As the U.S. upstream sector consolidates at a historic pace, Coterra Energy is keeping its M&A plans close to the vest.

Coterra, formed out of the all-stock merger between Cabot Oil & Gas Corp. and Cimarex Energy Co. in 2021, spent just $10 million on leasehold and property acquisitions in 2023, the Houston-based company reported in earnings on Feb. 22.

Meanwhile, U.S. upstream M&A activity totaled $192 billion last year, including a whopping $144 billion transacted in the fourth quarter alone, according to Enverus Intelligence Research.

The Permian Basin—where Coterra has deployed the bulk of its drilling operations—has been the epicenter of the dealmaking deluge:

- Pioneer Natural Resources agreed to a nearly $65 billion buyout by Exxon Mobil Corp., including Pioneer’s net debt;

- Diamondback Energy’s $26 billion acquisition of Endeavor Energy Resources was the largest buyout of a private upstream company ever;

- Occidental Petroleum is acquiring private E&P CrownRock LP for $12 billion to add scale and inventory runway in the Midland Basin.

Some of the Permian’s oldest and largest oil producers have been scooped up in just a matter of months. Many of the top private equity-backed E&Ps in the Permian have similarly been acquired by smaller operators, including Civitas Resources, Vital Energy, Ovintiv Inc. and Matador Resources.

There’s a feeding frenzy afoot across the U.S. shale patch; Coterra Chairman, President and CEO Thomas Jorden acknowledged as much.

“I think The Wall Street Journal should have a weekend breaking story that says, ‘Flash: Everybody Looking at Everybody Else in E&P Space’—because that’s what we have,” Jorden said during Coterra’s fourth quarter earnings call on Feb. 23.

Coterra hasn’t deeply engaged in evaluating M&A opportunities that have come and gone, Jorden said.

But the company definitely isn’t ruling out inorganic growth through acquisition.

“We remain deeply curious about what consolidation could offer for Coterra owners,” Jorden said, “but the bar is very, very high.”

Lease line look-around

The bulk of Coterra’s operations and production are in the Permian’s Delaware Basin. The company also has operations in the Midcontinent’s Anadarko Basin and in Appalachia’s gassy Marcellus Shale play.

Given the weak macro environment for natural gas, Coterra is choosing to allocate most of its capital spending toward its liquids-rich assets in 2024. The company plans to reduce drilling activity in Appalachia this year, and the Anadarko is attracting a small fraction of Coterra’s overall capital spending budget.

The company plans to use most of its development spending—an estimated $1 billion—on drilling and completion activity in the Permian this year.

So if Coterra wants to deepen its Permian Basin inventory, what might the E&P be able to digest? And what does the market still have to offer?

The remaining prospects out there in the basin are extremely limited after the past six months of M&A, said Rystad Energy Senior Analyst Matt Bernstein.

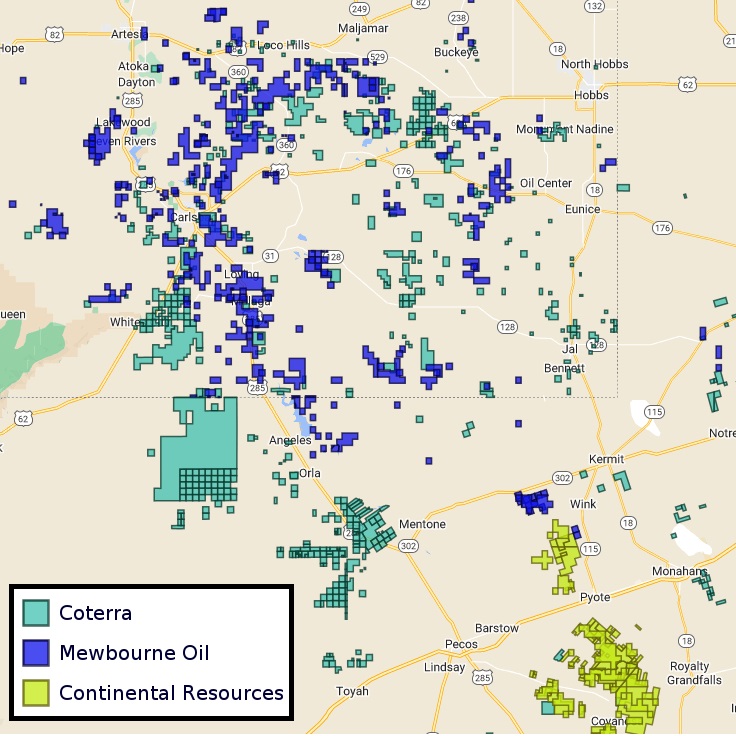

On the private side, Mewbourne Oil and Continental Resources are the most attractive remaining private E&Ps with sizeable portfolios of undrilled locations.

