With some overseas snafus and the pending acquisition of Callon Petroleum, the Permian Basin will be in the driver’s seat for Houston-based APA Corp. in 2024.

By fourth-quarter 2024, year-over-year oil Permian production is expected to rise 10% compared to fourth quarter 2023, APA CEO John J. Christmann IV said during a Feb. 22 quarterly webcast. That would return the company’s production to pre-COVID-19 levels by year-end 2024. The company will update full-year 2024 guidance after closing its Callon deal.

While the company is targeting a considerable production hike in the Permian, the company expects overall 2024 production to decline and guided lower spending for the year.

APA’s 2024 capex will range between $1.9 billion and $2 billion in 2024, down about 2.5% at the midpoint compared to $2 billion spent in 2023. Overall, production is expected to trend downwards nearly 3% in 2024 owing to declines in Egypt and the North Sea, with the Permian taking up some of the slack.

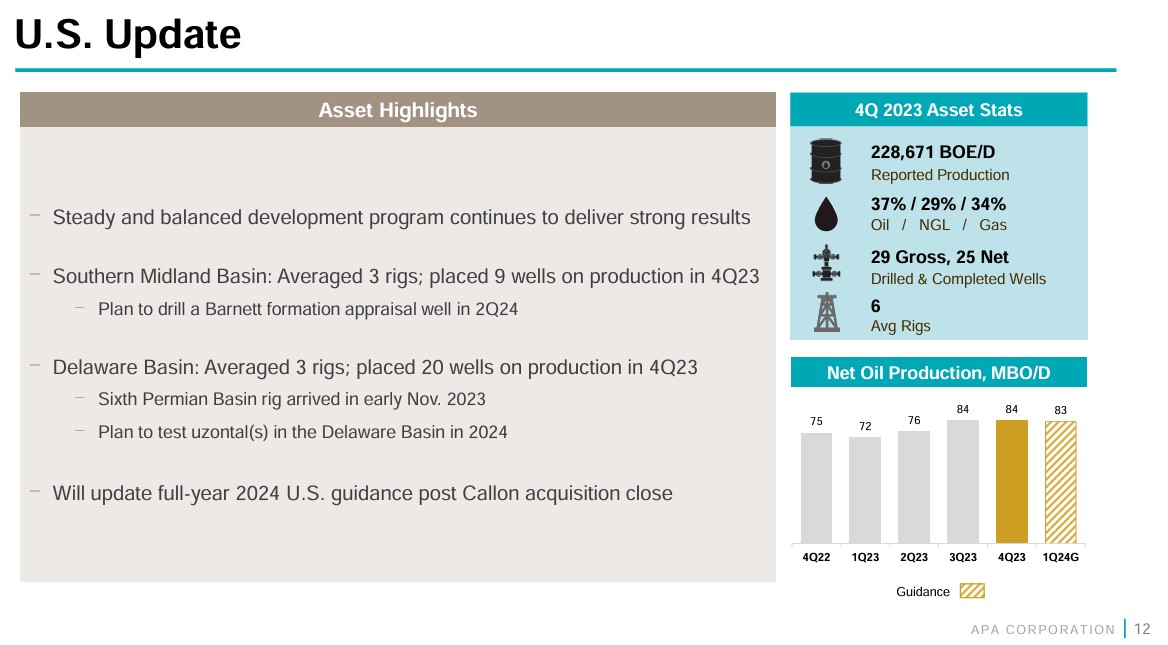

APA reported average U.S oil production of around 84,000 bbl/d in the fourth quarter of 2023, according to details in its quarterly financial and operational reports. The targeted increase implies production could reach around 92,000 bbl/d in the fourth quarter of 2024, according to Hart Energy analysis.

“This growth will be driven by the Midland and Delaware basins,” Christmann said, adding that Permian production would be back- weighted to the second half of the year due to the timing of completions.

The Permian offers APA a short-cycle asset base with predictable capital productivity and strong free cash flow generation, Christmann said.

In the Permian, APA’s combined production in the fourth quarter was divided among oil (37%), natural gas (34%) and NGL (29%). During the quarter, APA drilled 29 gross wells (25 net) and reported an average six rigs in operation.

