Oil and gas activity offshore Norway is ratcheting up as operators take advantage of the country’s greenfield tax incentive.

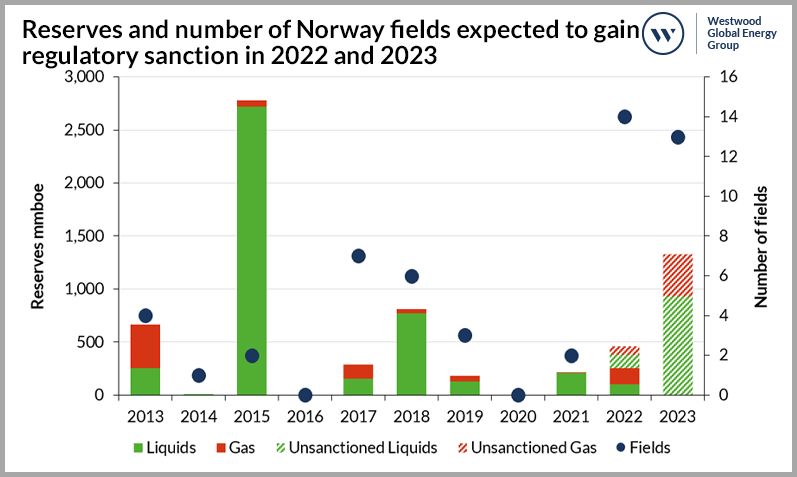

It’s a bit of a turnaround from the region’s previous focus on brownfield projects. The project pipeline looks set to jump from two sanctions in 2021 to the possibility of 25 or 30 fields being approved by the end of next year, according to an analyst.

While jackup rig utilization remains around 100% - mostly due to a shrinking fleet - the current semi drilling rig utilization market is softer. But that’s expected to turn around in a couple of years.

Yvonne Telford, Westwood Global Energy Group’s senior analyst for northwest Europe, said operators working offshore Norway have historically invested in brownfield projects, but they have had an “inconsistent pipeline of new fields.”

In 2020, as a reaction to the oil price downturn, the Norwegian government introduced incentives for capital expenditures, greenfield projects and discoveries, she said.

The incentive for capital expenditures was targeted at maintaining drilling rig activity and the service sector from mid 2020 to the end of 2021.

“With all that investment that was ongoing, it didn't necessarily mean that projects were starting,” she said. “What's happening now with the greenfield incentive tax incentive being stimulated is that the PDOs [plans for development and operation] that are approved that are submitted by the end of 2022 for new field developments and approved by the end of 2023 qualify for this tax incentive.”

She expects approvals for PDOs for anywhere from 25 to 30 fields by the end of 2023. Telford said those 25-30 fields could hold 1.8 Bboe of recoverables.

Some of those expected projects will be major, while others are likely to be smaller tieback projects, she added. A number of power from shore and windfarm projects are also moving forward, she added.

“A busy period for development work in Norway” is coming, she said. “It will be busy for the NPD [Norwegian Petroleum Directorate].”

Shifting rig market

The offshore drilling rig market in Norway is tight for jackups but softer for semis, said Teresa Wilkie, Westwood’s research director for RigLogix Offshore Drilling. It’s a very different market now than it was during the 2015 lower-for-longer downturn, she added.

“The global rig market really, really suffered” and most of the drilling contractors “really felt that pinch,” she said.

While Norway was hit “quite badly,” it still fared better than many other regions, she added. Norway-capable drilling rigs are a niche segment, as these harsh environment rigs must meet NORSOK standards.

In 2015, there were 14 jackups working offshore Norway, and now there are 10, Wilkie said. In 2015, the utilization rate was 100%, as it is today.

“It’s a tight market,” she said. “We expect over the next several years, we expect there will be more demand.”

That demand is related to Norwegian tax incentives that have made drilling efforts offshore the country more interesting for operators, she said.

On the other hand, the market for semisubmersible drilling rigs is a bit softer. Current utilization is at 79% while it was 96% in 2015.

“It’s dropped quite a bit but still faring okay,” she said. “The market held up pretty well in the downturn.”

In fact, she said, Norway-capable semi drilling rigs maintained some of the higher day rates.

“These are some of the most high-spec semis you can get,” Wilkie said.

Now, however, demand for semis is increasing around the world, and other regions are starting to outpace the day rates of the Norwegian-capable semis, she said.

As a result, she expects some semis to leave for other regions, possibly West Africa or the Mediterranean.

But starting in 2024, after the NPD approves a spate of PDOs associated with the greenfield tax incentives, she expects both the jackup and semi market to be much tighter.

“The market might be soft this year and some softness next year, but come 2024, it is probably going to be very difficult to get a semisub, and it’s probably going to be a lot more expensive as well,” Wilkie said.

NPD’s resource report

At the end of August, the NPD released its resource report for 2022, which analyzes opportunities and challenges for oil & gas operations on the Norwegian continental shelf (NCS).

The NPD estimated that the amount of oil and gas remaining on the NCS and the amount it has produced in the last half century are roughly equal.

According to the NPD, current forecasts indicate a steadily rising proportion of production after 2030 must come from undiscovered resources. The NPD expects small discoveries to account for much of this, filling spare capacity at infrastructure as production declines at other fields.

The NPD noted that bigger discoveries than those being made today are needed to slow the decline in production and that the potential for making large discoveries is greater in areas that haven’t been thoroughly explored or not yet opened for exploration.

Gas accounts for more than half the estimated remaining resources in open areas of the NCS, the NPD said, with most of the proven gas in the North and Norwegian Seas, while about two-thirds of undiscovered gas resources are expected to be in the Barents Sea.

One of the issues around the Barents Sea, however, is that it lacks export capacity, so exploration interest in the region is limited, the NPD said. The Polarled pipeline has driven exploration interest in the Norwegian Sea, it noted.

“It is important for resource management that the companies not only reap from earlier investment but also explore for and invest in frontier areas on the NCS,” Kjersti Dahle Grov, acting director for technology, analysis and coexistence at the NPD, said in a press release.

Recommended Reading

Tech Trends: SLB's Autonomous Tech Used for Drilling Operations

2024-02-06 - SLB says autonomous drilling operations increased ROP at a deepwater field offshore Brazil by 60% over the course of a five-well program.

E&P Highlights: Feb. 16, 2024

2024-02-19 - From the mobile offshore production unit arriving at the Nong Yao Field offshore Thailand to approval for the Castorone vessel to resume operations, below is a compilation of the latest headlines in the E&P space.

Rystad: More Deepwater Wells to be Drilled in 2024

2024-02-29 - Upstream majors dive into deeper and frontier waters while exploration budgets for 2024 remain flat.

NAPE: Turning Orphan Wells From a Hot Mess Into a Hot Opportunity

2024-02-09 - Certain orphaned wells across the U.S. could be plugged to earn carbon credits.

US Drillers Add Most Oil Rigs in a Week Since November

2024-02-23 - The oil and gas rig count rose by five to 626 in the week to Feb. 23