(Source: Hess Corp.)

[Editor's note: A version of this story appears in the May 2020 edition of Oil and Gas Investor. Subscribe to the magazine here.]

This year we can celebrate the remarkable contributions that the Bakken Shale has made to the U.S. energy picture since the first horizontal wells were drilled to the prolific formation. But at the same time, it is now one of the most mature of the shale plays: More than 14,300 horizontal wells have been completed in the Bakken-Three Forks formations.

Even before the price of WTI sunk to an unnerving 20-year low in March, people were already wondering how and where the play can evolve in the near term. For the past two or three years, the rig count has remained steady at about 50 to 55 rigs—and each modern rig can do the work of three previously. Permits to drill were averaging 55 to 60 per month before the oil price crash but are trending down now.

Officials recently presented data on estimated revenue from oil and gas to North Dakota lawmakers who are preparing the state’s next budget. They estimated about 95 well completions a month, or 1,140 completions, although they are revising those projections now.

In late 2014 before the so-called OPEC Thanksgiving Surprise, production was 1.32 million barrels per day (MMbbl/d). It fell to about 920,000 bbl/d during the price crash that endured in 2015. It had recovered to 1.54 MMbbl/d in November 2019—setting an all-time record.

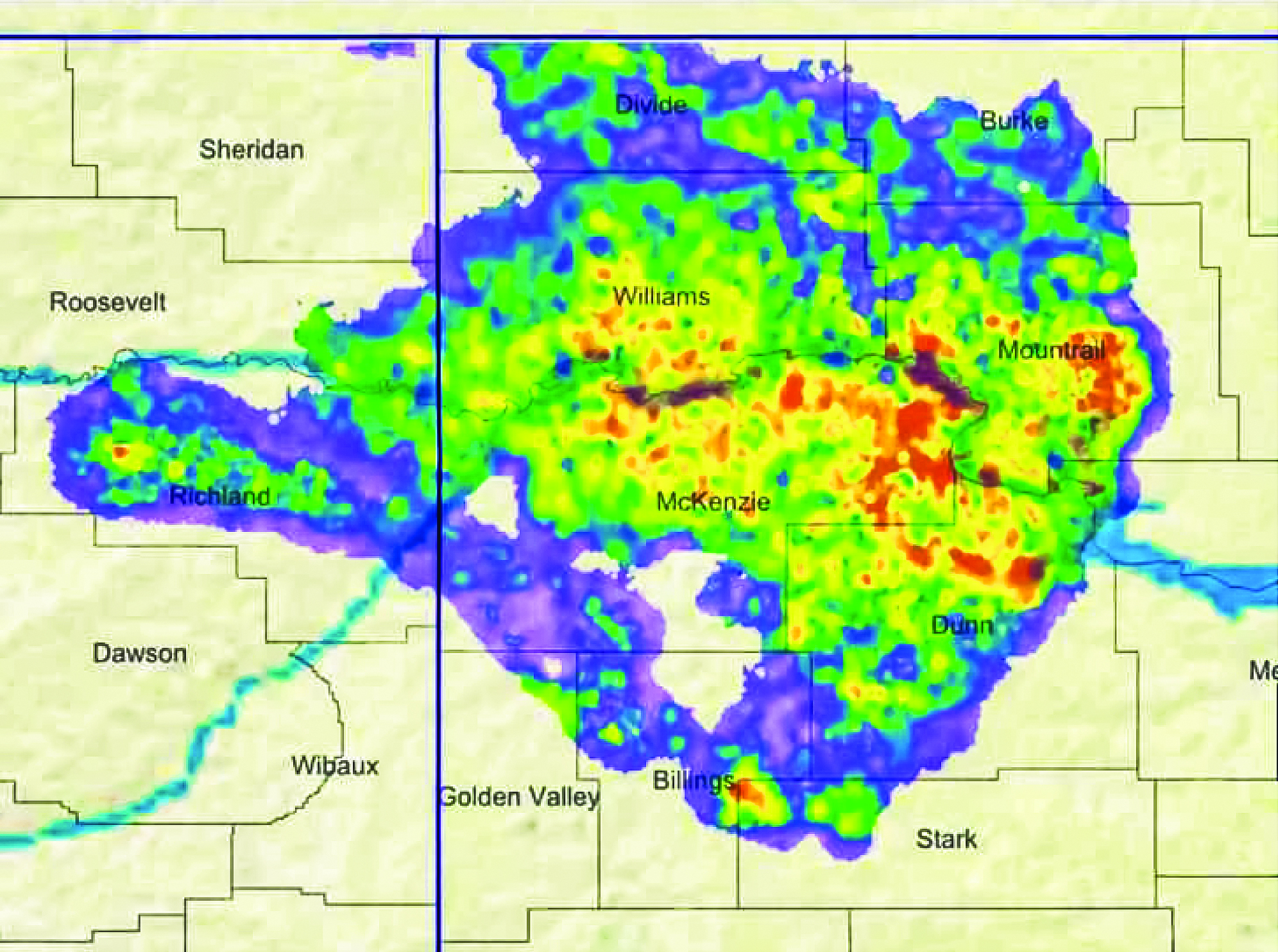

BAKKEN SWEET SPOT MAP

“The Bakken play was getting old, but we did that [record] simply with technology. We had to make the Bakken a $50 oil play and not a $70 oil play,” said Ron Ness, North Dakota Petroleum Council president. The group represents companies operating about 95% of the production in the state. One example of the way better technology keeps this play going: At its Foreman Butte area, Whiting Petroleum Corp. put on production 17 wells last year, and it said “they have consistently outperformed offset wells by over 2.5 times over the first 90 days.”

“Operators have proven they can make the Bakken work at an average market price of $52.98 in December 2019,” Ness told Investor. The $64,000 question now is: Can they make it work if prices remain below $30?

Lynn Helms, director of the Department of Minerals Resources, told North Dakota legislators that oil production could max out within five years as companies run out of core drilling inventory. He said roughly 20% of drilling activity already is taking place outside of core Bakken locations.

