This year, Chesapeake plans to drill 95 wells and place between 30 to 40 in production. (Source: Shutterstock/ Chesapeake Energy)

Chesapeake Energy plans to start slashing drilling activity next month as natural gas markets remain oversupplied.

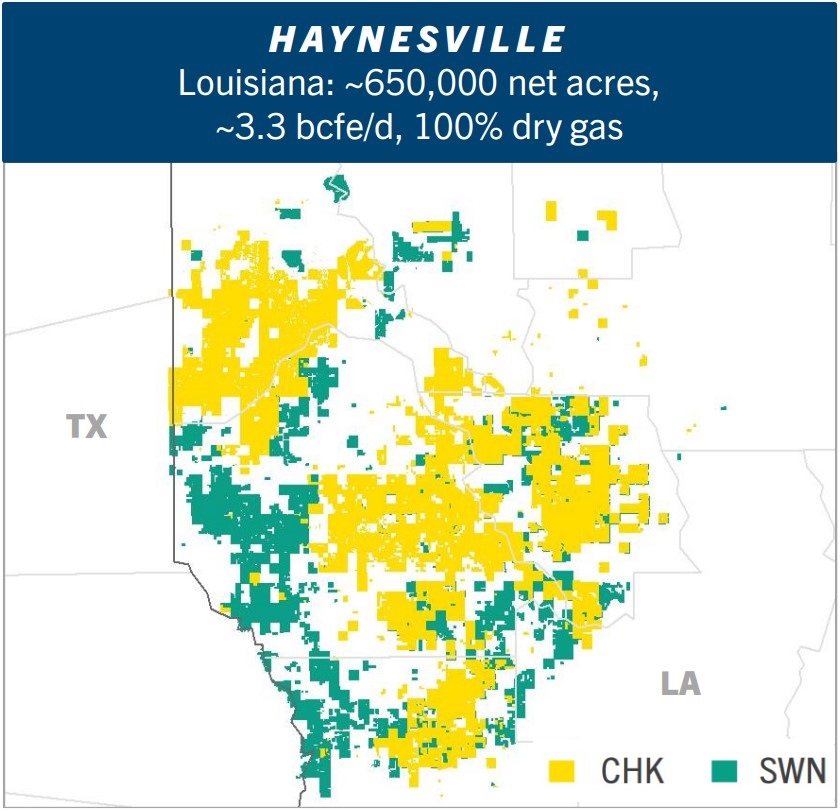

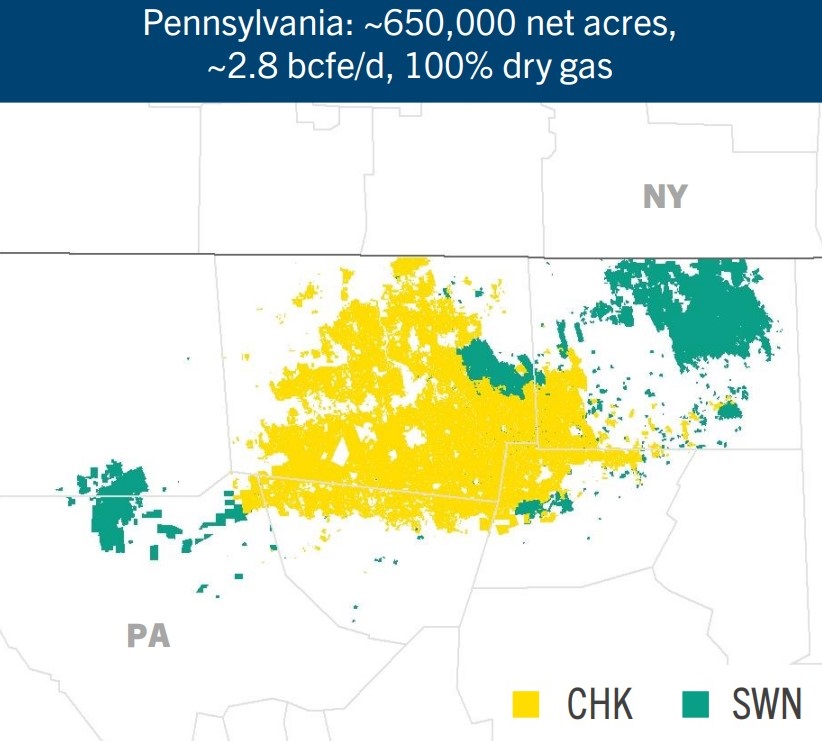

Oklahoma City-based Chesapeake is currently operating nine drilling rigs, with five in the Louisiana Haynesville Shale and four in the Pennsylvania Marcellus Shale. The company also has two frac crews operating in each region.

But “given current market dynamics,” Chesapeake plans to defer placing wells on production and reduce drilling and completion activity, the E&P reported in fourth-quarter earnings after markets closed on Feb. 20.

Chesapeake is planning to drop a rig in the Haynesville in March and another rig in the Marcellus around mid-year. The company also said it would drop a frac crew in each play next month.

Those activity levels will be maintained through the end of 2024, Chesapeake said.

“Deferring new well production and completion activity will build short-cycle, capital efficient productive capacity which can be activated when consumer demand requires it,” the company said in a Feb. 20 news release.

Chesapeake produced an average 3.66 Bcfe/d in 2023, based on an average of 11 rigs to drill 193 wells, with 166 wells placed on production.

Output averaged 3.43 Bcfe/d during the fourth quarter; the company used an average of nine rigs to drill 45 wells and place 52 wells to production.

This year, Chesapeake plans to drill 95 wells and place between 30 to 40 in production. Output is expected to range between 2.65 Bcf/d and 2.75 Bcf/d.

Chesapeake expects to spend less money through the rig count reductions and deferred completion activity. The company lowered its previous capex guidance by around 20% to between $1.25 billion and $1.35 billion for 2024.

The company is setting aside around $670 million for Haynesville development and $370 million for the Marcellus.

Chesapeake started off 2024 with a bang by announcing a $7.4 billion merger with fellow natural gas producer Southwestern Energy in January.

The combination is poised to create the nation’s largest gas producer, with nearly 8 Bcfe/d of production on a pro forma basis and a huge footprint spanning the Appalachia to the Gulf Coast.

“Our strategic combination with Southwestern will make our future outlook even stronger, extending America's energy reach by positioning us to deliver more reliable, affordable, lower carbon energy to markets in need,” Chesapeake President and CEO Nick Dell'Osso said.

“We are forming the first U.S. independent that can truly compete on a global scale, redefining the natural gas producer to the benefit of our shareholders and energy consumers alike,” he said.

Recommended Reading

Midstream Operators See Strong NGL Performance in Q4

2024-02-20 - Export demand drives a record fourth quarter as companies including Enterprise Products Partners, MPLX and Williams look to expand in the NGL market.

Matador Completes NatGas Connections in Delaware Basin

2024-03-25 - Matador Resources completed natural gas pipeline connections between Pronto Midstream to San Mateo Midstream and to Matador’s acreage in the Delaware Basin.

Kinetik Holdings Enters Agreement to Pay Debt

2024-04-04 - Kinetik Holdings entered an agreement with PNC Bank to pay down outstanding debt.

Summit Midstream Sells Utica Interests to MPLX for $625MM

2024-03-22 - Summit Midstream is selling Utica assets to MPLX, which include a natural gas and condensate pipeline network and storage.

Targa Expects Another Major Permian Pipeline Project This Year

2024-05-03 - Targa Resources says different projects are falling in place for gas capacity expansion