Xerion has cut what is typically a 14-step process down to three, directly electroplating battery materials such as lithium, cobalt, manganese and nickel precursors on the aluminum foil for lithium batteries, creating finished electrodes. (Source: Shutterstock)

As China tightens its grip on the global critical minerals supply chain and the U.S. works to boost domestic supplies, battery materials startups are sprouting up with technologies aimed at filling voids.

“There are tons of battery companies now, and they all have a shtick,” said John Busbee, CEO and co-founder of Xerion Advanced Battery Corp., a late-stage startup that manufactures lithium-ion batteries. “Some of them use specific materials. Some of them have higher power. This one’s safer. This one’s cheaper. … We have a very efficient manufacturing process that controls costs” with high energy and a fast, safe charge.

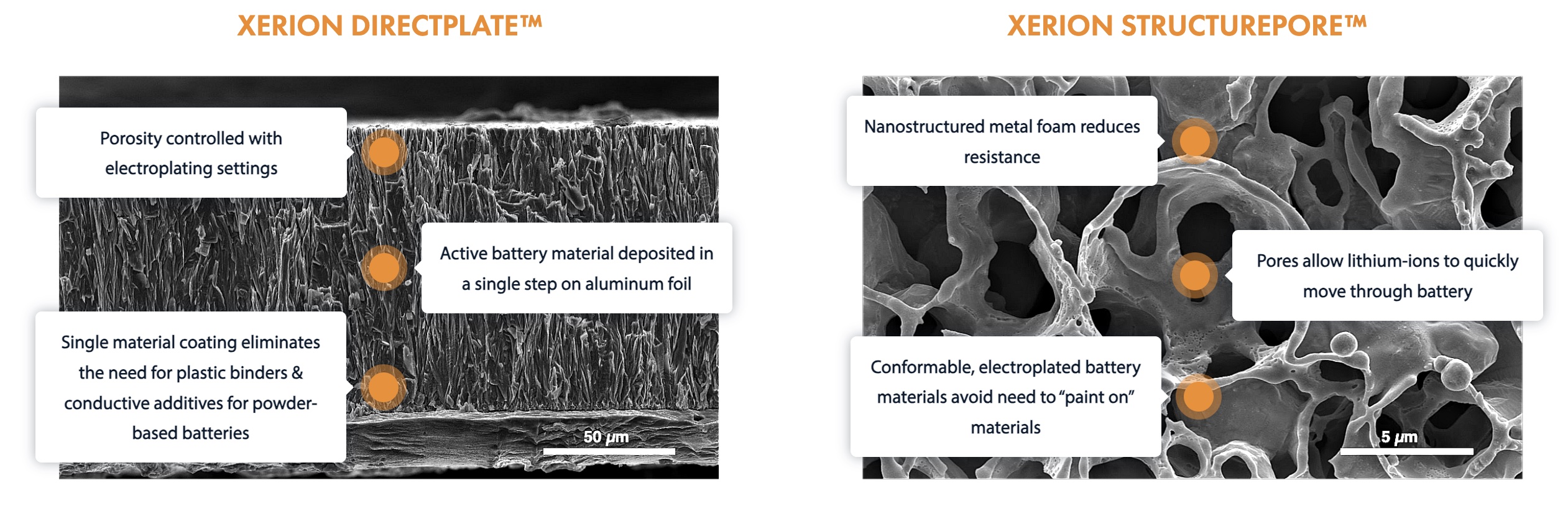

With the same material, there is only so much a company can do to set itself apart from the pack. For Xerion, “It’s really efficient packing of that material in a small space,” he added, to get more energy from the battery.

Xerion’s novel battery technology incorporates electroplating, a technique that changes an object’s physical properties by using electricity to coat a metal over a different metal. Think gold-plated jewelry.

The company’s technology, called DirectPlate, eliminates the need for plastic binders and conductive additives that are typically used for powder-based lithium-ion battery cathodes. Instead, battery materials such as lithium, cobalt, manganese and nickel precursors are electroplated directly on the aluminum foil for lithium batteries, creating finished electrodes, according to Xerion’s website. The process cuts what is typically a 14-step process down to three.