“The end of (core area-drilling) is on the horizon; we can see it from here,” Helms told the Legislature’s interim Government Finance Committee.

Bakken production has always been ultrasensitive to oil price, especially given its long distance from markets and the pipeline bottlenecks seen in recent years. At press time, the 12-month strip for WTI was about $20/bbl, but the price of Bakken sweet crude at the hub in Clearbrook, Minn., was around $13/bbl. From Clearbrook the crude flows south to Cushing, Okla.

A Dallas Fed survey conducted in mid-March of 107 E&Ps (not just for the Bakken but in all plays) indicated that 65% of respondents said they need WTI to be at or above $23 to cover operating expense for existing wells, never mind for drilling. To drill a new well that is profitable, the average response was $49/bbl.

Dropping rigs

Now, low oil prices will again hasten a production decline, because much of the production is in the hands of financially distressed companies that won’t drill as much to replace output, such as Whiting and Oasis Petroleum Co., or in the hands of smaller private operators that mostly own Tier 2 acreage with well results that will not be as good as in Tier 1.

In March, the largest public Bakken operators announced reduced completion activity for 2020. Continental Resources Inc., one of the largest acreage holders and producers in North Dakota, said it will cut its Bakken rig count from nine to three for the rest of 2020. Hess Corp. is cutting from six down to one. Beleaguered Whiting (which filed for Chapter 11 bankruptcy protection in April) has three, but it cut its 2020 capex by 30%. It also just drew an additional $650 million from its credit facility to weather the storm, but at the same time it is still moving ahead to expand capacity at its Robinson Lake oil gathering facility by 2021, to take an additional 20,000 bbl/d. Oasis Petroleum has guided to two rigs.

Helms and Ness told the legislative committee that the state’s oil production will peak at around 1.8 MMbbl/d in five years, up from the current 1.5 MMbbl/d, some 250,000 bbl/d higher than its previous, late-2014, peak.

But as operators, investors and government officials look to the Bakken’s future, these estimates could be thrown out the window due to two factors: technology advances we can’t predict today and the price of the commodity itself.