“It’s really Mewbourne and Continental and then everybody else right now as far as inventory goes,” Bernstein told Hart Energy.

Small- to medium-sized public operators have also gained a strong foothold in the Delaware Basin in recent years.

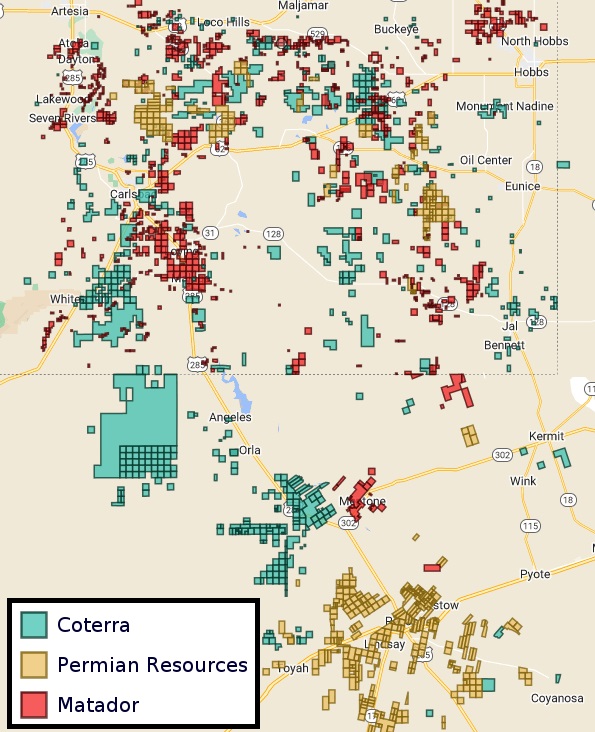

Permian Resources grew in the Delaware—and gained some oil production in the Midland Basin—through a $4.5 billion acquisition of publicly-traded Earthstone Energy last year.

Permian Resources, though, has become more expensive for a potential takeover. The company’s market valuation is around $12 billion, compared to Coterra’s roughly $21 billion market cap.

There’s also Matador Resources, which grew in New Mexico last year with the $1.6 billion acquisition of Advance Energy Partners from private equity firm EnCap Investments.

Matador has a market valuation of around $7 billion.

After the whirlwind of Permian consolidation over the past year, analysts expect a robust market for non-core divestitures as E&Ps parse through their portfolios.

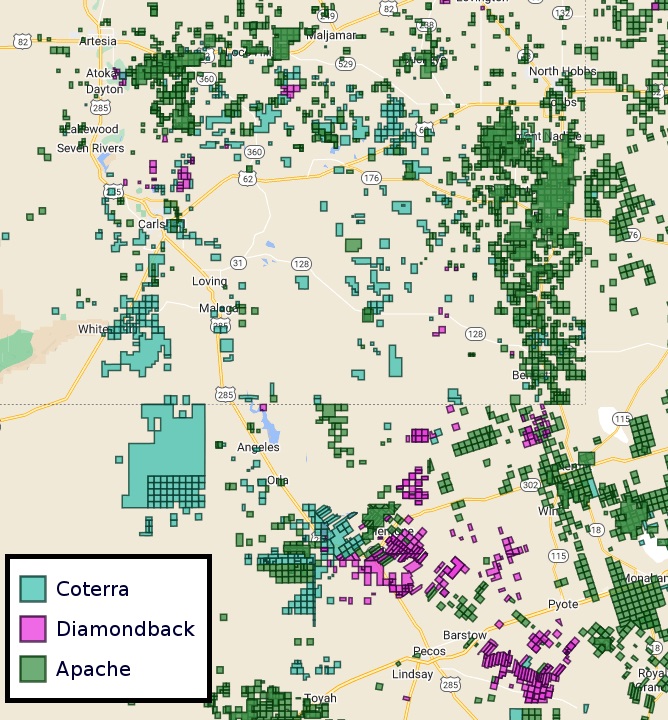

Diamondback doesn’t feel compelled to sell off non-core assets as the company integrates its $26 billion acquisition of Endeavor. But non-core asset divestitures could happen eventually as the company works to reduce debt after the deal, CFO Kaes Van’t Hof said during the company’s recent earnings call.

