(Source: Shutterstock.com)

HOUSTON—Attrition is aiding recovery of the oil and gas industry’s oversupplied offshore rig market, but retiring rigs will not be enough for a turnaround as more newbuilds line up to join fleets, analysts say.

“Demand is going to have to do its part as well,” said Terry Childs, head of Westwood Global Energy Group’s RigLogix.

Good news is market conditions are improving and more demand could be around the corner with rig tenders as oil and gas companies step up drilling plans and final investment decisions (FID) move offshore projects forward.

Analysts from the energy data and consultancy firm gave an update on the offshore segment on Aug. 22. The sentiment was that the offshore market has emerged from the latest downturn and rig demand is expected to continue improving as the sector works on its oversupply problem.

RELATED: Analyst Sees Positive Outlook For Offshore Sector

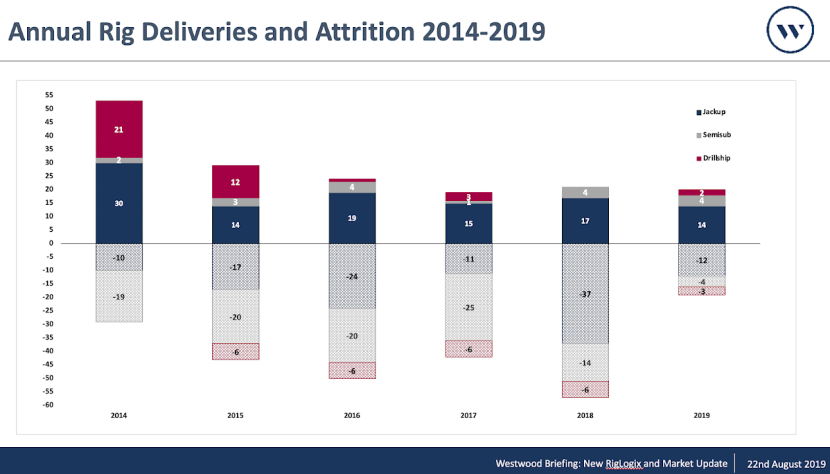

Since 2014, 239 rigs have retired from the global offshore fleet; however, fleet utilization dropped by 18% during that same time period, Childs said.

He added 57 rigs retired in 2018—the highest on record. But so far, only 19 units—mostly jackups—have retired this year.

However, “all that attrition has really essentially been cut at least in half and more,” Childs said, pointing to newbuilds.

Since 2014, 166 rigs have been delivered and 19, so far, this year.

But 85 newbuilds—down from 101 in May—are still sitting in yards, Childs said, though sales and bareboat charter agreements are adding to optimism.

“A lot of these Chinese rigs that were built have been contracted for programs in Mexico and some other places,” Childs said. “There’s certainly still a big inventory of newbuild rigs. … Attrition may really not have that much impact just because there’s still all these newbuilds that are that are going to come into the fleet at some point.”

Rigs sitting in yards are slowly coming out, mainly to displace other rigs.

Work is expected to arrive within the next year or two.

Westwood’s RigLogix database shows more than 200 drilling programs, ranging from expression of interest to ongoing or current rig tenders. “But only 74 of those have 2019 starts,” Childs said. “It’s certainly good to build great backlog. It’s not really helping for utilization at the present time.”

Westwood data shows the Africa region has more than 85 floating rig requirements, most of which start in 2020. The North Sea region has 81 requirements, mostly for jackups, while the Southeast Asia region has more than 60 requirements. There are nine active ongoing tenders in Mexico—mostly floaters—with another 20 drilling prospects—again mostly floaters—expected in 2020-2021.

“The Middle East has become the king of the jackup fleet,” Childs said, noting the region’s 166 or so jackups. But the Persian Gulf market is short on the number of current requirements at about 40, according to his presentation. “They put out a lot of requirements but not number wise compared to other regions of the world.”

Earlier this month Seadrill Ltd. announced a joint venture with Gulf Drilling International, called GulfDrill, to operate five jackups in Qatar with Qatar Petroleum, starting in 2020.

Adding to optimism for offshore rig players is the anticipated rise in FIDs. Westwood’s analysis shows the number of FIDs growing to 209 in 2019-2021, up from 172 in 2015-2018 but down from 219 in 2012-2014.

Regions where the most FIDs are expected are the U.K. (22), Mexico and Norway (18 each) and Australia (14).

Current utilization varies by region. But jackups are faring better, according to Childs.

In the U.K., for example, marketed utilization for jackups is at 92% and jackup utilization is at 84% in Southeast Asia.

In the Gulf of Mexico (GoM), jackup utilization dropped to about 80% from 100%. But with only 12 marketed rigs, “it doesn’t take many idle or many working to materially affect utilization,” Childs said.

But drillship utilization is at 100% in the GoM, with Norway harsh-environment semi utilization above 90% and Africa/Mediterranean marketed utilization at about 75%.

Looking forward, Childs said there could be a comeback in activity in the Golden Triangle based on talk from rig owners.

“But Latin America, obviously, would be another market that is certainly going to pick up again,” he added, noting activity offshore Mexico, Brazil, Guyana and Suriname.

COMING NEXT WEEK: Offshore Outlook

Recommended Reading

US Orders Most Companies to Wind Down Operations in Venezuela by May

2024-04-17 - The U.S. Office of Foreign Assets Control issued a new license related to Venezuela that gives companies until the end of May to wind down operations following a lack of progress on national elections.

EU Expected to Sue Germany Over Gas Tariff, Sources Say

2024-04-17 - The German tariff is a legacy of the European energy crisis that peaked in 2022 after Moscow slashed gas flows to Europe and an undersea explosion shut down the Nord Stream pipeline.

Pemex to Remain Fiscally Challenged for Mexico’s Next President

2024-04-16 - S&P Global Ratings said Pemex will remain a fiscal challenge for the country’s next president, adding that continued cautious macroeconomic management was key in its ratings on both Mexico and Pemex.