“Great resources can always withstand great challenges,” said Ness, the day after oil fell off a cliff in mid-March, hitting $20/bbl. “Every producer is always strategizing; they’ve been through this before. They do have challenges and difficult decisions to make.”

In mid-March when he spoke, Platts reported that Bakken crude for May delivery traded about $6/bbl below the price of WTI, for a net value of about $16/bbl—the lowest price on record for the front-month crude, Platts said. Year-to-date Williston Bakken crude was averaging about $45.60/bbl, down some 70% since New Year’s Day.

Free cash flow in most every oil play will be zero if oil remains at $30/bbl or below, according to Rystad Energy on March 18. And troubling, respondents to the Fed survey said if oil is at $40, only 25% of the companies could remain solvent one or two years.

Remaining locations

Near-term problems will endure throughout 2020, possibly through at first-half 2021, but setting aside any considerations about damaging oil prices, what does the future opportunity set look like? The 2013 assessment by the USGS estimated 7.3 billion bbl of undiscovered yet technically recoverable oil in the Bakken.

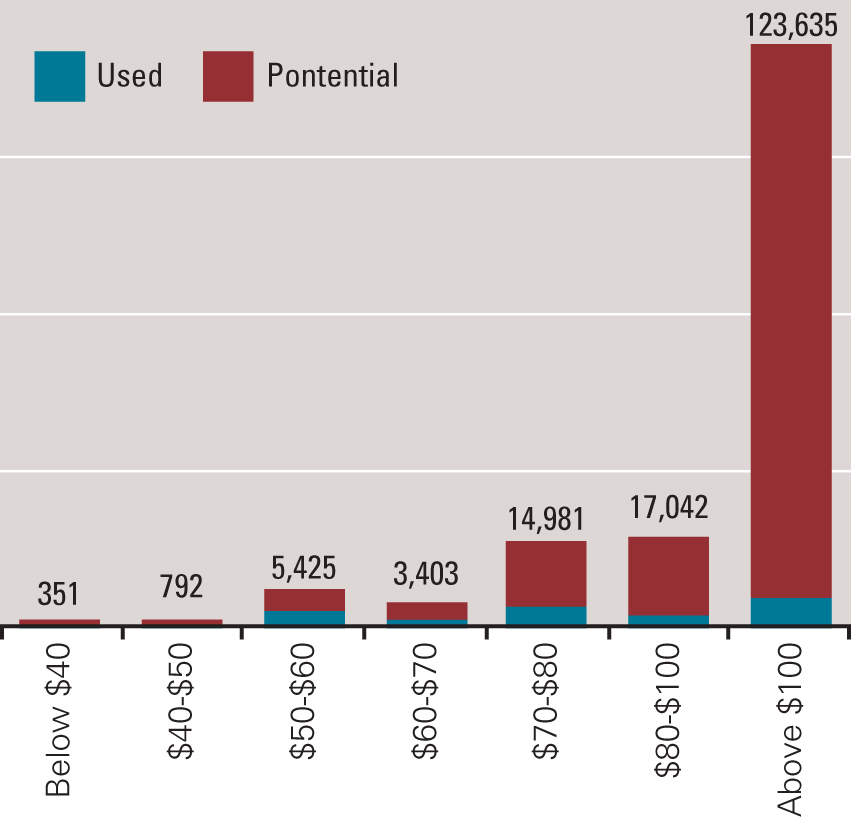

Bernstein Research looked at data and maps from Enverus Drillinginfo that show where most wells have been drilled to date and where the most prolific wells have been located—the so-called Tier 1 acreage. Bernstein E&P analyst Bob Brackett concluded in a report, “Only 1,100 remaining drilling locations are economical at or below $50/bbl WTI.

REMAINING LOCATIONS IN THE MONEY AT OIL PRICE POINTS

“That figure increases to 6,600 locations for WTI at or below $60. And, 6,600 wells would cover only the next six years of production under our supply model and assumes optimistically that no other hiccups occur. We ultimately need higher oil prices for the remaining locations to be ‘in the money.’

“Our findings are consistent with our expectation regarding a mature play like the Bakken. Most locations with low breakeven prices (i.e. most productive ones) have already been drilled. For instance, while about 60% of all the locations with breakeven below $40 have been exploited, 8% of all wells with breakeven greater than $70/bbl have been brought online.”

