Canada’s ARC Resources Ltd. on Feb. 10 agreed to buy Seven Generations Energy Ltd. for CA$2.7 billion (US$2.2 billion) in an all-stock deal to create the country’s sixth-largest energy company, as oil producers strive to scale up and drive down costs.

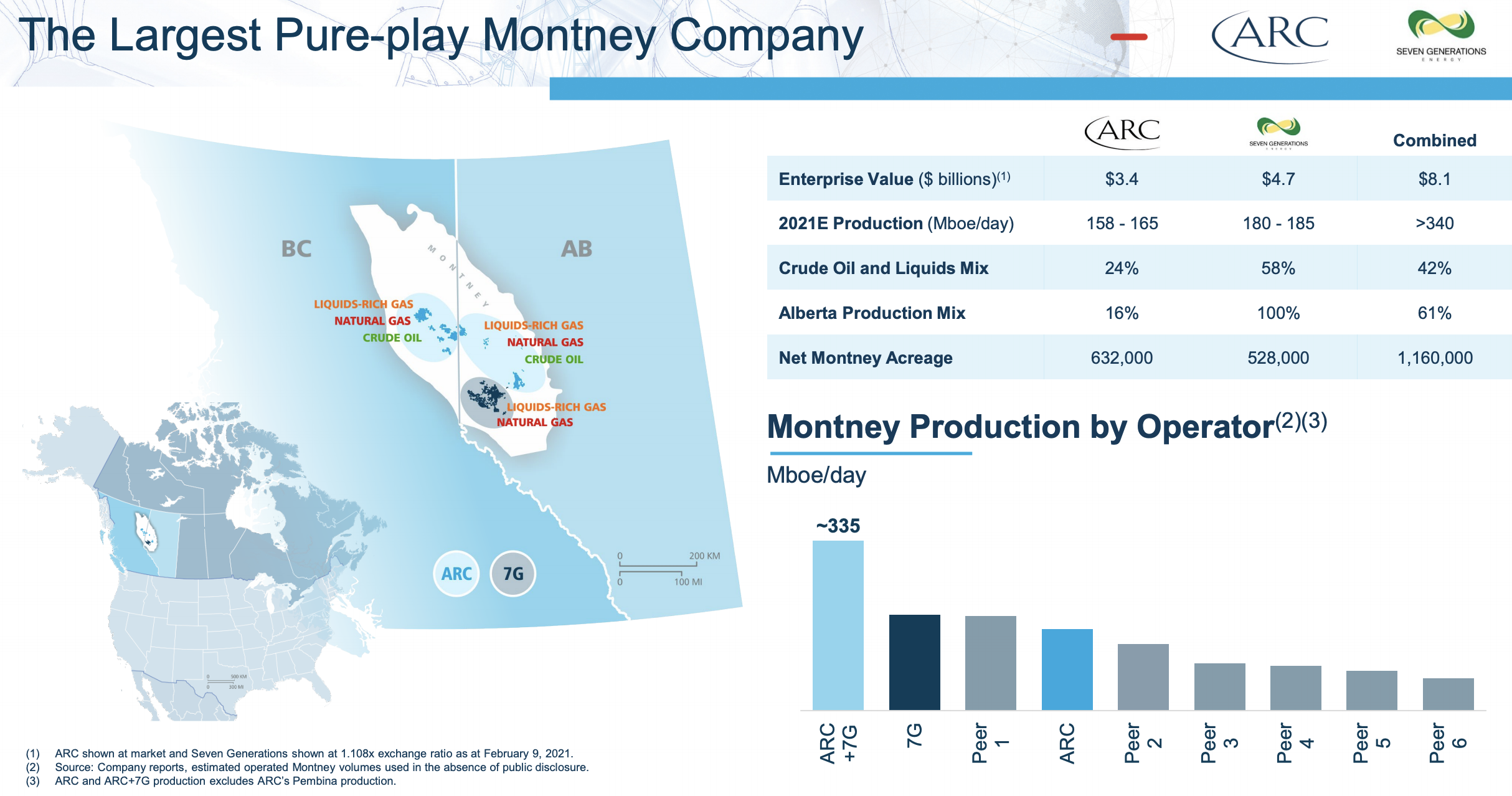

The combined company will become the biggest operator in western Canada’s premier Montney shale play, producing more than 340,000 boe/d. The deal underscores the rapidly shifting energy sector landscape, as oil companies face pressure to gain capacity to make them more attractive to lenders and investors.