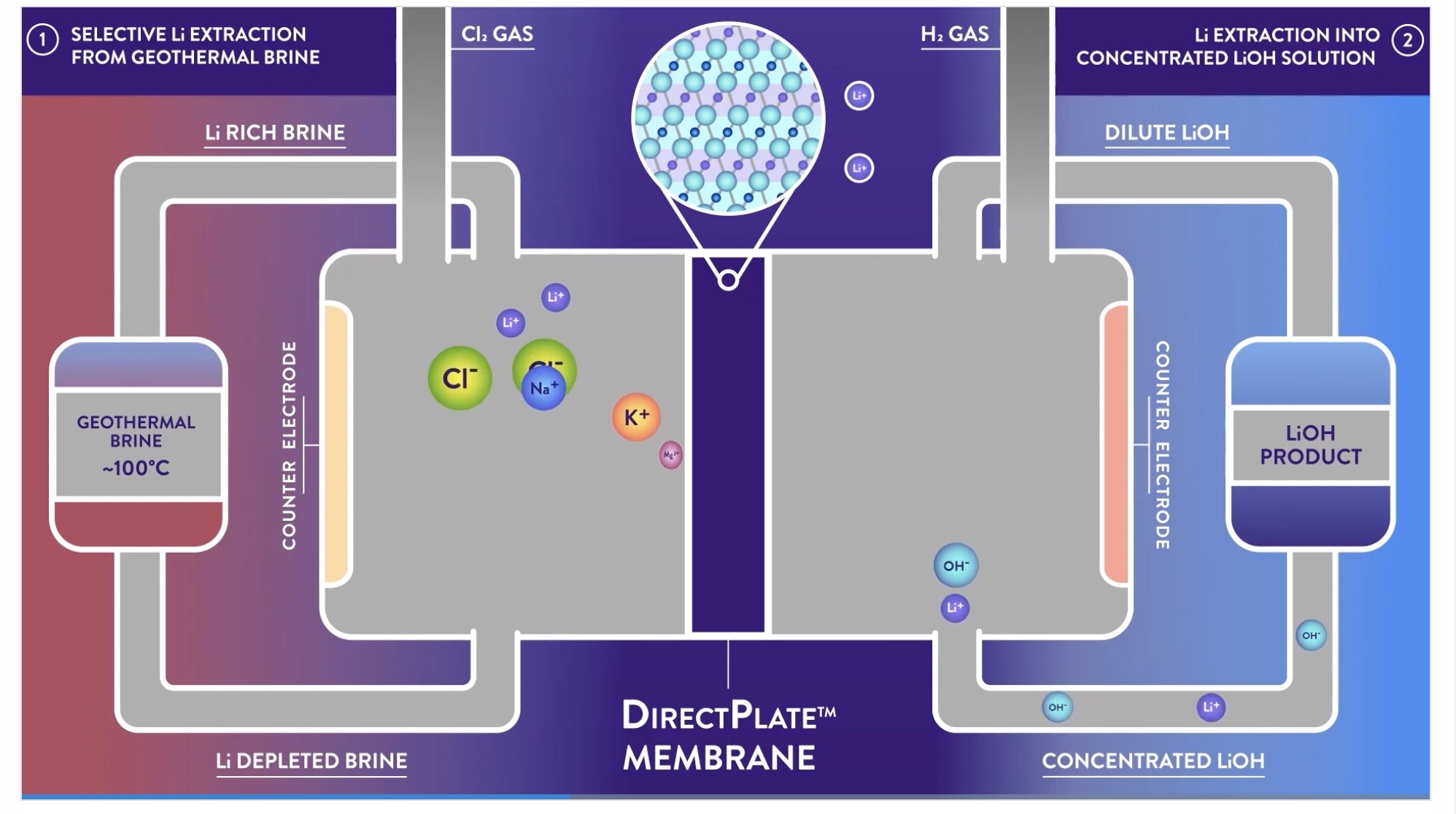

The company, which is constructing its first plant in Ohio with plans to start production in 2026, has served the military and electronics markets. But it is moving deeper into the automotive space as it evaluates grid-scale opportunities. Xerion’s 2023 win of the U.S. Department of Energy’s inaugural American-Made Geothermal Lithium Extraction Prize (Xerion CTO and co-Founder Paul Braun’s team) is also attracting some attention for its ability to extract lithium from geothermal brine.