APA Corp., parent company of Apache, also has a sizable footprint in the Delaware. APA recently inked a $4.5 billion takeover of publicly-traded Callon Petroleum Co.

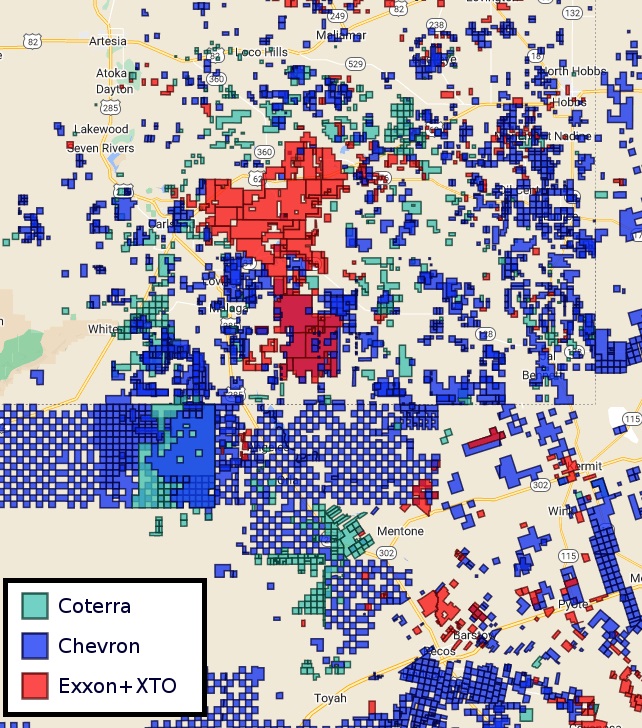

Then there are the majors, Exxon Mobil and Chevron Corp., which are each engaged in massive acquisitions of their own.

Exxon Mobil, and its subsidiary XTO Energy, have acreage across the Permian’s Midland and Delaware basins. But Exxon will become much more Midland-weighted after the nearly $65 billion acquisition of Pioneer Natural Resources.

Chevron signed a roughly $60 billion acquisition of rival Hess Corp. last year, giving the major a foothold offshore Guyana, in the Bakken Shale of North Dakota and in the Gulf of Mexico. The Hess deal didn’t include any more Permian acreage, where Chevron already has massive operations.

RELATED

Exxon, Chevron Tapping Permian for Output Growth in ‘24

Gas woes

Coterra churns out large volumes of natural gas from Appalachia, the Permian and the Midcontinent. But the company wants to bring down gas production this year amid prolonged low natural gas prices.

Coterra plans for gas output to come in between 2.65 Bcf/d and 2.8 Bcf/d in 2024; gas production averaged 2.97 Bcf/d during the fourth quarter.

2024 capex is expected to range between $1.75 billion and $1.95 billion, down 12% year-over-year at the midpoint due in part because of lower activity planned in the Marcellus.

“In the Marcellus, we are currently running two rigs and one frac crew, with plans to go to one rig and lower our frac activities,” said Blake Sirgo, Coterra’s senior vice president of operations.

Chesapeake Energy also plans to slash drilling and completion activity this year, the natural gas giant announced in fourth-quarter earnings on Feb. 20.

RELATED

Chesapeake Slashing Drilling Activity, Output Amid Low NatGas Prices

Recommended Reading

Salunda, Intellilift Enter Pact to Optimize Automation in Well Construction

2024-08-21 - The agreement was signed following a successful pilot trial integrating Intellilift’s digital technologies with Salunda’s patented camera and wearable red zone monitoring solutions on a drilling rig.

International, Tech Drive NOV’s 2Q Growth Amid US E&P Headwinds

2024-07-29 - Despite a U.S. drilling slowdown, slightly offset by Permian Basin activity, NOV saw overall second-quarter revenue grow by 6%, although second-half 2024 challenges remain in North America.

Transocean Contracted for Ultra-deepwater Drillship Offshore India

2024-09-04 - Transocean’s $123 million deepwater drillship will begin operations in the second quarter of 2026.

How Generative AI Liberates Data to Streamline Decisions

2024-07-22 - When combined with industrial data management, generative AI can allow processes to be more effective and scalable.

AI & Generative AI Now Standard in Oil & Gas Solutions

2024-07-25 - From predictive maintenance to production optimization, AI is ushering in a new era for oil and gas.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.