The combined company will be Canada’s largest condensate producer and third-largest producer of natural gas, operating under the name of ARC Resources and remaining headquartered in Calgary. Including debt, the deal is valued at CA$8.1 billion.

The tie-up is a case of two companies looking for a strategic fit, combining Seven Generations’ crude oil and liquids-heavy output with ARC's gas-focused production, said Mark Oberstoetter, director of upstream Canada research at consultancy Wood Mackenzie.

“This is a company seeking to become larger and more attractive to another investor class. They nudged themselves into this next sphere,” Oberstoetter added.

The vast Montney shale play straddles north-eastern British Columbia and north-western Alberta and is thought to have about half the recoverable resources of the entire oil sands region.

It currently produces 1.5 million boe/d, including 45% of Western Canada’s gas supply, according Wood Mackenzie.

“The Montney is the hot thing in Canada,” Oberstoetter said.

Canadian oil and gas companies struggled last year as the coronavirus pandemic battered demand but oil prices have rebounded in 2021 amid optimism about vaccine rollouts and concerns of a supply shortage.

“The transaction will create a combined company with material size and scale that enhances ARC’s and Seven Generations’ existing commodity and geographic diversification,” the companies said in a statement.

The Canada Pension Plan Investment Board (CPPIB), the country’s biggest pension fund, which controls 16.8% of Seven Generations shares, has agreed to vote in favor of the transaction, the companies said. The deal is expected to close early in the second quarter.

Under the terms of the definitive agreement, Seven Generations shareholders will receive 1.108 common shares of ARC for each common share of Seven Generations held, which values Seven Generations at C$2.74 billion. On completion, Seven shareholders will own 51% of the combined company.

The deal is expected to be immediately accretive on a free funds flow and net asset value per share basis to all shareholders, the companies said. It is also expected to deliver annual cost savings of CA$110 million by 2022.

“One of the benefits of the deal is the two organizations think very similarly, and have two high quality asset bases, and bringing them together gives us scale and financial strength,” ARC CEO Terry Anderson told analysts on Feb. 10.

Anderson will be president and chief executive of the combined company. ($1 = 1.2704 Canadian dollars)

Recommended Reading

Chevron Hunts Upside for Oil Recovery, D&C Savings with Permian Pilots

2024-02-06 - New techniques and technologies being piloted by Chevron in the Permian Basin are improving drilling and completed cycle times. Executives at the California-based major hope to eventually improve overall resource recovery from its shale portfolio.

CEO: Continental Adds Midland Basin Acreage, Explores Woodford, Barnett

2024-04-11 - Continental Resources is adding leases in Midland and Ector counties, Texas, as the private E&P hunts for drilling locations to explore. Continental is also testing deeper Barnett and Woodford intervals across its Permian footprint, CEO Doug Lawler said in an exclusive interview.

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

2024-04-25 - Henry Hub blues: CNX Resources and other Appalachia producers are slashing production and deferring well completions as natural gas spot prices hover near record lows.

TPH: Lower 48 to Shed Rigs Through 3Q Before Gas Plays Rebound

2024-03-13 - TPH&Co. analysis shows the Permian Basin will lose rigs near term, but as activity in gassy plays ticks up later this year, the Permian may be headed towards muted activity into 2025.

The Need for Speed in Oil, Gas Operations

2024-03-22 - NobleAI uses “science-based AI” to improve operator decision making and speed up oil and gas developments.