Busbee recently spoke with Hart Energy about the company and its technology, shrinking carbon footprints and the evolving—and crowded—battery materials sector.

Velda Addison: How would you characterize the state of the lithium-ion battery segment today, and where does Xerion fit into it?

John Busbee: It’s not still a fully mature industry. It’s been around for 40 years. But with the scale of the EV space and coming into the grid scale, it’s still growing rapidly. It’s starting to approach maturity. When it became obvious that EVs were going to be prevalent—an alternative energy solution to [a] lower carbon footprint for automotive, the battery arms race started. … [Focus has shifted] from high energy, positive liquid cathodes to silicon, silicon, silicon and then solid state. All of that has grown, and then everybody started the building craze. There are all kinds of gigafactories planned all over the world. ... Now they’re like, ‘Oh, we need raw materials to fill these factories with.’ You’re seeing a lot more emphasis on sustainability, raw material access, with geopolitical tensions with China. That’s really driving the domestic space.

You’re starting to see a lot more mature companies, …and you’re seeing a lot of people scrambling. They’re scrambling to secure supply. It’s kind of a strange time right now because the market’s depressed in China. We still have some of the recessionary tendencies. Even though the prices are low right now, everybody’s scrambling to secure raw material access, so there’s a lot of long-term contracts. There’s a lot of different mines and fields being further developed. We’re a 14-year-old company, and we started just looking strictly at the cells, the batteries themselves. As we’ve grown, we had a differentiated technology to do that. We’ve always found that our technology, which is based on electroplating, has the ability to reach back upstream. The reason I started the company is I wanted to really dramatically affect change in society. …So, I set out to completely change battery manufacturing. ... Electroplating is also a refining technique. We’re using it to refine the materials, to synthesize the battery, the actual crystal structures of the battery chemistries, and deposit them all in a single step.

VA: Is that what differentiates your company from others?

JB: That’s what started to differentiate us, but now the fact that we can use those same electroplating techniques, we can actually stop with some of the intermediate materials, which means that we can start from the refined materials. We can go all the way to the batteries. But the adoption cycle for batteries is years long. What we started to realize about three years ago was that we could greatly reduce the carbon footprint of the refining and extraction phase and, that is what people need now.

When you talk to large companies, automotive or electronics or grid scale, the qualification process is there. But can you give me the raw materials now? We don’t need the Chinese refinery. The Chinese have been very strategic about that. It’s been very smart, having locked up that market. And so, everybody’s kind of a captive audience. We don’t need to start with refined materials. We can refine our own either for our own batteries or to supply other people for them to make other commercial batteries, I think it’s a key component.

VA: Can you tell me more about the costs and how those compares to other lithium-ion batteries?

JB: We’re constructing our first plant now, which is going to actually start production at the beginning of ‘26. We have the economies of scale. … When we’re fully scaled, it could be as dramatic of cost reduction as over 50% because we’re starting from the raw materials. And what are the raw materials? It’s either salt from the salt brines or sand, and we dump them in an electroplating bath and we electroplate and our finished electrode comes out. So, it’s one step. It’s replacing 14. That’s three full manufacturing plants that we’re skipping. You’ve got the people who run those, the capex of all those and then most importantly the energy to run those plants that we’re skipping. There’s a dramatic carbon footprint reduction.

VA: Some oil and gas companies are starting to jump into this space. Are any partnerships on the horizon?

