East Daley said the merger creates scale to compete with top midstream companies, yet also combines operations “with virtually no overlap.” (Source: Shutterstock)

ONEOK Inc. and Magellan Midstream Partners investors signed off on the midstream companies’ $18.8 billion combination—despite a hotly contested stakeholder voting process.

The shareholder vote at Magellan’s special meeting on Sept. 21 ended with 55% of total outstanding units voting in favor of the merger.

“I would say that it’s probably a more contested [vote] than I can remember,” said Ajay Bakshani, director of analytics at East Daley Analytics. “55% seems pretty thin to me.”

ONEOK reported less drama at its own special shareholder meeting, with 96% of the common shares cast voting in favor of the deal.

Following shareholder approvals, the deal is expected to close before markets open on Monday, Sept. 25.

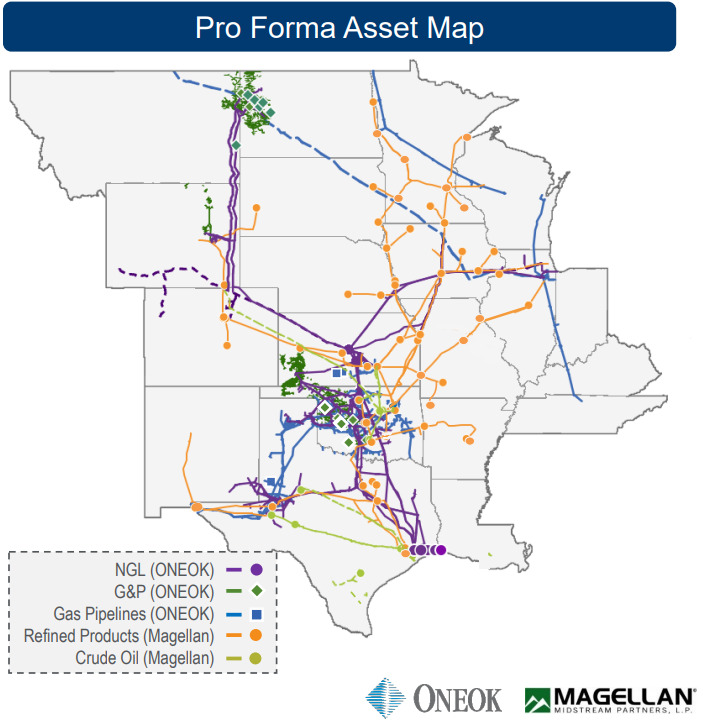

But analysts and investors have voiced concerns about the $18.8 billion mega-merger, which will combine ONEOK’s NGL infrastructure system with Magellan’s refined products and crude transport business.

RELATED

ONEOK, Magellan Midstream Stakeholders Approve $18.8B Merger Despite Opposition

East Daley has highlighted investor questions about how commercial synergies can be derived from the deal. ONEOK management has guided for between $200 million and $400 million in synergies, only $100 million of which will come from G&A cost savings.

Investors have had less clarity on the potential for $100 million to $300 million in commercial savings from three main buckets, East Daley said: the bundling of NGL and crude services; leveraging Magellan’s expertise in exports; and creating demand-pull dynamics for ONEOK’s butane blending operations.

“[Magellan doesn’t] really have natural volume growth on their core assets—just due to their serving more of a captive refining market,” said AJ O’Donnell, director of research at East Daley.

“They will benefit from annual tariff rate increases, but [Magellan doesn’t] have any real big growth projects in the pipeline,” he said.

In a Sept. 22 report, East Daley said the merger creates scale to compete with the top midstream companies, yet also combines operations “with virtually no overlap.”

Magellan will add considerable geographic diversification for ONEOK, reducing its exposure in the Bakken and Anadarko from 85% to 60%. However, ONEOK’s Permian exposure doubles from 10% to 20%.

“Despite the limited asset overlap, OKE could see several interesting commercial opportunities emerge from the combo,” East Daley’s report said, adding that analysts were most excited about the potential synergies from Magellan’s butane blending business once ONEOKE levers its extensive NGL pipeline and storage network for feedstock.

“Magellan also has interests in three terminals on the Houston Ship Channel that could serve as a future launch pad for NGL exports,” the report said.

Investors such as Energy Income Partners (EIP) have been vocal about their opposition to the deal. EIP, the fourth largest shareholder in Magellan Midstream Partners, launched a fierce opposition campaign urging shareholders to vote against the ONEOK merger.

In a statement to Hart Energy, EIP said it was disappointed with the outcome of Magellan’s vote, which it called a deal with “no strategic merit.”

“In our experience, Magellan was a great investment with excellent assets and historically excellent management,” EIP said. “We’re sorry things had to change.”

EIP said the deal represented a “$3 billion transfer of tax shield from Magellan unitholders to ONEOK. The institutions who voted for this deal did not incur the tax, their underlying taxable investors do.”

In a July 17 letter to Magellan’s board, EIP said the taxable structure of the merger results in a $13.40 average per unit up-front tax payment for Magellan unitholders that exceeds the merger premium by about $1 per unit ($0.2 billion).

Magellan’s management wins “golden parachutes” for selling, EIP told Hart Energy, whereas with “the practice in the asset management industry of reporting pre-tax rather than after tax returns for investors, there were a lot of conflicts of interest set ups that harm retail investors.”

While measuring the impact of EIP’s shareholder campaign is difficult, Magellan did see more pushback on the merger during its shareholder meeting than ONEOK saw.

In total, 55% of outstanding Magellan units voted in favor of the merger. But of the shares that actually cast votes, 76% voted in favor of the deal.

“So some of the units just didn’t vote,” Bakshani said. “Based on the public campaign that EIP put out, I was surprised at the 76% margin of those that did vote for it.”

Both companies will disclose the final shareholder voting results with the U.S. Securities and Exchange Commission.

At closing, Magellan unitholders will receive $25 in cash and 0.667 shares of ONEOK common stock for each outstanding Magellan common unit they own immediately prior to the effective time of the transaction.

The cash-and-stock deal, which includes assumption of debt, implies a pro forma enterprise value of $60 billion.

RELATED

ONEOK to Acquire Magellan Midstream Partners for $18.8 Billion

Recommended Reading

Segrist: The LNG Pause and a Big, Dumb Question

2024-04-25 - In trying to understand the White House’s decision to pause LNG export permits and wondering if it’s just a red herring, one big, dumb question must be asked.

Silver Linings in Biden’s LNG Policy

2024-03-12 - In the near term, the pause on new non-FTA approvals could lift some pressure of an already strained supply chain, lower both equipment and labor expenses and ease some cost inflation.

White House Open to Ending LNG Export Pause in Push for Ukraine Aid, Sources Say

2024-04-02 - Reversing the pause could be tolerable to the White House in order to advance Ukraine aid, in part because the pause has no bearing on near-term LNG exports, the White House sources said.

Tinker Associates CEO on Why US Won’t Lead on Oil, Gas

2024-02-13 - The U.S. will not lead crude oil and natural gas production as the shale curve flattens, Tinker Energy Associates CEO Scott Tinker told Hart Energy on the sidelines of NAPE in Houston.

Commentary: Fact-checking an LNG Denier

2024-03-10 - Tampa, Florida, U.S. Rep. Kathy Castor blamed domestic natural gas producers for her constituents’ higher electricity bills in 2023. Here’s the truth, according to Hart Energy's Nissa Darbonne.