In the southern Midland Basin, APA averaged three rigs and placed nine wells on production in the fourth quarter. APA plans to test the Barnett Shale with an appraisal well in second-quarter 2024.

In the Delaware, APA ran an average three rigs and placed 20 wells on production for the quarter. APA plans to test u-zontals, also known as horseshoe wells, in the basin in 2024.

In addition to running six rigs in the Permian, APA will also pick up five rigs related to the Callon Petroleum Co. acquisition announced in Jan. 2024. The companies have said they expect to close the deal in the second quarter.

“We're very comfortable running those 11 rigs and really look forward to being able to integrate the Callon assets into our workflow and our schedules and so forth, but that's going to take a little bit of time,” Christmann said. “And we're anxious to jump on their Delaware assets in addition to what we're doing in the Delaware and our Midland Basin.”

“We believe [APA’s] Permian program that is soon to be among the most active in the play will be key to continued, solid free cash flow generation and shareholder return,” Truist said Feb. 23 in a research report.

Overall in the fourth quarter, APA reported average U.S. oil and gas production of 229 Mboe/d, 144 Mboe/d gross from Egypt (before adjusting for non-controlling interest and tax barrels) and 42 Mboe/d from the North Sea.

In 2024, APA’s total gross production is expected to reach between 391 Mboe/d and 393 Mboe/d prior to incorporation of Callon’s assets, compared to 405 Mboe/d in 2023.

While APA expects higher U.S. production, lower volumes are expected in Egypt due to activity delays and scheduling constraints associated with limited available workover rig capacity and declines in the North Sea.

“This is an inexpensive toe hold in the industry with M&A clarity (vs. speculation elsewhere) and some long dated (and largely financed) barrels on the come from Suriname as time passes,” Evercore ISI said Feb. 22 in a research report. “The quarter-to-quarter volatility one needs to stomach we acknowledge remains the challenge.”

Callon scale in the Permian

The Callon acquisition brings “scale to our Delaware position and balance to our overall Permian asset base, making it fairly evenly weighted between the Midland and the Delaware upon closing,” Christmann said.

On Jan. 4, APA said it entered into an agreement to acquire Callon in an all-stock deal valued at $4.5 billion, inclusive of Callon’s net debt. Pro forma, APA’s and Callon’s combined production is expected to exceed 500,000 boe/d. Combined, the company’s enterprise value is expected to exceed $21 billion, APA has said.

“While Callon has experienced operational and productivity challenges in the past, more recently, they have begun to make good progress towards demonstrating the upside potential of their acreage,” Christmann said. “We expect to further build on their progress, most notably in the areas of capital productivity from well spacing, target zone selection, frac design and drilling, completion and infrastructure efficiencies.”

On the webcast, APA President and CFO Stephen J. Riney reiterated that the assumption of Callon's debt would increase APA’s leverage metrics slightly, but has not impacted discussions with rating agencies.

“We continue to target a BBB rating or the equivalent thereof with all three agencies. For this reason, we remain focused on further debt reduction, which will be achieved through the application of cash flow and possible asset divestments,” Riney said.

APA added it remained committed to returning at least 60% of free cash flow to its shareholders.

Alaska and Uruguay exploration, Suriname FID

APA also announced that recent entries in Alaska and Uruguay offer large-scale exploration upside. The company’s upstream exploration in capital total $100 million in first-half 2024.

