Johan Castberg quayside at Aker Solutions, Stord. (Source: Øyvind Gravås/Equinor)

Norwegian petroleum officials expect 2023 activity levels to carry on through 2024.

The Norwegian Offshore Directorate (NOD), which recently rebranded from the Norwegian Petroleum Directorate, said Jan. 11 that 92 offshore fields were in operation at the end of 2023, with 27 projects under development. In 2023, it added, many exploration wells were drilled but that 2023 gas production was lower than expected.

Operators made final investment decisions (FIDs) on several projects in 2022 that authorities approved in 2023. Combined with the 27 projects under development, the NOD said the level of activity shows the temporary tax regime change adopted in 2020 positively affected the Norwegian supplier industry.

With high development activity levels, oil and gas production is expected to remain stable for the next few years, the NOD said. Several fields have gained extended lifetimes and will invest in upgrades while other projects have accelerated investments.

Overall, NOD projects a large increase in investments for 2024, partly due to high industry activity levels, weaker Norwegian currency and rising costs. However, new FIDs are necessary to maintain activity leading up to 2030, the directorate said.

Discoveries and exploration

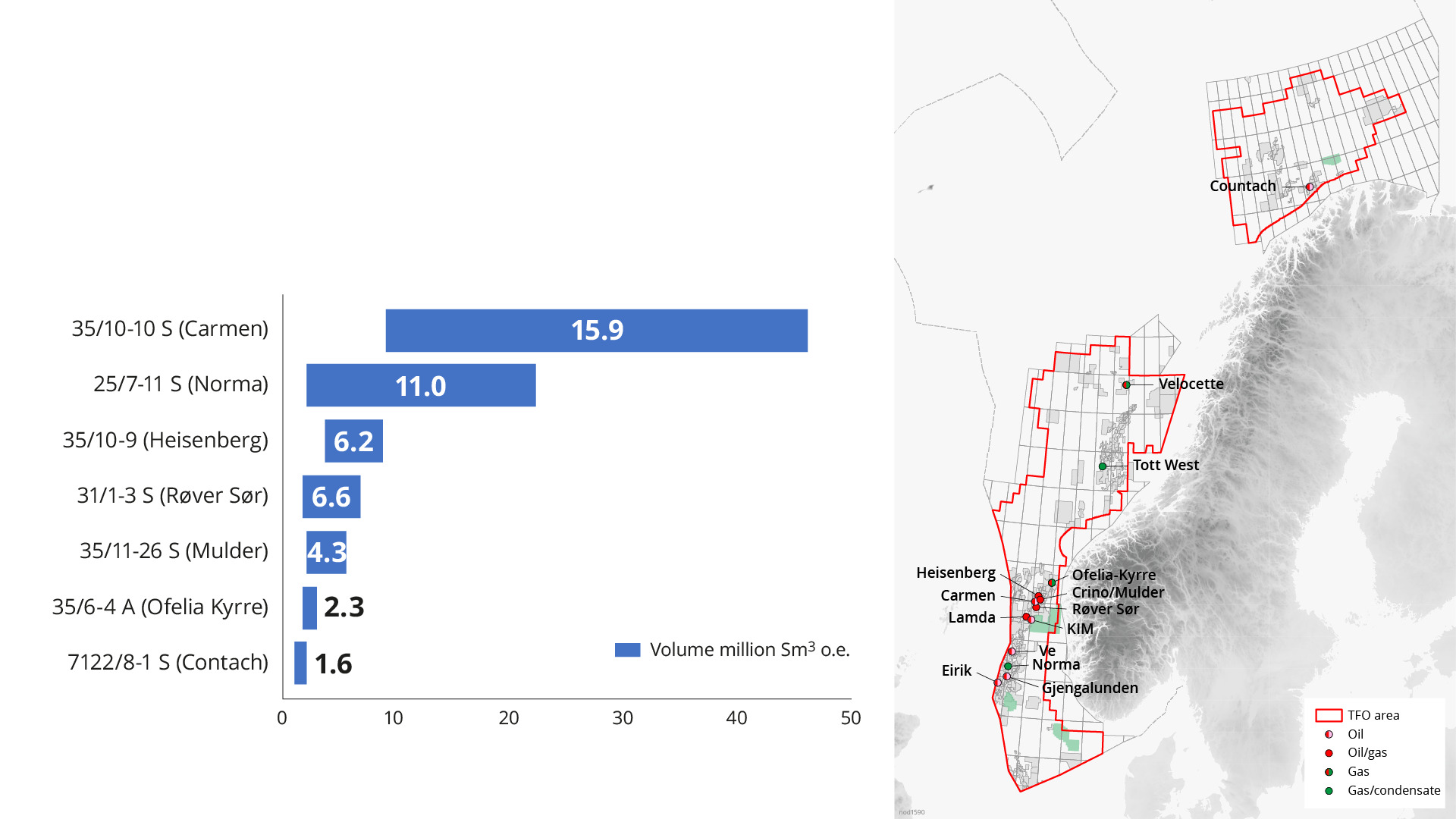

Of the 34 exploration wells spudded in 2023, 23 were wildcat wells and 14 discoveries were made. The NOD said that was on par with recent years.