Tier 1 vs. Tier 2

Experts contend that transferring technical advances and drilling longer laterals to fringe areas outside the core has worked well to increase well results since 2014. We spoke with Enverus to find out more about what defines the core: Tier 1 locations with a low breakeven price and good oil recovery per well, or EUR. The company has built different type curves for specific areas within the Bakken, all normalized to certain well lengths and completion techniques, according to Hakan Corapcioglu, senior energy market analyst, strategy and analytics, in Denver.

“So some wells’ EURs may be down-normalized, and some may be up-normalized. And these are not company specific, but rather we’re trying to look at the basin and these type curve areas more holistically.

“The average Tier 1 oil EUR is around 620,000 barrels (bbl) and Tier 2 oil EUR is around 445,000 bbl,” Corapcioglu told Investor. “But as I mentioned before, there will be individual wells that are way above these numbers.

“For the IRR piece, if I were to run an average IRR for Tier 1 and 2 at $50 oil and a $3 gas price, it comes out to about 36% IRR and 17% IRR, respectively. These numbers, of course, can and will vary from operator to operator and on an individual well basis. And IRR numbers are tied to commodity prices, so the returns will be much less under the conditions we are in today.”

If the play is quite mature, with most of the Tier 1 locations already drilled, then how are EUR statistics trending? “They actually have been trending upwards since 2014,” Corapcioglu said. “This is due to operators getting more efficient with their drilling and completion programs: drilling longer laterals, optimizing their completion techniques, the use of proppant and fluids for their fracture designs, etc.”

Midstream progress

The Bakken was among the first plays “to benefit big-time from the shale revolution, experiencing a 400%-plus increase in crude oil production in the first half of the 2010s,” RBN Energy said. “The play has had more than its share of challenges, however, including a serious lack of takeaway capacity that spurred the first rapid deployment of modern-day crude-by-rail, followed by a rig-count collapse and major production decline after the mid-decade crash in oil prices.

“Producers have been planning for continued production growth in 2020, though many may be reassessing those plans in light of [the recent] coronavirus-related price slide. In any case, production growth is only possible if there’s sufficient gathering infrastructure in place,” said the RBN report.

Consulting firm East Daley Capital said in a February report that the Bakken will be affected by expansions on the Dakota Access Pipeline and the Bridger Pipeline set to come online in 2021.

Bridger Pipeline vice president Tad True told Investor that he’s been “amazed at the ingenuity” of his customers to make the Bakken work at different oil price levels.

“I would say a lot of them have a lot more room to grow in the core by going back to their pads and drilling more on some spacing units. The core is an enormous geographic area of some 70 miles, and we have gathering systems in that area. On any given day we run 200,000 bbl/d, and we’ll be expanding to 400. This is the largest expansion we’ve done on Bridger.

“I’m confident the Bakken is still going to grow.”

Flaring of natural gas continues in North Dakota, but producers and midstream companies have been working overtime to build additional gas processing infrastructure, said an RBN report. “About 670 million cubic feet a day [MMcf/d] of new processing capacity was added in the second half of 2019, another 400 MMcf/d is coming online in the first quarter of 2020 and still more will follow later this year and in 2021.”

The Petroleum Council’s Ness said he’d be a fool to predict oil prices now, but he was confident markets and operators will adjust as they always have in the past. “The best thing to cure low oil prices is low oil prices,” he said. “We’ve just got to roll with the punches, but we’re going to see a contraction, no question. We will recover, but it’s a function of how long and how big is the fight to get us there.

“At the end of the day we’re still producing about 1.5 MMbbl/d. Dollar for dollar, it’s still the best play. We need demand—producing more oil at $25 is not the answer.”

Recommended Reading

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

2024-04-25 - Henry Hub blues: CNX Resources and other Appalachia producers are slashing production and deferring well completions as natural gas spot prices hover near record lows.

Chevron’s Tengiz Oil Field Operations Start Up in Kazakhstan

2024-04-25 - The final phase of Chevron’s project will produce about 260,000 bbl/d.

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.