JB: We are working with several that I can’t disclose because of NDAs. It’s not on the battery side so much, but on the raw materials side. About five months ago, the Department of Energy had a grand challenge in direct lithium extraction—a two-year competition—and we won that. That was a real nice boom, and that caught the attention of the people that are working on the direct lithium extraction. …We’re also on the raw materials side—nickel and cobalt primarily. We have a lot of people interested in that as well.

We’re working with oil companies and others on the brine. We have some unique advantages there.

VA: What are some of those unique advantages?

JB: The problem that everybody has in these lithium brines is they’re really salty and things rust and things corrode. We created our electrodes in molten salt. So, they are very stable, and we create them at 300 degrees. It is very stable hot. Those electrodes are meant to move lithium ions in and out flawlessly. And they’re fully solid; they are fully dense so the water doesn’t go through it. … My director of R&D said ‘Hey, this would make a really good separator membrane for direct lithium extraction.’ It wasn’t our manufactured product. It was our product that we used in a novel way that gave us all those advantages. We can just move it through and straight into water. Everybody else purifies it as lithium chloride and then it has to get turned into lithium hydroxide or lithium carbonate, and we’re going straight across that membrane from the brine to making battery grade lithium hydroxide in one pass.

VA: As you work to scale, has it been difficult to finance projects?

JB: Well, it’s always hard. … So first, you had COVID. Everything evaporated during COVID. It started picking up kind of towards the end of it. When people didn’t understand what was going on, everybody just quit talking. It just completely disappeared. And then, you come out of it [and we’re now in] a recessionary environment, concern about inflation. People have just been very cautious. When we talked to a lot of private equity, venture capital people, they’ve told us that they’re a lot tighter because people aren’t investing, which means they’re preserving their funds to continue to fund the people that they already funded… I’d say it’s a pretty austere fundraising environment. That’s slowed the whole industry down.

VA: What is Xerion’s growth strategy?

JB: We’ve tried to be really flexible. We want to supply what people need to help the industry grow. And so, our initial work has been really focused on batteries in small markets like the military and some of the electronics. We’re doing a lot of work with many of the conglomerates on the electronics sides in electronic wearables—things like glasses and watches—and the army for cells. That’s our initial business. … About one-fifth of the Dayton [Ohio] plant will be cells for the military and these growing wearables markets. The rest of that is going to be electrodes—components, not the whole cell—which we’re going to sell into the electronics market.

Our electronics material/battery material is mature. Our automotive material, the high nickel materials, are about a year behind. … We have existing relationships in automotive. We’re working on that pipeline to get it into their hands.… Our growth path is moving from military and electronics to supplying some of the large joint ventures with electrode components in four or five years. Then, we’ll actually have advanced battery products that will go in that.

We have a second plant planned in Florida. So eventually our Dayton area plants will focus mostly on Detroit with proximity and then the Florida plant will focus on automotive in the Southeast U.S. That’s where we’re going to actually start focusing on grid scale as well. … The grid scale is probably going to be a larger market in 10 years. We are also starting to develop collaborative strategic relationships on the raw materials side.

Recommended Reading

Kosmos Energy’s RBL Increased, Maturity Date Extended

2024-04-29 - Kosmos Energy’s reserve-based lending facility’s size has been increased by about 8% to $1.35 billion from $1.25 billion, with current commitments of approximately $1.2 billion.

NOV Announces $1B Repurchase Program, Ups Dividend

2024-04-28 - NOV expects to increase its quarterly cash dividend on its common stock by 50% to $0.075 per share from $0.05 per share.

Repsol to Drop Marcellus Rig in June

2024-04-28 - Spain’s Repsol plans to drop its Marcellus Shale rig in June and reduce capex in the play due to the current U.S. gas price environment, CEO Josu Jon Imaz told analysts during a quarterly webcast.

US Drillers Cut Most Oil Rigs in a Week Since November

2024-04-26 - The number of oil rigs fell by five to 506 this week, while gas rigs fell by one to 105, their lowest since December 2021.

E&P Highlights: Feb. 5, 2024

2024-02-05 - Here’s a roundup of the latest E&P headlines, including an update on Enauta’s Atlanta Phase 1 project.