Of the 14 wildcat finds, 11 were in the North Sea, two in the Norwegian Sea and one in the Barents Sea.

The largest discovery was the Carmen find with well 35/10-10 S in PL1148. This discovery may contain between 9 MMcm and 46 MMcm of oil, NOD said.

NOD set the resource growth from discoveries made in 2023 at about 50 MMcm of oil equivalent.

The NOD is urging companies to actively explore in frontier areas. In December 2023, the agency outlined suggestions for bringing production out of frontier areas in the Barents Sea.

The NOD noted ongoing significant interest in leasing areas, as 25 companies applied for new acreage in the 2023 round, resulting in the award of 47 licenses being awarded to those companies in January 2023.

The NOD also expects increased exploration activity moving forward will contribute to growth in exploration investments from 2024.

Development activity

Following a wave of plans for development and operation (PDOs) in 2022, only Equinor’s Eirin project plan was submitted in 2023. The 15/5-2 Eirin subsea development is in the central North Sea and has estimated resources of 4.5 MMcm oil equivalent.

PDOs submitted in 2022 and approved in 2023 include:

| Project | Target onstream | Style | Operator |

|---|---|---|---|

| Eldfisk Nord | 2024 | subsea template | ConocoPhillips |

| Idun Nord | 2024 | subsea template | Aker BP |

| Alve Nord | 2025 | subsea template | Aker BP |

| Halten Øst | 2025 | subsea template | Equinor |

| Maria Fase 2 | 2025 | well | Wintershall Dea |

| Tyrving | 2025 | subsea template | Aker BP |

| Verdande | 2025 | subsea template | Equinor |

| Dvalin Nord | 2026 | subsea template | Wintershall Dea |

| Irpa | 2026 | subsea template | Equinor |

| Fenris | 2027 | platform | Aker BP |

| KFL Draugen/Njord | 2027 | plants | Equinor |

| Ørn | 2027 | subsea template | Aker BP |

| Symra | 2027 | subsea template | Aker BP |

| Valhall PWP | 2027 | platform | Aker BP |

| Yggdrasil | 2027 | platform and plants | Aker BP |

| Berling | 2028 | subsea template | OMV |

| Snøhvit Future Phases 2 | 2028 | plants | Equinor |

Production levels

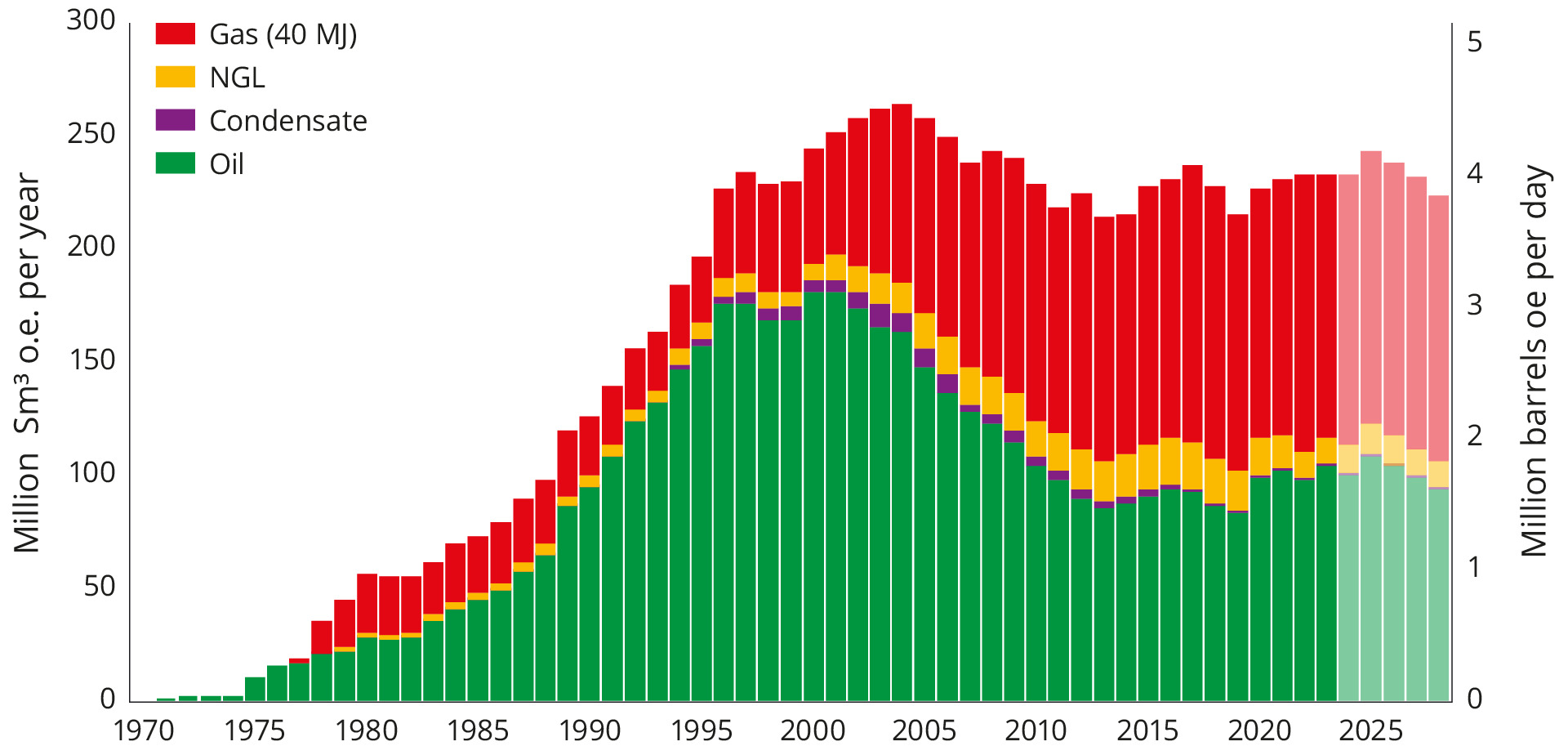

Oil and gas production is expected to remain stable over the next few years as a result of development activity on the shelf, NOD said. Without new fields or major investments in existing fields, production from the Norwegian shelf is expected to decline. Over the short term, the new fields that come onstream will offset lower production from aging fields, the NOD said.

