After pending conditions were met, including having secured third-party financing of $2.5 billion and receiving regulatory approvals, the joint venture between bp and Eni, Azule Energy, was finalized. (Source: Lukasz Z / Shutterstock.com)

Azule Energy, a joint venture between BP Plc and Eni SpA, was officially established on Aug. 2 and is now the largest independent equity oil and gas producer in Angola, according to a press release.

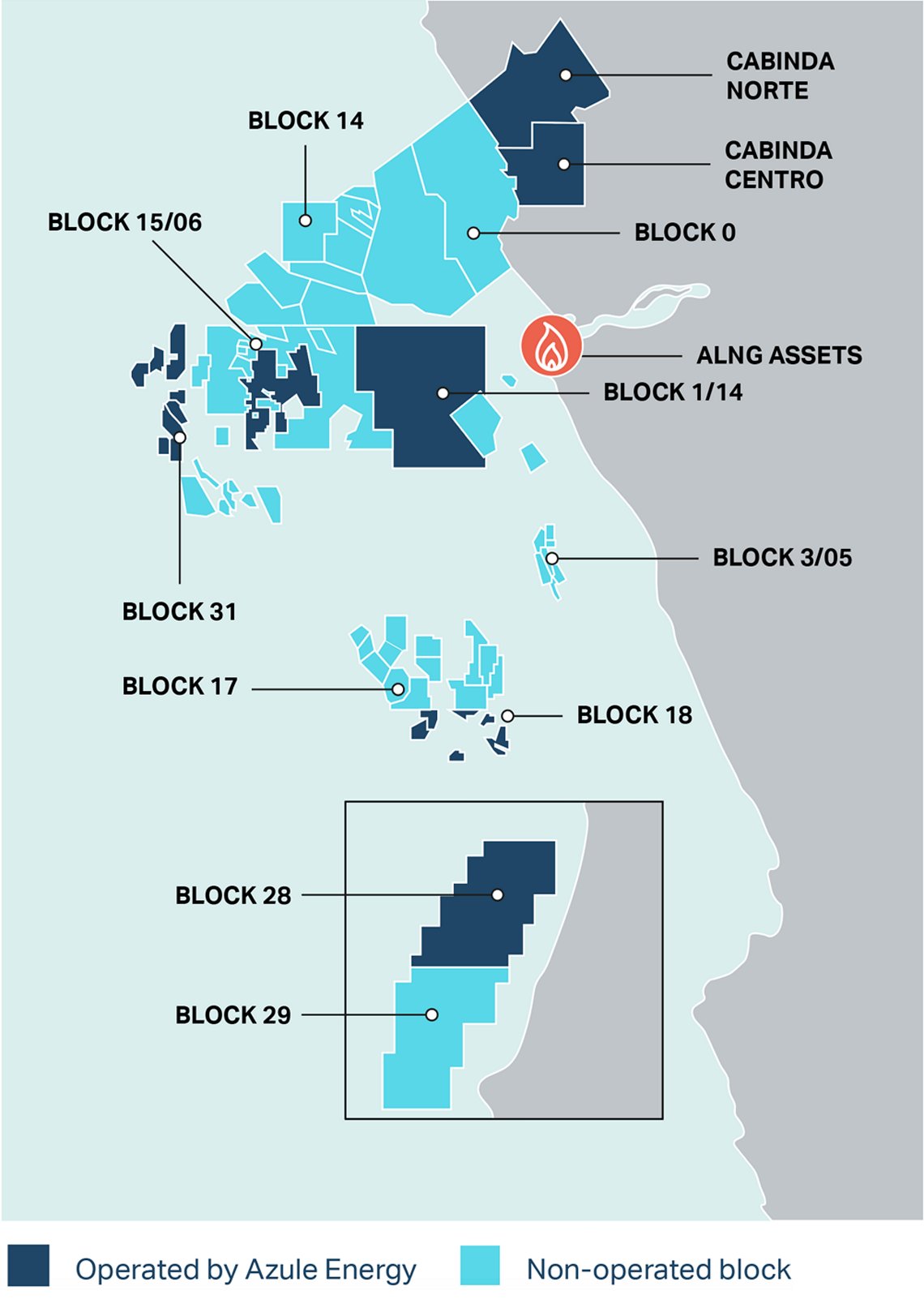

The company holds 2 Bboe of net resources and is growing to approximately 250,000 boe/d of equity oil and gas production over the next five years. In addition to taking over Eni's share in solar company Solenova, Azule Energy gained stakes in 16 licenses, including six exploration blocks, as well as a participation in the New Gas Consortium's Angola LNG joint venture.

Azule Energy already has a strong portfolio of new projects scheduled to come on stream over the next few years, including the Agogo Full Field project located in Block 15/06 and PAJ oil project located in Block 31.

As part of the New Gas Consortium, it will help to supply Angola's energy needs for the country's growing economy and strengthen its role as a global exporter of LNG. It also gives the company proximity to existing infrastructures in 30,000 sq km of Angola's most productive basins for exploration.

"A new, strong entity is born, which combines our experience, skills and technologies with those of our partner BP, putting them at the service of the development of Angolan energy resources, with a priority commitment to environmental protection and the growth of local economy," Eni CEO Claudio Descalzi commented in the release.

Comprised of BP's and Eni's Angolan upstream, solar and LNG businesses, the company's leadership team will report to a six-person board of three BP representatives and three Eni representatives, with all Angolan employees from both companies joining the Azule Energy staff.

Both BP and Eni anticipate Azule Energy’s new independent, integrated operating model will unlock significant cost savings, mainly from operational synergies in logistics and technology.

"Combining our Angolan businesses and drawing on both BP’s and Eni’s expertise, it will continue to safely and efficiently develop Angola’s resilient hydrocarbon resources and pursue new opportunities in oil and gas and other energies," BP CEO Bernard Looney added. "Azule Energy continues our commitment to Angola and will create real value for both the companies and the country.”

Currently, Azule Energy's main focuses are prioritizing HSE performance, project delivery and production efficiency, as the company will leverage technical support from BP and Eni to maintain access to world-class technologies and best practices.

"Together, with a highly competent and motivated leadership team, we are committed to develop the full potential of the company portfolio of development and exploration opportunities," Azule Energy CEO Adriano Mongini said. "With finance discipline and focus on HSE, Azule Energy will maximize the value of the assets for the benefit of Angola and of the shareholders.”