said the acquisition of FireBird will add approximately 75,000 gross (68,000 net) highly contiguous acres in the Midland Basin in West Texas. The acreage is 98.5% operated with an average 92% working interest and is currently 84% HBP.

The FireBird asset also includes 353 estimated gross (316 net) horizontal locations in primary development targets with an average lateral length of approximately 11,400 ft, which Stice also noted in October is adjacent to Diamondback’s current Midland Basin position.

Primary targets are the Middle Spraberry, Lower Spraberry, Wolfcamp A and Wolfcamp B formations, according to the company release.

“This asset adds more than a decade of inventory at our anticipated development pace, including inventory that competes for capital right away in Diamondback’s current development plan,” he said in the October release.

Diamondback expects the FireBird asset to add roughly 17,000 bbl/d of oil, or 22,000 boe/d, of production at closing, expected late in the fourth quarter. Production from the FireBird asset is estimated to average about 19,000 bbl/d of oil, or 25,000 boe/d, in 2023.

Alongside its agreement to acquire FireBird, Diamondback also unveiled a target in October to sell at least $500 million of noncore assets by year-end 2023.

So far, Diamondback has sold about 3,250 net acres in the Delaware Basin for $155 million as part of its divestiture target. Divestiture proceeds are earmarked for further debt reduction, to support the Midland, Texas-based company’s pledge to reward shareholders.

Kirkland & Ellis LLP is legal adviser to Diamondback for the transaction. Akin Gump Strauss Hauer & Feld LLP and Weil, Gotshal & Manges LLP are serving as legal advisers to FireBird and its affiliates. RBC Capital Markets and Goldman Sachs & Co. LLC are lead financial advisers to FireBird.

Recommended Reading

Vår Selling Norne Assets to DNO

2024-05-08 - In exchange for Vår’s producing assets in the Norwegian Sea, DNO is paying $51 million and transferring to Vår its 22.6% interest in the Ringhorne East unit in the North Sea.

SLB OneSubsea JV to Kickstart North Sea Development

2024-05-07 - SLB OneSubsea, a joint venture including SLB and Subsea7, have been awarded a contract by OKEA that will develop the Bestla Project offshore Norway.

EOG: Utica Oil Can ‘Compete with the Best Plays in America’

2024-05-09 - Oil per lateral foot in the Utica is as good as top Permian wells, EOG Resources told analysts May 3 as the company is taking the play to three-mile laterals and longer.

Chevron, Total’s Anchor Up and (Almost) Running

2024-05-07 - During the Offshore Technology Conference 2024, project managers for Chevron’s Anchor Deepwater Project discussed the progress the project has made on its journey to reach first oil by mid-2024.

SM Energy Targets Prolific Dean in New Northern Midland Play

2024-05-09 - KeyBanc Capital Markets reports SM Energy’s wells “measure up well to anything being drilled in the Midland Basin by anybody today.”