Industry experts say the outlook appears positive for the global offshore sector. (Source: Shutterstock.com)

HOUSTON—A pickup in project sanctions, rising—albeit slowly—capex and growing project sizes indicate a positive outlook for the offshore oil and gas segment and related markets, according to industry experts.

“We think we’re passed the bottom of the downturn in the offshore market, and we’re certainly seeing investment increasing,” Steve Robertson, director and head of rigs and wells for Westwood Global Energy Group, told attendees of the firm’s RigLogix offshore market update last week. “So, offshore is clearly an attractive proposition for E&P companies going forward.”

The recovery comes thanks to price deflation and re-engineered projects, which have improved the economics of some offshore developments, he said, adding standardization and integrated services have also played a role.

RELATED: Offshore Rig Market Continues Recovery

BP and partners, for example, cut the originally estimated $20 billion price tag for the Mad Dog Phase 2 project in the U.S. Gulf of Mexico (GoM) by about 60%. Focusing on value, industry solutions and collaboration with its partners BHP and Chevron USA Inc. affiliate Union Oil Co. of California, the operator chopped the massive 33-well development down to $9 billion with up to 14 wells.

Other major projects—including the Equinor-led Johan Castberg development in the Barents Sea and Royal Dutch Shell’s Vito in the GoM—have also seen costs and breakevens fall.

“Projects [are] now being tested to breakeven in a $40/bbl environment,” according to Robertson’s presentation.

The offshore market’s comeback reflects work on the engineering and cost sides, he said.

But “you’ve got to remember that the market is now out of sync with the onshore market. The onshore market is three and a half years into recovery; it started in May 2016,” Robertson added, pointing out the offshore market’s bottom-of-cycle pricing and lead times.

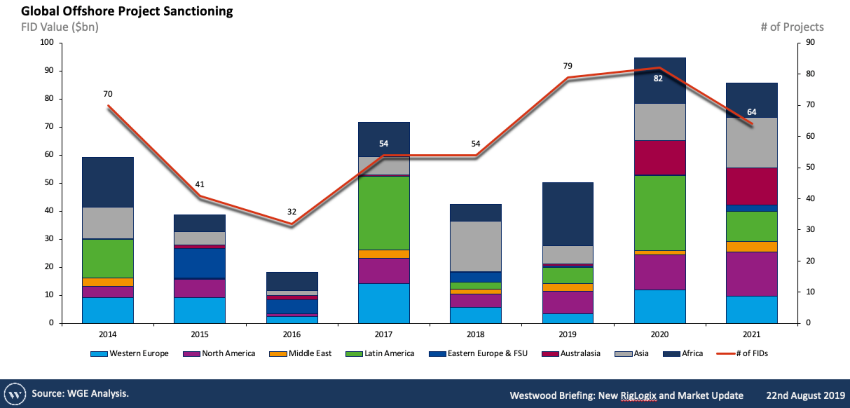

Improved project economics are expected to pave the way toward more global offshore project sanctions, jumping from 54 last year to 79 expected this year and 82 in 2020, according to Westwood.

But the total value of the projects, some of which are smaller subsea tiebacks, reaching final investment decision (FID) is still lower than previous years—about $50 billion this year, compared to about $70 billion in 2017. That, however, could change in 2020 when the FID value of offshore projects could surpass $90 billion.

It would bode well suppliers of fixed platforms and pipelines, which would also see a surge in orders.

Still, the future depends on how much oil and gas companies are willing to spend with oil price volatility, geopolitical uncertainties, OPEC moves and demand at play.

“The amount of offshore capex that we’ve been seeing year on year [for E&Ps] is growing but it’s not going to grow at a very quick rate when you compare it to the free cash flow of the majors,” Robertson said. “Since about 2016 E&P companies have been very profitable and this free cash flow tends to be their source for financing these field developments. At the moment, we’re not seeing the increase in free cash flow being affected by a similar level of increase in project sanctioning. If that does come back, it could have a material impact on the offshore market.”

Robertson’s presentation also pointed out that E&P operators are still “controlling capex and risk exposure by opting for phased developments and reducing complexity through standardized and/or simplified designs.”

Westwood forecasts deepwater activity will drive total subsea hardware spend to about $93 billion between 2019 and 2023 as the amount of needed pipelines and subsea umbilicals, risers and flowlines grows.

“Overall subsea tendering activity remains high, supporting Westwood’s expectation for a strong order intake in from Q3 2019 through to 2021, with key project awards anticipated,” according to the presentation.

Opportunities exist globally, given discoveries made in different parts of the world. More rig demand, Robertson said, is likely to come from both producing and emerging areas, including offshore Guyana, Suriname and Senegal as well as Southeast Asia, the Mediterranean and South and East Africa.

“On a macro side our conclusion is the market fundamentals are evolving positively and particularly on the project’s economics for the offshore projects,” Robertson said.

Recommended Reading

Hess Midstream Subsidiary to Buy Back $100MM of Class B Units

2024-03-13 - Hess Midstream subsidiary Hess Midstream Operations will repurchase approximately 2 million Class B units equal to 1.2% of the company.

Report: Crescent Midstream Exploring $1.3B Sale

2024-04-23 - Sources say another company is considering $1.3B acquisition for Crescent Midstream’s facilities and pipelines focused on Louisiana and the Gulf of Mexico.

Squashing Midstream: Lessons Learned as Sector Looks to Horizon

2024-04-08 - What does the next level look like for the midstream sector?

Hess Midstream Announces 10 Million Share Secondary Offering

2024-02-07 - Global Infrastructure Partners, a Hess Midstream affiliate, will act as the selling shareholder and Hess Midstream will not receive proceeds from the public offering of shares.

Plains All American Names Michelle Podavin Midstream Canada President

2024-03-05 - Michelle Podavin, who currently serves as senior vice president of NGL commercial assets for Plains Midstream Canada, will become president of the business unit in June.