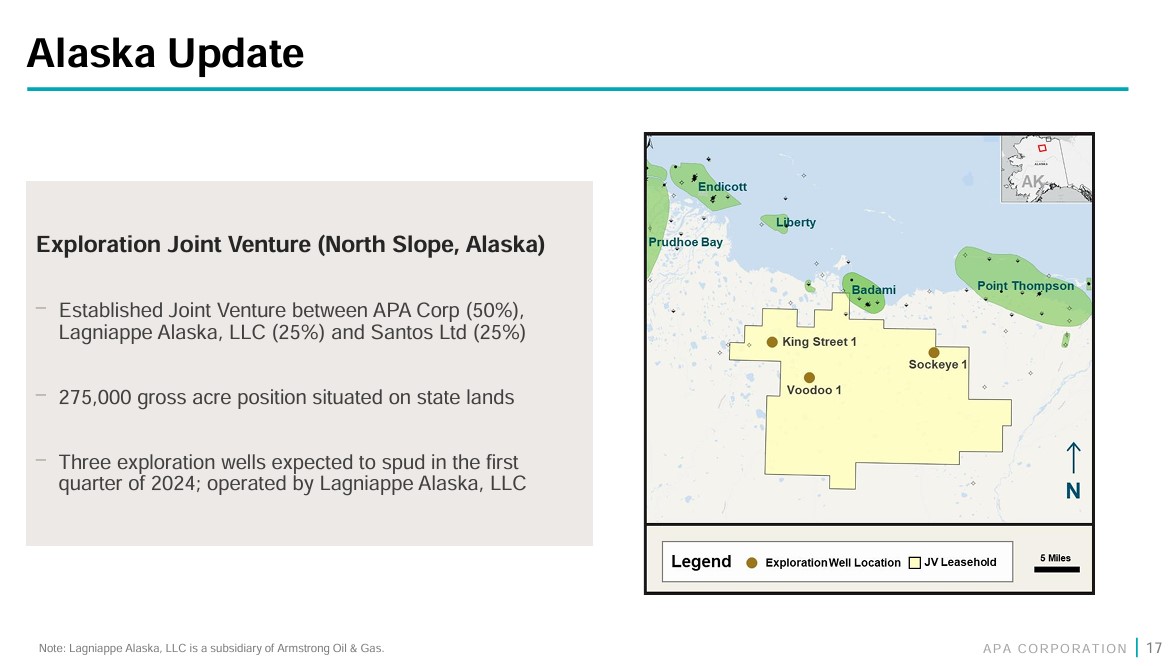

In Alaska, APA expanded its exploration portfolio through the addition of onshore leases. The company holds 275,000 gross acres on Alaska state lands. APA also holds a 50% working interest in a joint venture with Lagniappe Alaska LLC (25%, operator) and Santos Ltd. (25%). The venture will spud three wells in the first half of 2024 and is very close to spudding the first well, according to Christmann.

In Uruguay, APA was awarded two offshore blocks in 2023, although no drilling is planned for 2024.

At the OFF-6 Block (100% working interest, operator), which covers 4.1 million acres, the company has an exploration well obligation.

At the OFF-4 Block, APA has a 50% working interest and is operator, and Shell Plc has the remaining 50%. The block covers 2.5 million acres and APA has a seismic acquisition obligation.

In Suriname’s offshore Block 58, no drilling is planned for 2024 as APA envisions a final investment decision (FID) announcement by year-end 2024. APA, along with operator TotalEnergies SE, have identified an estimated 700 MMbbl of recoverable oil resource at the Sapakara and Krabdagu finds in Block 58 and have already initiated a FEED study. Initial production could commence sometime in 2028.

Truist expects incremental Suriname value once the project makes an FID later this year.

Recommended Reading

Chevron’s Tengiz Oil Field Operations Start Up in Kazakhstan

2024-04-25 - The final phase of Chevron’s project will produce about 260,000 bbl/d.

US Raises Crude Production Growth Forecast for 2024

2024-03-12 - U.S. crude oil production will rise by 260,000 bbl/d to 13.19 MMbbl/d this year, the EIA said in its Short-Term Energy Outlook.

Sangomar FPSO Arrives Offshore Senegal

2024-02-13 - Woodside’s Sangomar Field on track to start production in mid-2024.

CNOOC Finds Light Crude at Kaiping South Field

2024-03-07 - The deepwater Kaiping South Field in the South China Sea holds at least 100 MMtons of oil equivalent.

US Drillers Cut Oil, Gas Rigs for Fourth Week in a Row-Baker Hughes

2024-04-12 - The oil and gas rig count, an early indicator of future output, fell by three to 617 in the week to April 12, the lowest since November.