As 2023 wrapped up, 92 fields were online on the Norwegian shelf. Atla, Flyndre, Heimdal, Skirne and Vale shut down over the course of 2023.

Eight developments began production, including Aker BP’s Frosk and Kobra East and Gekko projects, ConocoPhillips’ Tommeliten A, Neptune Energy’s Fenja, OKEA’s Hasselmus and Equinor’s Bauge, Breidablikk and Statfjord Øst projects.

According to NOD, about 4 MMboe/d was produced offshore Norway in 2023, around the same level as 2022.

Gas production in 2023 was lower than expected, primarily due to unplanned and extended maintenance shutdowns at several onshore facilities and fields. NOD also attributed the shortfall to delayed well deliveries and multiple wells not yielding the anticipated production.

NOD expects production to peak in 2025. Equinor’s Johan Castberg development is expected to begin production toward the end of 2024 after technical delays associated with concerns over the FPSO’s hull construction. A fire broke out on the Johan Castberg FPSO while it was in the shipyard in 2022.

In September 2023, Equinor said the Johan Castberg project costs had jumped by $1.4 billion since the PDO for the development was submitted in 2017. That Barents Sea project is expected to go onstream in fourth quarter 2024, producing from estimated proven volumes between 400 MMbbl and 650 MMbbl.

Recommended Reading

Petrobras Not in a Race with Guyana to Boost Production, CEO Says

2024-05-14 - While Brazil and Guyana aren’t necessarily competing to see which country can produce more oil, Petrobras’ CEO Jean Paul Prates jokingly said Brazil was winning, while adding that Bolivia’s falling production was an opportunity for Argentina.

TotalEnergies FIDs Two Developments Offshore Brazil

2024-05-28 - TotalEnergies took FID for two developments offshore Brazil in the prolific Santos Basin where the French energy giant expects its equity production to soon exceed 200,000 boe/d.

Seatrium Awards Classification to ABS for 2 Newbuild FPSOs

2024-06-14 - The two FPSOs will be deployed by Petrobras in the eastern part of the Santos Basin, 200 km offshore Rio de Janeiro.

E&P Highlights: June 17, 2024

2024-06-17 - Here’s a roundup of the latest E&P headlines, including Woodside’s Sangomar project reaching first oil and TotalEnergies divesting from Brunei.

BP and NGC Sign E&P Deal for Offshore Venezuelan Cocuina Field

2024-07-26 - BP and NGC signed a 20-year agreement to develop Venezuela’s Cocuina offshore gas field, part of the Manakin-Cocuina cross border maritime field between Venezuela and Trinidad and Tobago.